Coffee Break: Rocketbook Core Digital Notebook

This post may contain affiliate links and Corporette® may earn commissions for purchases made through links in this post. As an Amazon Associate, I earn from qualifying purchases.

Our daily workwear reports suggest one piece of work-appropriate attire in a range of prices.

Amazon has some great Cyber Monday deals right now on Rocketbooks. This digital notebook, which started with a Kickstarter, feels like a regular notebook, and you write on the pages with a Pilot Frixion pen, then scan them with the app (iOS and Android), and wipe the notebook clean with a wet cloth. The system connects to the cloud, and you can search past notes by keyword, which is a huge advantage over pen-and-paper notes, of course!

The Cyber Monday deal we're featuring is definitely one to check out — you can get the Rocketbook Core today for under $20! Amazon even allows free returns on it! (See details.) This notebook measures 6″ x 8.8″ and has 36 lined pages. It includes the pen and a microfiber cleaning cloth and is available in lots of notebook-cover colors. The Core has 4.6 stars out of 5 from 27,000+ (!) reviews (and Fakespot verifies most reviews as legit).

(Readers, are you a fan of any higher-end digital notebooks, such as the ReMarkable or Kindle Scribe? Any smart pens you recommend?)

Sales of note for 6/30/25:

- Nordstrom – 2,700+ new markdowns for women — and the Anniversary Sale preview has started!

- Ann Taylor – 40% off your purchase, including new arrivals + summer steals $39+

- Athleta – Semi-Annual Sale: up to 70% off

- Banana Republic Factory – July Fourth Event, 50-70% off everything + extra 20% off

- Boden – Sale up to 60% off

- Eloquii – $19+ select styles + extra 50% off all sale

- J.Crew – End of season sale, extra 60% off sale styles + up to 40% off select cashmere

- J.Crew Factory – All-Star Sale, 40-70% off entire site and storewide and extra 60% off clearance

- M.M.LaFleur – Sitewide Sale, save 25% with code — 48 hours only! Try code CORPORETTE15 for 15% off

- Rothy's – Up to 50% off seasonal faves, plus new penny loafers and slingbacks

- Spanx – Free shipping on everything

- Talbots – 40% off entire purchase, includes all markdowns (ends 7/3)

Random question but is there any truth to the idea that Italy including larger cities like Rome can be a negative travel experience for people of color? Saw a reasonably compelling video on this issue but I also know how anything can make it on social media. But it was a young African American female who has traveled to fifty plus cities worldwide detailing how Rome was a terrible experience – with everyone from airport ground travel folks to tour guides ignoring her to being followed around in grocery stores as people thought she’d steal. And then surprisingly there were a TON of comments with people agreeing that Italy is not a great travel destination for non white people.

Reason I ask is DH and I haven’t had a vacation in years. It’ll be four years this spring due to the pandemic, but we have some time off in April and are contemplating going to Europe for a quick trip. Rome was high on our list just because of direct flights and relatively warm April weather. We aren’t black but are Indian Muslims living in the US. FWIW we don’t look Muslim – as in I don’t cover – so we just look like all Indians. Given that we haven’t vacationed in years, we’re just looking for a low key relaxing time and don’t want to spend money going someplace where we’ll feel uncomfortable. Would you go to Italy? We haven’t been to Europe in about a decade, and I’m guessing the migrant situation has changed some attitudes – more people thinking all x people are troublemakers or whatever. Otherwise also taking recommendations for European cities where you’ve had friendly, welcoming experiences. FWIW we’re looking for big cities, we’d stay in luxury hotels and do normal tourist things – so we aren’t specifically thinking the place has to have lots of indian restaurants or whatever.

Yes, I would go to Italy. I’m white but several of my closest friends are Indian and all of them have loved traveling to various places in Italy, including Rome. You can have a bad experience with racist people anywhere, but I don’t think there is anything uniquely bad about Rome.

I think this is where I shake out as a black woman who loves Italy. Unfortunately, racism is everywhere and it is hard to predict ahead of time, but I would sooner go to Rome than Boston, based on my personal experiece. But I also would not assume that anti-black racism (or the lack thereof) will predict the reception you would get as an Indian.

Of course the first comment is from somebody who is white but has all the answers on racism. C’mon.

I didn’t say I had all the answers on racism. I have a lot of Indian-American friends who’ve traveled in Italy and I thought their experiences might be useful to OP. It’s anecdata, but so is the thing she saw on the internet.

My friend who fits your description told me that she experienced more prejudice in Italy and a much warmer welcome in Greece, and it’s one of her reasons for much preferring to visit Greece. She felt the hospitality culture was stronger there in general.

I went to Italy with a darker-skinned Chinese-American friend and stayed in luxury hotels and did normal tourist things including shopping in high-end stores, and as far as I could tell she was treated the same as me. She certainly didn’t mention feeling uncomfortable and she’s not a person who’d keep stuff like that to herself.

I think part of it is that there are bad people everywhere, but I also think the racism in Italy is more likely to be directed to African-Americans than to Indian Americans, because Italy is grappling with its response to immigration from certain African countries and, to my knowledge, does not have a significant Indian population that would elicit any specific feelings. Just to be clear, I’m not saying the racism is any way justified, just that the cultural narrative around it will be different and I wouldn’t worry about it for you specifically.

There seems to be more prejudice in Italy, a male friend who is black (French, lives in Paris) mentioned this to me as well. He has travelled extensively in Europe so him singling out Italy as problematic stood out to me. You can still travel there but be aware that prejudice exists.

I currently live in the Paris metro area and would recommend the city. But I may be biased, I speak French now so I can blend in a bit and I am used to some of the unpleasant parts of the city e.g

congestion, pickpockets etc. I have travelled extensively in France. Other recommendations would be Nice and other towns in the Côte d’Azur. Amsterdam, Brussels and Bruge are also good cities to visit.

My Chinese-American friend honeymooned in Amsterdam, Brussels and somewhere in Italy (I think Venice?) and said Brussels stood out as incredibly racist. They were treated horribly at their luxury hotel and ended up leaving and going somewhere else. It may just be random or it may be that different cities have prejudice against different groups, but fwiw…

I’m a Black woman who has been to Italy with my very dark-skinned husband. I will say that I noticed some coolness towards us, until people realized we were American tourists. I’m lighter-skinned but I think my darker-skinned husband was assumed to be African, and I think that is common for Black tourists who are darker-skinned in Italy. Also it’s been my experience that they treat tourists differently because they know you’re going home in a week or whatever, and not trying to stay.

Indian here and Italy has been our favourite place. Super warm and welcoming. But I’ve read that Africans get very different treatment.

