Tales from the Wallet: Should You Get an MBA?

This post may contain affiliate links and Corporette® may earn commissions for purchases made through links in this post. As an Amazon Associate, I earn from qualifying purchases.

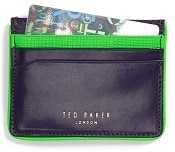

Should you get an MBA? If you've ever pondered getting your MBA but wondered if it was worth the investment of time and money, today's guest post is for you. We've talked about how to prepare your finances for grad school, as well as the pros and cons of changing careers, but we truly haven't talked about this — so I'm thrilled to welcome the personal finance blogger behind Well Heeled Blog, a young woman who just finished her MBA. Welcome to Corporette! – Kat. (Pictured: Ted Baker London ‘Neon' Leather Card Wallet, $55 at Nordstrom.)

Should you get an MBA? If you've ever pondered getting your MBA but wondered if it was worth the investment of time and money, today's guest post is for you. We've talked about how to prepare your finances for grad school, as well as the pros and cons of changing careers, but we truly haven't talked about this — so I'm thrilled to welcome the personal finance blogger behind Well Heeled Blog, a young woman who just finished her MBA. Welcome to Corporette! – Kat. (Pictured: Ted Baker London ‘Neon' Leather Card Wallet, $55 at Nordstrom.)

I recently graduated from a 2-year, full-time MBA program at one of the “15 schools that make up the Top 10 MBA.” I once heard a dean use that phrase and think it’s a humorously apt way to describe the way schools jockey for that much-vaunted “top 10.” designation.

Once you include the money I spent out of pocket and the opportunity cost of two years of foregone earnings and benefits (minus the living expenses I would have had to spend, MBA or not), this degree cost me at least $250,000. That's enough for a house in many parts of the country, and a hefty down payment in even the priciest areas such as San Francisco or New York City.

Was my MBA worth it? I’m a long-time Corporette reader and occasional commenter, and I’ve seen several questions on MBAs and finances. The decision to pursue an MBA isn't solely about the ROI in dollars and cents–there are plenty of non-financial benefits such as a grounding in business education, a wider and deeper network, and the opportunity to devote two years to furthering your professional and personal growth. Still, the fact remains that an MBA is an expensive proposition for most people, and this proposition can expand your career horizon while at the same time limiting your future financial choices. Here are my thoughts about the financial implications of an MBA now that I have completed my degree–what I would (and have) told friends who are thinking about pursuing an MBA, especially through a full-time program:

1. How much do you expect to make again?

There are a lot of jokes about MBAs raking in the big bucks once they graduate. That's not quite true, at least not to the extent that people imagine. One of the little secrets about the MBA is that the highest paying jobs for fresh-out-of-business-school folks tend to be concentrated in just a few fields, most notably finance (private equity and investment banking) and management consulting.

What no one really talks about is how difficult it is to get those jobs and how much your previous background determines your chances. For example, a private equity position is usually for folks who have private equity experience going into the MBA, and ever since the recession, the investment banking field is looking for people with very strong quantitative skills. It is still possible to be a teacher-turned-banker, but it is much more difficult in 2014 than in 2005. Management consulting is open to many more types of backgrounds, but the recruiting process is still difficult. Many of the desired tech marketing positions or product manager positions need a computer or engineering background.

2. How long can you do it for?

Furthermore, many of these industries have a regimented up or out, rank or yank, grow or go structure (the lawyers on this blog will recognize it as the Cravath system). Whatever you call it, a significant percentage of every incoming MBA class is culled every year. So in order to pay off that big student loan in a short time frame (say, under five years), you will have to get and then hold on to one of those relatively high-paying, very high-stress, very time-intensive jobs for at least several years.

3. What’s your payback period and are you OK with it?

Payback period: Previous after-tax salary x 2 + cost of MBA = Total opportunity cost of getting this degree

Total opportunity cost / (Post-MBA compensation – Pre-MBA compensation) = years to pay back

I've calculated mine – and it's somewhere around three to four years, depending on my post-MBA salary and bonus. Of course, this doesn't take into account interest or inflation and is not risk-adjusted on the likelihood of job loss, but I've found it a good gut check. Does this number seem unacceptably large to you? Sometimes people make a conscious decision to have a very long payback period, or even knowingly choose a scenario where an MBA doesn't make financial sense. Imagine an investment banker who returns to school to become a nonprofit consultant, for example, or a corporate lawyer who wants to get into marketing. That's OK. Life isn't all about money, and I would argue that an MBA shouldn't be either. What matters is understanding what you are getting and giving up when you go for an expensive degree.

