This post may contain affiliate links and Corporette® may earn commissions for purchases made through links in this post. As an Amazon Associate, I earn from qualifying purchases.

Happy New Year! I thought I’d start an open thread for what your resolutions are this year — and how you plan to tackle them. How do you make a new habit “stick”?

For my own $.02, I’m going to try to be much better about exercising regularly and eating a healthier dinner. (I do fine all day, and then get home and find myself too exhausted to cook, or even to order anything healthy… bad news!) I’ve read that it takes 8 weeks of repetition for a habit to stick, no matter what the habit is that you’re trying to do. So for me, I get this accomplished in two ways:

a) I visually keep track of progress

b) I promise myself a treat if I can successfully do the new habit for 8 straight weeks, at least 4 times a week.

(Pictured: carrots & radishes!, originally uploaded to Flickr by wine me up.)

(Pictured: carrots & radishes!, originally uploaded to Flickr by wine me up.)

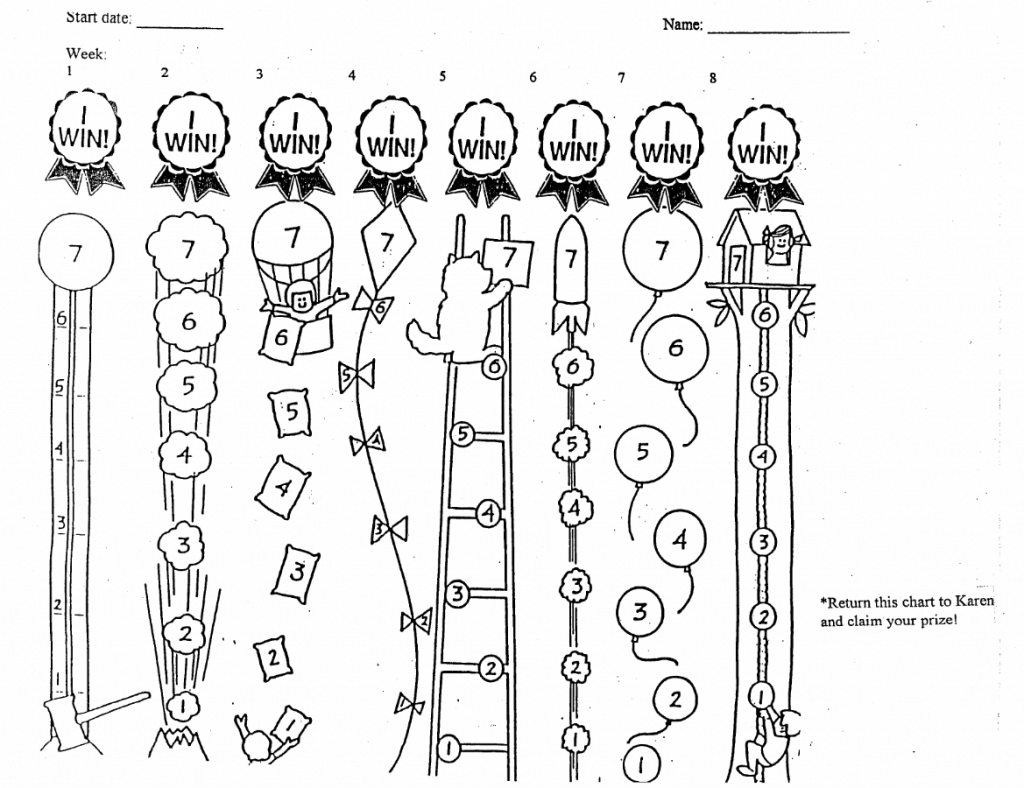

So, let me back up a bit — when I was in law school, my New Year’s Resolution was to exercise more regularly, so I headed to the exercise room. (I understand that Georgetown Law has a fancy, shiny fitness center on campus now — but back in the dark days of 2003 we only had a few exercise machines in the basement of Gewirz.) Anyway, the Fitness Director gave me a copy of this chart (below) which, she promised, would be a good way to get into the swing of things. It’s a ridiculous chart — I’m always reminded of something kindergartners might use — but it got me working out regularly back in 2003, and I’ve returned to the chart time and time again when I wanted to pick up a new habit (or revisit an old one).

The idea is, if you get 4 checkmarks each week, then “you win!” And at the end of 8 weeks, “you can claim your prize!” Now, the first time I did the chart my “prize” turned out to be a Georgetown Law eraser. But I’ve used it since then to get purses I wouldn’t have bought otherwise (like the green Dooney & Bourke one I used to wear) and other little gifts for myself. And I’ve found that I really like the idea of a carrot (something dangling in front of you). So, readers, here’s the second part of questions for this post: What do you treat yourself to when you’ve accomplished one of your resolutions? Any notable “carrots” that you have your eyes on already?

anon-ny

for some reason, just having a goofy chart (mine are generally more basic) posted in my kitchen really helps me stick with a training regime. All I do is put a sticker on the days I complete the workout and I usually use a massage every so often (4-6 weeks) as my carrot. It sounds silly but it gives me some accountability. I’ve also used the option of syncing up my runs on my nikeplus to facebook. Even if my sister is the only one paying attention, it motivates me to know that there is some visibility as to whether I’m running or not.

Now, if only I can get over this terrible cold so I can dive into a new post-holiday routine!

Eponine

Can you post that chart as a PDF that we can print? And does anyone know where I can buy gold star stickers? :)

E M

Usually the big box stores, craft stores, and dollar stores have some basic stickers – stars and smilie faces and the like. I usually see those goofy reward ribbons at my local dollar store too!

