Weekly News Update (And — Come See Us In Miami!)

This post may contain affiliate links and Corporette® may earn commissions for purchases made through links in this post. As an Amazon Associate, I earn from qualifying purchases.

Liking these posts? Follow us on Twitter or fan us on Facebook — this is the edited version of what we’re reading! (We also Tweet if we hear about a good sale.)

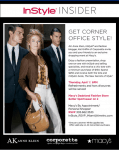

– As we may have mentioned, we'll be heading to Miami this Thursday night (!) to help host an event at the Dadeland Macy's with AK Anne Klein and InStyle. We're so excited!! Posting will continue throughout the week, but we thought we'd do the weekly round-up today instead of Friday. If you're near Miami, please come out and join us — you can RSVP by calling 305.662.3533, or e-mailing RSVP_InStyle_Miami@timeinc.com.

– As we may have mentioned, we'll be heading to Miami this Thursday night (!) to help host an event at the Dadeland Macy's with AK Anne Klein and InStyle. We're so excited!! Posting will continue throughout the week, but we thought we'd do the weekly round-up today instead of Friday. If you're near Miami, please come out and join us — you can RSVP by calling 305.662.3533, or e-mailing RSVP_InStyle_Miami@timeinc.com.

– Robin Givhan of the Washington Post has some thoughts on whether the fashion choices of Michelle Obama and Carla Bruni-Sarkozy are an “international wedge issue.”

– Robin Givhan of the Washington Post has some thoughts on whether the fashion choices of Michelle Obama and Carla Bruni-Sarkozy are an “international wedge issue.”

– Zen Habits has some suggestions on how to simplify your workday.

– The good folks at the WSJ's The Juggle ponder whether one should hire a CPA or go it alone for tax time. (Our $.02.: The only thing we got out of our tax law class was that there are a gazillion rules and exceptions to the Code. Thus: We've been happy with our CPA for the past 7 or 8 years.)

– Lifehacker seeks to perfect that mythical creature: the power nap.

Many thanks to this week's advertisers:

– AK Anne Klein

– Carissa Rose

– MySkins

OMG! I love the concept of “My Skins!” How awesome! They are not dark enough for me, unfortunately, but here’s to holding out hope that this company (or some other) makes some undies that match my complexion too!!!

See, I’m so ghostly pale I think they may not be light enough… but I’m hoping that they get made!

I know it varies, but what is the going rate for tax prep and filing in your area? (married couple, not too complicated)

I’m single, my taxes are mildly but not very complicated, and I pay my very good tax preparer about $200.

I’ve always paid about $225 for my NYC-based CPA.

If you live in a state/locality/etc. that requires extra filings, even though you might only have a couple W-2s and a 1099, be prepared to pay a little extra for the extra returns that the CPA has to file.

Our CPA is out of state. Our old CPA was $950, then he joined some other group and doubled his rates (without telling us about the rate change) – and he kinda sucked it! Every year we get some notice about something he screwed up a couple of years ago and end up having to send a check! I kept complaining that I didn’t like him, and I thought the rate increase was preposterous, and when I finally convinced my DH to let this other guy look at our stuff, he was floored….and pissed.

Our new guy is about $500 and awesome. We have a fairly complicated return as DH has foreign income, slightly less complicated now that we no longer have a nanny, (although that may be changing again). Our new guy re-did our last year’s (‘o8) taxes and discovered we’d paid taxes on some income that should have been excluded – he is going to review and re-do if necessary ’07, after the ’09 stuff is done. Just wish I’d found this earlier…no telling how much we’ve overpaid in the last 10 years….

Re: Taxes. Once you’ve got a spouse, kids, house, multiple investments, etc. it’s worth the peace of mind for a CPA, but if you’re fairly fresh out of school, single, renting, and have one source of income, it’s really a waste of money as the forms are pretty short and simple. If you’re still worried, TurboTax is not that expensive. (And I say this as the daughter of a CPA who still benefits from family vacations I could not afford otherwise and therefore has a vested interest in people using CPAs! I used to hate my dad for making me do my own taxes but this way I know the basics and when things get more complicated, I’ll feel totally justified in having someone else do them.)