Readers, any advice for someone considering an MBA? If you've made the decision yourself, how did you determine whether or not to go for it?

The author of Well Heeled Blog is a late-20-something who recently graduated from business school. She has been writing about her personal finance journey ever since she started a Roth IRA in 2006. Her favorite meal is breakfast, and she makes a mean waffle.

—————

N.B. PLEASE KEEP YOUR COMMENTS ON TOPIC; threadjacks will be deleted at our sole discretion and convenience. These substantive posts are intended to be a source of community comment on a particular topic, which readers can browse through without having to sift out a lot of unrelated comments. And so, although of course I highly value all comments by my readers, I’m going ask you to please respect some boundaries on substantive posts like this one. Thank you for your understanding!

H is getting his MBA. He’s an engineer in manufacturing with a goal of being plant manager, so an MBA is probably required. His company is paying 100%. He takes classes one to two nights a week. It’s a full MBA from a top 20 school. We didn’t think the executive MBA would give enough value, do he’s getting the full deal. Even if it doesn’t get him higher pay or a better job, I think the sense of accomplishment is rewarding enough. He’s exhausted most of the time and keeping up working 50+ hours a week in addition to 4-8 hours of classes am hour from our house is tough. But he’s glad he’s doing it.

Having an employer pay for an advanced degree is the only way to go, in my opinion. Obviously, it’s an intense workload for some years, but there is not regret the way there can be with big student loans.

Yups – a classmate once said, a bit tongue-in-cheek, that the luckiest students are those who’s getting their full MBA sponsored by their firms (so they don’t have loans and won’t have to recruit), the second luckiest are those who get/accept full-time offers from summer internships (so they can just have fun the second year of school), and then there’s everyone else.

Getting employer sponsorship is huge. If I had more foresight, I would’ve gone into an industry right out of undergrad that sponsors people for full-time MBAs. It hurts my head a little to think about exactly how much money that move could have saved.

I think this is a bit hard- To me the point of going to a high ranking MBA is to have the flexibility to move industries and/or firms. I wouldn’t want to shackled to my current firm for years after my MBA. However, I may feel differently if I were working at a large corporation I was committed to and that I was hoping to continue to move up the management ladder at (rather than in consulting) , perhaps I would feel differently about this topic.

My brother recently finished his MBA at age 52. It was a huge deal for him, with teenage kids, and a VP position. But, it was paid 100% by his company and now he has more flexibility moving into his later career. He also feels like he got a lot more out of it by doing it at this point in his career. In fact, his part of the company was just sold and he is moving to the new company. I’m sure his MBA makes him even more attractive moving forward.

I earned my MBA in my 40s at mid-career, although I wish I had done it in my late 20s. But it cost me nothing – my employer paid for it all – and I’ve doubled my salary in the eight years since then. And the doors that have opened were much better than I expected.

I have to say that I’m really glad to hear these anecdotes. I only vaguely hoped that the MBA would be useful in corporate jobs, but wasn’t totally sure. And like I said below, I don’t feel like I got a lot out of my MBA otherwise. Thanks!

Great topic, Kat! Yay! The manageing partner think’s I should be getteing an MBA. The manageing partner told him how smart I was and he thought I should be runneing thing’s after he retire’s! The onley probelem is that I do NOT like quantiteative thing’s and do NOT do good spreadsheet’s. Alan told me that is all they do in MBA school and I should stick to Law.

I think he is wrong. Shouldnt we do what we want, and not what our boyfreind’s tell us? I say, therefore that we get our MBA’s so we are NOT dependant on men to suport us. FOOEY on men that think that we should just say and do what they want us to! We are mature women and should be treated as such! YAY!!!!

You need to learn how to spell if you are going to be articulate and learn to get your MBA!!

I saw that nonprofit consulting was referenced in the post, and I was wondering if anyone out there is familiar with the field. I’m still in school but am hoping to go through the on-campus recruiting process for Bridgespan in a few years. Is a MBA absolutely necessary to advance further up the career ladder, or will something like a MPP suffice? (I’m probably going to graduate with a public policy undergraduate degree). Is there anything I should be doing now to prepare myself, either internship/extracurricular-wise or school-wise? I’m already pretty involved in several nonprofit-related activities at school.