First, I wanted to thank everyone for their comments on my Catholic funeral mass post last week – I really appreciated all of the thoughts, and it was very helpful.

Second, on a completely unrelated note, I’m going to an upcoming conference in San Francisco at Moscone, and staying at the Hilton Union Square. Any recommendations for convenient coffee shops/restaurants nearby?

In the area near your hotel, there’s pretty much a Starbucks on every block. Just go towards Union Square. If you go in the opposite direction (west), things get gritty and rough pretty quickly.

I find the coffee options to be better around Moscone Center. There’s a Blue Bottle near there and an Equator, both of which have excellent coffee and seating.

Anon for this – do you ever look around lately and wonder how exactly people are SO rich?? I don’t mean to complain as I know I’ve done well for myself with eight years as a biglaw associate and now in house at a F500 where I even have things like a pension. I’m single so I’m not saving or paying for anyone’s college or anything, nor do I have loans of my own anymore. Yet I look at people around me and EVERYONE has a McMansion in the suburbs, many living in these 3000 sqft homes with just a family of four are already planning on buying bigger mansions, fancy new vehicles every three years – luxury cars only, three vacations a year all international etc. I mean these people all have good jobs – but then so do I. I assume dual income has something to do with this, but then paying for daycares and colleges doesn’t exactly amount to nothing. I wonder if I’m missing something, or if I’ve just become a slave to my investments while others are more willing to get a new car every three years while I’m thinking well that car payment invested in the market would amount to x dollars in three years. Is this just me?

I live in the Bay Area and I do wonder how people with regular jobs afford to buy homes when “starter homes” in semi-decent but not spectacular areas are $1.5M+. It’s wild.

Yeah, I left the Bay Area because a single family home seemed out of reach, even as a dual professional couple with one lawyer (albeit one who didn’t want to stay in Big Law forever). Several of my close friends stayed and eventually purchased homes in the $4-6M range. I think there was family help in most cases, but I don’t really know. They work in tech, so they’re doing well but I wouldn’t have thought they’re making enough money to afford that kind of home…maybe I’m wrong though! I don’t know how anyone without a law/finance/tech job buys a house there.

There was an article in the NYT a while back about people who bought or refinanced when interest rates were super low. What it didn’t talk about were the Gen-X’rs or older millenials who bought during the two housing dips (immediately post 9/11 and again post financial crash) AND benefitted from low interest rates. If you were lucky enough to have enough stability/capital to buy during those times (which is easier as a dual income couple) you got almost boomer level of value for money if you factor in the ability to refinance below 4%.

I’m a Gen x er in the Bay Area. I did benefit from refinancing during low interest rate periods but my first home was bought during a high interest rate period (7% mortgage.) It was a 2 br / 1 ba, we put 10% down which we barely scraped together, and we lived there for 10 years. My current home was the result of selling that home and buying a larger fixer upper that we did not gut immediately but took the better part of a decade slowly fixing. We cooked in a kitchen for 8 years most people wouldn’t have considered living with for a day. Our lives have never looked like an HVTV show.

There is no family money, throw a divorce and remarriage into there and a year + of unemployment for my spouse and …. All this to say it’s not as easy as it looks. Salaries are higher in the Bay Area but a much higher % of our salaries in housing vs other areas. It has always been this way.

I remember when I first started working I was so mad at my bosses who were boomers and even silent generation who bought their first houses in the Bay Area when things seemed cheap – 5 figure amounts. And I thought I’d never get a toe hold. I was 30 when I bought my first house with my first husband. I would have been able to do that much younger if I’d lived somewhere else.

Dual income helps a ton and you’re likely not hearing about how many people were ‘helped’ by their parents for a downpayment on a house, or for their kid’s schooling costs. If people have access to a trust it’s pretty common to restrict it to only be accessible past a certain age (30-35 is common according to my trusts and estates attorney friend) or for education/housing costs. I once heard a colleague remark that he was buying a house in the burbs at a relatively early age (30, unmarried) because the ‘rates were so good’ and with his trust fund it was a better investment than the market.

“you’re likely not hearing about how many people were ‘helped’ by their parents for a downpayment on a house, or for their kid’s schooling costs.”

Yep. We know people where we think the same thing OP is thinking – how in the world can they afford X or Y – and then we find out, Grandma and Grandpa are paying for private school, gave the kid a car for their 16th birthday, and also have a college fund set up and fully funded. Or, Mom and Dad gave an “early inheritance” that allowed them to put 50% down on a house.

I’ll confess: people may wonder this about us, as we got a jump-start in life from an inheritance we received when my FIL was killed in an accident not long after we got married. We inherited his (modest) estate and there was a life insurance payout also. Not the way you want to get money from a parent, I assure you. But I can’t deny it gave us a leg up when it came to affording things like our first house down payment (and we put 50% down), international trips, etc. Early on, we ended up with a financial cushion that made some things possible that wouldn’t have been otherwise. You never know what’s behind someone’s story. We’re conscious about our spending and live below our means, but we’d never be where we are now without the money we inherited. At the same time, that was the worst experience I’ve ever gone through and I don’t like talking about it very much.

There’s a lot of this in my extended family as I’m from a flashy culture. In almost every instance, I guarantee those people are saving and investing a lot less than you – even accounting for the fact that they are dual income and you aren’t. Disclaimer – I know there are people out there who have it all because they make fabulous money as biglaw partners or whatever. But my family tends not to have those types. It’s more people who together with their spouse make 200-300k and have 2 to 4 kids, but always have a quarter million dollars in new cars parked out in front of their mansion, vacation four times a year, have a Starbucks in hand every time they go anywhere. Yet the quiet part gets said out loud sometimes as they sit around lamenting how expensive groceries are, how they can’t possibly send their child to an out of state college, how expensive their college kid’s rent is, and frankly down to retirement. Lots of people in my family keep slogging away well into their 70s even when they no longer want to – and then they let slip that they have to because they’re way behind on retirement.

In the meantime DH and I get mocked because we ONLY drive Hondas. We don’t say anything about it and let people assume we’re cheap or just don’t make as much money as them. But we’ve always prioritized investing a ton into retirement and brokerage because we want the option of retiring early or downshifting to very part time or consulting gigs whenever we want.

+1 Some people prioritize building wealth on their personal balance sheet. Wealth creates more wealth and they may drive a Honda. Others spend everything that comes in. It came out recently that my friend, who I thought was rich, has an interest only mortgage, no savings or investments and not even a 401k. She drives a G wagon (leased).

this is where family wealth is huge – my parents paid for college and grad school and would have loaned me money for my first home purchase if i needed it. when we sold that one and bought our second one i borrowed close to six figures from my dad for a month or two because there was a gap between buying and selling. i’d say we’re upper middle class.

dual income is part of it also, especially if the spouse’s family also has family wealth.

even when we talk about emergency funds here people like me note that we could borrow from our parents if we really had to so more money is free for investing.

and as these families get older they’re making gifts with their estate and taxes in mind – we recently started getting $10k from my parents every xmas, other families might do more than that or sell their home to their kids way below market rate.

