Tales from the Wallet: How to Live Within Your Means

This post may contain affiliate links and Corporette® may earn commissions for purchases made through links in this post. As an Amazon Associate, I earn from qualifying purchases.

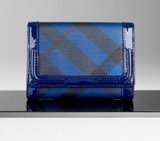

We've talked about budgets before, but we haven't really discussed how to live within your means, which is a bit of a different subject. So let's discuss. (Pictured: Burberry Medium Nova Pop Dégradé Wallet, available at Burberry for $275.)

We've talked about budgets before, but we haven't really discussed how to live within your means, which is a bit of a different subject. So let's discuss. (Pictured: Burberry Medium Nova Pop Dégradé Wallet, available at Burberry for $275.)

I think living within your means is a bit like packing a suitcase: you have to edit and curate what you have in your life right now. Stick with me here — whenever I go to take a trip I pull out everything that I want to pack and have it sitting on the bed in one big pile, usually evoking at least a joke or two from my husband. And then I'll keep adding things to the pile — a t-shirt here, a bathing suit, a dress, whatever — under the theory that hey, that thin t-shirt is just a little thing rolled up. Or that dress, you know, could just be folded in half and laid flat — it barely adds any bulk at all! And then I'll go to put things in the suitcase, and the damned thing won't close, so I have to remove things and figure out what I really want. It doesn't mean that I can't have the things that come out of the suitcase: it just means that they can't come with me on the trip.

So: in this analogy, your budget is the suitcase, and the idea of “living within your means” is what you can pack into your suitcase. That said, I think there are two big ways you can live within your means: the mechanical way and the more difficult study-your-budget way. The mechanical way is pretty easy: pay your planned expenses (bills, loan payments, etc) at the beginning of the month, and then put the amount of cash you have left in your wallet. When it's gone, it's gone — time to shop your closet, eat from your kitchen cabinets, and suggest going to the free museum night with your friends rather than going out for dinner.

The more difficult way is to actually study where your money is going — analyze it, and make adjustments. Ultimately, I think this is the more fruitful, useful way of living within your means — you end up with more money to spend on the things you want and need, with better habits for the long run, and without quite so many “deprivation” feelings. (I'm a big fan of tracking your finances in general, whether on paper or through something like Mint.com, which is the free tracking software that I use.)

- Choose a place to live that is within your means. This is a huge subject, and one we'll talk about more in depth in the months to come, but for now: don't rent or buy more of an apartment or house than you can afford.

- Study your bills. Sure, you may have had HBO and Showtime (and ….) for as long as you can remember — but how much do you really watch them? Similarly, your landline: do you use it? After 9/11, I insisted on having a landline — but after a few years I realized that the primary thing I was using it for was to call myself from work and leave “don't forget X” messages. Helpful, but not worth the $50 or so I was paying to Verizon on a monthly basis. Ditto the gym: how often do you really go?

- Avoid temptation. If your “going home” route takes you past your favorite store — maybe only take that route home once a week (if at all). If you regularly buy stuff online, leave your credit card at home, or leave it in a drawer at the office that requires you to get up to get it. If you've memorized your card number, get a new one. (Is it a bad thing that I have memorized my card number? Sigh.) Sometimes, “temptation” can even take the form of certain friendships — we all have that one friend who insists on going to the $21 martini place to “settle in” for the night, or that friend who insists on ordering a bottle of wine “for the table” and then drinks most of it. You don't have to stop seeing that person, but you can't turn a blind eye to your budget when you do see them — so either tell yourself you'll only see them once a month, or insist on choosing the place when you go out.

- Finally, study the little things — this is kind of like that collection of thin t-shirts in your suitcase; one of them won't break the bank but they really do add up in the aggregate. So consider this: Do you regularly pay $1.50 for a soda at lunch when you could buy a 6-pack at the store for $3 (or drink water)? Do you have a Starbucks habit? Look at how much you're really spending on lunch on a daily basis — can you cut that by even a little bit?

Readers, what are your tips for living within your means? For those of you who've struggled with this — what lessons have you learned?

For the little things (daily starbucks habit, I’m looking at you), I started using only cash. I put $20 in my wallet every 2 weeks, and when it’s gone, it’s gone (time to brew at home or drink the office stuff).

Once I realized that I was blowing through more than $100 a month on Starbucks, I bought myself a Starbucks gift card and set it to load $30 on the first of the month. I get rewards (free syrup, drinks, etc) and once the money runs out, that’s it for the month. I drink tea at my desk when that happens, lol.

I just realized I did the same thing when I realized my book buying habit was out of control. I bought a $50 gift card to Borders and b&n (and scored $10 rewards at each, thanks for the enabling) and bought books until I ran out of money on both of those cards. The coupons I receive via email don’t haunt me anymore.

Books add up so quickly! I recently re-introduced myself to the local library and love it. I also love being able to return “it was okay” books and know that I didn’t spend any money on them.

loooooove the library. Big library fangirl over here. I “discovered” the library when I was laid off and even though I have a job now I probably take out 1 or 2 books a week. I plan on becoming a big contributor to the library to thank them for how great they were to me when I was unemployed.

The library is great! I’ve even been getting videos there.

I don’t want to think about how much money I’m saving by not buying books. And YES, it’s a good thing (in terms of $ not wasted, at least) when I end up with a book I plan to not re-read, ever.

I agree with the whole library thing. Most books I won’t read more than once but if I really enjoy a book, I’ll buy it later at half.com.

I recently rediscovered the library too and am taking advantage of the amazing updates in technology since we were kids – you can reserve books online, pay a nominal fee ($0.50), and your book will get transferred from any other in-network library, even far away ones, to the one near you in a week or two. The library also has a surprising selection of contemporary CDs and books on tape!

Most libraries now have online downloads. I received a nook for my birthday and have not had to pay for a single book because I’ve been downloading them for free from the library.

Second Bonnie on loving the Nook. I have bought a few books, but for the most part I try to check everything out from the library or get the freebies B&N offers. I feel like it will only take 3 months or so to make up what I paid for the Nook in terms of savings.

y’all have seen the publishers threatening to restrict the number of times a public library can lend out an electronic book? grrrr….

I chose the Nook over the Kindle because I can check out books from my local library. I use it all the time and love it!

I LOVE the book transferring service. I live in a small town and check out probably 4 books a week, with 3 of them from other libraries. It’s free to get books in and you can request them on the library website anywhere. I just read and returned “Nice Girls Don’t Get The Corner Office” because of the recommendations on here, and it was super informative.

I get most of my books at either used book stores, a discount place like Strand, or on half.com

On half.com, I have paid more for shipping than the actual price for certain books ($3 S&H on .46 cent book once!).

For trashy novels & other disposable lit, my local library has a book annex where all those books are $1. I buy them, I read them, and then I donate them back or leave in my laundry room for others.

Unfortunately, because I never remember to return things on time, actually going to the library has been very, very expensive for me!

Another great option is paperbackswap.com. You list the books you want to get rid of, and other users request them. Once you mail a book (paying postage for media mail) you get a credit, and can request a new book, which is then mailed to you for free. It typically costs only a few dollars to mail a book, so it’s often even cheaper than buying used.

Another great place to get books is on abebooks.com! You can order books from used and new dealers all over the world, and sort by things like free shipping (if you’re being frugal) or first edition (if you’re not).

I recently started doing this with the Starbucks card, too. When the monthly card amount is up, no more coffee. Makes it a lot easier to get a Pike over a latte when you know there is a set amount to work with. :)

I actually spend more money when I try to use just cash because it evaporates into a mess of parking fees and Diet Cokes from the vending machine. It’s a weakness. So I like to use my card so I can see where it all goes on mint.

I love my local library. The last time I bought a book new was the night before we left on my international honeymoon when I realized that with the getting married and everything I’d forgotten to stop by the library and get books for the plane. I still wince when I see the new books (most of which we didn’t like) on our shelf.

I do sometimes feel guilty, since reading is a big part of my life and I know how badly the publishing industry is doing, for not buying more books new.

