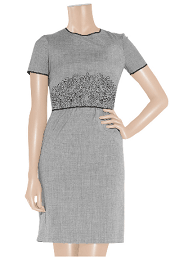

Wednesday’s TPS Report: Embroidered crepe-twill dress

This post may contain affiliate links and Corporette® may earn commissions for purchases made through links in this post. As an Amazon Associate, I earn from qualifying purchases.

Our daily TPS reports suggest one piece of work-appropriate attire in a range of prices. The Outnet has some new work-appropriate items on sale, including this gorgeous crepe-twill dress. I like the black silk trim and embroidery, which adds a feminine, but professional, touch. It looks super short on the 5'11” mannequin, but, well, she is 5'11.” Lucky sizes only, alas, but it's a good deal: was $470, now marked to $141. Philosophy di Alberta Ferretti Embroidered crepe-twill dress

Seen a great piece you'd like to recommend? Please e-mail tps@corporette.com.

(L-3)

The Outnet has some new work-appropriate items on sale, including this gorgeous crepe-twill dress. I like the black silk trim and embroidery, which adds a feminine, but professional, touch. It looks super short on the 5'11” mannequin, but, well, she is 5'11.” Lucky sizes only, alas, but it's a good deal: was $470, now marked to $141. Philosophy di Alberta Ferretti Embroidered crepe-twill dress

Seen a great piece you'd like to recommend? Please e-mail tps@corporette.com.

(L-3)

Sales of note for 7/3/25:

- Nordstrom – 2,700+ new markdowns for women — and the Anniversary Sale preview has started!

- Ann Taylor – 40% off your purchase, including new arrivals + summer steals $39+

- Athleta – Last Chance Semi-Annual Sale – Up to 70% off + Extra 30% Off (cute gym bag!)

- Banana Republic Factory – July Fourth Event, 50-70% off everything + extra 25% off

- Boden – Final call sale, up to 60% off + extra 10%

- Eloquii – Flash sale, extra 60% off all sale

- J.Crew – End of season sale, up to extra 70% off sale styles with code

- J.Crew Factory – All-Star Sale, 40-70% off entire site and storewide and extra 60% off clearance

- M.M.LaFleur – Sale on sale! Extra 25% on already discounted merchandise! Try code CORPORETTE15 for 15% off

- Rothy's – Up to 50% off seasonal faves, plus new penny loafers and slingbacks

- Spanx – End of season sale, get an extra 30% off sale styles

- Talbots – 40% off your entire purchase, + free shipping on $150+

And some of our latest threadjacks here at Corporette (reader questions and commentary) — see more here!

Some of our latest threadjacks include:

- what should I pick for our company-branded conference swag?

- what non-sneaker shoes can you walk a mile in?

- I'm 31 and feel like my life is too stagnant…

- which emojis fill you with rage?

- how can I make house guests more comfortable?

- my friend is at her wit's end with her SAHP

- when is it time to quit therapy?

- why is it so hard to stay on top of school communications for my teen?

- what hobbies or skills do you wish you'd picked up during the pandemic?

- how can I better enjoy domestic business travel?

- older parents: what actually mattered and what didn't with your kids?

- am I being petty by wanting to delete all of my how-to-do-this-job guides before I quit?

I will search the archives, but I thought I’d ask as well. My parents are moving from Houston to Canada (~1.5 hrs north of Calgary). Do you have any winter clothing recommendations? I have experience dressing for skiing, mostly in Utah, but nothing as far north as Canada. Would love some guidance.

Canada Goose is the best, but also expensive and not absolutely necessary around Calgary. A down-filled parka from Land’s End, LL Bean, London Fog, Eddie Bauer, Columbia, North Face or any variety of companies will do the trick.

If their new location is rural, I’d recommend Serious Winter Boots like Sorel or Columbia, but in more urban centres any boots and warm socks will be sufficient.

Even if their location is urban, they will need Serious Winter Boots. I live/work downtown, and on days when it’s -40C, even if the ground is dry, I know I want the warmth of my Sorels + wool socks.

Agreed with all the companies- I know Patagonia also sells great winter stuff.

Frost plugged boots (Sorels have them). Seriously. Do it. It will keep the heat from leeching out the boot of your foot.

I can’t give you specific Canada shopping advice for stores or anything (though I believe the Canadian readership has been all excited that a Nordies has recently opened in Calgary). But, as a person of relative northern clime, my best advice is layers. Because when its cold outdoors, you will very likely be traveling more by public transit there then you did in Houston (in which it may be warm) and then indoors it could be hot — so you may during any given winter day need to have two to three layers.

It’s not opening until fall 2014. Sears, who was there before, is closing this fall. I can’t understand how it will take 2 years, so I assume the store will be amaaaazinggg for that wait.

I assume you are mostly concerned with outdoor clothing, because the indoor clothing would vary less.

This has definitely be addressed before, but pay attention to your materials. A bulky cotton sweater may look warm, but that thinner wool or cashmere sweater will actually provide insulation. Purchase wool, cashmere or fleece hats and scarves, pashminas will not cut it in the winter. I wear leather gloves for the style and grip, but when the temperature really drops (say below 15 F), I switch to ski mittens. No shame.

This past winter I finally purchased a “puffer” coat that goes down to the knees. While certainly not as sleek and chic looking as the wool walking coat I wear most of the winter, on those really cold days you need the warmest option available. If the town is more casual, or you are just visiting, your existing ski jacket would probably do the trick.

Oh my gosh. As a Houstonian, I cannot even conceive of walking to work in temperatures below 15F. That’s going to be a huge adjustment for your parents. Good luck to them!

I know….good thing they both originally from the midwest, but they have lived in the south for 30 years!

Ha, this happened to me. Completely spoiled by four years in a mild-winter climate. Now I’m back to a “real winter” place and I joke those intervening years made me weak ;)

I did the opposite. I grew up on Lake Erie and lived in Rochester, NY, then moved to New Orleans and have been here for 22 years. I’m now officially a cold weather wimp!

My Dh was in Calgary for 5 years. I traveled to and fro often. It’s do-able. As a Houstonian, it’s nice to really wear winter clothing. Love my wellies with felt liners … great up and there and here, nice when Houston gets tons of rain. Kamik from Canadian Tire. We also wore merrells alot of the time as Calgary is a great walking town, esp. with the Plus 15 in the winter! Enjoy. Be sure to take in Stampede; it will put all notions of “rodeo” and/or state fair out of your Houstonian heads … it’s amazing.

Wishing to best to your parents and to you as I suspect you’ll visit them, eh?

Wow! What a big difference! Are they moving to Red Deer? I’ve never lived there but I’ve visited and one of my direct reports is in Red Deer. It’s a nice little city.

Anyway, a warm winter jacket, warm boots, and gloves/hat (or hood) are essential. Honestly, once they get here there are tons of brands from many different stores that will do the trick. My down parka I got from Costco and my winter boots are from the Canadian version of DSW.

They will also want warm indoor clothes – pants, sweaters, socks, warm layers. Because even though your house temp is warmer than the outside temp there will be a draft. I have a heated mattress pad on my bed that I LOVE because I hate getting into a cold bed.

They should also know that in the winter sunny = really cold. Cloudy = less cold.

They’ll need to plug in their vehicle overnight (and possibly at their workplace if it’s parked outside all day) to keep the battery warm so the car will start.

I have honestly never owned wellies, and I’ve lived in Alberta my whole life.

That’s all I can think of. Good luck to your parents!

“They should also know that in the winter sunny = really cold. Cloudy = less cold.” – This is spot on and can be a really tricky lesson for people coming from warming climates.

Also, a good point about warm indoor clothes. A good pair of house slippers, like the Lands End or LL Bean shearling slippers, will make a big difference at home.

Yes! I forgot slippers! Thank you. I also have a couple of warm cardis & hoodies that I only wear around the house in the winter to stay warm because my dh likes the temp in the house cooler than I do. And I have a blanket I pull out when we’re watching TV in the evenings.