Kat

I would, but I worry about the rights if I’m going to post it for downloading by a large audience. Email me?

Anonymous

I think I have seen star stickers at Office Depot

jcb

I’d love a copy of it, too! Visual aids always help.

Kryss

me too!

CFM

Just open the image in a new window and print it from there, or open it in a new window and save it as a pdf.

houda

This is exactly what I did :)

Coach Laura

Like this idea! I use my wall calendar and self-stick stars that I bought at an office supply store. I use the green star color for weight lifting, red for yoga, blue for walking, gold for biking and silver for everything else. I’m a visual person so I really like the visible log and reminder and love to see the stars add up over a month’s time.

For rewards, exercise clothes and massages are my choice.

Mplsmom

Target has lots of stickers by the greeting cards.

Res Ipsa

Try to make your new habits as concrete as possible. Instead of saying “get into shape,” be explicit about what that means for you: work out 200 minutes a week and a yoga class. Go on day-long bike ride twice a month; have six personal trainer sessions by March 1, etc. Instead of “eat healthier,” something like “prepare healthy soup/stew/salad on Sunday afternoons so that I have something healthy I can eat when i’m too tired to cook” or “Before I eat any snack food/dessert, whatever, I have to have eaten five servings of fruits and vegetables that day.” Etc.

ADB_BWG

And remember – to make time for a new habit, you’ll have to let go of something else you are doing OR multitask.

Louise

I like to multitask if I can, because then the two (or three) activities get linked together. For instance, I’m trying to strengthen my quads, so I do wall-sits while brushing my teeth. My electric toothbrush beeps every 30 seconds, so I know exactly how long I’ve been holding the pose. After about a week or so, it became pretty automatic to brush and exercise at the same time.

Ballerina girl

Anyone have any good tips on budgeting? My income is pretty high but I’ve got lots of debt and want to save as much as I can. The high income makes it hard to stick to a budget, though, because I know I can bend the rules without any real immediate consequences. I haven’t found mint.com to be particularly helpful. I’ve tried to put all my expenses on one credit card (which I pay in full every month) so that I can track my expenses a bit more and figure out where to cut back but it seems like there’s got to be an easier way. I’d even thought about taking cash out every week and only using that but I buy a lot online (I know that’s part of the problem) and like the protections that credit cards can give you in terms of warranties and getting ripped off.

MsZ

Divide your employer’s direct deposit into two accounts: one account out of which you pay automatic payment on your debt, and a second account for your household spending. Set your debt automatic payment as high as you can, and then make the direct deposit into that first account even higher than your total monthly debt payment. Then you will have less money to “play with” every month in your second account; you’ll be paying off your debt aggressively; and the first account will accrue a balance for rainy day savings. I find that if all of my savings is automated and behind the scenes, it hurts less and I’m less tempted to tinker with it to afford discretionary items.

Eponine

This. I’d actually advise three accounts though: one for debt, one for savings, and one for spending. If the debt/savings money disappear from my paycheck without my even seeing them, I never even think about it. If I have to proactively put money into savings, I save less.

houda

I do this; I have a current account and savings account.

I set up automatic transfer of:

– 36% of my salary to pay back for my apartment.

– 6 % for my savings, hoping to get a used car for my commutes

This way I have about 50% of my salary to spend.

I am planning on changing the date of wiring to be the same date I get my salary so I do not have the 1 week time difference where I am tempted to spend more. Once I am used to the new spending, I will increase the savings to reach 12% of my salary, and so forth until I reach my goal of saving enough for a car.

Also, instead of just tracking your costs, try to categorize them. Even if you use colored highlighters on your credit card statement. You will soon realize a color is recurrent, or has big amounts of money, or has a certain pattern. This is how I realized that I spend a lot on transportation but in small amounts frequently throughout the day.

ADB_BWG

I have three accounts: (1) Checking #1 – for general bills like utilities, gasoline, groceries, spending, (2) Checking #2 – for mortgage, student loan, and monthly parking permit, and (3) Savings – for emergencies.

For Checking #1, I set bill due dates so I pay 1/2 with the first monthly check and 1/2 with the second. What’s left afterwards is what I have to spend — on any and every thing, for the next two weeks. Checking #2 ensures that the money for big-ticket items is covered. I periodically sweep Savings money into other investment accounts. By doing this regularly and keeping the amount in Checking #1 consistent, I’ve been able to take on a car payment without feeling a huge and immediate bite.

Elle 2

The hardest part is probably setting a realistic budget for yourself (regular expenses, debt payment, savings, investment). That part is pretty personal and I can’t offer you much advice on that.

Once you’ve set up your budget, put some structure into your finances so you DO have conseuences.

For example, set up direct deposit for the part you’ve designated as “savings” to go directly into a savings account without easy access (i.e don’t sign up for an ATM card, don’t hook that account up to your regular checking account for online transfers, etc…). That way you physically have to go to the bank for any transactions. Plus, you won’t see the money as accessible since it’s not in your regular checking/savings account. You’ll check the balance once a month with your statement and then file it away.

Another option is to set up as many automatic payments as you can. Most utilities, regular investments such as life insurance, and phone companies will do automatic deductions.

You can also set up preferences with most banks so that the bank mails out regular payment checks automatically (can do this for car loans, regular monthly debt payments etc…) For example, my brother owes my mom some money and has his bank send her a check each month for a set amount so that he doesn’t “forget” or say “I’ll just skip this month and send her double payments next month.”