Great idea, random!

I also do this with the Starbucks card, £40 per month, which I ration scrupulously! Plus the free extra shot of espresso is nice.

for those of you that love your libraries, I encourage you to donate a to them if you can:-) I work for a library, and we (and all public institutions) are in serious budget crunches because not only is funding being reduced from state and local governments, more people are using the libraries because of the recession. So ponder what you would have spent on books for the year and how much you saved by using the library and give a little donation. Every little bit helps.

I second the donate to your local library… not only cash but many libraries have book sales and they would love that shelf of books you don’t use. I am President of our Library Board of Trustees… we have an amazing Friends of the Library book sale twice a year that raises over $200,ooo. All from donated books!

Something that many aren’t aware of… those great e-reader books cost the library the same price they do for you… the hardback books on the library shelves are greatly discounted. So libraries are really struggling with the balance of downloadable books (more expensive) vs. the actual books. The whole future of libraries are changing.

Oh yes. Thirded. The library my mother works with is always, always struggling – and they get a fair amount of funding from the school district. Also, if you have a bunch of books sitting on your shelves that you don’t want, most libraries will take them as a donation. You can also sell them to stores like Half Price Books or something similar.

They are sadly closing my local library. I never went to it, and never donated to it, but don’t my taxes pay for it?

You can also buy books on amazon that are “used” but they look new and are a fraction of the cost. I like hard-back books and keep them so I buy on amazon and spend under $5-8 always. It has saved me a TON of money.

Oh, and consider trading cable for Netflix. Most shows are available on DVD, and the monthly rate is very reasonable (I pay about $10/month). It’s still cheaper than renting movies if you watch more than one or two per month, and TV shows come without commercials (or the added expense of DVR). Of course, if it’s important to stay up to date in water cooler conversation about the latest episode, this may not be your solution, but it works nicely for me. I have to say I don’t miss cable one single bit.

Ooh I just cancelled cable and it’s great! I bought a Roku player (you can get it through the netflix site) for $90 (one time fee). You can stream Netflix through it AND for only $8 a month, Hulu Plus. So I essentially just pay whatever I was already paying for Netflix and $8 for Hulu. Much cheaper than the $80 a month I was paying before. The only time I feel deprived cable-wise is when there are big things on like the Oscars.

The Oscars were on ABC – you should be able to get basic network channels over the air (may require a digital converter box if your tv is older, and an antenna).

I actually do but I didn’t realize that until I had a friend help me set up my tv differently. Still, there are occasional things I miss–just not $80 a month’s worth!

If there are cable shows you love that aren’t on Hulu, they’re also often available on iTunes or Amazon (for purchase). I love The Soup and was really bummed about cancelling cable because of it, but then I found that I could download it each week on iTunes for $1.99/episode.

You can actually watch the Oscars and other shows online through instant streaming. I currently live with people who would die without cable, but when I move out it’ll be all Netflix and Hulu, supplemented with online streams of sports and award shows.

I agree. We haven’t completely canceled cable yet because my boyfriend likes sports live, but anything I watch, I can get online. I had a DVD player that can stream the internet–this not only includes my netflix account (which has a good streaming selection), but also means network’s websites. All of the shows I watch regularly during the year are all available online on the network’s website usually the next day after they air. My only exception is HBO in the summer, when I like to watch True Blood. For those months, I’ve got a friend that gets HBO and also watches it. I trade wine and food for HBO access for our weekly True Blood viewing during the summer:-) And if HBO had a pay-for-access online option, I’d probably take it. I’m of the opinion that eventually the world will move to a system where all tv shows are online and you’ll pay only for the shows you want. (or at least where you have this option). I have several friends that have gotten rid of cable and rely solely on the internet.

Totally with you on the pay-for-access option for HBO. We don’t have a TV and watch everything through Netflix and Hulu (we haven’t signed up for plus as of yet). It’s tough to be a season behind on Big Love.

We watch EVERYTHING online. You can also get the latest episodes from TVTorrent.com. I think they have a pay-for-use system in both dollars and bits. Basically, if you allow the use of your computer to make things faster for everyone, you can get things “for free”. Obviously, nothing is ever free, but more free in terms of dollars.

Many of these sites have be seized by the Federal Government for copyright violations. Everyone should just be aware of the risk since the government has been working to crack down on movies and tv shows that are copied and broadcast online.

I have been without cable for over a year now. My $10 Netflix account, hulu access, and a digital antenna for my tv are definitely a great substitution for my old $60+/month cable subscription.

I’m more of a frugal saver by nature so this topic probably isn’t intended for me, and my advice isn’t intended for those who really need this topic but…

On the subject of having your credit card number memorized – I actually never had mine memorized though I more or less “knew” my primary card number. I recently decided to just commit the whole thing to memory – expiration date and security code too, and I’ve found it very convenient! I love not having to fish around for my wallet when I make an online purchase now. If you don’t think you’ll be tempted to spend more, I highly recommend this as a small streamline-your-life trick.

Ditto. I have both of my cards (visa and discover) memorized and it makes things a lot easier.

This was death for me. I actively try NOT to memorize anything but my debit card number now, as having my credit card number memorized got me in a fair amount of trouble.

Memorized mine sometime during law school. Spent class shopping online and didn’t have to dig my card out, which was more of an enabling bad thing than a good thing. Now that I have more to play with, I find the convenience of having it memorized outweighs any spending I would be able to cut by getting a new card. Especially since my card number is saved on the sites I usually shop.

I keep an unofficial tally in my head…eg “I bought a dress, a skirt and 2 cardigans last month for spring, now NO MORE SHOPPING until April.” I have been fortunate enough not to have to look at the budget too closely, as I (and now my husband and I) have always made enough to cover our expenses, and we are both naturally pretty frugal. Also, during layoffs we (I) have gotten other jobs quickly, so haven’t had a period of no money coming in.

We do also use mint.com and an excel spreadsheet for the budget, but that is just to give us an idea of how much we can spend on our house renovations – we usually have extra left over after spending on our regular expenses.

I think when I get a smartphone we will drop the landline, unless we get magic jack. We get the cheap netflix with 1 DVD/month and unlimited streaming. We do get cable with bloomberg, but the bloomberg is necessary for DH’s work, and he works at home.

For coffee – Starbucks Via!!!! It is quick and easy and helps me face the morning when I can’t.do.anything.before.coffee! :) It is about 67 cents a cup if you get it at Costco, which is cheaper than actually going to starbucks.

I think about this a lot. I have a habit of eating out a lot. I don’t necessary spend a lot of money on eating out but I know that it’s cheaper to cook. I cook a lot too but only when I have time. I guess my biggest question is how do you know when you’re saving enough or spending too much? Are there guidelines for this sort of thing? The only thing I’ve heard is that your living expenses (rent, utilities, etc.) should be about 1/3 of your income. What do I do with the other 2/3? How much should be saved? spent? any thoughts?

Are you saving enough for retirement and also if something goes wrong? You should have (ideally) 4-6 months salary of savings in the bank, in case, let’s say, you get laid off. In addition, you should have an additional amount ($3000-$5000, but up to you) in a “life happens” fund (i.e., so that you can pay cash for unexpected car repairs, medical bills, etc.) Max out your eligible 401(k) and/or IRA contributions. Pay off all of your debt. After you have all of that down, then yes, the rest is discretionary (i.e., you can always save more, or save towards a specific goal, like a vacation or a new computer).

Res Ipsa, I agree with nearly all of your advice. But I think the rule of thumb is 3-6 months of living expenses in the bank, not salary. There can be a substantial difference between monthly expenses and my salary–I know many large firm associates who have monthly expenses in the $5K range but salaries north of $13K.

Good catch–yes, living expenses is what I meant.

Depends a lot on your longer term goals. I’d love to be able to retire early (in my 40s – possibly even early 40s), and that helps motivate me to save well over half what I earn (I also keep my living expenses to about 10% of my income – well below what I can afford). I’m sure there are benchmarks and guidelines out there, and of course how much you earn and what a reasonable standard of living costs in your area make a difference, but I’m of the belief that there is no amount that “should” be spent — every spending decision should be along the lines of “do I need this? if not, do I really want it? can I get it or something close cheaper?”