Something else – we are so far north here that in the winter days are really short & for a few months you don’t see the sun outside work hours. This can be tough on some people, but the summers help make up for it when its light at 10pm or later.

And if you can get a place with lots of south facing windows, open the curtains during the (sunny) day to help with passive heating. South facing windows in northern latitutdes are awesome.

Also, it will be dark by 4pm.

Get flannel sheets. Possibly a down comforter.

Definitely a down comforter. LLBean has great flannel sheets, too.

I like the flannel duvet covers from LL Bean, and their wool blankets.

Definitely agreed with the really sunny=unable to breathe outside without feeling pain cold. Cloudy/snowy = less cold (but still cold).

They should also know about Chinooks- the warm winds from the mountains that can make it really really nice outside in a very short period of time. I think the biggest jump I’ve been around for is around 15-20C. But, for newcomers, they can give you wicked migraines.

Oh, and the area is dry. They’ll need something to keep their nasal passages lubricated in the winter, otherwise nosebleeds are likely.

Get a humidifier. I finally wised up to that one and it has made all the difference in the amount of winter static I get and how dry my hands and lips are.

I have a humidifier at home- we’re not allowed them at the office, which is where I spend 10+ hrs of my day. :(

We easily got the plug for the engine warming put in our car in Texas … might be easy to do in advance here. Be sure to give the dealer a heads’ up though; they won’t have it on hand in H-town :)

I wore winter silk long pants, slips, camis, tanks, long sleeved items all the time.

Can’t say enough about good gloves and a hat – but your options will be better in AB than TX.

There are great socks for indoors called Varma. It’s an Icelandic blend and so soft on the insides. I also think that many of the hiking purveyors have winter wicking-away socks, but I can’t recall the brand right now.

Thinsulate zip up vests and jackets are great around the house too – LLBean.

Flannel lined pants around the house – LLBean

Ditto on flannel sheets

There are oil filled radiators (look like the old fashioned ones) that really do a great job in warming up a den or bedroom with the doors closed. They plug into your regular electric outlet. No exposed flame.

Not from Canada, but I’m from a very, very cold place. Lands’ End long commuter coat is amazing for a fairly low price. It’s Item # 41925-5AD8 (for women; I don’t know if they make something similar for men). All of Lands’ End’s “warmest” rated coats are good. I also recommend getting something they can cover their faces with when they’re walking outside. I usually just use a scarf over my mouth and nose, under my hood which covers my forehead. Skin can actually freeze fairly quickly in very cold weather. I also always wear a hat under my hood, and on days I have to look nice, I actually usually find it warmest to wear a long skirt with long underwear underneath, boots, and my long coat coming down past my knees.

Oh, cashmere lined weather gloves. They aren’t as warm as ski gloves, but you can move your fingers more. I just stick my hands in in my pockets to keep warmer when I’m not using my hands.

My Lands End commuter coat shed feathers to the point I had to give it away. Too bad, because it was super warm…

Really? I haven’t had that problem at all. Lands End will accept returns for money back at any time, even years after you purchased the item – I would have returned it if it started shedding a lot.

Update: I am losing my mind. It is a 2 hr PLANE RIDE (8 hr drive). Fort McMurray.

Whoa. Okay, that is seriously far north. Your parents are going to need serious winter boots, like the Sorel Caribou version, a hood over the hat, long underwear for underneath pants, etc.

Upgrade everything that has already been said and probably skip the leather gloves for ski mittens.

OK, yeah, Fort Mac is REALLY far north – and fairly remote. But I have a cousin who has raised her family there & they really love it.

Eddie Bauer makes really great, warm winter coats. North Face, too. Definitely scarves, really warm gloves, etc. If they are moving soon they should have time to buy everything they need when they get there before it starts getting really cold, so they can ask for advice from sales associates, etc. If they are moving November or later that’s going to be a huge shock to their system, and they’ll want to get as much winter gear as they can before the move – probably will need to buy it online.

Yipes. I’m assuming it’s oil-related if the jump is from Houston to Ft. McMurray, I imagine they’re not the first people to make that move.

I believe winter up there is equivalent to Calgary’s worse days but for months on end. Like -25C on average. I think Ft. McMurray maxes out at around -50C pre-windchill, whereas Calgary’s worst is -40ish including windchill. I’ve been told that the sun rises at like 10am and sets at like 3pm. I’m annoyed with the 9-4:30 sunlight, losing another 2.5-3hrs hours of light would make me seriously grumpy. They will definitely need Vitamin D supplements. And a humidifier at home.

They need to get down coats, and layers, and they need face coverings so they can breathe outside when the air is that cold, and mittens (not gloves, mittens keep your fingers warmer), definitely Sorels, but also wool socks under the boots as well….I know that I will sometimes pull snowpants on over my tights on my way to/from work on the worst days, your parents may consider that? Also, something to prevent windburn, not only on their lips, but also their face.

I’ve heard that things cost more in the north because it’s so expensive to get things up there, so your parents might consider buying the more expensive winter items in advance.

Eeesh! 5 hours of sunlight??? That sounds terrible.

And -50 degrees? People actually LIVE there? Without being oil drillers or scientists or explorers? Perhaps I’m more Southern than I thought.

Y’all. Seriously. I think I would literally die if it got that cold. I get obnoxious and whiny when it’s, like, 35.

I think it sounds delightful.

Well, it’s 50 below outside, not inside. And you really spend most of your time inside on days like that. Or just going outside briefly to get to a different inside. It’s really the extended periods of darkness that start to get to you. And then if its cloudy when the sun’s supposed to be out – ugh. Then you start to WANT it to be cold, just so the sun will come out, so you can take a nap in that pool of sunshine. Or maybe that’s just me. I hate February.

I think it sounds delightful, and also, 20 hours of daylight in the summer!

this is totally not helpful, but this makes me so happy I moved to Toronto. While last winter was probably not a fair comparison, I don’t think it dropped below -5 often, if at all, whereas I was in Calgary for a week in January and it was -50 with the windchill.

That amount of sunlight sounds just about what I’m facing in Norway for the winter – though fortunately I’m on the coast with the gulf stream going past so less gruesome temperatures. Just moving one hour by plane further north has some consequence

Advice in dealing with the lack of sunlight, as recommended to a colleague from Venezuela:

Vitamin D supplement (seriously, the Norwegian government recommends it in all months containing R, and then usually cod liver oil, so you get omega 3 oils at the same time),

A “daylight” lamp (possibly one with a wake-up alarm)

Roll with it – embrace candles, getting together with friends inside, toasting marshmallows in fireplaces, and so on. If you fill the season with happy times inside…

hyggeligt!

I’m west of you (and a bit further south so I get an hour or two more day light) and totally have my sad lamp.

I grew up there!!!

It’s really beautiful and I have heard that it’s grown a lot since I lived there. My parent’s old house went for millions a few years ago.

No recs for clothing since I haven’t lived there in so long. But I hope that they like it!

Sorel boots, long underwear (the good kind), full ski mittens (so much warmer than gloves), and any longer down coat (I survived just fine farther north in the Lands End “warmest” long down parka.) Ensure they cover their faces/exposed skin at all times during the winter. You may need to wear snowpants just walking around if they are doing lots of walking, because even that foot between boots and coat can be killer (only on the coldest days though).

I live farther north than Ft. McMurray, but on the coast, not inland. So perhaps not quite as cold and windy here, but it is darker and the winters are longer. Finding the perfect winter coat is a lifelong project for me.