The point being… If you have most of your regular payments automated and then a non-accessible savings account for your excess that you want to save, you’re essentially setting yourself up to live on a fixed income which you will have to regularly monitor to keep your luxury spending in check.

Good luck!

lawyerette

I would start with auto-saving some percentage of your income to a savings account that you dont’ normally look at. By auto-saving I mean automatic deductions every month. Start with 20% of your paycheck if you have a high income and have the deduction happen on the day your pay check clears your account.

But to really figure out how much you can afford to save, I created a monthly budget for the whole year (every month is slightly different so I did it month by month) and used that to figure out how much money I “need” to live the way I live now (without cutting anything down). Then I gave myself some “play money” every month so I wouldn’t feel deprived. The “play money” allowance gets increased sometimes (like around xmas time or my husband’s bday) but then I figured out what was left and applied it to my debt or savings.

I have a really great google spreadsheet for this that I found somewhere online. It’s probably more detailed than you need (I really only use the first “sheet”) but you can take a look and make a copy for yourself here:

http://tinyurl.com/32qmvk7

CW

I’m in a similar situation. High income, high student loans debt, and my fiance and I are saving for a wedding. This is what my fiance and I do. Note – I’m assuming that you already max out your 401k or come pretty close. If not, that supersedes all of the below advice, and I recommend that you do that first if you can.

We live together and pay most of our expenses jointly. We view our expenses on both a monthly and bi-weekly basis. For example, we both get paid on the 15th and last day of the month. Our paycheck on the last day of the month needs to be used to pay bills due up until the 14th; our paycheck on the 15th needs to be used to cover bills in the second half of the month. Looking at our bills like this helped us better track where our money is going and when.

On a monthly basis, we created an Excel spreadsheet that lists net income, expenses and savings. All of our expenses are listed – rent, cable, clothing, dining out, groceries, etc. We have a savings “expense” (meaning, it’s as if savings is a bill we need to pay ourselves every month); we transfer this morning into a high interest money market account (American Express). We transfer half of this number twice a month. I find that if I don’t pay myself first, it’s not going to happen. We only touch this money for its intended purpose (right now, the wedding). At the end of the month we have a “carryover” number (i.e., the remaining balance in the checking account). This carryover number can be used to rollover into the following month, pay debt, save, or spend.

Some of these items you will very easily be able to fill out (fixed costs). Others will take some thought – how much do you want to spend every month on dining out? Groceries? What is the minimum number in your checking account that you feel comfortable with? How much do you want to save, and is there a timeframe in place?

And obviously a lot of this can be flexible over time. My fiance and I love to go out eat and we love to cook. We set initial budgets of a certain amount to spend on both dining out and groceries; then we realized that our priorities had shifted given our (very) aggressive savings targets and we cut those budgets slightly. But not enough to have a really drastic effect on our every day lives.

In terms of prioritizing which debts to pay first, I just bought David Bach’s Debt Free for Life. Some of it is helpful, some of it seems like a giant ad for Equifax. However, he does say that private student loans should be paid off before federal loans (even if the private loans have a lower interest rate right now). In terms of credit cards (which, if your purchases are all on one card, doesn’t seem to be the problem), he has a formula to determine in which order to pay the cards off. Although, he mentions that he’s used it in other books, so if you already have one of them it may be in there (the DOLP formula).

I think the key with budgeting/saving is the same with dieting (which I’m trying to do right now as well!) – you have to believe in what you’re doing and be willing and committed to change your lifestyle. But it can’t be so hard that it’s impossible to stick with. And once you start to see results (more money in your savings account), you’ll have more motivation and will find new ways to keep it going and save more.

Good luck!

Ses

I dont do this all the time because it’s a pain, but when I need to make spending cuts, I will revert to the cash system, and to solve the online purchases with credit card problem: I will move the cash into a deposit envelope once it is “spent” on the credit card. Once it’s all gone I don’t use the CC any more. Then deposit the cash at the end of the month and use it for your CC payment.

This might be a good way to train yourself to pay attention to spending at first.

Ballerina girl

Thanks to all! This is very helpful. I should have added that I have my direct deposit set up to put a certain (relatively high) number from my checks into my high yield savings account.

Question: does it make sense to max out my 401K if I have $100K+ in loans ($40K of which is at 6%) and don’t expect to have such a high income in the very near future (leaving high paying job in the next few months with any luck)? I put about 5% of my income into retirement but given the fact that my circumstances will change soon, I want more of a cushion. I also thought that it was better to focus on my 6% loans and that when those were taken care of, put more into my 401K.

Great ideas all around–I especially love the spreadsheets and the “pay yourself first” philosophy. Thanks again!

Eponine

It’s better to put as much as you can into your 401K when you’re young, because it’ll appreciate over a longer period of time. If you put in $5,000 when you’re 25, it’ll gain interest over 40 years before you retire, while if you put $5,000 in when you’re 40, it’ll only gain interest over 25 years. Make saving for retirement and building an emergency fund your priorities, and then allocate extra money to pay down your debt.

MsZ

It always, always, ALWAYS makes sense to max out your 401k. The choice should not be between your 401k and your loans . . . but between your 401k and that discretionary spending you were saying you have trouble with. Since you think you are leaving your high income job, I would recommend maxxing it out over the next few months and imposing some austerity measures on yourself. This will: 1) make sure you pay your future self first, while you can more easily afford it; and 2) get you used to living under the budget cuts that your new job will require. I did this when I left biglaw to go to private practice . . . it seemed the only downside was that HR might notice my change and figure out I was looking to leave, but I decided to chance it. Good luck!

