This post may contain affiliate links and Corporette® may earn commissions for purchases made through links in this post. As an Amazon Associate, I earn from qualifying purchases.

Someone tweeted (X’ed?) at me just last week, asking about the best briefcases for women… I suspected that they meant “general work bag,” but on the off chance that they meant a traditional briefcase, I was intrigued.

(In general, the correct answer for “best work bag for women” is either Cuyana or Lo & Sons.)

We haven’t talked about the issue in a LONG time, though… so I thought I’d round up some briefcases for women.

Do YOU use a briefcase? (And if so, please list your city!) What brands do you like best?

Here’s another question — have you ever had a briefcase made? One of my family members swears that she and all the other working women she knew had that done in the early ’80s…

Are Briefcases Right for Professional Women in 2023?

Readers have discussed this in comments from time to time — the briefcase. One commenter advised the readers that in her big city, “not a single woman lawyer I know under the age of 50 carries a purse.” This led to a small debate between briefcase-carrying women and non-briefcase carrying women.

To my eyes, though, in 2023 it’s rare to see a briefcase. Most women I know carry a tote bag for when they need space to carry documents, and/or a backpack when they really need to carry a laptop.

Those frequently carrying files may switch to a tote/purse combo, but even then it seems like something I saw a lot more of a few years ago, before the cloud, flash drives, remote logins, and other convenient telecommuting tools were as common.

(I’ve even written about what your tote bag says about you.)

What is a Briefcase, and How Is It Different From a Tote?

In my mind, the defining feature of a briefcase is that it has a short handle and is meant to be carried at your side, or maybe dangling from the crook of your elbow. It should be large enough to fit at least a pad of paper, ideally a legal size. They don’t have to be deep, but they should be large enough to fit at least a 1″ binder. They can be made of a fabric or leather, although I tend to think of them as a being made of a good-quality leather. I also tend to think of them as having enough structure that they can stand up by themselves.

Contrast that to the classic tote bag: These generally have much longer shoulder straps, although they may also have a short handle as well. Tote bags are also frequently much deeper than briefcases; some even fit an extra pair of shoes, a water bottle, or even a lunch bag.

If you prefer a more modern idea of a briefcase, you may want to look into some of the larger padfolios or leather document holders out there. These can be carried under your arm like a clutch, or carried in your hand like a redweld folder. (See below for some of our latest favorites!)

Our Favorite Briefcases for Women

Here are some classic briefcases for women that have been around for a while — in fact the Dooney & Burke option has been around since at least 2010.

Some Great Trendy Briefcases

The Luxury Briefcase: Mulberry Bayswater

If you’re hunting for a gorgeous leather bag with some designer cachet, check out this Mulberry satchel. like the fact that it has feet (so rare these days!!) and smartphone pockets, but do note that it’s unlined.

The pictured Bayswater is one of the largest sizes; it’s $1,650 at Nordstrom.

The Modern Semi-Briefcase: Leatherology

I feel like this is briefcase-adjacent, but a reader had been looking for a large leather clutch/folder just like this, and this was suggested by one of the readers. It’s gorgeous! I love how it’s like a cross between a padfolio and laptop sleeve — almost like an elevated redweld.

The pictured holder is $150 at Leatherology; it’s available in five colors.

Hunting for something similar but more affordable, or with a wider range of colors? Etsy shops have a number of options, including this $30 leather folder, this Macbook laptop sleeve with pockets for $90, and this option for $50. And, of course, you can just buy plain redwelds (or, hopefully, get them from your office supply closet).

The Affordable Briefcase from Amazon: Cluci

This “briefcase for women” at Amazon looks great. I like the options of the long strap (handy for your commute) and the shorter handles (more attractive), and the fact that it’s real cowhide but under $180 is great.

There are seven colorways (including burgundy, always great with navy), and I particularly like the multicolored accordion side, which reminds me of a redweld in the best way. It has tons of great reviews at Amazon.

The Convertible Briefcase: Senreve

It’s somewhat rare to see a briefcase that converts into a backpack, so this entry in the category from Senreve is appreciated! It is more on the “satchel that CAN be a backpack” side of things, perhaps with a healthy dose of “so long as you don’t put anything heavy into it while wearing it as a backpack” kind of caveat.