Look for down insulation that is 700 fill power or higher. In my opinion, 650 fill power and lower just does not cut it. The higher the fill power, the warmer the down insulation and the more expensive. Also look for a coat that has “full baffles” or “box baffles.” Most down coats have “sewn-through” baffles which are not as warm because the inner and outer layers of the shell fabric are sewn together in between the down tubes, making cold spots where there is no insulation at all. Full baffles have strips of fabric sewn in between the layers to create tubes for the down fill so there are no cold spots. All the Patagonia down jackets have sewn-through baffles. Keep in mind that the puffier the coat the warmer it is.

http://www.mec.ca/AST/ShopMEC/WomensClothing/InsulatedOuterwear/Down/PRD~5017-629/mec-kamouraska-parka-womens.jsp – You might think this coat looks warm, but it won’t be. It has only 550 fill power down and the baffles are sewn through. It will NOT keep you warm below zero degrees F. The Storm Degree Jacket looks better but it doesn’t say whether it is fully baffled.

The best full baffle down jacket for your money I have found is the Eddie Bauer Peak XV for $350. It doesn’t look super puffy in the photograph but it is, and that is what counts. It also has an enormous hood. It ain’t cute, but being warm is not about cute, it is about survival. I also wear a Skhoop on the coldest days in the winter. Also not particularly cute, but the whole ensemble is VERY warm.

The only other type of coat that will keep you as warm as goose down is animal fur.

Goooorgeous. I just snatched it up.

So beautiful! Too bad it’s gone :(

Really pretty! Alas, way too short though :(

Yeah, I’m nervous about the length given that I’m 5’8″ but we’ll see. Perhaps I could let out the hem and get an inch or two more.

I know it probably would make clothing more expensive, but I wish all dresses came with a substantial hem… pretty please?

Nothing at the link so perhaps even the lucky sizes are gone as well.

When I bought it, there was only one size left (mine – yay!), and it told me there was only one left in my size. Sorry, guys.

I like the silk trim but I’m not sure if I’m a fan of the embroidery…

financial question threadjack: should I pull money from my anemic savings to pay down high interest (24%) credit card debt? I have a credit card balance of about 2 pre-tax paychecks (how did this happen?!?! I feel like this site is actually part of the answer…), and a savings account with maybe a month’s worth of living expenses in there.

I started my job this spring and am building savings much more slowly than I had hoped (in part because I’m spending too much money on frivolous things, in part because moving is legitimately expensive and I’ve had medical costs), so I’m anxious about pulling from the savings account, but 24% interest is huge!

I set up my paycheck to deposit in part in to my savings account, but I end up pulling the money back out every month for things like paying down my credit card. I don’t know why earning more money than I ever have is making me less responsible with money, but it seems to be.

have you tried applying for a card that will give you 0% on balance transfers? If you have decent credit there should be a number of such cards available to you. I would look into that and transfer as much of your balance as you can. If you have an account on mint.com they will suggest cards offering that option. If no such cards are available you might want to try calling your credit card company and seeing if they will lower your rate (unless it’s a penalty rate — if its that they won’t lower it).

Otherwise, I would not take money out of your savings, but I wouldn’t worry about adding to your savings right now either (assuming you have a stable job). I would put every last cent toward your cc debt.

Definitely try to transfer to a lower interest rate card if you don’t feel comfortable depleting savings to pay it off. This is what I did when I had huge amounts of credit card debt. I also called the credit card company and negotiated a lower interest rate with those who were willing.

Oh I am/was so in your boat.

Budget, budget, budget. You aren’t going to solve your savings problem or your credit card problem until you know how much money you have to work with. Calculate your fixed expenses and then go back through your monthly statements and see what your variable expenses are (food, utilities, etc).

Set up a fun money budget in a separate account. It is the only thing that helped me from continuing to purchase stuff on the cards and thinking I’d get to it later. It should be reasonable, but allow you to reign in your spending.

Make sure you are budgeting your savings and how much you want to put at your cards a month. Any “extra” money should be split between the two.

To answer your actual question, I wouldn’t pull the money out of savings because if you have a true emergency you’ll need it and you won’t want to be paying the high interest for that. Maybe consider opening up a new card to do a balance transfer and/or negotiating your interest rate down if you have good credit.

I’d start by calling your bank and asking for the interest rate to be lowered. It’s worked for me in the past when I’ve threatened to move my debt elsewhere (if you have a reasonable amount of debt and a high job, you’re a reasonably sure thing and represent future investment and mortgage business in the future). If you can get it down to around 8-10% then you might not need to pull from your savings.

If lowering the interest rate is not possible, then split the difference. Pull some of the money from your savings account to pay down your credit card principal, but also save some for a rainy day when you might need it.

This is what I would suggest:

(1) Call your credit card company right now and ask for a lower interest rate on your credit card. 24% is ridiculous and they know that.

(2) Keep your savings account intact as it is so that you have a little buffer and don’t go back into debt.

(3) Put the money that you are currently putting into your savings account towards the credit card debt.

(4) Don’t use your credit cards for anything at all until they’re paid off.

And of course, (5) cut down on your expenses as much as possible until you get the credit card debt paid off. See if you can get by for a few months on just the clothes in your closet, bringing lunch from home, and cutting back on eating out. The nice thing about making a good salary is that if you cut your spending down to the minimum, you can accrue a lot of money before you know it.

If having all this debt is freaking you out, I’d apply for a CC with a lower rate (you can DEFINATELY do better than 24% if you have decent credit), transfer the balance (as others have suggested, you can probably find a ) or close to 0% card), and lock your credit cards in a drawer until you have them paid down. Use cash to buy things you need, and skip the rest. Sounds like after 2-3 paychecks you’ll be back in the green.

Moving forward–and I know new jobs are the exception to this rule because there are a lot of up front costs–only put stuff on the credit cards that you can afford to pay off at the end of the month.

Then again, there are lots of people that carry a balance; that is, in fact, the idea behind credit cards. I’ve just never been able to stomach it.

Thanks everyone! I should have mentioned this was a store card, which I think changes their incentives. They won’t budge on the rate, although it’s not a penalty rate. The rewards probably aren’t worth it to me, so I guess I need to transfer my balance and close it. I guess I’ll also try to set reasonable goals for saving money, maybe bringing lunch two days a week. My rent is relatively low (26% post tax), I eat out maybe twice a month, I do my own nails, eyebrows, etc, and I have student loans, so clothing and lunch are sort of it in terms of flexible expenses, I think.

I have, for unrelated reasons, been looking for a new bank. Anyone have any recommendations in NYC? Has anyone banked with M and T? Chase? I’m currently with BoA and WANT OUT.

I’m not trying to be snarky, but is paying 26% of your take-home pay as rent considered low? I pay about 22% of my take-home pay as rent, and my take-home pay is obviously less my taxes but also less my health/dental/vision and my 401K contribution. And I thought I was middle of the road. Is this actually low and I didn’t know it?

Well, when you work in Manhattan it’s quite low. Generally I think the recommendation is for it not to be more than 30% or 33%, but many, many people in DC and NYC exceed that out of necessity. If I were in a Texas office, of course, I’d be paying less than than (or not living in a basement…)

I lived/worked in Manhattan for two years and it was _so hard_ to save money. Everything is expensive. Rent, taxes, orange juice… you just bleed money. All you can do is do your best and try to maintain stability as much as possible so you don’t have additional, sharp expenses (like moving). It’s a tough city to cut expenses and save money though.

I’m in DC, and pay about 40% of my takehome into rent + parking. I could pay less, but I already did the brutal commute from the burbs and didn’t want to deal with it anymore. So, I see it as my studio apt. rent and parking spot includes my sanity.

Mine is 15% post tax but I live in a very, very small space with a roommate and no cable. This is pretty much a necessity since I am paying my loans off on level payments which is 33%.

I am struggling with this too Cornellian but mine are all gifts and travel and food. I risked it and paid it off with my savings and I am now saving again. I just couldn’t really see any emergency that I couldn’t pay with my other cards. I do not think that is the financially smart move – probably best to be more patient than I was and split the difference like lawsuited said to do.

I think the main thing I have changed besides obviously budgeting is to stop telling myself “I deserve it” everytime I want something because I work hard. I was doing that way too much so I had to switch it around to tell myself okay if I accomplish this much paid off, this much saved and do not eat out for X days, I get one reward for that.