I did for-profit consulting, so take my input with a grain of salt. I did do a lot of research on the no-profit side, and the big non-profit shops are all structured based on for-profit ones. At somewhere like Bridgespan, you should not need an MBA to advance if you are really good. Also, the MBA/no-MBA cut off comes 3-4 years into your time there, so you don’t need to decide now.

Bridgespan is incredibly competitive (as I’m sure you know). I’m also going to assume that you are at one of the few colleges where firms like this recruit (because it’s pretty impossible to get in straight from undergrad if you are not). It is actually more competitive than going to a for-profit firm. They look for pretty much exactly what the Big 3 for-profits look for in undergrads + a demonstrable commitment to non-profit causes. But they have fewer spots than for-profit. You should also consider just going into for-profit recruiting with the goal of transitioning to a non-profit firm after a few years. This is a path many of my friends went. For-profit will teach you a lot of important skills that will both help you and make you more marketable to Bridgespan.

Lots of people do a couple years at Bain/BCG/McKinsey and then do a stint at Bridgespan. That is the most common path I’ve seen. As BB mentioned, Bridgespan is incredibly difficult to get into without a consulting background.

Thanks for the info! I go to a top 5 school so I think I should be okay on the school pedigree front but I am definitely not putting all of my eggs in the Bridgespan basket (I knew it was extremely competitive but didn’t realize that it could be more competitive than for-profit). I’m pretty early in my collegiate career but when the time comes will definitely think about doing for-profit and switching over later.

I meant for this to go under the main post – thank you also, BB!

I’m at Bridgespan – I originally worked as a trader at a big bank, and wanted to switch to nonprofit. Bridgespan really wanted experience in the nonprofit space before even considering candidates so I did a one year fellowship at a large, well recognized nonprofit basically for free to get that experience before I could interview for Bridgespan.

Have any other attorneys on this site considered the MBA path (post-graduation, not a joint degree)? Have you done it? I work in real estate development / finance and public/private partnerships and for several years I have wanted to do more public finance / investment banking type work (and not necessarily as a lawyer). I am 12 years out of law school but I spent the first several years of my career working in the public sector. Any tips / thoughts etc. would be greatly appreciated as I consider all of my options. If I were to pursue an MBA, I imagine I would do it part time while working. I’m in Chicago so I have two strong options for part-time programs with Northwestern and the University of Chicago. I’m also trying to keep in mind that I have a 3 year old at home.

I’ve seen lawyers with less experience just go to work in banking (but they were practicing in that field) instead of going in-house at a bank. So, maybe you don’t even need that MBA.

BUT I will say that banking seems to be more unforgiving of being a working mother than law, at least for the clients I’ve seen (almost all men, almost all will not progress past their early 30s, any old enough to have children have at-home wifes (or ex-wives)). Not too many clients with skirts.

I have thought about an MBA (in the idle curiousity sense; had a degree moratorium pre-children until law school debt was paid off) and have audited a few classes and have realized that it would never be worth it for me (huge step back in seniority, more debt, and I might truly hate it in terms of lifestyle).

Maybe you could make a lateral move within law or find a JD-preferred job somewhere and test the waters?

Former teacher-turned-banker here (with zero traditional business or finance background to speak of). Made the move in 2009. I got into banking as an administrative assistant. In my late 20s, I decided to swallow a major piece of humble pie and went from being a school leader to answering phones so that I could get an “in” into the industry.

Eventually I was promoted out of the admin role, but wasn’t quite where I wanted to be. So, I started my MBA to get the “formal” schooling many job descriptions said I needed. Mid first semester I sat down with someone in a role I wanted further down the road in my career after considerably more experience. The person told me that the MBA was so far from a requirement – she called them a ‘dime a dozen’, referring to non-top-10 programs or evening programs. She said I’d be better of spending my evenings in the office working my tail off, learning on the job and showing my commitment than in classes.

I now have that job that I wanted and have no MBA to speak of (annoyingly, just a bit of student debt to finish paying off from my few semesters). Now, in my investment banking life, commitment, willingness (AND ability) to learn, and communication with my superiors is what got me more of a return than any expensive piece of paper. The MBA is right for some, but not for all — and don’t start the program, particularly a part-time one, thinking that by earning that piece of paper you’re due for a 180 degree career change… experience goes much, MUCH farther in my finance world when it comes to getting that initial foot in the door for an interview.