I know my experience is only one person’s, but we are married, with money, and complicated investments/nanny issues. We hired a well-regarded CPA once and only once. Cost us over $2000 for them to do our taxes, and they made a rather significant mistake which required me to spend hours on follow-up with the IRS. The only tax advice they gave us was that no one would know if we pretended we donated to charity things that we did not actually donate (no, thanks). I’ve done ours via Turbotax every year since. It takes two 4-5 hours chunks of my time, and is maddening, but it works great, and I’m always happy I did it.

Run! Clearly illegal advice is the first step to run away from a CPA (or anyone for that matter). If they want you to cheat, they are going to cheat you!

I think it depends on how much you hate doing your taxes. I agree that probably everyone here is more than capable of doing them intellectually, but if you hate hate hate it and find a tax preparer or accountant you trust, there’s no more reason not to pay someone to do it than there is not to pay someone to come in and do the cleaning once a month (if you can afford it).

As a tax accountant I can say that that’s a pretty accurate picture. If you have more than W-2s and 1099s, talk to an accountant, but if that’s all you have (and you didn’t work in multiple states or a different state than you live in), Turbotax should be fine, or H&R Block for the squeamish

Turbotax seems to do just fine with working in a different state than I live in. What’s the basis for that advice? Should I be concerned?

Maybe it was a different person, but I know someone who used Turbotax and didn’t get the proper credit in one state for taxes paid in another. But it could’ve also been that he wasn’t doing it very carefully either. I don’t know, I’ve always done my taxes the old-fashioned way (which means they haven’t yet been done this year and I’m probably owed a refund!)

I know a lot of people who have never quite managed to wrap their head around the concept of non-resident tax returns to get back withholding, etc.

If you can handle it, terrific, but the NY Times just ran a piece last week on how states are looking to audit people who work there part of the year but don’t live there, so if you do a lot of travel to another state, etc., its something to be cognizant of.

Especially if you have a job where it is pretty easy to track that you “earned” money in other state. We have several friends who are college basketball coaches and it gets to be a nightmare when your conference plays in 8 states, and your non-conference schedule takes you to 6 others and then you play in the eleite invitational tournements which are in yet 2 other states —your schedule is published, so there is no getting around it….

You’re an accountant and you recommend H&R Block? You may be the first!

Not for anything too complicated – but yes, they can figure out how to plug in a W-2, a 1099 and a 1098 for your mortgage interest. But if you have anything more complicated, want to do estate planning, etc., go to a CPA – they’re your best bet. :-)

I second Shayna’s comments – before law school I worked for H&R Block, and only the senior people were really knowledgeable. The online version can handle lots of things, but I prefer a CPA for a business or rental income.

Divalicious – several friends who are college basketball coaches? Sounds like a fun crowd!

I’m agreeing with Kim in DC. I worked at Jackson Hewitt pre law school and I’m convinced I was the only one in my training class that could have possibly even graduated from high school. Aside from myself, there was only one other person there I would trust to do my taxes and mine are not complicated at all! The training is so basic that really all they do is read you the questions that are on the computer screen and type in your response. There is no way any of the seasonal employees would be able to answer even the basic tax question (I’ve experienced this first hand – I ended up quitting after the first year because the lack of competence was appalling.) I’d rather pay $15 and use taxcut or turbotax or HRBlock.com – I can read and type the answers in myself. I really do believe the only “service” actually provided by HR Block and Jackson Hewitt and the like are the quick access to money – people aren’t using them because they need help with their taxes… they use them because they want their money NOW and not in two weeks and they are willing to pay through the nose to get their money NOW. If you are concerned with your ability to do your own taxes, please spend your money on a reputable CPA and don’t waste it on the Jackson Hewitt/HR Block type of places.