L

It doesn’t ALWAYS makes sense to max out your 401k. 6% isn’t that high, so I’d say, yes go to the 401k. The question you have to ask yourself is would I make a greater return on my 401k than I would on paying back my loans. The return on paying back your loans is the interest rate you’re currently paying–6%. You’ll likely make that much this year and beyond in the 401k (I made 14% on mine this year, but obviously that’s a-typical as we’re coming from a very low bottom).

On the flip side, if your interest rates were closer to 10%, I’d say pay them off. Yes, you’re 401k is for the long haul, but you live in the now and in the now you have to pay 10%. Moreover, to see decent returns on your 401k investment, you have to take a decent risk. My IRA lost more than 50% of its value created over a 10 year period with this most recent crash. It’s back up to where it was just before the crash, but that still means I lost 3 years of gains. There’s simply no guarantee that you’ll make the money you’re hoping to down the line. Pay off your very high-interest loans first–it’s a guaranteed return. What to do with the 5-7% loans is a tougher question that requires more attention and more personal information than a blanket instruction to always do X.

CW

Agree with Eponine. Everything that I’ve read said that you should max out your 401k now (or come as close to it as possible). The difference in return between an investment now versus an investment in a few years (even say 5 years) can be significant.

When I signed up for my firm’s 401k plan they had a calculator that showed me what the net effect would be on my paycheck. I use those numbers in my budget. If your company’s 401k plan has something along those lines I would recommend running some numbers through there and seeing what you can feasibly afford to contribute.

Even if you increase your investment slightly, it will make a difference in the long run. And steadily increasing your 401k contribution by 1% each year (some 401k plans can do this automatically) will also help.

I can relate on the size of the student loans, but I view it as part of the whole “pay yourself first” package. Nobody else is going to take care of me during retirement!

Ballerina girl

This may sound dumb but is there a practical difference b/t maxing out my 401K and putting extra money into my Roth IRA? It’d be easier to make up for lost time that way.

CW

My understanding of a Roth IRA is that you can only contribute to one if your gross salary is under a certain amount (maybe 100k or 120k?). If your salary is above that threshold, then you can’t contribute to a Roth IRA.

A 401k uses pre-tax money, whereas a Roth account (whether Roth 401k or IRA) uses post-tax money. Whether one is better or worse, I can’t say. From my perspective, the 401k lets me contribute more money to my retirement than how I’m actually affected on a monthly basis (see Eponine’s example – invest $50 but actually only less $30 in my paycheck). With a Roth IRA, if you invest $50 that’s still $50 out of your checking account.

As for putting extra money into your Roth IRA later, I would think that the same principles hold – money invested now has a longer time to grow; money invested later has less time to generate a return.

MelD

I’d say it depends on what contribution you’re getting from your employer and how far along you are in your career. If you’re not getting a contribution and the 401k is pre-tax, I’d say that it’s better to put money in the Roth if you are at a low tax bracket now and plan on working for quite some time. Chances are you’re going to be at a much higher tax bracket now than you will be when you retire.

Anoner

MelD mostly said this, but the essence of the difference between a pre-tax 401k and a Roth (IRA or 401k) is when you pay the tax on it. If pre-tax money is invested, then you pay tax on it when you take a distribution (pull it out of the account).

If you go Roth, then you have paid tax on the money before investing it, and don’t have to pay tax on it when you take a distribution.

So its a matter of guessing what kind of income bracket you will be in when you retire, versus where you are now.

Anon2

I think Roth IRAs max out at $5k/ year with the limitation of $150k for a two person household (though please check online or with your financial advisor). This is the first savings method I max out every year. I track all my accounts on Fidelity and can allocate my IRAs depending on my preferences (certain amount in cash, stocks, ETFs (a really small amount), etc.).

To my knowledge, 401k max limits are much higher than $5k.

Eponine

Good point about the paycheck calculator. When you contribute more money to your 401K, you won’t actually be subtracting the full amount from your paycheck, because the 401K contribution is pre-tax and therefore you’re also paying less in taxes. Depending on your tax bracket, the difference can be quite stark – an extra $50 contribution could mean only $30 less in your paycheck, for example.

LA New Associate

Really useful discussion here, ladies! Also trying to figure out how to be a better financial planner for myself this year. I think I should start up the auto-save option, for one!

Happy New Year to all.

Lola

For questions like this, it’s great to have a financial adviser to help you out. That’s their job. They can look at your whole situation and help you figure out where your money would do the most work – invested (and in what), or paying off your loans, or in real estate, or whatever. There are a lot of young, single women earning a high income, but who could make a few changes and end up paying much less in taxes.

A lot of people think that a financial adviser is only important if you’re rich or something… but if you have a high-paying job, it doesn’t hurt anything to have some help figuring these things out.

Financial advice is not really that expensive, and worth every penny.

K

Any advice on finding a financial advisor? I think I need one to get me on track, but I have no idea where to start and don’t want to get stuck just being sold insurance…

Lola

I use my local Edward Jones representative, but you could check google maps to find someone around you. There are other companies, and first consultation is usually free. Check with some people you trust. (I’ve never been asked to buy insurance.)

Maybe other Corporettes have other ideas…

CW

Also, this sounds random, but you might want to check with your college/grad school/law school, etc. My law school’s financial aid office was actually very helpful and informative when I was graduating. They had a company that they referred students to (I’m not sure what kind of benefit either party received, if any).

