Tales from the Wallet: Asset Allocation and Rebalancing Your Investments

This post may contain affiliate links and Corporette® may earn commissions for purchases made through links in this post. As an Amazon Associate, I earn from qualifying purchases.

What does it mean to have balanced investments, and how do you do it? What is a proper asset allocation? I first tried to answer these questions about six months ago (maybe longer) and finally think I've got it figured out… kind of. Still, do note: this is not intended as a tutorial, just a jumping off point for a discussion. Readers, what are your best tips on asset allocation and rebalancing your investments?

Psst: In honor of this series' original title, Tales from the Wallet — here's a wallet we love!

This post contains affiliate links and Corporette® may earn commissions for purchases made through links in this post. For more details see here. Thank you so much for your support!

Why You Should Balance Your Investments

First — why should you balance your investments, or allocate your assets? I read Ramit Sethi's I Will Teach You To Be Rich a while ago — a great introductory book if you're new to financial stuff, and definitely a quick read. One of the only things that was new to me was his explanation of how and why to balance your investments, which I'd heard about through the years but never really focused on. (To be honest, I kind of thought all I needed to know was that bit about subtracting your age from 100 and putting that percentage in stocks, which roughly translated to me as “invest mostly in stock index funds.”)

In Sethi's book, he talks about how you should have a target asset allocation (also quoted on his website) of something like 15% TIPS, 15% Government bonds, 20% REITs, 5% emerging-market equities, 30% domestic equities, and 15% developed world international equities. Whoa! That's a bit different than “mostly stocks.” But I suppose it's easy enough to figure out, at least if you're just setting up your investments for the first time.

So, let's say you invest accordingly, and in that first year, domestic equities do AMAZING and emerging-market equities have a lousy year — so at the end of the year you may end up with 60% of your holdings in domestic equities and only 2% in emerging-market equities. So, Sethi says, at the end of each year you should figure out what your target allocation is and then readjust so that you're putting something like 20% into emerging-market equities and only 10% into domestic market equities. Uh huh. Ok. Simple!

Now, Sethi's solution here is that you should buy target date funds, which automatically balance for you. But no one advises you to put all of your money into ONE fund, which means that as soon as you diversify, you need to try to rebalance manually. (This may be where you're saying, “screw it, just get a financial adviser,” — but Sethi advises against financial advisers, noting that no one really knows what the stock market is doing, and (if memory serves – I read it a few months ago) he even analogizes financial advisers to a study involving sommeliers, who — while blindfolded — couldn't tell the difference between red and white wine. The lesson: “experts” aren't all they're cracked up to be.)

These are some of our latest favorite financial books for beginners:

Figuring Our Your Current Asset Allocation

OK. So now you're committed! Let's rebalance! But first you have to figure out what your current allocation is, which can be kind of tough. My husband and I own multiple stocks as well as mutual funds, index funds, and target date funds — spread out between Schwab, Vanguard, Fidelity, American Funds, and ING Retirement. Any one of those individual brokers will tell you what your asset allocation is within their brokerage — but only within that one account. No one gives you a full picture.

My solution here was thus: I went over to Morningstar's Portfolio Manager and entered info for ALL of our investments. (At least, all of the ones that had ticker symbols — I couldn't find them for the ING holdings, which kind of just makes me want to roll over that old 401K. Stay tuned for that post…) This took some time! After entering them all, it turned out that I needed to pay for premium membership to actually analyze them with their “X-ray Analysis” tool (you can get a 14-day free trial, or choose a monthly $22/month subscription thereafter — and if you cancel your membership halfway through the month they do prorate you).

Tips on Rebalancing Your Investments

As it turns out, there are a LOT of schools of thought for the ideal asset allocation, and you're not always comparing apples to oranges. For example, according to Schwab's Investor Profile Questionnaire Results,* I should have 35% in Large Cap Equity, 10% in Small Cap Equity, 15% International, 35% Fixed Income, 5% cash. According to Fidelity I should have 60% in stocks, 25% in Foreign, 15% in bonds, and 0% short term. You'll notice that those are very different buckets than what Sethi suggests you have — not just different percentages, but entirely different (and sometimes overlapping) buckets.