I live in DC and rent is 35% post-tax paycheck. I live in a 1 br and it’s worth every penny given the hours I sometimes have to work and the peace I come home to

My family’s rent on our house is 25% of my take home pay. We get by fine (but frugally) on my income alone, which is good because dh’s employment is inconsistent. However, I know I live in a high COLA for my country, or at least high housing cost area.

I live in NOVA and just calculated that I pay about 38% of my take-home pay in rent. Yikes! And that’s for an inexpensive (for this area) 1 bedroom apartment that doesn’t have central air, a dishwasher, in-unit laundry, etc. and is still a long walk to the Metro. I know lots of people that pay more per month and make about what I do or only slightly more.

No wonder I have trouble saving as much as I want to.

Our rent is 26% of my take-home income, but it’s more like 18% of combined income with DH.

We’re in the process of closing our BoA accounts and moving everything to a credit union. There are some downsides to credit unions (not always the most convenient option), but we refinanced our car with them at 2% interest (from 4.6%!)!

If you have a lower income and very high federal loan balances, you might qualify for Income Based Repayment on your federal loans. This sets your payment to a smaller amount based on income. You can check out a calculator on IBRinfo.org

The upside with Chase in NYC is that they’re everywhere and you can use Duane Reade ATMs for free, too. They also often have promotions for checking accounts where if you open an account and make it your direct deposit accnt, they’ll give you $100 or $150 (depends on the promotion). If you make the switch, definitely take advantage of that! The downside and dealbreaker for me is that they don’t have a 24 hr. helpline and are not that common outside of NYC. As someone who’s lost my wallet after hours and generally likes to pay bills online at midnight, I really consider being able to get help or cancel my debit card at 3 a.m. kinda essential.

I have no experience with M&T, other than to say that it doesn’t look like they have a lot of ATMs around here.

I have accounts at CitiBank and HSBC and am relatively content although the interest rate is so low I really should switch. HSBC is very convenient, has good customer service, has a decent number of ATMs and also had ATMs abroad so that when, e.g., I was in Paris, I could take out money without incurring fees. HSBC also has a cab that drives around Manhattan and if you happen to see it, you can get a free ride. Obviously, it’s rare but I’ve ridden it thrice! Oh, and when someone fraudulently used my debit card number, they placed the withdrawn money back in my account during the investigation so I didn’t have to deal with not having it while they figured out what happened.

I can’t say anything positive or negative about Citi. I mainly use it for a savings account and I need to move it because the rate is soooooo low but I just haven’t.

As for switching, I am considering switching to Capital One – they have a higher rate and refund your ATM fees anywhere in the world so that makes their lack of brick & mortar locations a non-issue. If anyone has Cap One experience, please share!

My local bank was bought out by Capital One and I feel like I’ve had excellent customer service from them. But, we have local Capital One banks, so that hasn’t been an issue for me. For what it’s worth, I have my checking and my credit card with them and I just bought a new car and it was Capital One financing and I was able to connect my accounts and now I can see my auto loan when I log into online banking and paying my car payment is as simple as transferring from one account into the other. Online banking and Bill Pay has been great, although I did struggle a little bit to figure out why I couldn’t put my Capital One auto loan as a payee (the answer was that’s not how to do it). I also have the Android app, which is great for checking to see if a direct deposit was made.

Just putting in a plug for a small, local bank here. Hubs and I switched to Apple Bank about 6 months ago, and I couldn’t be happier. They have better rates on savings accounts and personal customer service. Not many ATMs, but there’s one close to home, so we’re good with that. Also, they still have free checking, which is going the way of the dodo.

You don’t have to close the card, just transfer the balance and stop accruing the crazy interest. If you are in a position in the future to use the card and pay it off in full, then the rewards might make sense again (also, the longer accounts are open, the better for your credit score). But no rewards, generally speaking, are going to outweigh crazy interest rates.

This!

But be aware if you transfer the balance of how long the promotional rate is for and if you can really pay it off in that time. Most balance transfers are 6 or 12 months, and if you haven’t paid it all off in that time you pay an even higher interest rate, often retroactive to the beginning of the balance transfer. Don’t transfer more than you can honestly pay off or you’ll be in worse shape a year from now.

I’m also with BOA (mortgage through them so I get free checking), but I just switched over to USAA. It was super easy to open an account online and I did not have to provide any of my dad’s service information; they did not even ask for it.

I’m not in NYC but I bank with Ally. They don’t have their own network of ATMs so you can use any ATM fee and they reimburse all the ATM fees you accrue each month. They have online and telephone customer service (no branches), and everyone I’ve talked to has been prompt, courteous, and helpful. Decent interest rates on their accounts and I like their online banking interface.

Be careful about closing the card. It may lower the amount of credit you have available, which would impact your credit score. I would opt for paying down your total debt first (ie – whether you end up leaving the balance on this one or transferring it to another card), then maybe consider closing it.

This is a VERY good Idea. I had alot of credit card debt when I gradueated law school, and my dad said that I had to grow up and learn how to budget. He also said I had to learn the TIME value of money, and gave me an INTEREST rate calcuealator. From there, I learned that it is better to have MORE money in the bank (where they pay YOU interest) ONLEY if it is earning more INTEREST then the credit card interest that you have to pay TO the bank.

So if the bank is paying you 1% on the saveings account and you are payeing 24% to the bank on the credit card, you are looseing 23% for the priviledege of having a bank account with money in it.

That, my dad showed me, does NOT make any sense at all. Even my ex told me the same thing and he is a CPA, so between the two, I knew I was getting good advise.

Now I have both a bank account and a credit card debt, but both are manageable. I also am going to watch my spendeing more carefully as my dad is NOT happy that I am NOT planning to increase my 401(k) contribution’s. He said he is going to put together a financeial plan for me b/c he is not going to be here forever. I said YES YOU ARE!!!!! And he had better, b/c he helps me alot.

Ellen is gives wise advice here. For more info I’d highly recommend Suze Orman’s “The Money Book for the Young, Fabulous, and Broke” where she goes into detail about dealing with debt vs savings.

This book really helped me when I finished grad school and was starting to get my finances back on track after years of brokeness and debt accumulation. It targets 20-something beginners to financial planning and provides really straightforward and realistic financial advice.

I agree with the suggestions that you:

* do not take from savings to pay down the credit card

* stop using the credit card

* if you can (given that it is a store card), either get the rate reduced or transfer it to a 0% card

* divert some (half?) of your automatic transfers to savings to paying off the card

* reduce your expenditures so you don’t end up here again

Re the fact that it is a store card, I would close it as soon as you can. I think store cards are a bad idea, and I got rid of my only two (Saks and BR) years ago. If you have an Amex and a VISA, you can shop at any store in the US — or abroad, in my experience. Whenever a salesperson offers me “you can get 5% off your sweater if you open a store card with us today,” I tell them that my credit history and credit score is more important to me than the 5% off. I cannot tell you how many times this happens.

Good luck

I agree that 5% (or whatever – sometimes it’s 30% the day you open) usually isn’t worth it for me to open a card – my rule of thumb is that I want a $250+ benefit to take the hit to my credit score by applying for a new card. If you are buying a ton of stuff, it can make sense, but I agree generally – it’s good of you to turn down offers for new cards.

However, now that this card is open, it makes sense to keep it open (with the balance elsewhere) for several reasons:

1) Your credit score improves when your average age of account is longer. For younger people, this generally means it is better to keep your existing accounts open. The exception is if you have a very long credit history and this is a recently-opened card.

2) Your credit score is better the lower your “credit utilization” – so if this card is sitting there with, say, a $2500 limit and a zero balance, that will be good for the utilization stat.

3) I haven’t heard this one much, but based on my own experience with a service I trialed that advised me on how to boost my (already good) credit score, the more “types” of credit lines you have (e.g., credit cards, home equity, auto loan, student loan), the better for your score (other things equal). Store cards are coded as a different “type” than normal credit cards, so this card is helpful on that front.