I know this doesn’t work for everyone (I rationally know I’d be better off doing the same with the food I put in my mouth – “am I hungry? do I actually need more food right now? is there a healthier alternative?” but I can’t bring myself to do anything close to that on a consistent basis!), so take with a grain of salt! :)

Crazy question, but is there any particular reason you want to retire so early?

Because I don’t particularly like working even though I don’t particularly dislike my job. I’d rather live without certain niceties now (and potentially forever) than spend the majority of my days going to a job. I don’t give everything up (still travel) and I love the idea of leaving the workforce. There are some nonprofit organizations I’d also be happy to get involved with on a volunteer basis once retired. Maybe I’d get bored and/or take something on part time, but knowing that I don’t *need* to work another day in my life seems like it would be the ultimate experience of freedom. :)

It is, indeed.

The question is for curiosity’s sake, because as you can see from my moniker, I may want to make a similar choice as I progress in my career.

One challenge of early retirement: Don’t forget to budget for healthcare expense (now and future). Will you have enough to cover a significant hospitalization, need to be in a long-term care facility, etc.?

Not to be a downer, but I hadn’t thought of a lot of these scenarios when doing my “rainy day” fund. Paying your own insurance is tough and often has pretty significant limitations. Seeing my grandma’s prescription and whopping LTC bills makes me realize you may need a lot more money than you think even when you’re eligible for Medicare coverage and soc security.

If you retire at 40, will you have enough to make it another 40 years or more without new income (or very little) coming in?

When you’re no longer healthy enough or given enough opportunity to work is not the time to find out you’ve fallen short.

I agree that this is a scenario few consider. Unexpected medical expenses can really eat up savings very quickly. I have a coworker who retired in her mid-40s and is now working again in her mid-50s because her husband became fully disabled and she also has significant health issues of her own. She realized she had to come back to work at the height of the economic downturn and was almost at the point of bankruptcy when she finally found something. As it is, she has to live away from her husband during the week because there wasn’t anything available near her.

The reality is that these days, even a quick visit to the ER can run over $10,000. An overnight stay in the ICU may run 3x that before you include any treatment. A week’s stay in the hospital or a surgery may eat up what you expected to spend in a year or two of retirement.

Lady T – I think that you hit on the real question here – how much should you save/spend! Everyone has a different income but what are the ideal percentages?

I am saving for a house purchase within the next couple of months and what I can afford “on paper” I think – is different that what I can actually comfortably afford each month with enough money left over! This is tough. I use an excel spreadsheet to create a budget for myself so I know what is going where and how much I have leftover.

We qualified for more than 100K over what we spent. I’m glad we stayed within our budget and have a reasonable mortgage now.

Ditto. We bought the house on what we could afford on one income (mine) and it has made things significantly easier because all his money (he’s self-employed) goes towards savings.

The 60% solution is, I think, a great guideline — one to build towards if it’s too difficult right at first. The concept:

60% of your pre-tax income goes to committed expenses (all taxes, mortgage or rent, groceries, all monthly bills including utilities, cable, etc.);

10% goes to retirement savings;

10% goes to long-term savings (for an emergency fund, down payment or similar);

10% goes to a relatively liquid savings account for irregular expenses — things that aren’t regular monthly bills but are nonetheless likely to come up from time to time during the year (home repairs, car repairs, gifts, medical expenses not covered by insurance, new glasses, etc.); and

10% is for fun money — dining out, new clothes, movies, concerts, books, gadgets, other entertainment, etc.

For me, the one big question is where vacations/travel would go — I think you could make a decent argument that it could go in long-term savings, irregular expenses or fun money. Up to you. I first read about the 60% solution on MSN Money, and that site categorized vacations in the “irregular expenses” category.

More to read about the 60% solution from a personal finance website that I really like (Get Rich Slowly):

http://www.getrichslowly.org/blog/2008/04/14/building-your-first-budget/

Cooking does take a lot of time – I’ve become a huge fan of crock pot cooking, and making large batches of vegetable soups that can be frozen for later use – the latter I consider a cheaper, healthier version of a frozen dinner!

I’m in the last few months of my JD and right now I feel like I am drowning in debt. I paid for my entire education with loans, so I have amassed quite a large debt (roughly 2.5 times what I will make at my job that I am starting right when I finish school). I don’t live extravagantly now, and am going to be living very frugally when I start working, and paying every dollar I can on my debt, but I know it is still going to take years to get rid of (maybe 5 or more). Plus I feel terrible that my money will be going to debt rather than saving for a down payment. When I think of how much I owe, it makes me feel sick to my stomach. Any advice on how to stop feeling so stressed out about it? TIA!

Look at it this way, your loans at this point are a sunk cost that you have taken on, there is nothing you can do about that. In the grand scheme of a career, the time it takes to pay them off will be relatively small.

Starting from that point, pretty much the best thing you can do with your money right now is pre-pay your student loans. Presuming that your highest interest student loans are at the 8% or whatever interest rate that mine are, there is NO other investment out there right now paying that kind of interest rate. So every dollar you put towards pre-paying your loans is valuable and better then almost any other investment.

As to the not saving for a down payment thing…there’s nothing I can say, except that I think that many Americans way overvalue home ownership as opposed to renting. Especially given the recent downturn, you may very well never make any money off home ownership. Plus, once you own a home, you have to be responsible for all sorts of crap that your landlord deals with now. That’s no fun. So…on the bright side, even though your loans are a pain, they are delaying the day you have to learn to de-clog a sink. So there’s that. :-P

You’re not alone, Drowning! Kudos to you for living frugally and realizing that this probably won’t change in an instant when you go from student to employee. For most of us, we just have to make peace with the fact that our law school loans are going to be with us for a long time, pay responsibly, and let ourselves not feel guilty about that fact. 5 years is incredibly short for a repayment period. This is probably the “best” debt you can have (perhaps next to a home mortgage), and while the interest rates aren’t as good as they used to be on school loans, you aren’t likely to find uncollateralized loans much cheaper. IOW, relax about the school debt. Don’t be stupid (sounds like you’ve got that down), but don’t stress about it too much.

If your debt is only 2.5 times your salary and it’s only going to take you 5 years to pay off, you’re incredibly lucky and better off than most lawyers. Doesn’t sound like you have anything to worry about.

Amen to this. Five years to pay off student loans is pretty darn good. Basically you have to think of your loans as a mortgage that you took out for your career. Will they affect your immediate spending habits? Heck yeah. But hopefully your future earning potential/enjoyment of being a lawyer outweighs the inital debt.

Or at least, that’s how *I* rationalize my loan payments each month…

I remember when my real estate transactions prof walked into class and announced he’d just made his last student loan payment. He was probably 45 or 50. We all sort of sat there in horror as it came home to us how long we’d be paying on our loans.

God I feel the same way — I have about $150,000 in student loans and will be graduating from law school in May. In theory, I know I’ll be fine and it will get paid in the long run — but having this hanging over my head is terrifying. I can’t decide whether to commit to a ten-year plan and start saving for a house etc. at the same time, or whether I should live super-frugally for the next 3-5 years and just get it all paid off… I would love any advice others have who have successfully dealt with their student debt.

Commit to the 10-year, and then you have flexibility. You can always mail in extra if you have it, or have the option of building your rainy day fund instead (which is perhaps more important, as a cash crunch can be even more expensive). I have my loans on a 10-year plan, but have managed to pay down about $12k extra in my first 2 years, so at this rate they’ll probably be gone in 5-6 years anyway. I just like the freedom to scale back my early payments if it becomes necessary.

*N.B. You do have to specify that additional payments are to be applied to the principal for maximum benefit.

