The Best Mint Alternatives for Tracking Your Money

This post may contain affiliate links and Corporette® may earn commissions for purchases made through links in this post. As an Amazon Associate, I earn from qualifying purchases.

The super popular personal finance tool Mint closed up shop in 2024 (RIP), and unfortunately I haven't found an app that I like as much (granted, I haven't devoted THAT much time to researching tools, but still!). For those of you with the same dilemma, today we're rounding up the best Mint alternatives.

If you once used Mint, what have you replaced it with? How does it compare?

And if you remember, yes, couple of months ago we rounded up five great tools for managing your budget (including some helpful books!), but today we're going into a bit more detail regarding apps, because online personal finance tools deserve their own post. (And the apps below aren't just for budgeting purposes, anyway.)

{related: how much do you keep in your checking account?}

The Best Mint Alternatives for Tracking Your Money

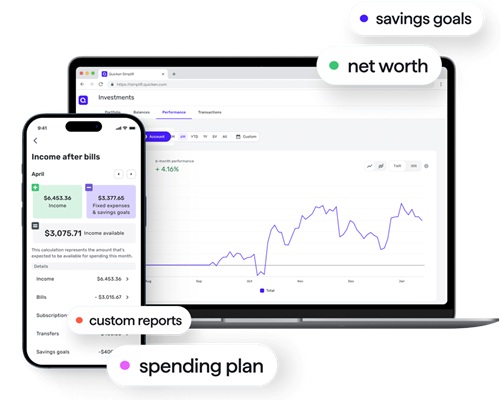

Quicken Simplifi

In addition to its basic functionality, Quicken Simplifi allows you to create a spending plan for the month, set custom savings goals (with virtual savings accounts to track them!), connect investment accounts, and make a watchlist to monitor your spending (according to a selected payee, category, or tag). The company has also recently added a retirement feature that lets you look at various scenarios to see how they'd affect your future savings.

To help you stay on top of your bills, you'll receive email notifications when you have a due date approaching, or when a bill has been paid — but you can turn those notifications off if you don't need them.

For some gamification motivation, you can also earn badges for actions like connecting an account, avoiding overspending, paying bills on time, and reaching goals. There's also an online community available.

Simplifi normally costs $5.99/month, but the summer sale [as of June 2025] gives you a rate of $2.99 (billed annually).

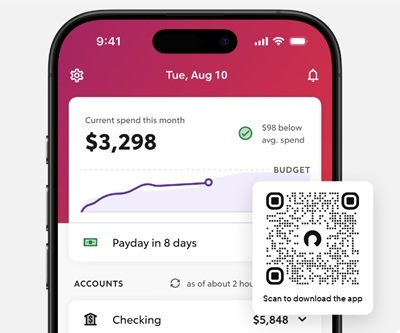

Rocket Money

Here's how we summarized Rocket Money in the post I mentioned above:

I've been hearing good things about Rocket Money lately (and no, not only from their podcast ads!) It has a couple of features YNAB doesn't have, especially regarding bills and the unneeded subscription services many of us have. (I mean, am I really reading enough Scientific American to keeping paying my online subscription? I am not.)

Rocket Money lists your subscriptions in one place, and your “concierge” can even cancel them for you (nice!). It also enables you to track your spending and net worth and to keep tabs on and lower your bills, with the aim of saving more and spending less. It also guides your saving habits to reach your goals, has handy phone widgets, gives you a free credit score, and even negotiates bills for you (for a fee, of course). Its website has free personal finance guides for members and non-members, and the company also offers a credit card.)

While Rocket Money is free, a premium membership with extra features is available for $6-$12/month, and you can sign up for a free 7-day trial (not nearly as long as YNAB's!)