Yeah, family wealth is a huge factor. Neither my husband nor I had educational debt, and although we haven’t yet received any cash inheritance, my parents are paying for college for our kids and we expect a very substantial (high seven/low eight figure) inheritance when they pass. Not having to save for our kids’ college and not having to save as aggressively for retirement gives us a lot more disposable income than most people in our tax bracket.

also: some people spend almost every cent they get and figure they’ll worry about retirement etc later on.

some people also consider different things to be valuable – all my neighbors have put in pools and $50k landscaping because, i think, they view their home as an investment, while we have not because we hate the outside and prefer the stock market.

This made me LOL – hate the outside and love the stock market. You do you!!

There is no world in which someone who is at the upper end of middle class has “close to six figures” to loan someone for a couple months. There is no world in which someone who is at the upper end of middle class is giving or getting $10k every year for Christmas. Sixty percent of America lives paycheck-to-paycheck. You are well-off.

https://www.investopedia.com/financial-edge/0912/which-income-class-are-you.aspx

https://time.com/personal-finance/article/average-american-savings-account-balance

Part of this is really regional. And also… many people are comfortable with a lot more debt than I am.

I don’t get basically the entire states of Utah and Texas. Like, it seems like a lot of SAHMs with big expensive cars who get botox and blonde highlights every 6 weeks and wear expensive clothes and dress their kids in fancy stuff… and live in these 6,000 square foot houses which are decorated for each season.

I live in Texas. There are a lot of regular people too and with the housing prices skyrocketing in various areas (DFW, Austin) many people are priced out the market. I’m amazed at how much my house as appreciated in 5 years. I was lucky to refinance in 2020 and feel terrible for people who are buying now.

I have ex-classmates who went to BYU and married Utah Mormon guys and are living the life you describe. I also have Texan relatives.

Short answers:

– In Utah, large families provide support structures that create income opportunities that are more lucrative than people think. As in: a family with 6 kids starts a family business; other Mormons do business with that business and the kids get shares of the proceeds as income. Family businesses are HUGE among Mormons and they prefer to do business with other Mormons (I have witnessed this for myself, first-hand). And some of those family businesses do very, very well as a result.

– My Texas relatives are way more comfortable with way more debt than I would ever choose to live with in my life. One of my cousins makes about $65k a year; his wife stays home with their kids, and they have a 3000 sf house and two 2022 vehicles; they have a boat and are talking about buying a cabin at the lake near their city, etc. It’s all debt. They have told me “we’re not going to worry about emergencies or what happens later, God will take care of it” or some variation of – the Rapture is coming any day now so no need to worry about the long-term; long-term they will be in Heaven while me and the other sinners get to stay here on Earth. I am not saying all Texans are like this but my cousins definitely are.

I don’t understand how people making that type of money are able to get the credit to buy these things.

Credit cards will give anyone huge credit lines. I got offers for $30k lines of credit when I was in law school with zero income and negative net worth.

The magical thinking. Oh the magical thinking, endemic in some religious circles and geographic areas. It ruins people’s lives and then they just think “it would have happened anyway.”

(I will not rant about how this is wrecking my marriage… I will not rant about how this is wrecking my marriage….)

I’m so sorry about the marriage… been there. Hugs to you.

God, or a GoFundMe

This might mean it’s time to widen your social circles. There are plenty of people not living this way, but if you spend most of your time in homogenous circles, you won’t see them. Few people I know are living this way, and the ones who are either have family money and/or are in debt to keep up with the Joneses. Neither of those apply to me so I’m trying to surround myself with people who lead more middle-class lifestyles and actively choose not to always upgrade and consume.

It is totally people’s prerogative to live this way if it makes them happy! But often it’s just smoke and mirrors and I found it made me unhappy to constantly compare when the truth behind all the purchases was either unrealistic (family money) or undesirable (stressful debt).

I agree that your social circle changes this perspective FAST. I have worked in environments where everyone has degrees, and others where I was one of the few with a bachelor’s or higher, and its very different. Most folks do not live this way, and working/interacting with people outside of the upper middle class makes that much clearer. I am very fortunate compared to most, but it can be hard to remember when it feels like you’re missing out on vacations, etc. that others have.

I have these same thoughts, but mine are mostly focusing on how people can afford more than one child. I’m in a dual income high earner house house, and don’t live in a state with super crazy taxes or anything, and wonder how people pay for childcare for multiple kids, plus save for retirement, plus save for college, and STILL drive $70k+ new cars and take elaborate vacations. I don’t know, I would say lots of credit card debt? But so at least some of these people that I’ve known a long time, I really don’t think that’s the case.

The per kid cost is real. We save a lot, have a nice house and take a good number of vacations, but all of that would go out the window with a second kid. We would have had to give up basically all luxuries like travel and still would not have been able to save anywhere near as much as we do now. I never felt a burning desire to have two kids, but finances were a huge factor in us stopping at one.

I have multiple kids, and gave up vacations (we now camp at state parks), cars (went from 2 luxury cars to a minivan plus a smart car), great schools (local ones now plus tuition and tons of free enrichment activities), and a nanny (now an au pair which is ok but they only stay 1-2 years). In short, with multiple kids your standards fall. They have to or your hair falls instead lol

it could be dual income, family money and/or a lot of people don’t save as much as you do and/or have credit card debt and are living well beyond their means

+1 savings makes such a difference. Many people barely save anything, even on high incomes.

This. I remember our mortgage broker being like I knew this was going to be easy when you both have good jobs, old cars and 401ks unlike most of your compatriots. I thought he was joking until I told the joke to my equally well paid colleagues and quickly learned how many had no retirement savings.

FWIW I think things are different now – at least from when I grew up in the 90s. I feel like back then things like travel, luxury cars, and mansions were only for the super super rich. Even people who were upper middle class back then weren’t jetting off to Europe three times a year, nor driving a Mercedes or living in a huge mansion. In my parents’ circles back then, hose UMC people WERE saving to be able to send their kid to the ivys debt free or with as little debt as possible. It was more a point of pride for my parents’ circle to have kids to go ivys or MIT or wherever than to show you their Mercedes or tell you they went to Europe again. Maybe some of this was regional, IDK as I lived in a fairly academically competitive area up north back then.