The bag comes in a ton of colors, and there are even “vegan leather” options for $695-$995. The pictured version is $995.

The Best Alternatives to Briefcases for Women

The Best Work Tote Bags

Some of the best work bags for women as of 2024 include great totes from Cuyana (with a zipper), Tumi, Tory Burch (lightweight, a laptop tote), Lo & Sons, and Madewell (north/south). Also try this highly-rated organizing insert or these clever pouches with some of the less structured bags! If you’re looking for a budget tote (or one in a specific color) check this Amazon seller (22K+ good reviews) or this Amazon seller (60K+ good reviews).

(Looking for a luxury work bag? Here’s our latest roundup…)

The Best Laptop Totes for Women

The Best Work Backpacks for Women

Update: Hunting for the best work backpacks? Some of our favorites in 2024 are below — see the full post for all the details!

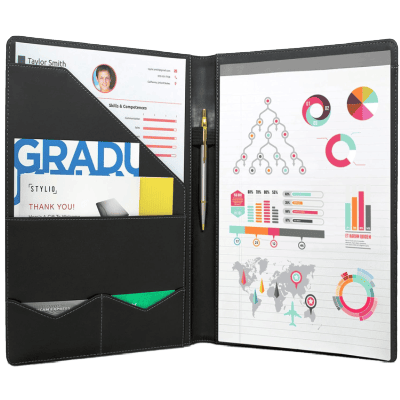

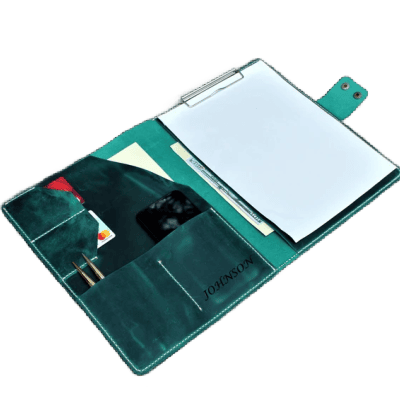

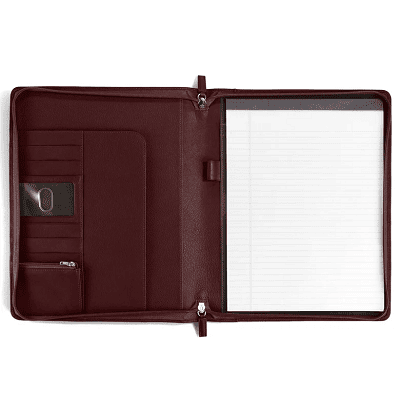

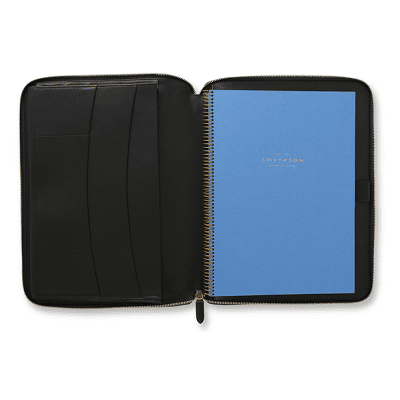

Stylish Padfolios for Women

Some of our favorite office padfolios for 2024 are below! If you want something monogrammed, check out Etsy, Leatherology, Levenger, or (for a splurge), Smythson — you can still find them at Amazon, Target, or Walmart. (Also check out our roundup of executive clutches and leather document holders, as well as women’s briefcases!)

Admin note: this post was originally written in 2010 but has been updated substantially as indicated.

shelly

I have a big red leather Levenger tote that my fiance gave me as a gift a number of years ago. It’s big enough to serve as a carry on or a briefcase when I need to travel for work and take my laptop but small enough to function as a purse during my work week. On the weekends, I switch to a smaller bag.

anonforthisone

I use an open-top tote purse (not too large, good size for my liter sigg and big wallet, and makeup and phone), and then a big tote bag (michael michael kors, about 12 x 17) for the files that I lug back and forth to work. I do want a new purse, but I need a tote style since sometimes my water bottle leaks if it is on its side.

Haven’t seen any women around here with briefcases – I am in Boston.

K

I’m also in Boston and don’t think I’ve ever seen a woman with a briefcase.