Good luck with AT event, Kat! I so wish it was in NYC, I have been coveting every item in the AT stores lately!

Whoops, I meant AK! Love both AT and AK actually!

Off topic, but Neiman Marcus is has some lovely dresses on sale at the moment, including this David Meister one that I just snagged:

http://www.neimanmarcus.com/store/catalog/prod.jhtml?itemId=prod95770030

lucky sizes only, but it’s worth a look through the “sale” “spring sale book” and “online clearance” (I will never understand all the different NM sale categories).

So pretty! LOVE the color. Totally not a size 6 though…….

Love that dress! Gorgeous color!

Love that dress!! No idea what size I would be in David Meister though, the charts are never helpful to me.

If it helps at all, I find David Meister dresses to be more generously cut in the bust area than average. I tend to fall between two sizes (I’m a top-heavy hourglass), but I’m always the smaller size in DM dresses, and can sometimes go down even one size more. If you happen to be shaped the way that I am, you’ll likely find the same thing.

That is super helpful Janet! We’re the same body type actually. It is a beautiful dress, but I’ve already exceeded my monthly clothing budget. :( That’s good to know about the brand in general though, I’m a 34DD and usually have to buy for my chest and get things tailored, especially where dresses are concerned.

Re taxes: I live in NY and work in NJ and go to graduate school. I did my taxes with H&R Block last year – the guy was a buffoon, it cost me over $200 and I almost missed out on $1000 on my return because he forgot to enter my education stuff – the form was right in front of his face. This year, I used TurboTax by myself, spent 6 hours and paid about $100 ($29.95 for deluxe edition, i think, and then for e-filing the 2 state forms).

haha i love the word buffoon!

lol – but he really was a buffoon. he couldn’t figure out what numbers to type into the boxes and kept asking his supervisor how to fill out something on every.single.screen. it was very annoying – i had to help him do something that i was paying him to do!

Always, ALWAYS, look at your returns before they’re filed – I don’t care who you paid to prepare them – it is so important that you look at them to make sure that the preparer didn’t miss a 1099 or your note about buying a car last year… etc.

(Yes, I am a tax accountant)

The one and only time I ever used H&R Block, they screwed up. I’ve been using TurboTax since I moved back to the US and I am totally satisfied with it. It ran me somewhere around $75 this year.

Good luck Kat!! Come to Texas too sometime okay?

Hmmn… I’m in the midst of planning a vacation to Dallas in July to visit my husband’s family. Hmmn.

And come to DC!! We have lots of historic landmarks and overachieving ladies who love fashion – and fashion advice!!

If it wasn’t so close to exams, I’d find a way to make it to Miami. But either way, good luck!!

Can I make a pitch for Cincinnati. No one ever visits us, but we have lovely shopping! :)

OK, schedule something in Dallas while you’re here. Talk with the AK/In Style team.

Congrats on the big career milestone!

I like all the tax return thoughts and advice. Kat, perhaps a post?

I’d also love to get thoughts on the best ways to respond to both compliments and criticism, especially when the comment is a fine line between the two. For example, when I was recently asked what I do for a living, I responded by saying that I am the IT manager for a local law firm. The person responded to me by saying, “Wow, you must be really smart. [interject awkward silence] Well, everyone has flaws.” To me, even the comment “wow, you must be really smart” is a fine line between a compliment and an underhanded snarky comment. Am I wrong… Do you think it is a straight-forward compliment? How do you respond to it? Perhaps, just, Yes I am, thanks? And how do you respond to comments that border on criticism? Sometimes they are too glaring to pass by.

I’m not necessarily looking for an answer to the above scenario (though that would be nice) but more to jump-start a conversation on the issue, as I am sure it’s something we deal with all too frequently!

Congrats Kat! I second the opinion about coming down to DC — too many of us wear dark pant suits and are in need of fashion help. ;)