I don’t have a financial advisor at the moment (since I don’t have a lot of money that isn’t already allocated for certain purposes!), but it could be helpful for the future. Also, a friend uses Edward Jones and she likes them.

ADS

Look at napfa.org – the National Association of Personal Finanicial Advisors. This is an organization made up of fee-only planners, meaning they make no commissions on the products they sell you – you and only you pay their bills. Some work on an hourly rate, some on a flat fee basis, and some take a percentage of assets under management, but they’re only responsible to you, and you don’t have to worry that they’re advising you to buy an insurance policy or investment product solely because of the commission percentage.

If you ever meet a finanical advisor who recommends whole (aka permanent) life insurance, run, don’t walk, for the door!

jcb

Just curious – why run away from whole life insurance? I haven’t purchased a policy, but from the numbers presented it looked to me that if I had the cash to frontload the policy, it would be a good stable investment for the long run.

lawyerette

Just google whole life insurance and investment and you’ll get lots of reasons why.

Lucy

I would recommend checking out Dave Ramsey. His whole shtick is getting out of debt, and he’s a great speaker. He has a radio show and a website, where he has his “baby steps” to debt freedom.

But the bottom line is- you are throwing money away by remaining in debt (through interest, etc). Cut all non-essentials until you are debt free, then enjoy the party. Intensity is the name of the game.

Kaye

Here’s how I set my budget:

For two months or so, I wrote down every dollar I spent. I did this by remembering the numbers over the course of the day and then writing it all down on a chart on my wall right by where I put my bag down when I get home. You could also use a notepad in your bag, or a phone app.

After the two months I looked at how much I tended to spend in each category and set a per-category budget. I set the budgets to be realistic (not so strict that I wouldn’t be able to stick to them) but not too lenient either.

Once I had my budget, I continued to track my expenses the same way. I eventually got sick of that and downloaded a great Android app called Financisto where I set up budgets for each category and dilligently recorded every dollar spent. It worked really great – I could always see how much of each budget I’d spent at any point in time.

Finally, I got sick of doing that as well. I noticed I only have 2 categories where I have problems with discretionary spending: clothing/fashion and bars/restaurants. So now I only track those, and I find that I’m able to track them pretty well in my head.

So now I have a super-simple process that keeps me on track to not overspend where it’s not justified.

MC

Also, mint.com is great for keeping track of spending and has a nice interface. I just started using it at a friend’s suggestion and really like it.

CW

I’m not sure if you’re still reading this, but I completely forgot to mention one of the best tools that my fiance and I use. A whiteboard. Yes, like what was on your door in college. We found one that is magnetic (Target) and stuck it on our fridge. We use that to track our most variable spending (for us that’s groceries and dining out). We have two columns, and every time we go to the store or eat out we write down how much we spent. We subtract that number from our monthly totals on a semi-regular basis (usually weekly), and we know how much we are “allowed” to spend for the remainder of the month.

A lot of people use online tools to do this (i.e., Mint), but we found that Mint wasn’t as useful for us on a day-to-day basis (although it can be helpful over the longer term) because we would forget to check it and it’s less of a visual reminder.

Ballerina girl

I’m still listening! I like the whiteboard idea. I’m not always high tech when it comes to this stuff.

Thanks to everyone again. Great advice. Always good to remember that student loans are not the only thing I need to worry about long term–retirement is key, too.

Kaye

Agreed – low-tech is often better for this kind of stuff b/c it’s easier to stick to – no need to start up a computer etc.

FBB

I am a big fan of stickk.com for making resolutions that work. You can pre-enter your credit card number and choose where the money will go if you fail: a friend you trust to keep you accountable, a charity you like to support, or if you REALLY want to motivate yourself not to fail, an anti-charity (an organization you would prefer NOT to support). Your credit card isn’t charged if you meet your goals, and you can assign a friend as your referee to keep you honest. The website sends you a reminder email once a week to log in and report on your success or failure for that week.

a

I am training for a half-marathon with a friend that lives in a different city, and the biggest motivator is having the runkeeper app that uploads to a website. That same friend is on my “street team” on the same app, so we see each others’ runs–the distance, pace, etc. Whenever I am running and want to quit, I think about the fact that my friend will see the run and my bad time if I slow down.

AIMS

My resolution, sadly, is to be more productive at work & to spend less time on the internet while I am at the office (inc. on this website).

As a reward I am imagining that regularly getting things done quickly will mean a random free afternoon once a month or so, or at least come the spring.

My other resolution is to lose some recent holiday & vacation weight gain (5-10 lbs.), but that’s pretty boring. I haven’t quite figured out a plan for it yet, except eating more sensibly, moving more, and not buying new clothes till the old clothes fit better.

AL

Any opinions out there on Weight Watchers? I’m considering joining too to lose about 7-8 pounds. My concern is that it’s going to make me obsess over food and feel guilty for every bite I put in my mouth.

I spent a good many years of my life (high school and college) being extremely obsessed with weight loss, even though I was quite thin, and it was an awful period. I was so unhappy. I’m not overweight now, and I already exercise three times a week on average, so I feel pretty healthy as it is. It would be nice to weigh a tad less, but not if points-counting is going to make me obsessive again.