Anon IB

ditto – no briefcases here. I carry an open-top tote with two divided sections – one for wallet, umbrella, toiletries, shoes; the other for files, notebook, whatever work I am bringing home. My major requirements in shopping for a new tote earlier this year were 1) professional look and 2) had to be big enough to put about 2″ worth of 8×11 paper/folders, which is often what I bring home at night. If I have more than that (carrying presentations to a meeting with clients for instance) I bring a separate bag.

Anon

See — I read this, and I think “we must have a different definition of briefcase.” Because I go to Boston all the time for work and see women carrying what I’d call briefcases. Maybe you’d call them totes? Maybe the choice of word itself is generational. I’m closer to 40 than 20.

Susan

Really? I’m in New York and every attorney I know carries a briefcase. Totes are great for off days, when you don’t have meetings, but they smack too much of shopping bags for top-level appointments. I’ve had a black Coach briefcase for a dozen years and it is still in perfect shape.

Mary

My daughter will graduate from law school in May! I’d like to get her a professional brief case or bag. It has to be special. She’s stylish & professional & I don’t know a thing about designers & what’s in!

Thank you for any guiding advice.

Proud Mom Mary

Anonymous

Mary,

Did you find anything you like? My daughter is getting her Master’s in Journalism and I would like to get her a nice, professional looking leather tote bag.

Thanks,

Robbie

Anonymous

What brand did you end up getting? I am graduating law school in two weeks and someone wants to get me one as a gift. I was looking at Coach but they are all men’s briefcases

Emily J

“Never” a computer bag? Eh?

I’ve seen scads of computer bags both in NYC and elsewhere.

Myself, I don’t carry a briefcase OR a purse; I carry a computer tote bag. In it goes my computer (obviously) as well as my wristlet and any other odds and ends that I need while commuting or traveling.

AIMS

I have stopped reading the words “never” and “always” — here and elsewhere — as the absolutes they should be, given their meaning. I just take it to mean either “rarele/often” or “i don’t/do like this.”

L

Computer bag as in black rectangular bag with nylon straps? I can’t remember the last time I saw one of those carried by a woman in NYC.

Laura

This has been on my mind as I recently started commuting for both work and school (MBA) purposes. I previously used a large Kate Spade tote, which had enough room for all I needed for the workday, but now that I must bring my textbooks and school necessities, I am in need of more bag space. My school gave us all messenger/computer bags with the school logo on them, which I like the idea of using since it is a rather prestigious school and could be beneficial for networking purposes. Nevertheless, it is not at all stylish. (Not an issue for most since the school is about 80-85% male.) Does the networking potential outweigh the lack of style?

lawyerette

Frankly I’d use a laptop or a wheelie bag if you’re carrying textbooks back and forth. This coming from someone who carried too heavy bags for years and now have a recurring shoulder injury as a result. Not worth it IMO. The logo thing is also probably not worth it, but you never know.

Another Sarah

I second the wheelie or laptop bag if you have textbooks. Take it from someone who carried her law school texts (approx. 2500pgs each, hardcover) in around in a messenger/computer bag. Ever since I graduated I’ve been trying to build up my back muscles to stand up straight again.

7

Ugggh, prestige whoring is barftastic comment.

Anon12

LOL

Lawgirl

LMAO. All of my branded/logo — from legal conferences, “prestigious law school,” and corporate swag — are used for my kids PE clothes, random jaunts to the beach, swim lessons for my kids, impromptu picnics, snack hording to the movie theater, etc. Didn’t know they were “networking tools.” LOL.

Anon

Mine are grocery totes, mostly :)

jcb

Mine tend to end up as dog park bags, dog towels … :)

MC

I use them as grocery bags too! :)

Anonymous

Using a school-logo bag is a pretty tool-ish thing to do, and doubly so if the bag is ugly. I’d suggest getting a nice leather tote to use for interviews and professional events, and a rolly bag or sturdy backpack so that you don’t injure yourself while hauling your textbooks around.

Ira

But what if your schools is raaaaather prestigious?

anti-logo

If your school is prestigious, then some might view is as doubly tool-ish.

anti-logo

*it

Ru

I’ve never looked at someone with their school-logoed bag and thought “hey, I want to network with that person.” It just comes off as pretentious. Also, the bags the schools give out are usually on the flimsy side and offer poor support.