So I picked ONE school of thought — Schwab's, since that one at least was the result of my telling the program my risk tolerance and our personal investing timeline. I'm not really sure it matters which school of thought you pick, just so long as you pick one.

ANYWAY: so according to Schwab, I should have:

35% in Large Cap Equity

10% in Small Cap Equity

15% International

35% Fixed Income

5% cash

Note that that is mostly still true to the “subtract your age from 100” thing that you've heard — I'm 36 — but it gives quite a bit more information about where to put the rest of it.

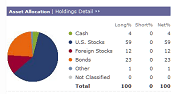

According to Morningstar and the handy-dandy pie chart (above), I had:

59% US Stocks

12% Foreign

23% Bonds

1% Other

4% Cash

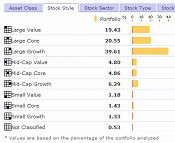

Now, it's worth noting that that “cash” is the cash being held by various investments (as in, a fund I own keeps a small percentage of its money in cash, outside the market) — that doesn't take into account the family emergency fund or other cash accounts. So my first self-assessment here: we had way too little in bonds. Clicking on another tab within Morningstar, I could see that in my stocks, almost all of my holdings were in large cap stocks.

So the second lesson from my self-assessment: we needed more smaller cap stocks. (This is depressingly simple when written out like this — buy more bonds and small stocks! — but really, it was hours and hours of research.)

Rebalancing Your Investments

Not to be a tease, but I don't have any super easy advice for rebalancing your investments, or even any final tale for what I did because we're still in the midst of it. If I were investing an amount on a regular basis, I might reconfigure my percentages by eyeballing them — more bonds and small caps, less big stocks. However, because it's April and I'm self-employed, we had money that we had to invest in my SEP-IRA plan — so almost all of that chunk of change went into bonds and small caps. My super-scientific plan: I researched index funds in Vanguard that invested mostly in bonds and small-cap stocks, and then put a little bit of money into each fund. Hooray for diversification!) I happily entered the new info into Morningstar and saw that my allocation had changed:

59% U.S. Stocks

12 % Foreign Stocks

24% Bonds

4% Cash

Looking at the makeup of stock types, I saw that I had gone from a total of 3.14% to 8.35% in small cap stocks, out of 100% of all stocks. So: everything I did was a drop in the bucket in terms of rebalancing our investments. I've started the process to roll over my old 401K at ING to an IRA in Vanguard; my husband and I have also talked about investing a bit more money in the market anyway (beyond our tax-savvy investments), which will likely go into bonds and small caps. Once those changes are done I'll probably check my allocations yet again and decide whether to change our automatic investments (like his 401K or the tiny bit we invest automatically), or sell some of the holdings we have “too many” of.

Kat's Takeaways on Asset Allocation and Rebalancing Your Investments

This is not rocket science, and I think this is something that people can do themselves. That said, it probably would be a better use of my time to just pay a financial adviser to figure this out, particularly now that I understand what the goal is and why we do it.

Readers, what are your thoughts on asset allocation and rebalancing your investments? Do you outsource this to someone else? Do you not pay attention to it?

* If you already have a Schwab account, get to the Investor Profile Questionnaire by logging in to your account –> selecting the “Guidance” tab at top –> choosing “Schwab Portfolio Checkup” –> then click “Investor Profile Questionnaire” in section B. (Fast AND easy!, she said sarcastically.)

2021 updated images (balanced pile of rocks) via Stencil. Originally pictured: Kate Spade New York Carmine Street – Lacey Wallet, available at Nordstrom for $158 in green, pink, and black.)