I agree that you should still be setting aside an emergency fund while also making timely loan payments. That may or may not dictate whether you go for the 5-year or 10-year plan. Regardless, the cash-on-hand is just as important as being debt-free. At some point, you will have the necessary cash fund and you can redirect those dollars each month toward your loans.

“How much” is difficult, but it comes down to individual needs. I hate debt and I hate my law school debt, but due to chronic health issues of mine (another one of the IBDers here!) I need to have money set aside for hospitalizations. Even a “routine” stay has can result in a few thousand dollars out of pocket. As a result, I feel more comfortable with more cash on hand than others might need, even though it means I’ll be living with student loans longer then I would like. So, take away is definitely have an emergency fund, but how much depends a lot on your personal situation.

Sorry, didn’t mean to appear like I disagree with Anonymous at 5:17. I completely agree, just was adding another voice to the importance of cash reserves even while trying to pay off debt. Also, even more than debt, I hate that typo in my previous post.

Once my law school loans came due, I sent any extra money I had at the end of the month towards my student loans. Even if it was $200. This alleviated the feeling of drowning, because I felt like I was taking control and doing everything I could do. I checked my balance frequently, and felt a surge of joy every time I shaved off another $1K. If you get a bonus, treat yourself to a new handbag and then commit all the rest to your loans. Little by little, you will get things under control.

If you use every spare dollar to pay off your loans ASAP, you will be buying yourself freedom. Really. Remember the scene in Braveheart where Mel Gibson gallops in front of the troops and yells “They can never take away our FREEDOM?” That’s how you will feel.

I, too, borrowed every last cent for law school. Then I went to work for an AmLaw 100 firm. While my fellow (mostly male) associates bought fancy houses and cars and dependents (I mean, wives and children), I sent every last dollar I could to the student loan people. Every December, I would buy myself one nice thing from my bonus (e.g., a lamp, a necklace) and send the entire rest of the bonus to the student loan people. The fourth December, I paid off the loans and had some of the bonus left over. What a tremendous sense of liberation.

That was the only reason I was able to leave my firm shortly after becoming a partner to go in-house. Because as a young lawyer, instead of buying “stuff,” I bought freedom.

You can do it!

Well said. It’s amazing how quickly you become a slave to debt. I work for my student loans now and dream of the day that I will be free. I would suggest living frugally and paying off the student loans as soon as possible.

I love this, thanks!

I absolutely understand your feelings. I got my JD and an LLM and have been unemployed since I graduated 2 months ago.

My personal plan for once I get a job is to immediately pay off the $3500 I have in credit card debt and make my regular loan payments while I save up an emergency fund. Once the emergency fund is set, I’m going to pay everything I can to my loans to pay them down as quickly as possible.

I live in NYC, so not being able to save a down payment doesn’t stare me in the face every day since everyone I know rents. My loan is my house/apartment for the foreseeable future.

Now I just need to get a job so that I can put this plan into motion. Know that you are definitely not alone. I wish I had advice on how to not be stressed out about it, but I’m in the same boat myself. Having a plan in place has helped me a little.

All debt is not created equal! I think you also need to consider your interest rates. i have debt from law school and my undergrad, and my undergrad loans are almost free. I paid off the high interest ones, (the tax deduction gets phased out so not much benefit of the interest deduction), but I have about $50K in undergrad debt hanging around at 1.5%. I am going to take as long as they will let me pay that off! instead of funnelling the extra cash to those loans, I pay off higher interest debt (e.g., mortgage) and save/invest. I am getting a better return on the savings and investments than I am paying in interest, so it makes sense. I still have some other loans at about 3.7%, and I will split the difference and work on paying those down a little faster. But educational loans can be super cheap, so think it through before making broad brushes on paying down debt!

Yeah j-non, but sadly for most of us more recent grads those days are long gone. My lowest, subsidized rate is 6.8, and the rest are 7.9. Sigh.

yea, those 3.7% sound like a lovely dream. I’ve got 6.8% and 8.25%. The student loan people are making a killing on my interest.

Gah! Those rates should be criminal!

yes, yes they should. And that’s standard right now. the 6.8% is my stafford loans, which somehow makes it even more absurd. (8.25 is grad plus)

Here is a great blog you should read about a Harvard MBA who graduated in 2009 and has a goal of paying off 90K in student loans in 9 months. He is basically doing it by cutting expenses and trying to find a second job.

http://www.nomoreharvarddebt.com

Big fan of Mint. More specifically, I plan out everything, including savings and investing – and put as much on autopilot as possible. I use my reloadable Starbucks card for coffee- I have a set amount loaded monthly, it discounts my coffee and keeps me aware of that kind of mindless spending, without hovering over my accounts.

I also keep 10% of my take home in my personal account for misc shopping etc…

Then there are the basics, bring lunch from home 2-3 times a week, etc…. That come up whenever these issues are discussed.

One new thing I have done. Instead of paying my kids tuition in full and getting 2% discount, I do auto deduct 2x a year from my high interest savings (ha!) BUT it may only be earning 1%, but I earn the 1% monthly on the full tuition for half the year, and on half of the tuition for the other half.

are you ever concerned about having all that info out in internet land? I read Mint’s privacy and security info, and it SEEMS good, but still… that is a lot of info. ever been concerned? Or had reason to be?

I have not signed up for mint for that precise reason.

Yeah I’m really worried about it I don’t use it. It seems safe now, but someone could buy it and get all the information.

I am also worried about mint.com for this reason. I’d love to have something like mint.com, but downloadable. So it wasn’t on the internet, but stored on my own computer. Any suggestions?

A Corporette a few months ago posted a google spreadsheet that was for personal budgeting. Does anyone have that still? It had multiple sheets and was very detailed, but she said she only used the first one.

People who cook regularly–how can I cook for cheaper? I know that theoretically it should be cheaper to cook than eat out, but I feel like it’s really not because I end up with things leftover that I don’t use and then go bad and I’ve wasted. Example–I buy the smallest bundle of broccoli my grocery store sells, but always end up with half leftover that goes bad. Or I make so much of something intending to eat it for the entire week, but get bored with it half-way through, and it doesn’t freeze well. Basically, I feel like this xkcd comic describes my cooking life: http://xkcd.com/854/

How can I fix this? Does anyone have any suggestions for cookbooks with recipes designed to serve just 1 or 2 people, maybe?

This is not a good reason to join weight watchers (esp. since this is a thread about savings), but if you were thinking of joining or are already a member, I love the recipes on WW .com. They are generally fairly simply and involve fresh ingredients. And often only a few ingredients. When they serve 4+, I tend to halve them for me and hubs. Or, if it’s something that gets better “with age,” I make the whole thing and take leftovers for lunch (this is esp. true with soups, stews, casserole type items).

Most receipes can be halved fairly easily, but something like a stir fry will be easier to halve than say, a casserole. I generally plan my meals out for the week and shop accordingly. If I’m buying something that will go bad and only comes in large bundles (like, say, a giant bundle of kale or fresh herbs) I’ll try and find multiple receipes that use the same ingredient but are different enough that I don’t get bored. I generally make 3 different receipes a week, including one that freezes well, and between lunches and dinners that seems to work out.

I cook for myself all the time, and for cheap. The trick to not wasting food is to cook the same thing, or variants of a dish, multiple days in a row. Also, instead of buying fresh, buy frozen (like bagged veg). That should make you food last a little longer.

Also, if the food doesn’t taste too great, try hot sauce as a way to temporarily “fix” the problem.

Would love to have your taste buds ;)

My husband and I cook a lot, and have managed this pretty well. The biggest thing is to just try to think about and learn what you’re going to use. For example, I rarely buy things like a head of broccoli, because it would be hard to eat it all (my husband can’t stand it). If I want broccoli, I get it frozen. I’ve also found that it helps a lot to make things more accessable- for example, I will use lettuce or veggies if they are already cut up and washed, so I do that all at once. Many veggies will keep a lot better if you cut them up and place them in a bag with a just slightly damp paper towel. Celery keeps for a few weeks like that, and lettuce usually for about a week. But focus on what you are going to use and will last- for example, carrots and apples last a long time in the fridge.