Lyssa

I’ll disagree on the networking issue. Bear in mind, I’m in the South, and I would say that we probably have a bit of a different culture when it comes to striking up conversations with strangers. But, if I were carrying a bag (or something) that indicated where I went to school, I would have no end of people stopping to chat about whether I went to the school, how they went to the same school, how their [insert relative] went to/is thinking of going to that same school, etc.

So, if you look at networking as making as many connections as possible, it could certainly be good for that. (Note that this has nothing to do with the prestige of the school, more with the public’s familiarity with it.)

2L NYC

I agree. This is some of what I was trying to get across…and it is not only limited to the South! (although I am originally from the South…I don’t think the random people I meet can tell though).

2L NYC

I am in school and I use a backpack, which is great. If you have large books (and biz school might not), I can’t imagine doing it another way. If you are in a big city, everyone hates you if you have a rolling bag. Especially if you use public transportation.

Originally, my undergrad school gave me a backpack from my department, which I was trying to use only temporarily, as it was not at all stylish, but it was incredibly durable and I couldn’t find a replacement for a while. My undergrad school is quite prestigious, so I felt like a tool, but it wasn’t actually that bad. Probably what will happen if you carry the bag with your school name is that alumni of that school will notice, not really people from other schools, and occasionally other people who are MBAs (this is what happened with me — people from my undergrad/other people with my undergrad degree). It was actually quite a nice experience.

Kate

I have been considering getting a briefcase for a while, since it’s becoming more necessary to carry a laptop and folders. I love the ones that Levenger offers, but they are pricey. I have a mini messenger bag from Levenger (sadly too small for a laptop) that has been fantastic–holds up great and isn’t too heavy. They now sell it in laptop size, the Bomber Jacket messenger bag. It’s a little masculine, but highly recommended.

R.

I use a large Tory Burch totebag. I have a black messenger bag-type briefcase from Coach. I use it only when I am going to court. I’m in NYC.

Anon

In Chicago, a lawyer — I carry what I call a briefcase. I am wondering, though, if some of this isn’t just semantic. I’m not sure that others wouldn’t call it a tote. Black leather, soft-sided, rectangular with big loopy handles, open at the top (it CAN be zippered shut, but rarely is). It fits computer, power cord, wallet and stuff, and a couple of papers. I could not imagine my regular bag being something that couldn’t fit my laptop, because, well, that’s just how my job is. Among the other women at my firm, I am far more likely to see a canvas computer bag than I am to see a proper “purse.”

LC

That sounds exactly like what I carry, and I definitely call it a tote. In my head, a briefcase at least has to have a flap at the top, usually with two buckles/snaps on it. I wonder whether the semantic difference is regional or generational or just due to manufacturers who can’t figure out what to label their products.

Anon

So the item pictured at the top of this post, which Kat labels a “briefcase” is not, to you, a briefcase because no flap? Mystery solved. I think most of us, then, pretty much carry the same type of bag.

Anon2

For question 2, I brought this up in the designer bag discussion a few weeks ago. I plan on having a couple of bags designed and made in India during my vacation. I’m bringing pictures and have an idea of the colors I’d like that complement my wardrobe. The bags will need to carry my laptop and wallet so I guess I’d fit in the purse/ combo category. In addition to my work bag, I also bring my gym bag and lunch tote so if I had to carry a purse I would probably collapse!

Carrie

I have a black Coach messenger briefcase that I have had for nearly 11 years. I’ve had Coach repair the handle and the stiching once, which they will do for $20. I used to carry this all the time, now I only take it to court or depositions when I am only carrying a few things.

I’m on the market for a nicer totebag that I can carry to and from the office that will fit either a few files and/or my Ipad. My laptop bag is a joke and adds bulk with no real storage space and I’m so over carrying that thing around.

I’ve been known to use totebags from bar association meetings and I also have a wheeled case that I use when I’m taking larger files with me. When I’m hauling a lot of stuff around, I’m all about function over style.

J

This is the bag I got and I love it:

http://coakleybags.com/Products/Products.aspx?lid=4&cid=3

I had never heard of the brand, but it came recommended from a friend. I got the dark red, so it goes with everything. Its a nice, strong nylon rather than leather so it is amazingly resilient but still looks really classy. It is keeping up in great shape and I have been carrying to court, meetings, and on travel for a few years (and it lives in my office floor the rest of the time, which is not exactly taking careful care of it *sigh*)

It has one padded pocket that can be used for a laptop (or not) the middle section has pockets galore on both sides, outside pockets on front and back (one zips open on the bottom so you can slip it over a roller bag handle for travel) and pockets on the side for sunnies and water bottle. The bag itself is actually less heavy than my smaller coach briefcase.