A big thank you to everyone who commented yesterday on breaking into sciences! I passed along the great advice and now he has a networking event this weekend. Plus the fed resume book suggestion was really helpful as well. You all really are the best.

I just wanted to thank everyone who took time to comment on my exceedingly long question yesterday about balancing marriage with a career that I love love love. You brought up some great points that I hadn’t really thought about, like a career being similar to a marriage with ups and downs.

I had a really good talk with H last night, and I think we’re on the same page. We agree that I haven’t been as present and our time hasn’t been as high quality lately. He said he doesn’t really believe me that things will slow down in a couple of years, but that he’s ok with that as long as he feels important. I also told him (nicely) that it’s unlikely that I’m ever going to be a person who works 40-45 hours per week and that’s it and that he needs to really consider whether he’s ok with that. He seems like he is, so hopefully he’s not just saying that for now. Anyway, thanks again to everyone!

Glad you guys had a good talk! Getting into the habit of frequent and honest communication is so very helpful :)

^HiveFive!

i hope this catches on.

Me too. I just went back and read the part of the thread where that came up and was like YES. THIS MUST HAPPEN. It is so fetch.

Is anyone else saying this in a Borat accent???

Oh yes.

HiveFive! Is great success!

I just laughed out loud at my desk. Hadn’t even thought of Borat.

Gretchen, stop trying to make fetch happen.

im doing what i can to help with that ;o)

Me too. HiveFive!

I like this! Hive five!

Post-baby, I bought some nice work clothes for a body that was largely one size larger but two sizes larger in the pooch area. I have not so much lost weight, but the pooch has shrunk since putting these clothes away in the spring (so pooch area is maybe 2 sizes too big, but the rest has gone to “relaxed fit”). Now that it’s getting chilly again, they don’t fit (so legs are too long and are hems are dragging; fixed for now with heels) and I’m not sure if you bring things down a lot in the pooch / upper hip area, especially in pants (where I had pre-baby issues with having a small waist for my hip size).

The crazy thing is that these are my main washable pants (so bonus of no ironing if I grab them out of the dryer quickly enough), so they are not my “nice” things, but the things I’m not afraid to wear and really like having.

Thanks!

Your question is a little unclear, but a tailor can take in pants at the side seams. It wouldn’t hurt to take them to a tailor & ask what can be done.

Short version:

Can you take apple-shaped pants in size X and tailor to pear-shaped body in size X-2 in the waist and X-1 in the upper hip?

Not sure if this is a miracle or ordinary (have had to learn this the hard way with hair styles; stylist assures me that while she has talent, she is not capable of true magic).

Short answer is yes, but get a price from a tailor.

If the tailor says the waist can be taken in, it will fix the length issue and pants will hang correctly. In DC it was $15-20 fix. If you can fix 4-5 pairs of pants for less than 1 new pair it’s worth it in my book.

Has anyone had a parent control their finances well into their 20s? My father paid off my student loans (a significant amount post-grad school) with his savings and so I intend to pay him all back. While this is clearly a boon – an interest-free loan – and I make a good enough income to pay it back in a few years, I am struggling with how to pay him back. He has control over my bank account and pays off my credit card (I keep track w/ Mint and my own spreadsheet). Every time I try to discuss implementing a payback schedule w/ him and even figuring out how much he paid in total (they were not consolidated, so it was all over the place) he says I’m not a crazy spender and all is fine, just keep doing what I’m doing. I am not comfortable with this uncertain timetable. I am trying to move out from home soon and find an apt with my bf, gain independence and be in charge of my own finances…any ideas on how to handle this issue? Money is a sensitive issue in our household with my dad having always been the primary breadwinner before I entered the workforce.

What do you want? Do you want to control your own finances? If so, open a new bank account and start getting your paychecks deposited into it. Open a new credit card, and start paying it off yourself–with your new bank account.

If you want to pay back your dad, figure out how much you owe him, and how much you can pay per month. Then start sending him checks. Keep a record. If, for example, you owe him $10,000 and you send him a check for $100 each month, you’ll know that after 8.5 years, you’ve paid him back [assumes 0% interest].

Of course, sounds like Dad doesn’t like this idea one bit or he’d have encouraged it much earlier.

Ach, this sounds somewhat familiar to me. While I never was in this situation with my parents, they did offer to do nice things for me financially for a period of years in my early 20’s, after I had disentangled myself from them financially in almost all ways. I refused these offers because, while I know they love me and I truly believe they thought they were just doing something nice, I also think they like feeling as though I’m dependent on them. Kind of like the poster yesterday who said she asks her mother for advice about trivial things because her mom likes to feel needed.

All this is to say that it’s easy to get in these types of situations with your parents, but I think it’s dangerous for the relationship and your independence, which it sounds like you recognize. It also sounds like you may just have to push harder with your dad to implement a repayment schedule. So, when he brushes you off saying everything is fine, you insist, “No, I really need us to sit down, figure out the total amount I owe you, and establish a repayment schedule. I don’t want to continue this way.”

Also, an important first step is getting control of your own bank account. Why does he have control of it, anyway?

This is really easy to solve on the straight $ side, although I don’t have any suggestions on how to communicate with your father.

1. Apply for a new credit card in your name only.

2. Transfer balance from previous credit card to new credit card. That takes care of the credit card issue.

3. Open a new bank account.

4. You say he “has control over [your] bank account.” I assume you mean it’s a joint account to which you’re also a signatory. If this is correct, transfer $$ from old account to new account (but check your minimum balance requirements first so you don’t rack up fees for either account). Done.

The bigger issue here is obviously that you’re looking to be more independent but haven’t really put your foot down with your father. I don’t envy you. I was in a similar situation at one point, and it took a LOT of gnashing of teeth and needless emotional drama to get my father out of my finances. Once you put your foot down, you’re going to have to stick to your guns. I can’t tell you it’s going to be pretty, but (1) it will be worth it in the long run and (2) time heals all things. Your dad will get over it eventually.

Your dad sounds like mine. He controls the bank account that I use to pay my student loans. I’m sure there’s some historical reason we set it up this way in the first place, but I no longer remember why. But it’s my money in the account and he just makes sure the payments happen on time, so I don’t mind – it’s actually helpful since I travel so much.

Anyway, I borrowed a ton of money from him in law school, and some more to help pay off credit cards after law school. He let me set up a payment plan for the credit cards, but wouldn’t hear of being paid back for law school (even for the car he bought me). I guess it makes him happy to feel he’s taking care of me even though I’m well into adulthood. I just gave up and named him as the beneficiary of my life insurance policy.

Regarding feeling dependent on him, why can’t you take back control of your checking account without worrying about paying him back for everything?

My dad loaned me money to pay off my credit cards a couple of years ago (which i’ve completely repaid to him) and financially supported me for a few months when I was unemployed. He never had control over my bank accounts or anything though. I’ve always respected his approach to dealing with money and value his advice, so when he loaned me money, I kept him in the loop as far as what my budget was each month and how I had budgeted to pay him back. For the credit cards, I paid him the same amount I was paying the credit card companies, but it was 0% interest with him. We agreed to a certain percentage of my income that is above my monthly budgeted amount for the living expenses. This way I’m still adding to my savings while paying him back.

Maybe something similar would work with your dad. You could keep him involved on your decisions and plans, but have him removed from your accounts.

Another option would be to just move the money to a new account without his name attached. It would be easier since I think you’d need his approval to remove his name from your current accounts, but it might cause friction between you if he thinks you’re going behind his back.

Hi all, thanks for the words of wisdom thus far. To clarify, the credit card is in my name he just pays it off along with his since I work long hours and it’s an errand off my shoulders. In terms of ‘control over my bank account’, I wasn’t really clear. It is in my name only (I have removed him, per his suggestion actually) and my direct deposits go straight there. I don’t touch the account because I view it as accumulating loan repayments to him. Since he pays my cc bill, I’d need to offset the amount in the account from what he paid for my bills. The remainder is how much I have paid him off so far.