Fast forward three decade and things have changed. IDK if it’s because things like ivy admissions are next to impossible or private colleges have gotten SO expensive that most in my current circle – who are just as educated as my parents friends back in the day – have all accepted that state school is all they’re going to do. That frees up a lot more money for much bigger houses, fancy cars leased every three years, and a ton more vacationing. Frankly leasing cars is an option that has opened up luxury cars to a whole new market now, and IG/social media has made people feel they MUST vacation, have a car no more than three years old etc.

Right. I talk about my first tiny house to people 20 years younger and they say they could never live in a place like that. I drove a broken down Ford Escort so I could save for that 10% down, I never went to restaurants, I had 5 outfits for work I wore every week. People have more things and nicer things now. Times and expectations were just different.

I didn’t have a dishwasher in my first house. And I had Formica. The humanity!

I had a dishwasher but it broke and we couldn’t afford to replace it for a very long time. Also Formica countertops haha.

Confession: I actually like Formica because it’s quieter than hard surfaces – no banging every time you set something down and a less echoey kitchen.

Counterpoint: I had beige Formica with what I think were cigarette burns in it. Good times.

No dishwasher, no air conditioning and no TV, before you could watch whatever on the computer! Because I was raised in a very low middle class family, I did not think I was deprived. So much is about expectations and peers.

I thought my countertops in my first home were formica but I just looked that up and realized that was what was in the house I grew up in, and was much sturdier than what my house came with. My house had countertops that were trimmed in wood around the edges (honey oak!) and the middle part was basically a sheet of white plastic? I don’t know what that was called and I can’t figure it out online.

My second/current home had almost no countertops, basically free-standing appliances here and there, but the small countertop around the sink had aqua blue tile on top of a tin cupboard with doors that were permanently stuck and painted shut. There was about 2 feet of counter on one side of the halfway broken range, and one foot on the other side, and that was red/burgundy tile a different size and shape vs the blue sink tile. The red tile countertop sat atop plywood cabinets that were painted roughly the same color as the tin cabinet.

We didn’t remodel for several years due to spending allllll of our dough just to get into the house. I cooked Thanksgiving in that kitchen! I hosted more dinner parties then than I do now (with my very basic Home Depot remodel.)

Not everyone lives in a McMansion, even though it does seem that way sometimes.

Yes, this is completely true. My first house was built in 1923 and had had a cosmetic facelift but the plumbing and electrical were still original and we UPGRADED the kitchen to Formica countertops! And as far as furniture — it was all hand-me-downs and things from The Pennysaver, which was a throwaway newsletter you’d pick up at the grocery store — an analog equivalent of Facebook Marketplace. And I drove a Toyota Corolla to my job as a BigLaw associate, where I rotated about 5 work outfits.

I loved the Pennysaver! All of my pots and pans came from there when I was first starting out.

Grew up in the suburbs of Boston and this is so, so true.

Back then (1990s), there were obviously the rich families who could afford a big house and to send their kids to college (usually at least one parent was a physician, and had gone to med school in the 1970s when it was a lot cheaper). There were a lot of families who lived in modest homes, drove old cars, and sent their kids to top-flight schools. Sometimes the kids took scholarships at schools a notch below the best they got into, but the parents were still paying, eg, half tuition plus room and board at Smith or WUSTL.

There were a couple of families who lived in big homes (4-5 bedrooms, 3+ baths) and told their kids that they had to figure college out on their own, or very limited money would be given (think, $30,000 total to cover all four years). That wasn’t the norm though.

Grew up in NJ in the 90s and it was exactly like this. In the circle I grew up in, the UMC parents def lived in regular homes, drove regular reliable cars like Toyotas but it was ALL ABOUT the kid going to a top school. It was an unspoken decision in most families that the kids were going to go to the best schools they could get into with as little debt as possible. I know everyone likes to act like tuition cost 20 dollars back then, but by the time I went the ivys were 40 to 50k per year so mom and dad even if they couldn’t shell out all of it, were shelling out 20-30k per year even if that meant the Toyota got driven for a decade or more.

Maybe some of this was just because I grew up amongst Asian immigrant families and our Indian parents all thought we’d couldn’t be successful if we didn’t go to ivys or top 10 schools. But fast forward a decade, more recent immigrants in my family DO NOT feel that way about school. It’s not that they have the benefit of saying – eh I went to an ivy it was NBD – they all immigrated in their 30s or later. It’s that they say – hmm I can have a Mercedes and mansion NOW and go to Europe multiple times a year or save for my kid to maybe get into an ivy, yeah I’m taking the luxury now and forcing my kid to go to local state u, even if he can get in someplace tip top. It’s just different things being important now.

I’m the person you responded to and will correct your numbers a bit. When I started college in 1999, my parents paid for everything; it was $33,000 per year total (tuition, room, board, books, health insurance, fees, incidentals). Adjusting for inflation, that would be $60,500 now. Except my college costs $88,000 a year, which is 46% more than the inflation-adjusted price.

Also, back in the day, kids on the upper end of middle class (parents are engineers or some such) would get about $5k to $10k a year in aid. Let’s split the difference and say it would take the $33k cost down to $26,000. Adjust for inflation, and that’s about $47k a year after aid. These days, those same families aren’t getting $40k in aid… they aren’t getting $30k in aid… they are getting a few thousand dollars in aid.

It doesn’t make sense any more. I absolutely love my college but have no desire to send my child there unless they radically reform their pricing systems. We don’t make enough and never will make enough; and even if we did, it’s not worth it.

My kids came from an upper end of middle class and got zip for financial aid. They’re currently in college. It wasn’t even worth filling out FAFSA anymore.

My son got “conditionally” approved for a middle class grant this year and then they said oopsies and withdrew it. Ugh. We are paying the list price.

“IDK if it’s because things like ivy admissions are next to impossible or private colleges have gotten SO expensive that most in my current circle – who are just as educated as my parents friends back in the day – have all accepted that state school is all they’re going to do. That frees up a lot more money for much bigger houses, fancy cars leased every three years, and a ton more vacationing.”

So I see what you’re saying, but in my social circle, everyone has decided “we’re just going to pay for state school and that’s it” because otherwise people can’t afford to retire. Like, maybe I hang around with poor people or something, but the choice isn’t – let’s send Junior to State U instead of Harvard and so now we can afford a new BMW every three years and an annual two-week European vacation. It’s – let’s send Junior to State U so we don’t have to work until we’re 75 and still worry we may have to eat cat food in retirement.

I will also just say: I do not fault anyone for not saving enough to pay for an Ivy education for their kid(s) out of pocket. That could be $500,000+ for two kids. It’s like the whole thing about “not buying a latte every couple of days is not going to help you pay a down payment on a $650,000 house.” A family giving up a car payment or a few vacations is not likely to help them save the $500k they would need to cover Ivy League educations for two children.