Check it out- it may be a great option for you. Plus, I don’t see it EVERYWHERE, which for me is a plus (but i know is not a plus for everyong). Also, a federal court judge (female) complimented me on it at a luncheon– coakley FTW!

Divaliscious11

Chicago – I have 2 but never use them. When I need to carry something that doesn’t fit in my purse, I carry a tote. If I need something that can fit in purse, I’ll carry a larger bag on that day.

AT

Uhmmmmm…I use a backpack. And a nice Coach purse. I know. I know! But I have files, lunch, makeup, workout clothes, etc. all to carry with me on my commute on the Metro (in D.C.). I have a Coach briefcase but it doesn’t hold too much and is a little heavy. I use it for special meetings (and interviews). I don’t see a ton of briefcases, mostly totes.

MPC

I use a backpack, too– it gets awkward carrying more than one bag on the Metro, and I’m more apt to leave something on the train. I also developed scoliosis in middle school and am wary of carrying anything on one shoulder anymore.

AtlantaAttorney

I am always on the lookout for a good tote bag. I very rarely carry my computer back and forth, but almost always have a legal pad, journals/magazines, calendar (yes, I’m old school and use a paper calendar), and a few files. I used a beautiful brown leather tote bag from Coach (classic, simple lines) for years, and finally retired it because it was looking so shabby. Now I’m having a hard time finding its replacement.

Anonymous

Brahmin has some really nice smooth leather totes.

commuter

I am a lawyer and i carry a backpack. Not particularly professional, but I lug around a lot of stuff everyday and any kind of bag made me leant one side and really tweak my back. wheelie bags aren’t feasible either because streets in my city are filthy and I do not want to track anything into my home or office.

RR

In Ohio, and I use a huge Hobo International tote that holds my normal purse stuff, laptop, and a couple inches of files, along with water bottle. It zips shut, but I don’t normally zip it. I have a briefcase, but it just doesn’t hold much more than a thin legal-sized file, so I find I don’t use it often. I’ve been through several iterations of totes before finally hitting on the Hobo International, which I love.

coco

which one do you have? that sounds great

RR

This is what I have–the Agatha.

http://www.hobobags.com/Agatha/pd/np/27/p/1416.html

coco

hmm, I think I had something similar saved on zappos for a while, but it was much shinnier, which is why i never got it. that one looks perfect, thanks for sharing!

Nancy P

I have a Hobo fabric bag — black nylon — that I use for a purse and briefcase. I can fit a laptop in there, files, you name it. And the sides snap up so I can make it less enormous. I like how anonymous it looks — well-made, but not an obvious brand.

NYC

I had Paulina Carcach (on etsy) make one of her bags in a bigger size, so it would function as a briefcase and hold big binders and folders, etc. I can fit my work computer in it, but worry that it strains the bag too much (the computer is a honker). So sometimes I use the boring computer bag when I need to take it somewhere.

I would love to find a true briefcase, but precisely because they are sort of unusual, retro and masculine. I remember my mom’s big briefcase she used to take to court. Maroon leather, hard sided, almost the size of a lit bag. Had her initials on it. Yes, the sign of success in the 80s!

R

My mother has exactly that bag. It is still in beautiful condition. I wish I could find one now. It’s been nearly long enough that I feel it would look retro, not dated.

Sarah

BEAUTIFUL, thanks for the great idea!

Dawn

A lawyer in upstate New York–I have a soft-sided briefcase that I use for large files, to carry a laptop, or for those meetings when only a briefcase will do. Otherwise, my day to day is a Nine West cloth sided tote. It has great pockets, can fit lots of things, and since it’s black, it wears really, really well. I’ve gotten a lot of compliments for it looking “professional” without looking too much like a briefcase.

SoCal Litigator

I have been a litigator for more than 30 years and what I use to carry my work has changed over the years. When I was first practicing, there were few women lawyers and all you had to choose from was a masculine hard top attaché case (with a programmable lock). And I had several. I then changed to a soft sided attaché case with a strap. I added a rolling trial case (essential for trial) and replaced that once over the years. I still use that for trial.