Also, plan for leftovers. Most of what we make involves the basic starch (pasta or rice) with a protein mixed in and a veggie on the side. Most of the time, we eat frozen veggies (which are actually healthier). The pasta/rice dishes make excellent leftovers and freeze well- if we find that we have less than 2-3 servings on hand, we specifically decide to make something that makes good leftovers.

I also half almost all recipes, since there are only 2 of us. Be creative about that and experiment. For example, I’ve found that most baked goods that call for 1 egg can be halved but still use the whole egg (I usually hold back a little on milk or oil, but just a tad).

Also, try to focus on buying basic ingredients that last- things that you can do a lot with, like eggs, butter, flour, cheese, pasta, etc. Don’t buy things that can only be used in 1-2 dishes (but for special occasions). And try to focus on buying things that can keep well in the pantry or be frozen. Fresh is not always better, particularly if it’s going to rot before you use it.

Good luck! Cooking is fun.

My significant other is now insisting that I learn to cook and that we eat in at least 5 times every week. I told him that I am not a good cook and that I enjoy going out after a long day working in the office. He has a fairly easy job working in NYCity Government, and is always home by 7:00 pm. I do not get home that early EVER so I do not know why it is that he does not take up cooking rather than have me come home at 8:15-9:00 just to start putting together some food for us. He says he is trying to economize so that when we get married we will be able to buy a co-op together in Manhattan rather than in Queens or Brooklyn. Frankly, I just want a clean, safe place to live, and I grew up in Queens and have to take the subway to work anyway. So I am going to just tell him that economizing is great, but not when I am working much longer hours than he is (at a more stressful job), and that if he is so gung-ho on cooking, to learn how to do it himself. I am a bit worried that he will get mad, but think I should hold my ground here. I do not demand much of him, either, so I do not think I am being unfair. I already do the laundry and handle most of the shopping for food. Am I reasonable here?

Very, very reasonable, yes. Hold your ground!

Not sure how reasonable it is to plan on marrying a guy who’s so stuck in the 50s he can’t even muster the pride in what you’re doing to get up and learn to use a frying pan.

Seriously. I couldn’t believe all the “you were too good for him” comments I got after my ld bf cheated on me last fall, but looking back I sure can! Think about it.

I don’t think you are being unreasonable, but what if you cooked a few different things on Sunday to reheat and eat 2-3 nights during the week, and he cooked the other weeknights? I often don’t get home until 8 or 9 or even later, and cooking a real meal is the last thing I want to do.

Very reasonable. He can cook if it’s his idea. On the practical side, look into fresh direct — they have ready to cook stuff that takes minutes to cook; same with some Trader Joe’s stuff. I buy their frozen veggie dumplings, several bags at a time, or the multi grain veggie lasagna, and then it’s a no hassle frozen dinner I can make if I just don’t feel like moving, with very minimal effort.

Not to medle, but you should have a general discussion with him about splitting the housework. Things don’t have to be 50/50, but they should be “fair.” So, for example, since I get home after my husband he cooks on weekdays and I cook (and grocery shop) on weekends.

You are being 100% reasonable. I really hope the two of you can work it out. Early on, my husband and I decided that whoever is working more gets a break on the chores. So, if I work until 7 but he got off at 5, he cooks/cleans/whatever until approximately the time I get home. We’ll each take a night off from that routine every now and then, but it all evens out. No way would I be able to work longer hours, and do all the laundry, and do all the shopping, and do all the cooking.

Absolutely. A friend of mine and her husband agreed that whoever gets home first is responsible for cooking. The cooking responsibility has shifted back and forth over the course of their marriage, but I liked that way of settling things.

Is this a real question?? Of course you’re being reasonable and he’s being ridiculous. Tell him to put on an apron and fix up a meal when he gets home. Your post reminded me of a post from last week, about the law partner who commuted to work via a time machine. Looks like your hubby is sitting in that time machine as well .

Their carpooling allows them to use the fast lane in the time machine portal :). I bet there are a lot of other men in our professional and personal lives which are in that carpool too.

And to the OP, I agree with everyone else. If he wants homemade dinner, and he gets home first, he can make it, and I am sure you will appreciate having a homemade meal when you finally get home from the office. I tend to make a double batch of something on Sundays for planned leftovers later in the week. During the work week, we usually cook twice, eat leftovers twice, and eat out on Friday nights. We try to cook on the weekends as well, and aim for leftovers.

Wow — he gets home 2 hours before you and expects you to make a late meal. I am floored at this. Either dear SO needs to take up cooking or accept that you are not Miss Homemaker.

That being said, if you want to compromise and tell him you will cook 2x a week and he pick up the other days. I would say use a crockpot, busy person’s best cooking device. You can get one of those vacation timers and rig it to start at noon so it won’t be over done when you get home 9 hours later. Also, if you can do something like casserole/lasgna/enchiladas you can assemble it ahead of time and have the SO pop it in the oven so it is ready when you get home.

Good luck to you, be strong and tell your man to get realistic about the household duties.

How about, you cook on the weekends and he cooks on weekdays? That he can have his fantasy about the wife who cooks, and you can have wonderful evenings with yummy home-cooked food.

Also: I’m guessing you earn more than he does. In families where the women have the easy, low-earning job, they tend to take on extra housework. When the roles are reversed… just sayin’.

Hi Ellen/Alan! We missed you!

My thoughts exactly… :)

Ditto! I was confused by all the correct spelling though…

Exactly.

allrecipes.com has some meals for 1 or 2. Also you can find recipes for things you can freeze so you don’t have to eat it all at the same time. I find it helps me to divide things into single-size portions to store right away, too. That makes it easier (and more likely) for me to grab a portion for lunch on my way out the door rather than have to pull the whole 9×13 pan out, dish out a bit into a container, and put the pan back. My fridge is more conducive to use when it’s full of single-size portions than big pans of food that have to be divided and assembled for a meal for one.

I’ve found pre-dividing the food to be really helpful, too. Get a bunch of those cheap gladware type containers (stackable ones helps) and have them ready.

Or the really nice rubbermaid ones. They’re a little pricier up front, but worth every penny since they are durable, don’t bend under cutlery, dishwasher-hardy, and don’t stain in the microwave. Also much more pleasant to use and won’t feel like you’re eating out of a butter dish or leak on your papers on the way to work.

First, frozen vegetables are just as healthy as fresh, cheaper and can easily be eaten one serving at a time. If you really prefer fresh get things that can easily be purchased in one serving quantities (green beans, turnips, shallots, mushrooms). Ditto in the fish/meat department. Buy one serving at a time or buy frozen.

I never use recipes per say, but here are a few things basic things you can easily make for one and change up with different ingredients: Pasta/ravioli/rice with roasted veg (there are a million variations you can make with this), Tacos (corn tortillas last forever in the fridge) with any combo of beans, vegetables, fish, eggs, meat, Omelets, and I’ve also been baking an egg on top of all sorts of leftovers recently too.

Hm, I have a hard time believing frozen vegetables are just as healthy. But they certainly do come in handy when you haven’t had time to shop.

The frozen-is-healthy is a bit counter-intuitive. The reason frozen is often better for you is because of timing. Vegetables (and fruits) gradually lose nutrients after being picked. A just-picked apple is better for you, as far as nutrient-punch goes, than an apple that was picked a day ago, which is better for you than one that was picked four days ago, etc. By the time you buy your fruits and veggies at the store, they have been “off the vine” for at least a few days, and then they probably sit in your kitchen for a few more. Frozen vegetables, however, are generally frozen within hours of being picked (or at most within a day or two), and once frozen no longer lose nutrients. So unless you have a vegetable plot or are buying from a farmer’s market and eating your produce within a day or two, frozen often reall is better for you.

Of course, you lose a lot of this benefit if you then boil the vegetables to cook them. Then all those nice nutrients leach out into the water! (Same goes for fresh veggies). So to get the maximum benefit, you should steam or broil your veggies instead.