Anonymous

Hmmmm, I’m not sure if any of us can really address whether this is likely to make you obsessive about weight loss or not. However, I would suggest maybe trying a free calorie counting app first (I have used LoseIt on the iPhone; sparkpeople is one I have heard good things about but have not personally used). I know there is more to WW than just counting calories, but at least using one of these apps will give you a sense of how obsessive something like this will make you. Since there is really no commitment with a free app, you may feel more free to quit if it is not working out well for you (as opposed to if you joined WW and made a commitment for however many months). 7-8 pounds is really not that much, and you may be able to do this on your own without needing to pay for something like WW.

lawyerette

I did WW to lose 50 pounds and I’m doing it again now to relose the 20 I gained over a few years. If you had these issues before and only have 7-8 pounds to lose, I would not recommend WW. It does have a tendency to make you a bit obsessive and I think is fine for most people (and very possibly for you) but given that you have so little to lose, I wouldn’t take the chance.

I would recommend paying for a personal trainer at the gym for at least a few sessions to “spiff up” your routine (or at the very least, increasing your activity as much as possible in intensity and weight training) and a combination of the following (essentially WW without counting points):

1. Cut down on alcohol and sweets

2. Eat 5-10 (aim for 10) servings of fruits/vegetables per day. 1 cup is one serving.

3. Drink as much water as half of your weight in ounces per day (a 150 pound person would aim for 75 ounces of water)

4. Eat/drink 3-4 servings of fat free or low fat dairy per day (yogurt serving is 6 ounces, cheese is one ounce, milk is 8 ounces)

5. Choose lean meats or fish when possible and eat 10-30g protein with every meal (dairy has a lot of protein)

6. Choose whole grains and try to eat less processed carbs (good grains: quinoa, barley, brown rice, whole wheat couscous, whole wheat pasta; try to cut out things like bread and crackers)

I find that when I do these things (and not all at once necessarily), it’s very easy to lose 10-15 pounds without trying (at a rate of 1-2 pounds per week, usually just 1).

K

I am in exactly the same boat as you in terms of a small amount of weight I’d like gone, but a history that makes me wary of becoming food-obsessed. I have found that I can either set goals for increased activity, or set goals for food INTAKE (6 fruit/veggie servings per day, 8-10 glasses of water per day, increase servings of whole grains…) without a problem. If I restrict food intake or count calories, I get into dangerous territory quickly. If I am focussed on eating healthy foods, I eat less “bad” food without ever feeling guilty about putting food into my body. Does that make sense?

houda

Same here; I have 5 pounds to lose.

I tried doing some cardio and counting how much calories I burnt each time. I eventually became sad and did not enjoy teh workout.

Now, I have shifted my mindset, and instead of saying I will do 350 calories on elliptical followed by 200 on the stationary bike; Now I say: I will do Body Combat, have fun for one hour and then see if I want to workout my abs with the (cute) trainer and do stretching.

In my case, thinking about activities and the fun you get from them is more effective than counting calories or minutes.

Nonny

I agree, not because I have a tendency to obsess about intake/calories, but because when I focussed on calories burnt, I found it very difficult to motivate myself. I find it much easier to just focus on doing something active and fun. The weight loss and strengthening follows automatically.

W

If that is your concern, I would avoid Weight Watchers. I joined it in my late teens, became obsessed with what I ate, and developed an eating disorder. My weight ballooned after I overcame my eating disorder, but I have lost the majority of that weight by exercising and eating healthy. Since you are already healthy and workout, I would try to do something other than WW. Perhaps try working out 4 days a week (instead of 3), adding some variation to your routine, or even just switching out a plain coffee for a latte. It will take some time to lose the weight, but it is much healthier than developing obsessive eating habits. Take it from someone who knows. Best of luck to you!

Anonymous

I had a similar experience. I was bulimic as a teenager, got help and was able to stay in recovery for several years, but gained a pretty good amount of weight in that time. I decided to get on Weight Watchers on the advice of my doctor (who I hadn’t told about the bulimia, although I should have), and it became a real problem within a couple of months. The problem for me was that the program allows you to offset a certain number of points used on food by exercising; I was an exercise bulimic (I would binge and then work out intensely for hours, often until I threw up) so this was a bad trigger for me. I backslid into a lot of the compulsive behaviors that had landed me in rehab in the first place. The other problem I had with WW was that under the old plan, veggies and fruits counted the same as regular food and so there wasn’t a lot of motivation to eat 3 points worth of carrots vs. 3 points worth of fat-free, sugar-free pudding, for example, meaning I was eating a lot of low-nutritive dietetic foods, which made me feel bad, which didn’t give me a lot of motivation to continue with the plan. I understand they’ve overhauled the point system and it’s no longer like this, though.

I think if someone does not have compulsivity issues related to food, WW is a good plan and very sustainable, compared to other plans. The things that have helped me lose the most weight? One was cutting carbs and upping protein – The Zone, Protein Power, South Beach Diet, etc. books all have good guidelines on how to do this. The other was going to a therapist who is specifically interested in helping me resolve my emotional issues related to food. My eating behaviors were 100% not driven by need for food, but by need for control, comfort, rebellion, etc. I am still working on it, but by learning how to eat for sustenance, rather than to fulfill an emotional need, I have lost about 25 lbs. I would strongly encourage anyone with emotional overeating issues, especially if you have past trauma from abusive parents, sexual abuse etc. to pursue therapy rather than a diet plan. I have been on every diet you can probably think of, but none of them worked because they didn’t change what was going on in my head.

Anon for this one

I am on WW now and have lost 12lbs (which is all that I wanted/needed to lose). I found that a lot of times I wasn’t eating enough and then other times I ate too much. I use the iphone tracker app that they have now and I find that it is really great. plus on the new plan fruits and veggies are no points so you don’t have to track them or anything. just eat away!

I exercised regularly before this and ate pretty healthy. but this just gave me the little extra push to beat the plateau! You can always try online only with no meetings for a month and see if you like it.