When I started to carry a laptop around, I bought a standard nylon laptop case. That has recently been upgraded to a Timbuktu bag that holds the laptop in a separate compartment that zips open so it can lay flat and not have to be taken out for TSA screening. But usually I now use either a large nylon tote with a padded envelope or a large satchel handbag and just carry around my iPad. I only use my briefcases when I go to court. When I travel and go to court I try to use just one bag (either a briefcase or large tote) as carrying a briefcase and a purse is cumbersome.

I see most female lawyers in SoCal either using a briefcase or just a tote bag that fits everything.

M in CA

Same here. I no longer litigate, but when I did I used: briefcase (slim, neat, zipped at the top, had 2 top handles and a longer strap if necessary) and a small black purse that shut at the top to carry my personal items.

I wonder how much geography has to do with it. In SoCal (I’m in LA) we’re in our cars a lot, so we don’t have to carry everything around with us all day (gym clothes, etc.). It’s relatively easy to “travel light” when you’re having a day at court, because whatever you don’t need in court, you can leave in your car. I would imagine it’s a bit different in cities that use public transportation regularly (New York, DC, Chicago, Boston, etc.).

Chi litigator

Another long-time litigator here. When I go to trial I bring a paralegal who carries my stuff in a bankers box.

Anon

ooo – is it designer?

J

Wow. I really hope that was tongue in cheek.

Bonnie

During the week I carry a large open top purse that can fit a couple files and my laptop in a sleeve. If I need to take lots of work home, I use my wheeled bag similar to this http://www.ebags.com/product/solo/rolling-laptop-catalog-case-wfile-hanger/10487?productid=36517

I have a briefcase that I rarely use because it just gets too heavy to carry that much on my shoulder. I’m in D.C. and hardly ever see women carrying briefcases.

KM

I use a totebag/purse combo. It is the Kate Spade Griffin (sp?) bag that I got super cheap from Gilt. It’s large enough to carry all my stuff (files, shoes, lunch, wallet, etc.) yet it’s small enough that if I’m going out after work it passes as a larget purse. I really like it because it is tall w/ lots of pockets not wide which makes item placement easier (at least for me). I also like that it is a really soft croc embossed leather. It wouldn’t fit gym clothes, which isn’t a problem for me since my apt building has a gym.

Jen L

This is an excellently timed post. I recently watched the movie Post Grad (not very good) and Alexis Bledel’s character carries a sort of briefcase to her interviews. I’ll try to find a picture. I’ve been looking for something similar. I already have a great Nine West laptop carrier/tote bag that I love, but I don’t take my laptop to interviews and its really too big for an interview. I’m looking for something closer to the size of a portfolio that I can put my keys, phone, touch up makeup, etc in to carry to interviews. I’d love any suggestions.

Anon

This bag?

http://content7.flixster.com/photo/11/65/07/11650777_gal.jpg

Jen L

Yes, thanks! I got busy and couldn’t find a picture. Do you know what brand that is or know of something similar?

Anonymous

I am a lawyer. I have a very pretty leather, structured hobo-style handbag that holds my wallet, personal stuff, planner, blackberry, etc. When I have other stuff to carry, I normally bring a LeSportsac tote. I picked the LeSportsac because it’s waterproof, so I can stick my leather bag in it when it’s raining, it’s sturdy and easy to clean, and it has a zipper so I won’t spill stuff out of it. For nicer professional events, I carry a Franklin and Covey tote that I’ve had for years.

BigLaw Refugee

When I was in BigLaw I had a Levenger large purse/tote that could carry 8.5 by 11 files. It was a little heavy for my pathetically weak shoulders, but I got a lot of compliments on it. I carried that to and from work most days.

Now I carry a small purse and, for days when I am carrying more stuff, a tote-sized black LeSportsac. I love the light weight and don’t give a hoot whether I look fashionable anymore.

I have a rolling litigation bag (not very nice, but gets the job done) and for court I’d probably use that plus the Levenger tote.