This is pretty much all I have retained from my undergraduate “nutrition” course…. Yay science for non-science majors!

What if you make it in a stew or slow cooker, therby consuming all the water/liquid that comes from the veggie? I’ve always wondered about this because I love soups/stews/slow cooker recipes and it’s a great way to incorporate veggies I don’t like into my diet.

If you are making soup, you are drinking the “lost nutrients” in the stock. You could do the same thing with the liquid you boil your veggies in, but people generally don’t.

First, I want to say that cooking saves a lot of money. I started cooking when I got laid off and was amazed and how much less money I spent.

I had a similar problem but then I bought a cookbook of slowcooker recipes for two people (http://www.amazon.com/Your-Mothers-Slow-Cooker-Recipes/dp/1558323414). It helped me get a handle on how much food two people need for dinner (answer: four chicken thighs). If you do not have a slowcooker I would invest in one because it makes cooking much easier and hassle-free (splurge on one with a timer, it should be $40-$50 max, there is no need to get the $200 all-clad slow cooker like some people *cough my sister cough* d0, and trust me, this is coming from a snob).

The other thing about the slowcooker is you can make soup, and soup freezes great and is perfect for Sunday afternoons when you could order pizza ($10) or eat soup (basically free + healthier). I make a big batch of soup, eat some, freeze the rest in single-serving batches, and then eat it over the course of a few weeks. There are tons of slowcooker soup recipes out there, any my favorites involve opening assorted cans of things and putting them in the slowcooker. Tip: potatoes, although good in soup, do NOT freeze well.

Finally, and also slowcooker related, buy things that are frozen or canned. If you are throwing out half your broccoli, you should be buying a bag of frozen broccoli and using it as needed. And if you make things in a slowcooker, it doesn’t really matter whether it’s frozen or not – at the end of the day it all tastes the same.

I love that cookbook too, alhambra! Crockpot cooking is fantastic.

Can anyone recommend a crockpot cookbook for vegetarians?

I’ve actually had really good luck with just googling “vegetarian crockpot recipes,” then looking for ones that are well-rated. Hope someone chimes in with a cookbook recommendation, though.

I have Fresh from the Vegetarian Slow Cooker. It’s not spectacular, but it’s the best I’ve seen.

http://www.amazon.com/Fresh-Vegetarian-Slow-Cooker-Recipes/dp/1558322566

I love this one and frequently make the White Bean Casserole for lunches.

I love soups. Mark Bittman had a great column the other day about how to improvise soups: http://www.nytimes.com/2011/03/06/magazine/06eat-t.html?_r=1&ref=global-home

His cookbooks are good, too.

I agree potatoes do not freeze well in soups, and neither does pasta, such as in a minestrone.

Let me just start out by saying that I have not mastered this, but I’m definitely better than I was. Also, love the xkcd reference!

I used to go to the grocery store and think “I love cucumbers! I love peppers! I love all vegetables and I want to eat them all this week!” Unfortunately, the execution of that never went quite as well as I planned :) I finally made a rule for myself that unless I knew exactly how I was going to use said (perishable) vegetable during the next 4 days, I was not allowed to buy it.

Shopping for specific recipes also helps. Dividing recipes in half helps. Making recipes that do freeze well (e.g. soups) helps. I use my freezer a lot. Blanching vegetables is pretty easy to do and it can be helpful when you only need, say, a cup of cabbage, not an entire head of cabbage.

One thing I learned about myself is that sometimes, I get lazy about making even simple preparations. So, for me, it’s easier to steam most of my broccoli at once and reheat a portion later. (I realize that steaming broccoli is about a 10 minute endeavor from start-to-finish, but sometimes I am really that lacking in motivation.)

I’ve also found that there’s a big difference between something with a yield of 4 and something with a yield of 6-8. 4=I can have it at lunch a day or two and one other dinner, 6-8 means I probably need to freeze something if I expect to get through it. I also have a high tolerance for food repetition, so take all of these thoughts w/ that grain of salt :)

When I was single, I found a cookbook I loved: the 15 minute single gourmet. I loved it so much that I tracked it down on ebay when my library time was up. http://www.amazon.com/gp/offer-listing/0025853554/ref=sr_1_3_np_2_h_olp?s=books&ie=UTF8&qid=1299008377&sr=1-3&condition=new

I can relate on the boredom issue. I do what another poster here does – I aim to cook at least 3x a week (ideally more).

You should check out allrecipes.com. They have a scaling calculator, so you can adjust the amount of the recipe based on the number of servings you want. It’s not perfect, but it’s helpful.

Balancing cooking (which I love to do) with work has been really hard. I’ve been trying to cook more frequently by using a Crock-Pot. There are tons of books on crockpot recipes, and if you prep your ingredients ahead of time (chop veggies, etc.), it’s about 10 minutes of prep in the morning and you have a meal waiting for you at home versus takeout.

one of my favorite cookbooks is cooking for two: perfect meals for pairs. it drastically reduces the leftovers! there are also other cooking for two books out there

Something I see trip up my friends who cook but are then surprised by how much they’re spending on food is that they select whatever recipes they want and buy whatever ingredients they want (e.g., nice fish, expensive cheeses). It’s important to select recipes where you don’t need to go out and buy a dozen or more new ingredients or expensive ingredients (at least not all the time). For general groceries, buy what’s on sale instead of getting $10 worth of berries every time you head down the produce aisle (this week I’m eating a lot of grapefruit – last week I had a lot of apples).

Home cooked meals can be simple chicken breasts with some veggies (two nights in a row and you can do this for under $3/night), eggs with veggies, tofu & veggies, plus maybe a starch – all very cheap. If you start introducing expensive fish or high end cuts of meat and intricate sides, it gets more expensive. I hosted Thanksgiving for friends and one suggested a stuffing recipe that – no joke – would have cost $40+ to prepare. I opted instead for a different recipe and spent about $5.

So true! I got the allrecipes.com app on my phone, so now when I’m at the store, I just see what meat is on sale and then look up recipes on my phone for that meat and pick something with few ingredients that sounds good. It can be a fun way to explore foods I’m not familiar with, too.

I agree with everyone above re: planning ahead. It’s boring to eat brocolli all week if it’s the same. But it can be great if you make pasta with brocolli one night, and then, say, brocolli pancakes the next.

That said, a lot of what’s expensive about cooking is the start up costs, so if you don’t cook a lot, cooking can be very expensive initially. I made pad thai last summer and was so annoyed that it cost like 4 times more than getting 2 pad thais to go from our usual spot. But, subsequently, all my pad thais & stir frys (sic?) have been very inexpensive b/c I already had most of the ingredients (rice wine vinegar, peanut oil, etc.). I would recommend you just start with basics — cook simple stuff. And see about reusing things in creative ways. I used to get really annoyed buying herbs because I would only need a few sprigs and then would have to throw the rest away. Now, I just make pesto out of whatever looks like it will go bad (all you need is olive oil and a cheap food processor, some nuts help but aren’t necessary), and that lasts a long time & can be eaten with other meals down the road.

Also, try shopping at different place. For ex., my local “fancy” supermarket lets me buy chicken by the cutlet and fish by the fillet, so I never get extra. Some smaller health-food type supermarkets (like the excellent Sprout’s in Phoenix) let you buy grains by the scoopful, you can literally get a 1/4 cup of cornmeal or spelt if that’s all you need. So on and so on. You may also consider splitting produce or bulk items that go bad with a friend (e.g., if you never eat the whole loaf of bread, just cut in half).

In terms of recipes for one, Martha Stewart has an easy guide (and a whole book of this, too) — you can easily double to 2, also. http://www.marthastewart.com/photogallery/everyday-food-for-one?lpgStart=1¤tslide=1¤tChapter=1

If you’ve got any space for it, herbs are really easy to grow. I hate buying them because they always go bad, but now I keep several pots near a window with some of my faves and just clip them as needed. (Inside, because I hate the idea of parting with them in winter.)