{related: 3 great online personal finance classes}

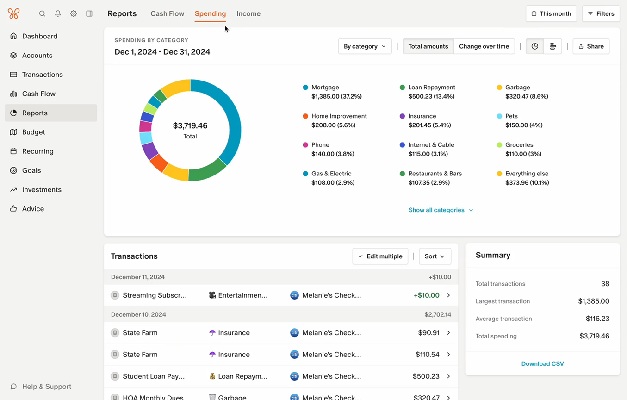

Monarch Money

Monarch Money‘s budgeting, tracking, and planning functions offer lots of helpful features. For one, a cool aspect of this app is that it has features aimed at couples, for those users who want to track together. For example, one user can flag a transaction for someone else to review (e.g., if they come across a “Um, what the hell?” purchase).

In addition to the basics, Monarch Money allows you to connect to unlimited accounts and has integrations for external tools like like Coinbase, Zillow Zestimates, vehicle values, and Apple Card. The app tracks your subscriptions and offers two budget systems, goal tracking, custom reports, AI categorizing of your transactions (which you can correct if needed), and more. It also has a feature called Flex Budgeting for, well, added flexibility.

Monarch Money claims that it connects with more financial institutions than any other app, but you can also add things manually to track them.

The full prices for Monarch Money are $8.33/month ($99.99 billed annually) and $14.99 for a monthly subscription, but right now you can get 30% off your first year [as of June 2025]. And if you sign up but aren't a fan, the company has a “no-questions-asked, money-back guarantee.”

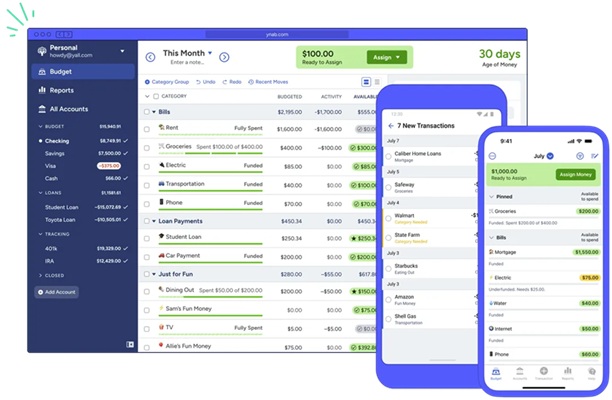

You Need a Budget

Here's what we recently shared about longtime reader-favorite YNAB:

YNAB is a hugely popular personal finance tracking tool, and lots of readers are big fans. Its website promises to teach users to “give every dollar a job,” “fund your wildest dreams,” “define priorities and guide spending decisions toward the life you want,” and “life spendfully.” (Does the word “spendfully” bother anyone else? Eh, I won't hold it against the app.)

In addition to the basic features you'd expect, here are a few others to know about: all-device syncing, community challenges, goal tracking, key reports, debt management help, and the ability to share your subscription with others. Online, YNAB also offers free Q&As, workshops, a blog, and an online community.

YNAB has a free 34-day trial (the site doesn't ask for your credit card first), and after that, the fees are $109/year (comes out to $9.08/month) or a $14.99/month plan. Here's a guide to starting out with the app.

NerdWallet

As part of their varied personal finance resources, NerdWallet provides a free personal finance app, -partnering with fintech company Atomic Invest to include extra features for users. NerdWallet's app is best for personal finance beginners who aren't looking for a ton of bells and whistles.

First off, the investing tools: You can get a Treasury account through Atomic Invest and earn 4.18% APY, and Atomic Invest also offers an Automated Investing account.

Plus, not surprising from a site like NerdWallet, their app contains financial education topics as well as staff ratings and reviews for credit cards, bank account, and loans.

Unfortunately, that's about all the details the company lists on its website, but again, this is a relatively basic, free tool.

{related: money challenge: review your renewing subscriptions}

Readers, please share your favorite Mint alternatives for tracking your money! Have you tried a few?

I was just thinking I need to get back into mint. I had no idea they had disbanded! I feel like credit karma is always pushing this type of thing but never looked into it. I’ll review some of these and report back. I use quickbooks for my business but since everything went to getting that started I’ve not much paid attention to (or had funds for) a personal budget until now.