Erin

I’ve only ever carried a big, structured leather tote in brown or black and I’ve worked in Boston, NYC, and DC. I feel like all the other young professional women I saw in those cities (say in their 20s – 30s) carried the same thing. I do remember my mother’s briefcases from the ’80s, though — softsided oxblood with handles that slid down into slits in the side (why the retractable handles?). I prefer my tote but what I do wish would come back from the ’80s are the galoshes-for-high-heels that she wore. Anyone else remember these? They stretched over the toes of her shoes with sort of a slingback around the back of the shoe. Kept her toes nice and dry in bad weather! I’d love a pair of those today.

Salarygirl

They still sell these in Japan, I had no idea they were from the 80s!

Eponine

They still make those and I’ve seen them posted on this site. I can’t remember what they’re called though… perhaps email Kat?

Kat

try these?

https://corporette.com/2008/10/17/bargain-fridays-tps-report-shuella-your-shoe-umbrella/

Texas

I have to have a bag with wheels for my laptop and binders. I can’t tote all that crap on my shoulder. I do carry a nice purse and last year my husband bought me a really nice Kate Spade tote that I carry now when I do not have to carry my laptop. I have gotten away from carrying my laptop to hearings now that I have an iPad. I have been an attorney for 20 years and I never paid that much attention to what kind of bags my fellow female attorneys carried until I saw this website. I live in Houston. I guest you fancy pants east coast executive types are more high faluttin than we are in Houston :)

Sharon

I am a consultant. I just got rid of my black Coach briefcase (about 8 years old) – it was black, had the flap, and was rather neutral in gender. It was in good condition still, but I just felt it was too dated looking and I am in a situation where my clients are younger than I am and I cannot look middle-aged. I got a Tumi nylon tote in plum (I did look at the Tumi bag referenced above, but preferred a different style) and have already gotten compliments on it. It just seems a younger, fresher look than the traditional flap-over briefcase. And the plum is fun. I do carry a handbag for everyday to my office, but for travel I simply use a wristlet to hold identification, credit cards and money. That’s the best thing for travel – you can hang it off your wrist as you go through security for easy access to your license, then stick it back in your tote. I don’t know any professional women who carry actual handbags for traveling on airplanes — they all seem to use wristlets of some sort, and they’re fine if you go out to dinner with a client.

L

But where do you put all the other stuff that goes in your wallet? I just looked at my wallet – it has 16 credit card slots and they are all full – some of them have more than one thing in them. I would never be able to fit all of those in a wristlet!

MG

I’m a law student, so the only time I ever use a briefcase is on interviews, but the briefcase I have was a hand-me-down from my aunt, who did have it custom-made in the 80s. It’s one of the nicest things I own, and since it’s lasted nearly 30 years I hope I can get it to last another ten when I go into the workplace!

kz

I think there may be a problem of definition here. What exactly makes something a briefcase? I’ve seen totes that some people would consider a briefcase, but I just consider a tote. When I think “briefcase,” I think the men’s version, and I rarely see women carrying anything like that, but I definitely see nice totes/laptop bags that some might consider a briefcase…

S

I’m in SoCal, and I generally carry a purse. But if I bring my computer with me or need to carry a lot of files, I use a laptop bag. Not sure whether it’s a “briefcase” or not. I have this bag, except in red:

http://www.ebags.com/product/mcklein-usa/w-series-deerfield-leather-womens-17-laptop-case/89261?productid=1172677

LC

I’m a young lawyer in SoCal, and I only know one woman my age who carries a briefcase. I use a large, black leather Coach bag, and it’s a durable, simple piece of equipment.

Beth

I agree with the varying definition of a briefcase. Are we all really talking about the same thing?

When I need it, I still carry a black Coach satchel-style briefcase that I’ve used for the last 13 years. It may not be trendy, but it’s classic and it’s served me well.

mamabear

When I carry a “briefcase”, it’s a laptop bag that looks like a tote. (Jack Georges)

However, it’s too big for me to carry around when I’m not toting my laptop, so I usually carry a purse. I’m aware that purses look less professsional, so I try to steer clear of logos, charms and other geegaws, but it’s still clearly a purse and maybe I should think about this more.

I only carry it in and out of the building, not to internal meetings. However, I do carry it to external meetings.