I actually did this all summer on my balcony. They made it through mid sept., would not take indoors. I am going to start up another garden as soon as it’s warm enough — I seriously had an amazingly delicious summer (and drank too many mojitos with my mint plant).

Heh! Yeah, my husband loves mojitos, so I got an extra-large pot for the mint (unfortunately, it didn’t make it inside before the weather got bad- but I’ve been told that mint comes back year to year, so we’ll see if it lasts).

I’ve had little success with keeping herbs alive indoors in the winter (lack of light in this climate, I think), so I harvest mine every fall and freeze it. Basil can easily be made into pesto and frozen in an ice cube tray to get you through the winter–much cheaper (and more delicious!) than store-bought pesto. All you need is a blender, some olive oil, and some lemon juice (leave the cheese out to add later if you’re freezing it).

I had a big bowl of lettuce growing on my balcony the summer before last. Fresh lettuce out of the garden is one of my favorite foods.

Can I just say that it makes me happy you posted an xkcd comic? :) There’s a good many comics on that site that describe so many problems we all face!

When I make soups, I freeze half right away, because I get tired of eating the same soup for lunch every day, and that way I have some to pull out of the freezer when I don’t have time to make it. If I find a lot of one thing that I don’t want to eat, I’ll look online for a recipe for a soup to make with it (like curried carrot soup, which I made when I found myself with way too many carrots).

Ditto what others said about frozen vegetables. I especially like getting frozen peppers, because they tend to be really expensive to get fresh, and if I get a bag of red, yellow, and green peppers cut into strips, I can have some of each color in my stir fry, whereas if I were buying fresh, I wouldn’t buy all 3 and might end up wasting the half that is leftover. I really like the Whole Foods frozen veggies–I don’t live near one any more, and the frozen stuff from my local supermarket doesn’t taste as good, especially not the peppers.

I also wash and prepare foods as much as I can all at once. If you are cooking something with half your broccoli, you could wash and cut the remainder so it’s easier to use in another dish or eat plain for snacks.

My strategy is to commit to freezing immediately. Don’t kid yourself: You are not going to eat all that broccoli. Use half for the recipe; blanche the other half and freeze it immediately. Bonus: Some day you will be too lazy to go to the store and then you will remember your frozen stash!

We only eat out one night a week, and then generally get sandwiches for Saturday and Sunday lunches (because our weekends are so damn busy we can’t guarantee we’ll be home to eat sandwiches there). I have champagne tastes when it comes to gourmet ingredients and so I’ve definitely had to adjust my shopping habits, because at one point I figured out we were spending as much on groceries as we had been eating out. Here’s how I try to contain costs on groceries:

– Cooking as much as you will eat – and not waste – is key. I used to cook enough to have leftovers until I realized we never ate the leftovers, and it was a waste. Trial and error is about the only way to figure this out. There are great cookbooks out there on “cooking for one” if you need help/ideas. Everyday Food magazine used to have a regular feature on Cooking for One, not sure if they still do, but you could look on their website to see if they have recipes posted.

– As other people have mentioned, frozen veggies are a lifesaver. Organic frozen veggies can actually be more nutritious than fresh, because they are flash-frozen soon after harvest, and a lot of organic produce has to travel a long way to get to market. I still buy fresh produce occasionally but I buy small amounts of it, and then round it out with frozen veggies. You can get bulk frozen organic veggies at Costco for almost nothing, if you have a membership (and the freezer space to store them).

– Buy meat/fish in bulk, when it goes on sale, and then freeze it. My mom used to do this when we were kids – she’d buy a ton of chicken or ground beef when it was on sale, then freeze it. That does several things – one, you always have a protein in the freezer you can work with. Two, you’re cutting down your cost-per-portion. Three, you can buy a lot and then portion it out the way YOU want. In our house, for instance, for me to make chicken breasts for a meal, I need two and a half chicken breasts (one per adult and a half for the kiddo). I buy 10 breasts at a time, go home, and then portion them into freezer packs that fit my needs. If you are single, you can freeze individual breasts and use them as-needed. Less waste.

– One thing I do is buy dry staples from the Amazon grocery store. You have to be careful – watch the cost-per-unit and have an awareness of what things cost at your local grocery store so you don’t overpay – but sometimes Amazon has great deals on things like pasta or rice that will last a long time. It’s like Costco – stuff comes in bulk – but there’s no fee to shop and Amazon ships free over $25 no matter what you buy.

– Be realistic about what you’re going to cook. If you absolutely love Indian food, and know how to cook it and will cook it a lot, then go ahead and buy a full set of Indian spices and ingredients. If you just like Indian occasionally, go out for Indian food – don’t spend a lot of money on ingredients for something you only want to cook sometimes. I get the most mileage out of the most basic ingredients: plain pasta, plain frozen veggies, meat, pasta sauces, and cheeses. The fancier or more flavored it is, the more chemicals it has in it, and the harder it is to “flex” it to work in different recipes. Stock your pantry with staples and go out for fancy stuff. The staples will carry you through nights when you come home with no idea what you want to cook, and you’re tired.

If you are interested in cooking a certain type of food and live in a big-ish city, see if you can find a grocery store that caters to that population (Thai, Indian, Korean, etc.). Sometimes these stores can be more expensive, but I’ve found that I’m able to buy necessary and sometimes-hard-to-find spices/noodles/fruits/vegetables at a much lower cost than if I were to go to my local grocery store.

There’s a writer at the Washington Post who does an occasional “cooking for one” column, and he just published a cookbook as well.

http://voices.washingtonpost.com/all-we-can-eat/cooking_for_one/

I guarantee this concept will not be universally popular, but when I wanted to cook more cheaply I started eating less meat. Meat is expensive and most people eat too much of it anyway (and when I say meat, I include poultry). I decided to focus on eating more vegetables and legumes and by doing that I cut down on my food costs considerably with minimal effort. It was also a fun way of learning more vegetable-based recipes rather than the standard North American green-veggie-as-side-dish approach. I am not a vegetarian but even now I cook meat only about once a week, maybe twice. I get my protein from other sources and I save a ton of money.

One of the cookbooks that I use, and love, for interesting vegetarian cooking is Madhur Jaffrey’s “World Vegetarian”.

I did the same while I was going to school. I cut down heavily on meat and animal products, and it really does save money. Now that I’m working, since I’m eating less meat I can afford to buy meat that comes from more ethical sources. Once you start thinking of meat as a side dish instead of the main attraction, it’s a lot easier to eat cheap.

Great suggestion and I am trying to get there. Unfortunately, my husband grew up in a “meat and potatoes” household and to him, it ain’t a meal if there’s no meat. :( I am hoping this year’s cholesterol check gives me some ammunition to go meatless on more nights. It’s healthier, cheaper and I find most meatless meals are faster and easier to cook.

Eating less meat is something I have done during graduate school as well! I am a fan of the Essential Vegetarian Cookbook, which has a helpful section on making sure you are still getting all the nutrients you need from a vegetarian diet. Meat now is something I will get as a splurge when I occasionally eat out.

thanks, everyone! Great suggestions. I especially like the frozen veggies–I never really thought about it because I assumed fresh was just better for you. That should cut down on a lot of waste.

The key is remixing. Fresh vegetables last maybe a week, tops. Buy ones that can go in many recipes. So, let’s say you buy tomatoes, broccoli, and mushrooms. Day 1: pasta sauce out of those three ingredients. Day 2: omelette with those three ingredients. Day 3: Risotto with the same vegetables. Day 4: use up remaining broccoli in a soup, along with some zucchini. Now you have zucchini, so day 5: zucchini pancakes. And so on.

If you buy vegetables that only work in 1 or 2 dishes (bok choi, some rarer mushrooms, beets, etc.) you’ll have to get more creative with the remixing, freeze leftover veggies, or just use up the whole stash in one recipe and freeze the leftover portions.

This is an odd place, but I noticed this morning in this months “Parenting” magazine they have five quick dishes made from one whole chicken! I also subscribe religiously to health magazines and put all the recipes I like in a binder for easy access.