Being able to pay cash for a private, high-dollar college is a realm of privilege few in the U.S. can achieve. And I also just want to say: the continued focus on shaming people for not being able to pay outright for college, pay outright for a house, have $1 million in the bank for retirement at age whatever, is pulling focus away from the fact that maybe our society should do a better job of taking care of people – you know, like they do in other countries? And not leave all of this financial burden for living life on the individual. Don’t get me started on health care and caregiving costs. If we had decent social supports in this country, people could do a lot of things differently.

For 100% sure school tuition, both public and private, has way way way outpaced inflation and income growth for a long time. The equation for putting kids through school now is totally different than it was for some people who remember their middle class parents saving for an Ivy League education for all of their kids. It’s roughly equivalent in terms of % of income for today’s parents to put a kid through an in-state public college.

As I posted above, it’s worse than $500k for two kids. At $88k per year per kid, it would be more like $700,000 for two kids if you pay the sticker price.

I graduated from top flight private schools, loved my experience, and my entire attitude on elite education can now be summed up by the computer in War Games: “The only way to win is to not play.”

What college is $88k per year? The Ivies, MIT and Stanford have total estimated cost of attendance in the mid-high $70s and many good-but-not-quite-as-exclusive colleges are a lot less.

It’s also very common to get some aid even on an upper middle class income. Stanford, for example, is free for families earning less than $100k, and there is significant aid well above that income level. If you’re earning $300k+ per year you might have to pay sticker price, but to suggest that many or most upper middle class families have to pay full freight is not accurate. The vast majority of families who send kids to these schools don’t pay the sticker price.

A sample: Harvey Mudd is $89k, Columbia is $92k, University of Chicago $89k.

I was the kid with very middle class Italian parents who advised us to commute, live at home and go to a state school, which I did. I was so disappointed I had to at the time. I eventually got a doctorate and excellent post doc training, but I used to feel,despite getting to the same place as colleagues from the ivy league, that I missed out and they were inherently “better trained” because of their undergrad experience. Anyway, now mid career, twenty years in, two teens, we absolutely supported our daughter picking a very good state school that was a match to her major. The veil of the private undergrads and the halo of excellence that I thought only came in those places, has been lifted. My parents were right, you can excel even with a degree from a state college. The costs have just also become prohibitive at our income level ($225).(Anything over 30 k per year per kid was going to hurt). We woukd have done it by going into retirement money but fortunately my daughter picked the state school and got some merit aid. My parents are now both 90, and still live in NJ, as “the millionaires next door.” It’s a different time.

Not just you. I completely don’t get it. I feel like I couldn’t afford to buy the house I live in at today’s prices and I can’t imagine how younger poeple manage.

Same. I’m good at math and personal finance and when it doesn’t make sense to me on a large scale, that should be a sign. Not everyone can have a trust fund or family help (my family is middle class where they come from but a good house is 200K where we are from). I can’t explain a lot of what I see on my daily drive (mom doesn’t work, house is 7figures, cars are 6 figures, private school tuition is likely 90K a year). There is often a beach house or mountain house also.

It’s not on a large scale. It’s a biased sample. It’s the people you are aware of.

Of that skewed sample though, there is often a LOT of head scratching for me. I’m in BigLaw and know the income side of things and the expenses are visible. I get someone living big if they are a partner in Big4 or BigLaw or are in various medical specialities. The math either includes a secret meth lab or, more likely, more debt than I would be comfy with. Or risk (neighbor gave kid a LandCruiser to start a moving business but I’m convinced talkative is just to write off the car and they have no insurance or workers comp on their workers, all of whom are paid cash). Like one accident and it is all toast or the homeowner gets sued and this is in something people routinely get hurt doing or have wrecks.

Family money and the housing dip in 2008. But family money is HUGE.

Good point – we bought during the dip and sold it for nearly double in 2015. We walked away with over 500k cash as profit.

I live in a very fancy neighborhood where everyone is young, beautiful, and underemployed. For the longest time, I couldn’t figure it out. It’s family money. People are getting a lot of money from their boomer parents.

IDK – my boomer parents are likely to outlive their money and don’t have pensions. I’m happy they don’t currently need $ from me.

Yes obviously not all boomers are wealthy? These are generalizations.

My kids are in college now but I remember their early elementary school days like it was yesterday. When I took them to daycare and preschool it was all dual working parents. But elementary school opened me up to the rich stay at home moms who always had something to say about me being a working mom. They kept saying they “sacrificed” to be home with their kids and suggested that’s what I needed to do. Like it was that easy. These same moms had annual European vacations and ski cabins. Sacrifice my ass. It was generational wealth.

I LOL-ed at your last two sentences because I know those women.

Same.

My current house is my 4th house and I was in BigLaw when I got it. What I don’t get is all of the early 30s people here who have a SAH wife and multiple small children. Like how is this a starter house neighborhood?!

Sacrifice. /s

Yes, I wonder about this a lot. We both make very good money in the greater scheme of things. But some people around us seem to be taking extravagant trips, buying giant houses, fancy cars, extremely expensive wardrobes, etc. I don’t know if those people make more than I think, save nothing, have family money, or are somehow managing better. We try to save a lot, so maybe others don’t do that, but it’s hard not to compare sometimes.

The vast majority of Americans don’t save that much, so if you’re saving a lot that’s almost certainly the explanation.

Re: “extravagant trips”

We’re taking one this summer, two weeks in Europe, and most people don’t know this but – I took on an online adjunct teaching assignment at my local community college, this semester and next semester, and that’s how we’re paying for about 75% of the trip. I had to do a conflict-of-interest form for my job and they didn’t want me advertising that I had this side gig, so I haven’t told basically anyone I’m doing it, and it’s not on my LinkedIn. I imagine when we take the trip and I post the pictures, people might say “how did they afford that?!” and the answer is: I have a secret second job (which is super-fun, BTW, and I wish I could do it full-time). We were going to fund a shorter trip out of some savings we had set aside but this way, we can do a nicer trip for a longer period of time. After I did this, I started wondering how many people out there that I know have secret side gigs/second jobs I don’t know about. You never know!

Love that, good for you!

It’s a different story when you’re talking about someone who has the fancy trips AND the fancy house AND the fancy cars, but I think some of this can also be explained by different people having different priorities. We spend an outsized amount of money on travel for our incomes, which has raised awkward comments and questions from coworkers, including my boss (I work for the govt so everyone’s salary is public knowledge). I’m sure there are people think we don’t save or have debt. But we have a cheap lifestyle otherwise (one kid, modest house, old cars, not a lot of “stuff” or outsourcing) and travel is our one real indulgence. My boss sometimes makes salty comments about wishing he could afford to travel like I do, but like dude you have three kids and a McMansion and a new Mercedes and a gardener. It’s not a mystery why I have more money to spend on travel.