I am really interested in the responses to this. I work for a mid-sized sort of botique-esque (industry specific but management focused) consulting firm. I have a lot of opportunity to advance here. However, I feel like without an MBA I have a ceiling, and that I am a little bit “trapped” in my industry and perhaps my company. However, obviously MBAs are hugely expensive and give up a big period of your life. I think ultimately its not really a choice- I have to get one to achieve the things I want and to have all the options I want, but I am extremely interested to hear what people think about the value and timing.

I got my MBA coming in from a non-boutique consulting firm. Is there no path to move up without an MBA at your firm? If not, and you want to stay in consulting, then fine, you should probably get an MBA. Your employer may even sponsor you. I’ve also seen the MBA as a way for people working in boutique firms to go to one of the Big 3 (or just another firm) if that’s interesting to you.

I guess what I’m saying is that I’m not sure I understand your question. If you know for a fact that you cannot be promoted without an MBA, then you need an MBA. But that’s a question that only your firm can help you answer.

I could continue to advance to a fairly high level at my company without an MBA. Likely to partner type level. However, I wouldn’t be able to move into higher level c-suite type roles at my firm without an MBA. I think the bigger issue is that if I became unhappy here or wanted to work in a different industry, I think I would struggle to transition to high level roles without an MBA. I think my firm may have a more liberal stance on the need for MBA than many other similar roles at other companies, particularly outside of the industry I work in.

I have the question out to myself about how high I really am aiming, and how comfortable I am allowing myself to just move up through my company and industry, without as many “exit” options or true high high level options. I’m just interested in how people decided that an MBA was “worth it” to them and in line with their long term goals. Ultimately, I may not become a super high level person even with an MBA, or I may get older and no longer even want that.

There seem to be 2 questions: 1) should I get the MBA to have c-suite potential at my current firm and 2) should I get an MBA to have exit options.

Question 1. For some consulting firms, it is culturally a ‘thing’ that you need an MBA to be at a certain level, you’re right. If that is really where you want to be, then go for it.

Question 2: As far as improving exit options, the best time to switch careers with an MBA is during the program. If you wait, you likely will put yourself right back into your current niche, albeit with a larger network that could facilitate a switch if/when you do decide to go that route. The MBA coursework won’t help you switch as much as the network will.

If you do the MBA, it will probably force the decision on whether or not to stay with your current firm in the long term. A part time program would give you 3 years to figure it out before while keeping your options open, whereas doing a full time will mean making the decision up front.

For myself, I knew I wanted a 180 degree career pivot into consulting and that the ROI was there given the low salary in my previous my non-traditional job. The decision to do a MBA at a top school was an easy one.

The daughter of one of my mother’s friends, having got her first degree from Oxford, has now got a Fulbright award to do an MBA at Harvard… That’s one way to do it!

Yet another reason we should defund the Fulbright grant program.

Initially I assumed I was misreading defend as defund, but I’m not, am I….? Okay.

I’m using a similar scheme, the Erasmus+ programme, to do a year in Germany next year, and so I’m naturally in favour of them.

I was surprised to learn that they’re considered part of a country’s soft power arsenal for International Relations – elite socialization theory

Your friend must not be American, right? US citizens use Fulbrights to study abroad, while people from other countries can use them to come here.

Sometimes a Harvard MBA funded in this way is appropriate to the mission of Fulbrights. For example, I knew several graduate students at Oxford from African countries that were in desperate need of reform. Some of the most driven, politically aware students I knew where using their schooling to go back to their countries and improve them. While some may have become despots, I am hoping those were the outlier. Many a future world leader has gone to Harvard and gone back to their home country to make a difference.

Now there are so many different kinds of “Fulbrights” funded in different ways….

I had a Fulbright to study in my graduate field at Oxford. US citizen here.

Oh yes, sorry – British. Since studying at US universities is so prohibitively expensive to most Brits, I forget that the opposite isn’t true! I met a guy at my Oxford interview whose parents had done the maths that even factoring in international fees, the exchange rate, and cross-Atlantic travel, it was cheaper for him to travel from the US to the UK for university (shorter degree helped) than to go at home. I think he may have not had great in-state options

I have loads of American students here and it works out quite a bit cheaper even at full-freight international fees.

I am halfway through my MBA right now (at H/S/W). I am learning a ton and having the time of my life – but I will also graduate with just under six figures of debt (and many MBAs graduate with closer to 200K – I have a scholarship that covers about half). That terrifies me, and I’m banking on getting a post-MBA salary that will cover it (it’s all government debt, so I can take advantage of IBR if necessary), while also not being particularly interested in the most lucrative post-MBA paths.