1. Cultivate a hatred for disposable garbage and “stuff” in general: low-quality clothing items, a new kitchen gadget when you have something else that does the trick, a new outfit when you already have an appropriate outfit for the occasion that you probably like better. Let’s buy less garbage made in China.

2. The corollary to #1 is: nothing that isn’t perfect.

3. Live in a smaller home so you can fit less stuff. I have a small, but fine closet, and around 15 pairs of mostly comfortable, stylish, and versatile shoes. I live the same life I would in a bigger house with more stuff, even if I got deals on all of it.

4. Learn to mix a cocktail and entertain friends yourself.

5. Avoid car ownership if possible. You can take a lot of cab rides for less than a car payment and insurance.

6. Think about the future: would you rather have your $20 and cook yourself or would you rather kill some debt or throw some cash at your savings and retirement goals?

7. Worry about the big things and your attitude. Think of yourself as a producer, not a consumer. You don’t have to own everything you like. Libraries and Napster keep the budget in check.

8. MagicJack is great. Really.

9. Take care of your health and your teeth. Gym memberships and new toothbrushes are cheaper than prescriptions and dental work.

10. For big things, if you can’t pay cash for it now, you can’t afford it. No more credit cards unless you have the money and the discipline to pay it off every month.

Gym memberships are also cheaper than diet food and new clothes (because the old ones don’t fit anymore).

Ditto the library tip. Also, I downloaded the free Kindle app for my laptop and download a lot of free books from Amazon–most books that are out of copyright are free, including most of the “classics.”

I also immediately recycle catalogs for clothing (Nordstrom, I’m looking at you). The longer they sit, the more tempted I am to rationalize the purchase and buy something full-price. Out of sight, out of mind.

I’ve thought about the car thing quite a bit. In bigger cities, it may work, but with one and a half kids (a step child we have joint custody of) My husband I and both need a car. His is old, and only cost us $1000 when we bought it two years ago (and maybe another $300 in repairs since then), but is economical for him as he works close to home, loves this kind of car and can fix it easily on his own or with little help from my mechanic dad. My husband bikes to/from work 6-8 months during the warmest part of the year, and that helps him be fit and happy, and then comes home, gets car and drives to get the kids when I work late. I’ve thought about parking my car where I drop the kids off and biking to work, but haven’t gotten the guts to do it yet. Especially since I like to be work work well before 8 when possible.

Also, I work in health care. And I can’t even tell you how much preventative exams for your and your family will save you in the long run. You need your vaccinations yearly (if you don’t have any indication-philosophical or otherwise- against them), multi vitamins, calcium (once we hit 30 our bones are as dense as they will ever be) and other such “maintenance” stuff. An ounce of prevention goes a long way!

Little things that add up: Bring your own lunch to work. Check out books and videos from your public library. Reuse and repair things instead of buying new ones. Don’t save credit card information on websites, so you can’t be tempted to “just click” on purchases without thinking them through. Don’t go to the grocery store (or to the mall) without a list of intended purchases.

Big things: Don’t just live within your means, live below it. For example, my spouse & I based our mortgage payments what I could pay on my salary alone, rather than our combined salary. We didn’t have to worry about not being able to pay the mortgage when he later lost his job.

This sounds simple, but don’t buy things you can’t afford. Pay your credit card off every month. Don’t take out loans for anything other than education and mortgage.

Don’t spend more than you need to. For me, that meant that I always lived with roommates, paying cheaper rent in a group house, until I got married. I didn’t buy a car until age 32, because I didn’t need one before then. Save your spending for what you care about. I’m happy to buy a dining room table from a thrift store, because furniture is not something I care deeply about. I can do my own manicures, but pay for salon waxes.

Home manicures, pedicures, and facials help so much! I’ve only ever had one professional manicure, which chipped the next day!!! (It was for a friend’s wedding). I also started going to cheaper hairstylists such as chains like supercuts and cost cutters, as I found some stylists there who actually were more talented at short hairstyles than the more expensive place I had been frequenting. Finding a hairstylist took several months of research and included some just-okay haircuts… so it can be a risk. My husband and I purchased a hair-cutting kit and I learned how to cut his hair.

Whenever I get a raise I choose to “ignore” it as spendable income and it goes straight to either the 401k or savings plan. The same goes for bonuses. I give myself a percentage for a present and the rest goes to paying off a debt or towards savings.

I read a book by Elizabeth Warren recently (“All Your Wealth” for those who are interested), and she recommends that you divide your income as follows:

1) 50% essentials (defined VERY strictly: for example–rent, car payment, electricity, water, fuel, insurance and $300 per month for a 2 person household are essentials, but the gym, cell-phone, cable, clothes and extra food are not)

2) 30% savings

3) 20% extras

I have found this method of budgeting extremely freeing. It’s a very set-it-and-forget-it way to live. I have three (no fee) bank accounts. One for essentials, one for savings, one for extras (E.W. recommends using cash for extras, but I like to online shop too much). I have almost unlimited flexibility in the “extras” department, and at the end of the month, I have a satisfying chunk of change in the savings account.

It may not work for everyone, but it really works for me.

How do you control which account the money is drawn from when you make a purchase on a credit or debit card?

Separate debit cards for the separate accounts. I never use my credit cards anymore.

So I applied for my dream job… and they called, persumably to set up an interview. The problem? My stupid voicemail box was full!

What would you polished ladies do? Call back? How can I play this off without seeming impossibly flakey and disorganized?

Definitely call back. Just say you missed the call and you’re following up. Don’t even mention your full voicemail box. Just sound professional and confident.

Agree completely so long as you are sure it was them and not someone else in the same area code.

I am still a student (so I’ve never been in a position to hire someone), but I would probably just call back and pretend like that did not even happen. They might ding you and they might not, but my thought is that saying something about it is only going to highlight the issue if the person who called didn’t even think twice about it. If the person has already dinged you, there’s probably not much you can say that would take the ding away.

As for what to say when calling back, I’d say something like, “Hi, this is Feeling Stupid. I saw that I missed your call from earlier, and I was just wondering if you needed anything additional from me.” Or something like that.

Agree with the above comments, and would add to delete your messages so this does not happen in the future! Occasionally (it’s rare but DOES happen) someone actually leaves an important message and you don’t want to miss it.

Call back, and immediately after you get off the phone, clean out your ridiculous mailbox. (How does it get full? Delete that crap.)

dream job? CALL BACK! Be honest and let them know you saw they called but unfortunately didn’t receive a message. Better to call and be denied than live the rest of your life wondering!

Something similar happened to me during OCI — I applied to a firm and they had this “secret dinner” for those who were likely to get call-backs — which your interviewer typically invites you after your screening interview. Anyway, my phone was out of batteries, so I didn’t get this invite until the next day, and naturally, freaked out.

I called them and apologized profusely — and then I told them, this is my DREAM job — please don’t take this as a sign that I am not interested. And I got a call-back and an offer. So there you go — tell them that you’re sorry and you really want this job: jobs like to be liked too, and you won’t seem all that disorganized. (FWIW, I didn’t have a charged phone because I had left my charger somewhere else and was waiting for a new one…that part I didn’t tell the phone).

*the firm, not the phone.

Great advice.

What do you do with your savings after you’ve maxed out the retirement account? I got burned by the stock market a while back and have been hesistant to move savings from low-interest accounts. I’d love to hear your suggestions.

I’m interested in this too. I was extremely dissatisfied with the performance of ALL my stocks and mutual funds when I had them. I have about 100K in my savings account earning .0025 percent interest. I’m actually contemplating buying a super cheap studio apartment and living in it to eliminate my rent payment, because there doesn’t seem to be any other way to use the funds to financial advantage.

If nothing else, you could be earning more interest. See, e.g., ING direct savings account — 1 % annual.

http://home.ingdirect.com/products/products.asp?s=OrangeSavingsAccount&utm_source=Google&utm_medium=CPC&utm_term=orange%20account&utm_campaign=OSA_Non_Brand

There might be even better options, if you look around.

…”when I had them”