The ones I know like this it’s a combination of family money and where they live. I don’t know as many people my age like this in my M-HCOL town. I do know plenty of people I went to highschool with living like that, but it’s because they’re still in my LCOL hometown. You can get a fancy, newish mcmansion type home in my hometown for the same price I paid for my not-mcmansion, older home in my current town. But then you have to live in my hometown, and no thank you.

So a lot of people say “big law lawyer” or “big law partner” and it means SO many things. But every $50k you make on top of someone else is $50k to spend on vacations and homes and stuff (and taxes!). I work at a big law firm but part time and am not paid well; my husband makes a lot more than I would ever have based on my law firm and my practice area, and that is how we live well.

I guess I’m just saying – say you make $300k and have all of your needs met, and many of them met pretty well. So then someone making $400k has all of their needs met, and many of them met pretty well, but $100k to spend making more of their needs met. Once you get above a threshold, the additional bits are all gravy, and the gravy is what you’re seeing.

One thing I repeat ad nauseum to people who wonder if they can make it on one income, by taking a pay cut, etc: “discretionary income is exponential.”

Let’s say $150k a year gets you a maxed out 401k and HSA, all bills paid, emergency fund stocked, charitable giving taken care of, college savings on track to fully fund state school, and allows for $5,000 a year in fun money. (Adjust as needed for your area of the country.) Now you get a raise and you’re making an extra $10k a year after taxes and inflation. Your 10%ish raise tripled your fun money.

Flip side is, if you cut your salary by only 20%, it doesn’t mean that you now have $4,000 in fun money. It means that you’re saving less, driving those cars longer, maybe putting big expenses (new roof?) on credit, and, yes, tightening your belt on fun.

LOL you’re not missing anything. The game is rigged. Most people don’t get to be rich.

If my coworkers are any indication – retirement savings is not a priority. FWIW we are government financial regulatory attorneys, ranging from mid 30s to mid 40s. Our salaries are public info, so we talk about them openly amongst each other too. Most people are making in the high 100s or low 200s. Retirement is an after thought to most – most put in as little as possible to get the match. Some put in less than that. Some are quick to withdraw money out of retirement when they want to do something like a fancy multiple week vacation or put in a nice outdoor kitchen at their house – yes they’ll pay taxes and penalties. And no this is not because we have a fabulous pension. We do have a pension but it’s a fraction of yesteryear and retirement now very much centers on a TSP.

That’s the situation in my state government workplace too. I haven’t heard of people raiding retirement accounts, but most people seem to pretend they don’t exist, and don’t contribute anything other than the small mandatory contribution and what we get from our employer (which is a fixed percentage of our salary, regardless of what we contribute, not a “match.”) My husband and I contribute about $50k/year combined beyond the mandatory contributions and employer contributions, and sometimes I feel guilty about not doing more, because we could contribute quite a bit more if we cut back on fun spending. But then I remind myself that most people I know are contributing basically nothing and I feel better.

FWIW, these people are mostly in their 40s and 50s, so not spring chickens relative to retirement.

What y’all might be realizing is that being a lawyer isn’t the path to riches anymore. I’m in the Bay Area and most people I know don’t come from generational wealth. But they were in the right place at the right time and got hired by startups that became Facebook, google, apple, Salesforce, etc. and made a fortune that way.

Being a lawyer has never been a great path to huge dollars. Even Big Law equity partners (which is obviously a small percentage of all lawyers) make a lot less than similar level people in finance.

I don’t know, it was a combination of privilege, dumb luck, catching lightning in a bottle with jobs in tech, living frugal through our 20s, compound interest and now that my three kids are out of daycare (but not in $$$ extracurriculars), I feel like of my 99 problems, money isn’t one of them.

Gift help:

Physical gift needed- this is for an acquaintance that is part of a gift swap/secret Santa type thing and there are Rules (no gift cards).

Mid 40s suburban woman, married with 13 year old B/G twins. She’s a former ski instructor and is now (and has been for 15+ years) a 4th grade teacher. She spends summers at her beach house. Loves coffee.

Looking in the $50-75 range.

All mugs/water bottles are out as she has a zillion nice ones from years of teacher gifts.

Ideas?

If you can make an informed guess about her size I’d grab her the linen ‘beach shirt’ from jcrew, I wear it constantly in the summer. It’s nicely oversized so you’ve got some wiggle room on sizing. Maybe pair that with a beach read type book or a straw hat/straw tote?

lululemon belt bag, backpack cooler, sand resistant beach towels/blanket, wet/dry bag to keep stuff in by the beach

OP here- I had some of those same ideas but then realized, as a beachgo-er myself, I have them already. She has a summer house and I’d be super surprised if she and the family didn’t have a good backpack cooler on hand. Or…maybe not?

La Colombe has 30% off today, if you want to for a coffee-themed gift.

I love my Dyptique candle in the pine scent (the name of which I can’t recall). *looks it up* It’s Sapin, and you can get a small one for $50!

And it’s Diptyque.

I feel like unless the recipient is a Known Candle Person, a small $50 candle might seem like a cr@ppy present. Maybe not? Are they really so awesome that a non-candle person would enjoy it immensely?

I mean no shade on the suggestion, I’m just thinking about getting one for a relative and wondering if they will appreciate it.

I am a candle person and they are really, really awesome.

Not a candle person and a sensitive to scents person, so I would be positively revolted that someone had spent so much money on something that would go straight into the trash (normally I’d try to give things away, but scented stuff can’t just sit around the house until I find someone to take it). So I’d only get one for someone you know likes that kind of thing.

As the saying goes, it’s the kind of thing that people who like that kind of thing really like.

And actually? I’m not even a candle person and I still really loved it. (Obvioulsy the scent-haters gonna scent-hate so you have to take that into consideration.)

Same. Scented things and smoke make members of my household feel unwell, so they’d go straight to the outside bin if I couldn’t immediately think of someone who’d like the candle. I’d feel really bad about tossing, too.

Third person here who would have to throw it in the bin immediately.

According to research, one-third of people get negative health effects from artificial fragrances so it’s much safer to avoid scented gifts unless you know everyone in their household is ok with it.

(I’d still recommend avoiding them as I can’t visit friends who have scented candles, but I recognise I’m sensitive than most).

I get headaches from cheap scented candles but not always from the high end ones. I assume there’s some synthetic fragrance booster that is my trigger, since I also don’t get migraines from strong smells in general.