However since I have no clue the exact figure I owe and he brushes me off whenever I try to get into a concrete plan (I think he doesn’t care about exact repayment, it makes him feel good to know he helped his daughter who worked so hard in school), the money is just sitting there accumulating and I am not sure when it will reach the total amount owing. I guess I just need to put my foot down and wrangle it out of him.

Do you have any of the loan paperwork? Even if they’ve been paid, it might be possible to log into your accounts and see what was paid.

It sounds like you need to sit down and have an honest conversation about this. Ask him for the loan totals paid or for copies of the paperwork if he doesn’t know the answer off the top of his head. If you are planning to move out, you’ll need your paychecks to be deposited into an account that you feel comfortable touching since you’ll have regular expenses. Also, I’d start paying the credit card bill yourself every month since you are basically immediately paying him back each month. Tell him you’d like to do it since you’ll need to get used to paying all sorts of monthly bills when you move out. It really only takes a few minutes every month, so even though it’s convenient for him to do it, it wouldn’t be inconvenient for you to do so.

You really should take the couple of minutes it takes to pay the credit card.

You should be able to get credit card statements that would show how much has been paid.

You could also get statements from the bank account that shows withdrawals.

Using either of these two options (or the two together for checks/balances), you should be able to tell what’s been paid on the credit card.

I would double check your credit card to see what automatic payment options are available. My card (thru BOA), allows me to select an option which pays the card off in full from my checking account. The payment goes through automatically on the due date. This might resolve the problem that your dad has to pay your card due to your travel schedule. It’s automatic, no input necessary except to set up the automatic payment mechanism (which is a one-time event).

you could just start paying him a few hundred a month…

You can figure out how much your student loans were by using the National Student Loan Data System at http://www.nslds.ed.gov You would need to know your PIN from back when you filled out the FAFSA online. But you can also request a new PIN be sent from that site. It will tell you how much your loans were when taken out and the balance at payoff, if memory serves me correctly.

It was definitely a pain getting that pin, but I had private debt after I exceeded the fed maximums. There was also interest and fees involved as it took a while post-grace period to pay it all down.

It seems to me that you need to tell your dad what you said here: so grateful for his help, but you’re an adult and you need to take control of your own finances.

Out of curiosity: Has anyone joined the National Association of Professional Women? Is it worth the hefty membership fees?

I have never heard of this. It seems sort of vague — is for lady-issues networking? I envision random doctors, architects, accountants, lawyers, finance people, but what what would they talk about?

I guess I’m biased (lawyer, 2 small children), so if it’s not client-related or likely to help me in my field (CLEs, etc.) or really fun, it’s not on my list. More a function of No Free Time.

My understanding is that this organization is a scam.

Ohhh – now that you say “scam” I kind of do remember hearing stuff about this a few years ago. I had forgotten about that and tried to join, thinking it was my duty to check it out for you guys — just had a longish “interview” call, was told I was accepted, and then asked if I wanted the $775 or the $995 membership. And then she gave me attitude when I said, “Look, I’m going to have to do a bit more research before making a decision about that.” Hmmn.

Actually this is refreshing my memory too… I recall it being a scam because I also was intrigued by it when first starting out in the professional world. I never go to the interview, but I did get a number of what I would call harassing/annoying calls from them, which led me to learning that they were a scam via the amazing google.

A scam organization of theoretical professional women with vague or unspecified purpose? Sounds more like my niche than Kat’s. Maybe I will pretend to join and post a fake review on my own sight. Thank’s!

Never heard of it either. I’ve heard great things about Women in Technology (hey, this is a blog) in terms of networking, professional development, mentoring, etc. etc.

Morning question for all of you ‘rettes: The alumni association from my undergrad set me up with a mentor. She was unable to make the official initial reception and we’re meeting for lunch later this week. The instructions for the program indicated that she should initiate the communication and she proposed going to lunch and picked the place. Should I still offer to pay, since she’s taking the time to mentor me? I’m not clear on what the proper etiquette is. Thank you!

I think you pay for yourself only or the mentor pays.

I always pay for my mentee (see previous post regarding budget problems with gifts/bar tabs). If I could not afford to pay for lunch, I would suggest coffee and pay for that. If I could not afford coffee, I would invite her into my office and meet with her privately there. It’s not the same situation, my mentee is a current law student and it is through a women’s organization. But, when I volunteered to do it, the rules were not clear but I assumed I should pay if I suggest we go out. I would never let a mentee pay for me though but, that’s just me.

If s/he pays, I would genuinely say “you didn’t have to pick up my lunch, thank you so much!” when she pays and then thank her again at the end for lunch and her time. Be prepared to pay for yourself. Let her make calls on splitting the bill when the server asks (if applicable). If it is an “order then sit” scenario, let her order first and see if she pays just for herself.

That’s nice they have that program. Make sure to keep contact. Even if it is 6-12 mos. later I think it is okay to ask questions or see if they have time for another lunch/coffee date. I am really busy and so I rarely follow up with my mentees. The ones that do follow up, I always make time.

I’ve been through these situations many times. Oftentimes they’ve whipped out their cards so fast, they made it clear it was them who pays. Other times, you offer but so far everyone had declined. I think it is understood that the mentor pays, them being a fully-employed professional and often able to charge it to their firm account.

Thanks for the advice! It was less clear to me because I am also employed full-time (does that affect your answer?). She is ~10 years my senior.

Offer to pay but she’ll expect to pick up the check. Just remember to say “Thank you.” (I know this is common sense but people forget due to nerves.)

California ladies, a PSA. You can now register to vote online at the Secretary of State website. Register by October 22 to vote in November. Regardless of who or what she supports, I hope every woman on this blog who is eligible is registered to vote and exercises her right to vote. We are way too smart not to participate. CA registration link to follow.

http://www.sos.ca.gov/elections/elections_vr.htm

This.

Even if you think you are registered, you should check your registration. I moved in the last year and filled out a change of address voter registration form but apparently it was never received or process, as when I checked my registration last week it was still at my old address. I’ve since changed mine. Google [yourstate] voter registration and most states allow you to check your voter registration online, many also allow you to register or change your address.

Also, as pointed out on a different blog – if your state has voter ID laws, make sure your name on your ID matches your legal name matches your voter registration – if you’ve recently marriage, divorced or otherwise legally changed your name your ID needs to match, and in order to change your name on your ID you need to FIRST change your name with the Social Security Administration.

Ohio link: http://www.sos.state.oh.us/SOS/elections/Voters.aspx

oops, married, not marriage. Stupid fingers typing ahead of brain

YES — I just checked my registration in my new state and I wasn’t registered (until just now, of course), even though I said YES when they asked me at the DMV. Thanks for reminding me to check — I would have been so bummed if I couldn’t vote this fall.

This. So many people forget to update their registration for life events. Finding out at the polling place is not ideal.

Thank you so much for this. After years of registering as “decline to state,” I decided after watching the conventions that I am and have always been a Democrat and need to re-register, so thanks for making it easy for me!

Tell your friends! Pass along the karma and register someone else.

I just got my ballot via email!!

http://gottaregister.com

Thanks to everyone who provided suggestions for my marriage problems. I took your advice and had a serious talk with my H last night. I told him that the situation with him not having a job or seeming to be looking for a job was making me extremely anxious, and that I thought we needed a five-year plan and to be more transparent about our finances/debts. I also told him that I was not going to tell him what to do or try to “parent” him (although, I didn’t say “parent”). He seemed to take everything really well, but he was very… quiet. So, we’ll see. I think he feels really disappointed in himself and guilty, but he has a hard time expressing his feelings. Anyway, I feel MUCH better today! It’s like a weight is lifted knowing that I don’t have to feel responsible for his choices, and that this weekend we’re going to sit down and put together a budget and figure out how much he needs to be making to keep us out of the poor house. I cannot thank ya’ll enough for your support!