Kelly

I need to travel frequently for my job and, despite my best intentions, always seem to have take my laptop and a number of files. After years of dealing with my tote (I hate the man-looking standard issue computer bags) sliding around on my wheely bag, I bought a TheresaKathryn bag. They are stylish yet practical. And, most significantly, have a zip-slot on the back that allows you to slide them over the handles of your luggage to make dashing through the airports much easier. They aren’t cheap but I’ve found them well-worth the investment. http://www.theresakathryn.com/

anon

I’ve not heard of these bags before, but they look cute. Can you comment on the quality and construction?

Carolyn

I have carried a TheresaKathryn bag for five years, I use it for my laptop (in a sleeve) and files. This is the best work bag I have ever owned and well worth the investment!

anon

My preference is to use one bag for work and my personal items, rather than a tote and a purse. I commute on the metro (DC), so I prefer to limit the number of items I have to carry. I can fit several files in my latest bag, if necessary and if I have more files, I just take one of the office’s rolling bags to court or home. http://shop.nordstrom.com/S/3004346?origin=keywordsearch&resultback=81

By the way, for the person looking for the bag from the movie, here is a similar one:

http://www.ebags.com/product/lodis/audrey-slim-triangle-briefcase/14985?productid=1097027

Ash Law

What do you think about this bag as a briefcase-type tote? Thinking about getting it, and I was wondering if it was professional enough.

anoninSF

I shelled out for this awesome work tote made by a local guy here in San Francisco a few years ago and I love love love it. I’m a 40-ish biglaw partner, and wanted something professional but feminine that I could take to court and just lug files to and from work each day. Mine is black with silver hardware and I like it better than the brown pictured. It’s very high quality leather and still looks new after about 5 years.

http://www.glaserdesigns.com/Pages/WorkTotesHandbags/TotesHandlesStrap/TotesPD1413HST.html

S

Biglaw in NYC — I use a large Prada tote. (Which I got at an Off-Fifth at a fabulous discount last spring.) I’ve taken it to court and seen another associate with nearly the same thing.

S

It’s basically this but in shiny black pebbled leather:

http://www.purseblog.com/totes/prada-glace-zippers-tote.html

And I paid 1/3 of that listed price.

I’ve also used a large deep brown Furla tote that looks like a “briefcase,” about $290 on sale at a Neiman Marcus outlet. It often shows up on Gilt. Furla makes some great feminine but very professional looking structured totes and are often very reasonably priced on sale.

Sharon

When I hear “briefcase,” I tend to think something that either has those retractable handles (very old school) or something that has the full flap over it and tends to be a piece that could be worn by either gender. When I hear “tote,” I think of something without a flap, that is either fully open at the top or maybe has a zipper, and could potentially be appropriate to carry things other than laptops (such as clothing for an overnight stay). Totes tend to have more style to them, IMO. But that’s just me.

Working Mom

I’m curious about the comment that a purse is something only older women carry or is not professional. I’ve never heard that before. Can someone chime in on this?

Ru

I wouldn’t worry about that comment. Do what works for you, whether it’s a purse+tote combo, tote, briefcase, laptop bag, school bag, etc. I’ve done combos of all of the above depending on what I needed. Focus on what you functionally need and make sure it looks neat.

Anon

When I started practice I was advised by a family friend who was an attorney that if I usually carried a purse, I should continue to do so, and if I didn’t usually carry one, then don’t. Male lawyer, but he was pretty observant and from a long line of lawyers and judges so I figured he know what he was talking about.

ana

I am a lawyer in San Francisco. I carry what I would call a briefcase to court. It is black leather, zips closed at the top and has several pockets/compartments including a padded one for my laptop. It has both a shoulder strap and handles. When I carry the briefcase I also carry a small purse, simply because what I need usually won’t fit in the briefcase. I would much rather not carry more than one bag, so when I’m not going to court, what I carry depends on how many papers I think I’ll be bringing home that day. I have several large purses or “totes” into which I can put files and papers if I need to. I see other women lawyers carrying briefcases, totes, and large purses to court. If I have a whole bunch of files to bring with me, I use a black nylon wheeled briefcase.

LexCaritas

I’m in London and carry a purse. Actually, it seems like nearly everyone I see carries a purse. Younger women especially. There is a smattering of backpacks/gym bags and also a fair number of tote bags. Women carrying nylon laptop bags I assume seem to be traveling rather than just commuting. COuld be my perception though.

I think here most women in law seem to do a combo of purse and (if needed) tote bag.