I still have asthma so try not to deliberately lower the air quality in my house, but I have no problem with strong scents that don’t have whatever that particular trigger is.

You could do a 3 month subscription to Atlas Coffee club plus a bag of fancy coffee to hand over at the exchange.

How about a beach game? I like molkky / scatter, ladder toss, or kan jam

Straw hat for beach

Beach-read type book

Sunglasses

Fancy coffee

Coffee or caramel chocolate

I’m firing my commercial housekeeping service next week. I hired them in mid-August when we moved here and I wasn’t immediately impressed but thought the girl (she’s 19 or 20 and is the only person who cleans my house – they don’t use teams) would get better after learning our house and preferences. I’ve been traveling so much, I only last week had a chance to intentionally note before and afters, and it’s not good. I sent photos to the manager and she was only somewhat apologetic. (Um, I can write my name in the dust on nearly all horizontal surfaces and my shower is mildewed. I recently left a dead stink bug on my desk for 3 weeks while I was out of town to see if she’d get it – nope.)

This same girl has been cleaning our house since August, except twice when she wasn’t available. I have not been tipping her each week because I typically give a very generous Christmas tip. But she’s…not good at her job. Do I still tip her next week after the last cleaning? Give something nominal? I feel bad firing her at Christmas (she has a baby and lives with her parents), but this is a commercial service and a tip is for good service. Do I just give her $100 and send her on her way? (A cleaning is $200. I used to give my previous housekeeper $500 every Christmas – I loved that woman!)

I would not tip someone you’re firing because she’s bad at her job.

Just fire the service now.

Do it sooner than later before she’s buying Christmas gifts that she can’t afford. I’d rather know now if it were me.

THIS! And it gives her more time to find something else.

I would give her $100 and send her on her way because I am constitutionally incapable of giving her nothing, especiallyl after reading “Maid.”

I have had a housekeeper, the same one, for 17 years and the word “maid” bothers me a lot. My housekeeper is not my servant, she’s my partner in helping me keep my house clean and maintain my sanity.

Maybe she’s not doing a good job because you’re weirdly not tipping her. One tip at the holidays is ok if she is a solo. It isn’t for a commercial cleaner. I’d try fixing yourself first.

I had cleaners for years and never tipped per service, it was standard to do one service worth of tip around this time of year. I dropped my cleaners just before the pandemic started (thank goodness I didn’t have to decide whether to pay them during the pandemic) because they broke things right and left and tried to hide the fact. I haven’t had cleaners since. But that was only 4 years ago and not one person I knew tipped every service. And yes, I used a service.

Same, we’ve always just tipped at the holidays even though we have a service. I thought that was standard.

same in my city

I wondered this as well. We had someone come in every two weeks and tipped small each time as well as something bigger around the holidays, just like a hairstylist.

It’s also kind of crummy to figure that yearly tip is their compensation and then fire them right before but what’s done is done.

what’s the brand name for those fancy totes that you get monogrammed (like with intiials or one that says sun and one what says surf or whatever)… trying to find on line.

LL Bean Boat n Tote

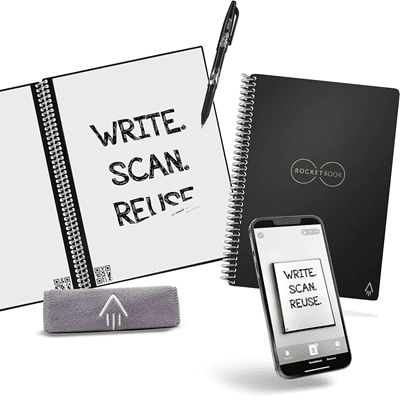

does anyone have one of these notebooks? I think i want the steno notebook (spirals at the top).

My daughter got one as a gift and found it to be a useless gimmick.

Thank you for saying this – it seemed that way to me, but I thought I might be too much of a Luddite. I would pay for a notebook that synced my written notes and then I could pull them up again, but if I have to scan a page and wipe it clean like a MagnaDoodle, I don’t see the point.

I had one. It worked *okay* the first time, but the microwave didn’t fully get rid of the old writing and it made the pages wrinkly.

Also I definitely don’t recommend the other versions which have wipe-off paper. Those are useless.

I do. I used to use it a lot when I actually went to in person meetings and took handwritten notes. Post-pandemic, where everything is by Zoom and I just type notes, I haven’t used it at all.

Also, in retrospect, I think just a tablet with a stylus and a handwriting notetaking feature would be more useful. It’s kind of a pain to erase the pages on these.

Had one, but it seemed to be more pain than benefit. Plus, once I spilled water on it, and all my notes were lost that I hadn’t uploaded yet (the ink is water soluble). My ipad notes app and its pen are way more useful than this.

Yeah since ditching my rocket book, an ipad mini with a paperlike screen and pen are far more functional. I use one note to organize and store my notes. It is so much better.

If you’re looking for a digital notebook, a coworker/friend of mine has had a reMarkable since they were a kickstarter and she loves it.

Not sure why I went to mod, but if you’re looking for a digital notebook try remarkable.

Love mine!

are airtags worth the hype?

yes IMHO, we put them in our luggage and love being able to verify where it is. The batteries have lasted 1.5 years at this point.

This just seems like it’s created a new thing to be anxious about. I don’t need to also devote mental energy to tracking my luggage’s every movement.

I don’t track its every movement. For checking when on board a flight that your bags made it with you (for airlines that don’t offer tracking in their app)? Nice peace of mind, or an early heads-up to file a claim.

I love them for this too.

If you’re me? Yes. I am constantly leaving my keys or badge in totally memorable I can’t remember places. The ability to have my keys chirp at me and remind me that they’re in the closet? Priceless.

I also don’t know if I’ll ever check a bag without popping one in my suitcase. A friend was only able to track her bag down by calling the airport it was pinging at and asking someone if they could see it. Turns out it WAS in her connecting city and sitting in the lost luggage office.

What it’s not good for – a child tracker. We tried to LoJack our kids at Disney and it had limited utility.

Depends – we almost never check luggage and that seems to be the main usage, so for us, no.

I just gave my college aged son an AirTag for his birthday. It was meant as part of a 3 part gift of new earbuds (Sony Linkbuds), a silicone keychain case to go around the earbud case, and the AirTag was supposed to slide into the earbud case because he is ALWAYS losing his earbud case. But instead he put the silicone case on his keychain and thought that would make it much easier to keep track of, and immediately put the AirTag into his wallet, which he also misplaces regularly.

He has already used it a couple of times to find the wallet (he’s a Sagittarius in case that gives you and idea of his recent his birthday was!) and it seems like it’s working well.

They sell a silicone keychain fob with an AirTag slot and I think I will get that + an AirTag for my sister who can never find her keys!