Prompted by Cornellian’s budget inquiry . . .

I have never had trouble managing my money. I don’t have a budget, just a general sense of goals and a built in balance to spend more sometimes and save more others. So why oh why can’t this translate to food? I overindulge, limit too strictly, get too hungry, rinse and repeat ad naseum. Budgeting via WW works, but I struggle with it so much. I’d like to get to a place with food like I am with money- a check-in every quarter but generally staying on target without worrying about it. Has anyone else made the transition?

I was like that. What helped me was using the sparkpeople tracker and planning my food for the day. What is a budget other than a plan, really? I’d consider what i had going on that day, if I was going out for lunch, etc. What we’d be having for supper. Then I’d see what nutrients I needed more of (usually protien & fibre) and try to plan my snacks accordingly. Of course, I screwed up lots. I love food! But after a month or two it became more second nature, especially as my body got used to the new eating plan/budget. I’m not as strict as I once was, and should really work at losing 5-10 lbs, but I still know what proper portion sizes are, etc.

I also spent many years like that before reading a book called ‘Eat What You Love, Love What You Eat.’ It took me awhile to change my habits, but this book helped a lot in terms of making me aware of how hungry I am (or am not), and why I was eating. I still keep track of what I eat and how hungry I am/how full afterwards, but do not measure or track calories/nutritional information. I am definitely more relaxed about eating now, and not so focused all the time on what I am eating, when, etc.

No advice, but this is me exactly. I have so much discipline without doing anything overwhelming (or anything, really) in terms of money and don’t fully understand the mind games people have to play with themselves to spend less. But on the food side, I am the complete opposite. So, commiseration!

What’s your built in balance for food? You need to have a general idea of healthy eating like you do with your spending – maybe it’s eating 5+ servings of fruit and vegetables a day, eating x servings of whole grains, eating x servings of lean protein, avoiding sugary drinks, limiting it to a couple snacks a day, etc. Once you figure it out and start eating that way, you’ll have an idea of what that balance should be and your body will come to expect it. It might help to draw up a plan and test it out for a month.

I wanted to eat more healthfully and I looked up the Harvard Guide to Healthy Eating. Very good, concrete steps (week-by-week) on how to re-adjust each part of your diet. They were big on these mini-reforms like eating enough fruits and veggies.

Try the no diet approach. This has really helped me to be aware of my feelings when I’m eating and when I’m hungry I eat, when I’m not hungry I don’t. It takes some getting used to, but I feel much better, I weigh less because I’m only eating when I’m hungry and stopping when I’m full.

I’ve been doing it for about a month, and it isn’t easy, but it is getting easier.

Dr. Jenn Berman – my favorite radio shrink- has an app called No More Diets, I haven’t used it, but it is the same idea.

I struggle with this too! For a while I counted calories, but it became exhaustive and I started to see myself getting a little obsessive. Not a road I wanted to go down….

Now I keep a daily food journal – no counting!!! I just keep a 4×6 notebook in my purse at all times, and jot down what I eat. Sometimes I do it throughout the day, sometimes at night. It just makes me so much more aware of what I’m putting in my body and that’s incredibly helpful for me. The hardest part was making it a habit, but now that I’ve been doing it for a while it’s just part of my daily routine.

I haven’t made the transition, quite yet, but what I’m trying to do is have a set breakfast and lunch every day for a week, and bring the lunch to work. Something where I know the total amount of calories in my two earliest meals, plus the afternoon snack – and then I have a remaining “budget” of calories for the rest of the meals of the day.

I decided to go with the same thing every day to make it easier on the day to day operation, but to change it up weekly, so I don’t get tired of having the same for lunch forever.

Example of my lunch last week,

2 Wasa crisp breads with 1 slice roast beef, a bit of margarine, tomato slices, pickled cucumber and a small smattering fried onion on each, and one carrot.

Lunch this week:

2 Wasa crisp breads, each with 2 slices of ham, a bit of mayo between the ham and crisp bread and cucumber slices, and one carrot.

Breakfast has usually been an apple, and a yoghurt or crisp bread. The snacks have been fruit or a couple of crackers before exercise.

I’m uncertain how it will go in the long run, but taking the work cafeteria out of the equation has definitely helped me control the amount of calories I have at work.

I’m not there, quite, in terms of dinner/eating out, or sweets at home. I wish.

This may not be that helpful, but I don’t think you can really expect to manage your eating like you manage your money. There’s a lot more complexity to food “budgeting” that makes the analogy not really work — yes, you may have a daily calorie allowance set for yourself, but there’s a lot more complexity in terms of when you eat, nutrients, bodily hunger signals, etc that make it really hard to say, “oh, just 400 more calories to eat today and then I’m done!” without a lot of struggle.

I personally try to eat “intuitively” now — no counting anything, but paying more attention to hunger signals and things that I’m craving, on the assumption that my body will more or less find its own balance. The only problem with this is that for some who try it (myself included) your body settles into a higher weight than what you might want. For me, the extra pounds are far outweighed by the extra sanity that comes from no longer obsessing about food, though.

I am so there too. I track my food sometimes on myfitnesspal and when I do I eat much healthier and weigh about 5 lbs less than when I don’t. But then I veer into compulsion/wierdness. So then I stop and I head toward overindulgence. I’m pretty moderate and controlled in all other areas of my life and I am not overweight, but my clothes do fit better and look better when I am just a bit lighter than I am now. I am just coming off a couple month period of no tracking (and the 5 lb weight gain attendant with that) and re starting the tracking/losing cycle. I exercise quite heavily and am healthy but I do kind of find it annoying/ difficult that I continue to put so much effort into my weight.

I’ve been on WW for about a month and doing pretty well, but I am always hungry. They have the alternate plan that allows you basically anything off of a core list of foods with no tracking then you track anything not on the list (butter, cheese, alcohol, sweets, etc.). You could easily (or at least more easily) approach food like this without subscribing to WW itself. I am going to give it a whirl and see if I can still lose weight without worrying if I ate a 4 oz chicken breast instead of 3 oz while at a friend’s house.

I have had this problem my whole life (always being either too strict or too loose with food intake) and I only now feel like I’m getting to a good place. I told myself I would take care of my food issues before becoming a mom, and that’s happening in a month, so I went gung-ho for this:

1. I figured out generally what foods make me feel better (healthy not heavy, happy not moody). These are usually veggies and whole grains.

2. I’m totally “allowed” to eat whatever I want. Recognizing the foods that make me feel good without also restricting myself seems to be the key.

It sounds simple, but it’s really hard when you’re used to counting every calorie or “treating” yourself with comfort food every time you have a bad day. I consciously think about my “plan” all the time, but I avoid thinking to much about specific food choices in the moment. The great thing is that I’ve lost weight–just a few pounds in a few weeks, but enough to convince me that this is the way to do it. It’s like giving myself permission to eat everything has made me choose healthier foods without even realizing it. I’m becoming less food-obsessed every day. :)

Bahhhh – vent. Boss continually discusses politics and uses the word “retard” – I thought people stopped using that word a long time ago. Zappppps my energies!!

There was a thread last week (I think) where we discussed this issue and there were some great examples of what to say to someone when they use a term like that. One person even called her boss out on it.

It was me, and my boss used the word “rape” inappropriately.

I thought it was you but then completely blanked! I think what you said to your boss could be similarly used by others for other terms.

I was in North Carolina (middle of nowhere in NC) 3 years ago and stopped at a random gas station that was also in the middle of nowhere. They had one of those donation trays with the words, “Help the retarded children”. I was like, “Wow, apparently the fact that is no longer PC to use that hasn’t reached this place yet”.

I’m 28, and last year, I took a new job. I was brought on to lead a specific initiative that is a “special project” of our board, but that project has been stalled–and stalled again– for various reasons. It has been almost a year since I was brought on, and I literally have nothing to do.

I spent my first 6 months traveling around doing client roadshows, then was told to slow down until we build the infrastructure to support new clients. Also, I work remotely.