TAH

I’ve been on WW for about 2 1/2 years and have lost 100 lbs. The plan has NOT made me obsessed with food, and I have no guilty feelings when I splurge here and there. For me it’s really more of a lifestyle change, not a diet, per se. There is a way to do the plan that does not involve counting points, but it limits the types of foods you can eat (I don’t know much about it, since I don’t follow it).

My suggestion would be to check out a meeting (you can do it for free), and stick around after for when the leader explains the plan to new members. You can get a feel for the programs, and ask any questions that you wouldn’t really get direct answers for if you just look at the plan online.

20 pounds down!

I joined WW in May and I have lost 20 pounds. Slowly but surely! I think one of the great things about WW is that it purposely tries to make you NOT feel guilty. It doesn’t eliminate anything from your diet, it just helps you be aware of exactly what you are putting into your body. I still eat pizza, cookies, ice cream, cheesecake, macaroni and cheese and even Chick-fil-a! however, now I know how long it will take me on the elliptical to burn off that brownie and I can have a little discussion with myself about whether or not it is worth it. Sometimes it is, usually it isn’t, and occasionally I ask my husband to eat half the treat so it is only half as bad!

Since you have so little to lose (I am 20 pounds lighter and still need to lose another 45 or so pounds) I would suggest signing up online and giving it a try for a month. Even if you hate the program you will have access to the recipe library during your trial, and sampling a few of those might be enough to get you heading in the right direction.

I also second all the advice to get a personal trainer for at least a few session. It really is amazing what they can help you do in a short amount of time.

Good luck!

Lola

Aw, we’ll miss you, AIMS. :)

AIMS

Aw, thanks!! I won’t be totally gone — just have been getting super distracted left and right, and need to purge some bad habits like checking non-work internet every half hour. So far it worked for today (checked off one long over due project – woohoo!!); and, bonus: I had a healthy lunch and took the stairs a bunch of times while running around the building. Tomorrow is another day, of course. But, baby steps, as they say.

Lola

Fair enough. But sometimes Corporette is a nice break. :)

JessC

Maybe you could try the “carrot” method that Kat mentioned. Like if you do x-amount of productive work without putzing around on the internet, you can then have a little bit of distraction time? Maybe something like 2 hours of solid work time for 15 minutes of screw-off time?

AIMS

That’s pretty much the plan! But it was also the technical “plan” before, but by the time I checked e-mail, wrote back to various friends, checked news, corporette, clicked on some cute links, went on gofugyourself, etc., I would spend 30-40 minutes and that was getting out of hand. I think I just have to get to a place of better habits, which hopefully the new year and the holiday break will enable me to do :)

Midori

Leechblock saved my workday! But my resolution is also to be more productive at work. My billables have been lousy. I’ve been giving myself all kinds of excuses (I have a young child! I’m tired! My work isn’t always interesting!), but they aren’t cutting it. The hardest part for me is recognizing that this kind of rut isn’t something I can just “snap out of.” It’s going to have to be a gradual process. I need to set more realistic goals.

Makeup Junkie

My resolution is to cut back on how much makeup I buy! I cleared out almost all of my stash (a local women’s shelter was thrilled with it) so I will just use up what I have instead if falling for limited editions and gifts with purchase

I think I will save a lot of money this way and I will be more creative with what I still have

Kryss

if you ever need someone to donate to… :)

MM

I am trying out the website JoesGoals.com this year. It allows you to list all of your goals, and then give yourself checkmarks each day (or on days you designate for accountability check-ins). You can assign different levels of “points” to each goal if you want, to prioritize. It keeps track of your compliance streaks, total days complying with your goals, total points earned, etc. It appears that you can share your progress and points with friends if you want. It’s pretty handy. Let’s see if I use it!

I have a number of personal and professional goals on there, including Houda’s great idea of “Maintain professional image” every day — no points for me when I am too lazy to do my hair and wear my pullover all day in my office!

Lizzie

Months ago, my husband and I made an agreement that when we both lost 10 lbs, we would treat ourselves to massages. If we lost 20 lbs, then we got a trip to Disneyland. We never got anywhere near either, sadly.

AIMS

You never know when you’ll get there! I recently found my to-do list from when I was 12, and I think I more or less accomplished everything on it. Granted, it was things like “grow out my hair really long” and “make out with my best friend’s brother” but eventually (and long after I forgot I made the list) I did get there (although the friend’s brother thing was a huge disappointment — cute at 12 does not always translate to cute at 22 ). Anyway, I guess I’m just trying to say that it’s never too late to do something if you really want to :)

Arachna

Hahaha. This is perfect.

Ru

Hilarious – that’s awesome!

jr. prof

So true. It can be so rewarding to find these old to do lists! This comment prompted me to look up my ’30 by 30′ list, from more than a decade ago. I’ve accomplished everything on there, from “go to Alaska and Hawaii” to “take the GRE” and “apply to grad school” to “own and display original artwork.” Guess it’s time for a new life list. 50 by 50???

SJ

I just started a couch-to-5K program today:

http://www.coolrunning.com/engine/2/2_3/181.shtml

It is a nine week program that ends with running 5K 3 times/week. My carrot is a new laptop: the one I have is 5 years old but still works adequately, so I can’t tell myself that I *need* a new one. This way it is my treat for 9 weeks of work that sets me up for further exercise.

ballerina girl

I like the couch-to-5K program! Good luck!