We have on our dog’s collar and like that. It gives peace of mind when he stays with our dog-sitter. And if he ever wandered away (he’s pretty lazy so he really doesn’t), it would help find him.

I agree that they are definitely worth it! In addition to luggage, we have one on our pup’s collar, in our car, and I keep one in my purse when carrying my work laptop. I don’t check any of them regularly, but I find having them has really actually eased my anxiety were anything to happen (such as getting lost/stolen). For additional reference, we travel a ton and our neighborhood has increased instances of theft recently. Getting them on sale made it a no-brainer for me!

I have one on my dog’s collar. She’s chipped and wears a tag, but it’s worth it for the extra piece of mind. When I run in for an errand, I crack up every time I get an alert that I’ve left her behind in the car.

I’m looking for a mid-thigh lightweight puffer coat that works for my pear-shaped body. Any suggestions? Thank you!

I just got a puffer coat from Lands End and I love it. It’s light but so warm. Mine is mid-calf but they should have shorter options.

Columbia parkas are great for my very curvy body. I have last year’s version of the Joy Heat long hooded jacket (with the reflective lining) and it’s lightweight but very warm.

Athleta! Love mine and it’s on super sale right now.

Uniqlo. But size up.

I realize that I go for days with a pervasive undercurrent of dread running through me. It’s like there is a big medical procedure or presentation coming up, but there is nothing coming up. I thought everyone had this but a friend of mine told me that she doesn’t, so now I am wondering. Do other people get this and if so how do you stop it. Thanks.

Have you considered whether it may be a form of anxiety?

Hey girl, it’s anxiety and we take meds

Yep

Ding ding!

+2

A strong feeling of dread can actually be a medical symptom, but I think that’s usually for pretty fatal events so probably not your problem if it happens regularly. I agree that it sounds like anxiety.

I have chronic anxiety and I feel your pain. Maybe a little therapy, maybe a little medication. I’ve had a lot of therapy and I have way less anxiety these days.

Not OP, but another person who handles the days well mostly, but someone who feels like she could use a little help. What specific meds do you all take for anxiety if you’re not also depressed? I seem to only have the one side of the coin.

I take a very small dose of Valium/Diazepam and it’s just enough to ‘dull the anxiety edge’ for me. I also enjoy THC/CBD gummies =)

I tried gummies that were 4 CBD to 1 THC per their label and I just knocked right out. It was nice to sleep like that, but not so functional for day time!

Maybe just try CBD?

It’s anxiety. Lexapro made it go away. Highly, highly recommended. I didn’t have depression, just anxiety, and Lexapro cured it.

Yes. I have a history of trauma. I do not take medication but did do extensive therapy.

needs gifts for boyfriends kids (girl and boy, college aged). They need to be comparable in price etc, looking to spend between $50-$100. Right at this moment debating getting them both a cashmere sweater and calling it a day but interested if anyone has a more exciting idea… they have both been away at school as long as we’ve been together, i don’t know either of them that well and they are affluent kids, certainly isn’t anything they “need.” Has to be from somewhere where they can return with a gift receipt….

Gift card

i know a sweater isn’t particularly inspired but i don’t want to do gift cards…

It wasn’t intended as an insult to your sweater idea, I just think cash or gift card is what people this age most want and it would be super appreciated and win you lots of stepmom points.

Cashmere sweaters are always awesome, but perhaps they’d like a hoodie or pair of pants from Vuori, instead?

Why Vuori when there are other more coveted brands that make better garments?

I’m pretty convinced the Vuori sales department has a few commenters here.

Yes!! The quality is so so and there’s always someone bugging them up. Nope!

I wouldn’t do a cashmere sweater that costs less than $100, sorry. It won’t be very good quality.

i don’t know all these places are having 50% off cyber monday today…

I think this is the perfect case for using one of those “best gifts for . . .” lists from Wirecutter or NYMag.

Do you know what your boyfriend is gifting them? You could piggyback off of his gifts to them with a coordinating or accessory gift.

he basically told me they are impossible and he doesn’t know.

For the girl, I was going to suggest a scuba sweatshirt from Lululemon but it looks like they’re almost sold out. Maybe a hoodie + shorts set from someplace like Alo?

Yeah, I would absolutely ask BF and get what he suggests. Otherwise I like the idea of picking something from the “best of” lists with a gift receipt.

We do a small physical gift combined with a gift card for my similar aged niece and nephew. My niece has liked water bottles/coffee mugs/spices (setting up a new apartment)/makeup sets (the gift sets at Sephora). I’d then pair it with a Visa gift card. My nephew likes the Jack Black shaving sets so we stick with those plus the gift card. I aim for ~25 gift plus $50-$75 gift card.

Slides from Hoka or Oofos? That way you can get them the same thing, just different colors.

Hey, check back tonight if you can. I will ask my college-aged son and daughter for suggestions, but I won’t be able to have the conversation for a few hours.

This is from my 21 year old daugther.

Girl – Cozy themed gift basket with : plain crew neck sweatshirt in a neutral color, very popular right now (not hoodie); claw clips, the big kind; lip balm or plain lip oil type lip gloss or Sol de Janeiro mini lotion

Boy – maybe a crewneck sweatshirt like from Northface + Stance brand socks.

NOT cashmere. That’s too “old.”

Just wanted to say I think it’s awesome you asked your kids and reported back! Not the OP but thank you for your service.

OP Post here! agreed! thank you…

Cash. I would do a nice pop up card with a $100 bill. They can spend as they see fit.

If you want to get the cashmere, maybe get it from Uniqlo? That should be a store where a college aged person could exchange for great, neutral items and accessories if they prefer to exchange the item?

Personally I would use the same money for a merino sweater and a fleece lined hoodie and maybe the banana bag in one of the new cord colors.

I just saw an ad (I hate being a sucker for a well-targeted ad, but I am) for a device from Journey that wirelessly charges 3 Apple devices at once-watch, pods, phone. It’s pretty snazzy-looking for a bedside charger. With their BF sale, they are under $100 each.

Cashmere is not a present people in their beer pong era will appreciate.

Are they in dorms or a house/apartment?

I need help choosing a pair of winter boots that pair well with business formal clothing for days when I have client visits. Ideally flat (the days of the three inch heels on icy sidewalks are over). I am open to both booties and calf-length.

La Canadienne if you can swing the cost. Lots of different styles available, but maybe the Sawyer? Check Zappos, too, for discounts.

https://www.lacanadienneshoes.com/ca_en/sawyer-leather-bootie

https://www.zappos.com/p/la-canadienne-sawyer-brown-leather/product/9887508/color/216

Blondo is a good budget alternative to La Canadienne.