The checks keep coming in, but I am SO BORED. I have about 15-20 hours of legitimate work to do each week. I’m filling my time keeping current in the industry, working on internal projects that I’m basically making up as busy work.

Do I stick it out, enjoy the free time while I have it, and see if my business unit starts to pick up the pace? Do I try to make a move within the company to a place that has more going on? Cut and bail, see if I can find some other sucker of a company to match this (IMHO awfully high) salary?

I know these are first world problems, but I’m afraid that at my age, if I’m just treading water waiting for something to happen, I’ll have nothing to show for it after a few years. But I really do like having so much free time at home…

Look at the internal openings first – that way you have a better chance to stay at the same salary level.

Step up your networking – volunteer for proposal work, participate in charity events, anything that may expose you to other units of your company.

You may also use your free time in the office to study for a professional certification.

I’d say you’re at high risk of being laid off, so I’d start looking for a job. The suggestion to look for a job internally is good, but I’d have my eye open externally, too.

That was my biggest concern…and I talked it out with my supervisor. I didn’t say “I have no work to do” but I did say that in light of the ever-moving project i was hired to spearhead, I was concerned I wasn’t being valuable to the team.

She apparently thinks I have a lot to/do contribute, and assured me that if nothing else, she thinks I will be building out a team under me in the next few months. She’s #2 in the dept, so if there were talks of making cuts, she’d know. I think.

I think it would be valid to ask her if there are projects you can help her out with, since your schedule is looser right now without the roadshows. You don’t need to say “I don’t have enough to do” but more “I have some time if you need me since I’m not traveling”. Also, I would be concerned about the overall viability of a company that brings people in without much to do – how many other employees do they have like you? I think an equal worry along with being laid off is if the whole company goes belly up, especially if its a newer company.

Are there trainings you could attend in your freetime? Or take a related class online? Is there a professional organization you can join to “keep current in the industry” as well as network in case your position does get cut?

Shockingly, this is not a newer company. I am very confident it isn’t going anywhere. I recognize that the situation is a little ridiculous,; DH laughs at the situation. I am doing the networking thing and have been spending a lot of my time at various industry events (“nothing to do? here! go to a tradeshow!”)

I figure if I can stick it out for another year, I can always take a couple years off and have some kids ;) Not trying to be flip, but I did run the math when I took the job–working 18 months at NewJob is equivalent to 2.5 years at Old Job. So even spending 6 months unemployed would work out as a net gain in income (assuming, of course, I could find a job in 6 months).

I have an interview for a judicial clerkship at a state court of appeals coming up. Our state does an en masse pool process so I’ll be facing 8 judges at the same time. Any advice on prepping for an interview like this? It seems impossible to know the details I would normally research about an interviewer for all 8 of them.

I don’t think it’s impossible to read 8 judicial bios. You don’t have to know every last detail, but you should be able to learn their names, any really important info, and to scan for anything relevant to you, such as recent important decisions, or if one of them went to your law school, etc.

As for other advice, make eye contact with all of them, don’t focus on just the one asking you the question. Be really enthusiastic and prepare a well thought out answer as to why you want to do this. I think in clerkship interviews, enthusiasm is really important. I would also come up with one or two examples of how you had to quickly learn a new area of law/confront a legal issue and mastered it (this is a lot of what you’ll be doing), and also some examples of when you had to face tight deadlines and how you handled that. Finally, this is often an intimate job where you work with people in small groups – personality counts. Think of some interesting hobbies, etc., to share if you are asked. Don’t just say, “I like to read and hang out with my friends” – come up with some fun facts.

Good luck!

I had an interview like this (and got my clerkship out of it!). Definitely read their bios to know where they went to law school and if they have any special interests. I also read some recent opinions from the court (you should be able to easily find on the court website) in case they asked–pick topics that interest you. If you can match names and faces beforehand, that would help. Even though I tried to do that, I got nervous and forgot who had made a prior point–no biggie, it’s just something you can try to prepare for.

It was definitely a little awkward trying to meet everyone and shake hands while trying to get started with the interview, but don’t let that thrown you off, if it happens. Bring enough of your resume/etc. for everyone, in case you want to distribute it (I would expect them to have it, though).

Just remember that the judges are all really bright, passionate people and I would guess they get along with each other if they’re doing a group interview. Be prepared to have eloquent answers if they ask you who you would prefer to work with or where you would prefer to work, if some of the judges sit in different locations.

I will say that my en banc clerkship interview made me so much more confident with interviews in general.

I haven’t had this type of interview, but I have had “panel” interviews that are four or five on one. The most awkward thing for me was whether to respond directly to the person who asks a question, or to “look around” and make eye contact with all of the folks when explaining an answer to a question. This was exacerbated by the fact that the questions were more likely to come from the “senior” person in the room, so I felt like the other people were just staring at me. AWKWARD! This would largely depend on the physical setup of the interview, but when I did a few of those interviews, the table was round, and it was really uncomfortable. So…just one thing to keep in mind–have an “answering” strategy re who you’re going to look at. The physical/eye contact aspect seriously distracted me until I got the hang of it.

Good luck–sounds like a completely amazing opportunity.

I also had the same experience and I did get a job out of it. What helped me most was doing mock interviews with professors at my school. Also, don’t freak out if you flub it a little–I totally put my foot in my mouth during the interview, but they hired me anyway! They’re looking to see if you’re a “good fit” so just be your charming self and you’ll be fine.

Thanks for your helpful comments!

While I am not good at budgeting what I eat (I am the girl who goes grocery shopping to buy dinner for TONIGHT, pretty much every other day. I eat a lot of Subway…) my best friend is a rock star at it. She goes grocery shopping every Sunday, and puts everything in tupperware for the week. When we were in law school, she’d be able to just pack her lunch in 5 seconds each morning, because it was set to go. It’s all in her preparation, and it’s very much like a budget. Perhaps a similar approach could help?

I know it’s really superficial, but did anyone else get the horrible email from Starbucks yesterday? No more free syrups and soy milk with Gold membership?! Well then what’s the point?

I agree! You do get free drinks more often (every 12 as opposed to 15), but I think I’d rather have the free syrup.

I was so sad!! Hazelnut soy latte was my go-to. Means I probably will stick with tea/coffee and save lattes for the free drink =(

What?! is this for real? I didn’t get the email so maybe they’re not rolling it into Canada yet but that is awful! I love my soy lattes…

My email said free drinks/food are every 12 purchases, the free “drinks” can be used for food now too, and that they’d load the free drinks onto your card (which is great, because I only get maybe 1 out of every 3 “Free Drink” cards in the mail that I earned, I’m certain Canada Post is to blame), and yes, no more free soy/shots, and no more free tall coffee when you buy a pound of beans.

its on their website at starbucks . ca / rewards faster (no spaces… obviously).

I don’t get my post cards either! This might actually end up to be better if I can stick to just brewed coffee and then save my lattes for my free drinks. (plus less calories!)

Agreed! But I’m glad they got rid of those postcards – I was always leaving mine at home.

Same. I never end up actually using the postcard before it expires.

:) This made me laugh. Would make a great submission to first world problems.

I was really disappointed with that change too.

what’s the deal with sbux anyway? I go about 1x weekly, but don’t have a “membership” is it worth it? my office has not great coffee, so 7/10 times, I’ll get a venti pikes.

You don’t have to pay for a membership and earn free coffee (and now food) after a while. I use the Starbucks app on my phone so don’t even have to carry around a giftcard and just pay with my phone.

You just get a Starbucks gift card, register it on their website, and use it to pay. You start racking up rewards after you’ve bought 5 drinks, I think.

In Canada, you buy a gift card and register it. After you use the registered gift card for 40 transactions (40 transactions, not 40 drinks. If you buy 3 drinks at once, it counts as 1 transaction) they send you a Gold membership card.

With all the money and trees they are saving on no more birthday postcards, they cannot afford to give away free syrups. Wait….