Anon

Ladies, I need some advice. I have an opportunity to change jobs (potentially) and be in a job I will love, but it will come at a price — namely, a 60% salary cut. Would you ever do this? I’m currently in big law in a major southern city and hate the atmosphere. I love law, but I think I’d be better suited to law in a different environment. Has anyone here taken such a massive salary cut? Thoughts on doing it? Are you truly happier being in a job you love but making less? I foresee losing nearly all my discretionary income. I can still cover the basics, but my online shopping and free spending ways will have to go. I keep telling myself that I will be happier in a less stressful job, even if I’m wearing old jeans and not traveling as much. Is this a ridiculous statement to make?

ballerina girl

I’m making the same decision myself but it’s not even a close call. I would 100% trade the money for the job happiness. I think it’d be a harder call if it were a closer call, but for me it’s not. I’d evaluate how much the money makes you happy (or comfortable, which is important) and think about whether the job would make up for that. Chances are you wouldn’t be that salary forever–it may just be a two or three year sacrifice for a better lifestyle long term. That’s the decision I’ve made at least.

AnonymousFRA

I took a 40% salary cut when i went from a law firm to an in-house position. It will take me a bit longer to pay off my student loans, and I have less discretionary income, but I wouldn’t change a thing. Your statement is not ridiculous and it fits me to a t :) I am truly happier in my current position for more reasons than I have time to put into this post, chief among them: liking my coworkers, having real responsibility and autonomy, no b.s. fire drills, evenings and weekends are my own, etc.

That being said, everyone has different obligations (financial, family) and everyone has a slightly different take on what level of discretionary income they “need” in order to be able to do/afford the things they enjoy (no snark intended with “need” btw – I certainly don’t actually need to spend a significant chunk of my income on athletic training/competitions they way I actually do need to buy food and to shelter myself, but it is a passion and therefore I “need” it when calculating my budget).

So, I guess my longwinded response is that you know yourself best, and good luck with your decision and potential new adventure!

Anonymous

I completely agree with the other responses. I did this six years ago and it truly saved my life.

I just wanted to chime in to tell you that the money is a real issue, or at least it was for me. Even though my new salary covers all the basics, a lot of discretionary spending had to go. But, I discovered how much I mindlessly spent ($100 every week at Target on who-knows-what). It took me about 3-6 months to adjust and not feel like I was constantly out of money. And during those months I doubted my decision to change jobs. And even now, all these years later, I’ll still sometimes think, “gosh, if I made more money, we could do such-and-so.” I wouldn’t do it differently because I love me job, but, for me, the money was a real factor.

AnonymousFRA

Yes, the money factor is definitely real, and it will take you some time to adjust to your new income. Also, I still have moments of envy when my law school classmates do things that are out of my financial reach at this moment in time (pay off loans completely, buy a house) – so it is important to keep a list in your head of why you made the choice to earn less, what benefits you are getting out of this change in your job situation, and the big picture.

Louise

I changed careers in 1990 and took a 40% paycut. I never regretted it. However, several aspects of the change were more difficult than I anticipated.

1. My inability to do expensive, social outings. I was a big skier back then, and could no longer afford ski vacations with friends. We could still hang out, have drinks and dinner, etc. But I had to skip the big weekends, which was painful.

2. How much grief my friends gave me for no longer having a “real job.” That probably won’t happen to you since you will remain in law, but there may be some big law snobbery that gets directed at you. Can be quite unpleasant, even if people say they are “only kidding.”

3. Quitting my continuing education in my first field. I was half-way through an advanced engineering degree when I switched fields completely to publishing. My former employer was paying for school and I no longer needed the degree, so I dropped out. It was one of the hardest things I had ever done.

I guess my advice is simply to be gentle with yourself when unanticipated consequences pop up. The time you spend at work is a huge part of your life, and being happy there shouldn’t be underestimated. Good luck in your decision!

houda

I started chatting about my resolutions in the open thread, but here is the full list:

– Become more high maintenance and beam a vibe of effortless elegance

– Exercise such as to attend at least 5 classes per week (even if back to back)

– Finally have a 6-pack by June (my graduation)

– Fit in my graduation attire by June

– Fit in my mustard dress for my thesis defense, end January

– Fit in my MMA shorts just for the fun of it by March

– Build a great network of friends because I recently moved to a new city

– Not stress anymore about getting a car or other money-related issues

My carrots are usually enablers that help me progress further in my resolutions; now every 2 weeks I buy myself a treat.

For my put together look, I have purchased good quality red lipstick, hosiery and other details.

Today, I was about to wear some worn out used-to-be-navy-now-a-bit-grayish pants and flats but decided to wear hosiery with a black pencil skirt and pumps. I am glad I did this because the general manager and HR manager came to us one by one for the new year hello and cheek-kiss (here it is common to cheek-kiss your managers/colleagues males and females).

For working out, every two or three weeks I buy an item. Yesterday I got biking shorts with padding, and wore them few hours later. It had been 2 months since I last went to a spinning class, the experience was completely different. Having the right equipment and attire sure helps.

I will print the chart and see how good I am at sticking to resolutions.

This year I am motivated because last year was very challenging. I am ready for a fresh start.

Louise

“…beam a vibe of effortless elegance.” I *love* this phrase! What a fantastic goal. The best part is that you get your carrot immediately, as soon as you look in the mirror.

Ru

I resolve to bring lunch from home at least 3 times a week (skipped yesterday and today, now I *have* to for the rest of the week) and I bought the NYC jazzercise groupon this weekend. If you bought it and see two hijabis stumbling over themselves, I’m one of them, lol.