I would say the value of the degree comes a bit in the starting salary bump, but much more in the 4-10 years out range, when your career accelerates more quickly than many of your peers. It could be selection bias, ie, if you are able to get into the top schools, you’d be doing this anyway — I don’t know. But I do know that, at least at my school, people move and change jobs more frequently than average, and “climb the ladder” therefore, at a much faster pace. Is that due to the people involved and their own talent (allowing them to be headhunted more frequently), their career aspirations (being willing to move around to move up), the network (better contacts in more places), the credential (ie a solid foundation in business education)? I would argue it’s all three with the least important probably being the credential itself.

Like law schools, MBAs are cash cows for universities as there are few scholarships and most students pay the full sticker price. Thus, like law schools, business schools crop up in universities EVERYWHERE – and some are more worth the price than others.

I would say because of all of that, it’s pretty much only worth paying out of pocket for a select few schools – probably the top 10 or rather, top 15 that make up the top 10. I’d even go a step further and say if you drop below the top 5 or so, you should probably choose a school that’s in the region you want to work in, so its regional reputation is even higher. If you can go for free by scholarships or employer reimbursement, that’s different (take the free stuff!)

I would say my MBA has definitely changed the course of my life, or at least, accelerated it. Even in a less lucrative career path (marketing) I’ll be making the yearly equivalent of 100K this summer at age 26, and expect to make a similar or slightly bumped salary when I graduate. For me, coming in from a 40K a year salary – that’s a true and major shift in my earning potential. I’m not sure how long it would have taken me to reach this level but it’s a LONG time. So for me it’s been worth it – but I’d never say that for everyone.

I like what you said about top programs. What floored me in my part-time program was how many people (mid/late 20s) were in the program to change their careers, without ever considering the need for experience in said new career/industry. An MBA is not a meal ticket unless it’s from a top program (even then not a guaranty), and I mean top 10-15 max. But no MBA program is going to tell you that – it’s going to sell you a dream, which they should to some extent – education can absolutely open doors. But, if you’re paying out of pocket, just think hard before you pull that trigger.

There’s a distinct difference in H’s program between those with no work experience and those like H with 5-10 years in management

They’re taking a substantial risk, just hoping the MBA will get them a job, whereas those with experience have the job and just want the MBA to advance. Anyway, when H finishes, he’ll have the exact same degree as daytimers. Not all evening programs are less. It’s mainly the executive MBA programs that are distinguishable, not evening programs.

+1 on the top program brands. What I always say on this site is that you should only go if you get into one of the top 10 programs OR if your employer is paying for a lesser program. A lot of the value is in the brand. I went a Top 10/5/whatever (right below HSW).

I will say, however, that I had a very different experience than you. I didn’t find the MBA particularly life-changing (or even that useful). I made just over 100K before and got about a 50% raise after graduating. Definitely not bad, but not life-changing. For me, it’s more having the check box on my resume, and it does let you skip a few levels within a corporation.

As someone in a top 5 program (also the same age as you…and had a similarly low pre-MBA salary), I agree wholeheartedly on all of your points.

I also am coming from a non-trad background, so an MBA was crucial for me to switch careers. Well, I could’ve done it without an MBA, but with the degree, I get to skip quite a few steps to get to my end goal.

I am interested in an MBA but this post doesn’t really address my question. I work in a middle-management position in a non-profit, I would like to stay in that realm but move up to the director/c-level eventually. I agree with the above commenter who said she feels like she hit a ceiling of advancement without some sort of advanced degree. I was thinking about getting an MBA part-time while continuing to work. Since I want to stay in the same general field, quitting my job seems silly, as does going into a very high amount of debt to get a degree full-time. Does anyone have any experience with this type of situation?

This is exactly H’s situation. It’s worth it to him so far, even if he’s not guaranteed the advancement. One benefit he didn’t expect is that upper management has taken a much bigger interest in him since he started. He asked his top manager to write his recommendation and that impressed him.

I’m 2/3 of the way through my part-time MBA program, not at a top-tier school but a local school that’s ok, and if I had to do it again, it would be the only way I would do it. I just got a new job actually, with a really nice pay boost, and even being 2/3 of the way through helped in the interview process, and I’m sure played a factor in salary negotiation.

I know not everyone would do it this way, but to me, I didn’t see the point in losing 2 years’ worth of experience and income, and this way I can just pay as I go per semester for a less expensive school rather than having a lump sum of debt at the end and being worried about finding a job.

