Tales from the Wallet: Investing in a Volatile Market

This post may contain affiliate links and Corporette® may earn commissions for purchases made through links in this post. As an Amazon Associate, I earn from qualifying purchases.

The market has been pretty volatile for more than a year at this point — so let's discuss. Are you investing in the market, whether with index funds or stocks? What other money moves have you made, such as setting up stop limit alerts or parking your money in CDs or Treasury bonds?

(I should note at the start that I'm not a financial professional, nor do I have a crystal ball — this is just what I'm doing with our money with the intention of long-term investments. Because the market is incredibly volatile, if you need the money any time in the next 5-10 years, you're probably better advised to keep it out of the market!)

How I'm Investing in a Volatile Market

For me… the answer is all of the above!

We still have automatic investments going to big S&P index funds on a monthly basis, which I'm hoping is giving me the benefit of dollar-cost averaging. As I've noted before, in Schwab I’ve had good luck with SWPPX and SWTSX; in Vanguard I’ve had good luck with VTSMX and VFINX. You can also do automatic investments into one of Vanguard’s higher fee funds like their “Target __” funds (2040, 2045, 2050, 2055) where you’re targeting a particular year with hopes of having the money out by then.

I've moved a chunk of our emergency fund money into both CDs and Treasury bonds (specifically, Series I Bonds) — CD rates are pretty high compared to where they've been in the past, with pretty low commitments in terms of time.

Treasury bonds can be a different beast because you don't automatically get your money back at the end of a set period, nor are you guaranteed a great rate for any longer than six months — so investing in those feels like the biggest gamble because it'll be a pain to move the money out if the rates go seriously south.

Meanwhile, just having the money parked in an online savings account is getting a pretty great rate of return right now, so I'm not even sure the energy I spent moving the money into CDs or I bonds will have a great return on investment. We shall see! (We talked about CDs and I bonds in our post on financial tasks to do ASAP in a new year.)

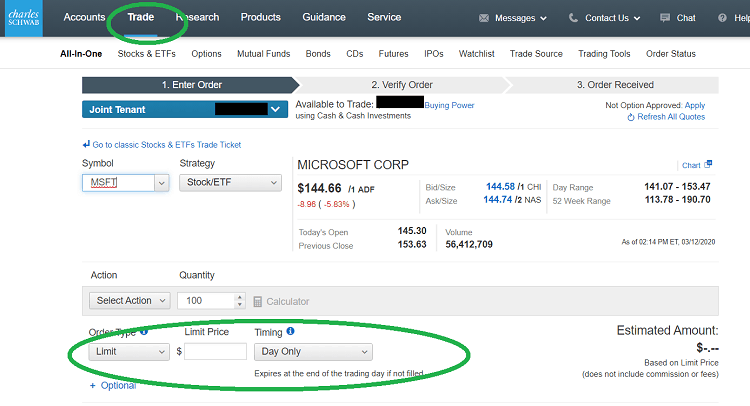

I have set up a lot of stop limit orders to buy specific stocks I'm interested in, which is something I've done every time the market has these crazy big dips — I look at it as a way of getting stocks on sale.

If you're unfamiliar with stop limit orders, when you go to buy stock at your online broker (I'm most familiar with Schwab and Vanguard, but mostly buy stocks through Schwab) you can say when you want the order to be filled. One of the options is to set a price to buy the stock; if the stock hits that price at any point in the next 60 days (if that's what you choose) then the online broker will buy the stock — if it doesn't hit that price, then the order is killed.

The down side to stop limits is that if the market is truly volatile, the stock may hit that price and then swing upward again before the order is executed. Another downside: With Schwab at least, for each theoretical order you place like this, you have to keep the money in your account in cash, waiting to be invested — so your money isn't getting the great interest rates elsewhere.

For my purposes, I'm generally making small purchases on blue chip stocks — I view these stop limit orders as a way of my not really having to pay attention to the market so long as an order is set up. (Plus, I love a great sale!) I'm also investing for the long term.

In terms of how to pick a price for stop limits — I'm sure there is better advice out there than what I'm doing, which is pretty simplistic, so take this with a grain of salt! I basically just look at the stock chart for the past year, and ask myself when I would have been happy to have bought the stock. Usually within the past year there will be major dips, and you can pick a price between where it is today and where you'd be happy to have bought.

(Think of it like a sweater at one of the stores that often goes on sale — it may be $119 at full price, then there's a 50% off sale, then a 30% off sale, then a 40% + 10% extra sale… etc., etc. $60 is probably the lowest you'll get the sweater while all the colors and sizes are still in stock — but if you really like the sweater, you'd be happy with $65 or $70, too.)

Readers, how about you — how are you investing in the volatile market right now? Are you doing stop limit orders, automatic investing, or putting money into CDs or I bonds?

Stock photo via Stencil.

Our retirement accounts are in target date index funds with Fidelity and that hasn’t changed. We’ve cut back a bit on retirement contributions to put money in high-interest savings and CDs, but that isn’t because of the market, it’s because we want that money more accessible to us before we retire. We’ve also stopped contributing to our 529 and switched to buying I-bonds instead. That’s partly because of the market and the high interest rates for I-bonds, but it’s also because our 529 is fully funded for four years at a good in-state school and we don’t know that our child will need additional money for education. I-bonds are tax free if used for higher education, but they’re also a fine general savings vehicle so they’re earmarked for college if needed but we won’t have to pay any penalties to use them for a different purpose.

Thanks for sharing that great use of I-bonds that many folks don’t know about.

My siblings and I just inherited some I-bonds from a relative that died. My brother has a child that will go to college soon. So he is saving the I-bonds to use for her education for the tax free benefits. Very smart.

I didn’t know that (or had forgotten that) as well! Thanks.

There’s an income limit for this. In 2022 it was $124,800 in AGI if you’re MFJ.

Thanks!