So: yes, I am getting 100% ROI on my degree, but only because I’m doing part time and keeping up with payments. Not going to lie, it is ROUGH going to class after work and on weekends.

I’ve been working on and off toward an on-line MBA for years. Why? Just because I want one. It’s been something of a hobby, and lots of family issues have come up to interrupt the process, but I think business is fascinating. I don’t expect it to lead to a better paycheck (I’m older than most of you, near retirement age), but I can afford it and I enjoy the challenge of it. The class that was probably most useful was an elective finance course on investments.

Full-time MBAs aren’t the only option. You can also keep working and attend an online program. That way, you don’t have to move to attend an on-campus school or give up your job. I know online education has had a bad rap, but things are changing. UNC Chapel Hill offers a reputable program online called MBA@UNC.

I attended a company paid program (night school)-a lot of work but definitely worth it for the career benefits at my company. I would not leave a job to do a full time MBA at a top school after 5 years into my career, but I can see why early career people would consider that. Every situation is different…

Currently, I work for the state. I really love the public service, and I’m considering getting either an MBA or an MPA. Anyone else in the public sector have any advice? I’d probably have to go to a state school for an MPA, where the total cost is about $25,000 for 3 years. USC is another option for an MPA, but I can’t stomach the $60,000 for 3 years, especially since I’m already in debt from my undergrad. Any advice??

Hi Stephanie,

I just completed an MPA from a state school that had options to do courses both online and on campus, for a total of under $15,000 for the entire program. I worked full-time in public service the entire two years while taking my courses online, and real-time work was an excellent complement to what I was learning. True it’s a state school and not a big name Ivy or anything like that, but a) it was super affordable b) it was convenient c) it’s an online program at a brick-and-mortar school and d) it got me a 35% increase in salary. I’m happy with the decision and encourage you to consider it as an option to further your own education!

Does anyone have any feedback on going to a “lesser” university?

My boyfriend and I have been planning to get or MBA for the past couple of years but he was so eager to do it that we started studying for the GMAT a month prior to the test when we were incredibly busy on a project at work and bombed so that put a halt on the whole process.

I had convinced him to go to a state school that only cost about $40k (part time) but is on the rise in terms of improving it’s program and was actually doing very well in specific parts of the graduate business school (like entrepreneurship). It seems like a no brainer to me. Out work reimbursement for school will cover well over half of the cost and we’d be able to pay out of pocket. No debt and a decent school that appears to be on its way to better rankings.

But after we took the GMAT, he started getting second thoughts about where to go. He has a recommendation from our CEO (multi billion dollar corp) and a few other people are filling his head to go to a highly ranked school. He already has a decent amount of debt from his bachelors degree (I had no debt from bachelors), a good sized house debt payment, and then we both have car payments. I don’t think it’s financially smart to go for the over $100k school (work pays only a fixed amount of tuition so there will still be a hefty loan). He’s making right at six figures so I guess it makes more sense for him but for me at only around $60k, I feel like i would be setting myself up for some serious debt. And we both have no real desire to stick with the company long term and are interested in creating/running small businesses.

He goes back and forth between the school I want to go to and the more expensive choices. Half of what drives me crazy is that I KNOW he’s getting tainted advice and wants one school in particular for the name even though I’ve proven that the school is well overpriced compared for what the name carries nationally, rather than locally.

I feel like the value and knowledge of the MBA we could get at the $40k school is worth it. I don’t know if I can justify the higher priced schools. And from what I can tell, the school has potential. And I’ve watched other women be successful in the company with degrees from even lesser schools.

An MBA used to be the end goal for me, as far as my education goes. I just graduated with my undergrad, and my plan was to work for a few years before applying to all of the top programs.

Then, just last week, I went to an event where I sat next to an MBA grad. She advised me not to get an MBA unless an employer is paying for it or I get a full ride. Basically, don’t do it if I have to pay out of pocket. She told me that work experience is more important than an program that will take you out of the job market for two years.

Since that night, I have been really debating how I feel about getting an MBA. On the one hand, I don’t want to have to take myself out of the job market and lose that opportunity to get ahead. The idea of a part-time MBA doesn’t sit well with me; I don’t want to be stretched too thin. On the other hand, I want to get an MBA partly to make my mom proud (because we’re immigrants, and our journey has been rough), and I want to say that I got an advanced degree.

I have some time to think about this, but I am really conflicted.