My company has a financial education/planning program that has coaches who will work with you on everything from retirement to estate planning, as well as webinars. When I first started, made an appointment with a coach to discuss financial/retirement planning. We discussed my risk tolerance, timeline, etc for over an hour and we used that to allocate my investments. That was a few years ago, and I haven’t rebalanced at all, so I’m long overdue. It’s all with one company, so it shouldn’t take too long (I hope).

Our firm has NOTHING, except that Frank manage’s the Firm’s 401K for everyone. We all put in whatever % we want (my dad has me at the MAXIMUM 10% of salary), and the firm matche’s up to 5% of salary (which does NOT include my clotheing allowance — FOOEY!). Then, every year, Frank give’s us a STATEMENT, showeing how much money we have made and how much is in there.

My dad keep’s this statement with my paper’s so that when I retire, I will NOT have to pay doubel taxes on it. My dad is here NOW, goeing over the book’s with Frank, and then, I am leaveing early with Dad, and we are going to go to Penn Station and eat at the Zaro’s there. He love’s there BRIOTCHE SANWICHES, COFFEE and CHEEZE DANISH, and I love their bagel’s and chicken salad! He is NOT going to complain about my tuchus either today, b/c he said it looke’d good! YAY!!!!!

Ladies,

Just wanted to point out that in the current interest rate environment, bond mutual funds are far less safe than they would typically be. When rates go up, yields (returns) go down, and this is a problem, as rates have very little choice but to go up in the mid-term. This leads to erosion in principal (e.g. LOSSES).

Ask your friendly finance geek to explain, but bond funds are less safe than they have historically been, and you can’t always rely on mantras like “Stocks are risky/Bonds are safe” given that we have a non-typical (e.g. very low) interest rate environment. This would also affect target date fund returns as well, as they are invested in bonds too.

Cheers.

In general I’ve heard quite critical things about the age-specific investments.

In a similar vein to MJ, I was recently surprised to learn how many short term municipal investments I can get in to WITHOUT paying an entrance OR exit fee. If anyone is saving money for a purchase in the next, say, six months, and thinks the market is due for a correction, I’d look in to them. I’m in a 3.0% one now with no minimum investment.

This is a very sensible comment from MJ.

I’d also add to be careful of adding different flavours of public equity to a portfolio under the incorrect impression that the portfolio benefits from diversification in this way.

There’s plenty of recent data and practice which challenges the ‘orthodox’ portfolio thinking of the 1970s, which advocates diversification to reduce risk, and on which I’m guessing Kat’s advice to get into small caps and global equities is based.

In particular, the theory has said all along that an investor benefits from diversification ONLY if she is adding assets with sufficiently different performance than what she already has (‘uncorrelated returns’).

The recent data is that many risky asset classes are far more correlated than previously thought, from public equities in different countries, to private equity, to credit-sensitive bonds, and particularly in event of a major crisis when an investor is most likely to be at risk from catastrophic loss.

I would say the important thing is to think about asset allocation with your own long-term commitments in mind – what are your future expenses, where will you incur them, how do you best protect your purchasing power for these expenses – and think about optimising any applicable arrangements for tax, cross-border transfers etc. And then if you receive advice that is non-intuitive and requires costly/ complicated tinkering with your investments, just feel free to ignore it.

Going anon here. I applied to an in-house position and recently had an informational interview with an attorney in the group I’m applying to (s/he who is reviewing the resumes). I’d like to send a thank you email but also want to reiterate my interest in the company. I’d like to get an official interview with the company but don’t want to come across too brash. What would be the most appropriate way to convey these thoughts?

I was thinking:

Dear XXX:

Thank you for speaking with me last week about your experiences at [company]. [Company] seems like a great place to work, and I enjoyed our discussion about the [relevant] group. I am very interested in contributing to that group and want to reiterate my interest in [Company].

Should you require any additional information from me, please let me know.

Best,

Anon

I think this strikes a good balance between being direct and not being pushy. I would go for it.

Agree this looks good – good luck with the position!

In the same time well-bred people who attend colleges or even academic institutions find it problematic sometimes to prepare a logical and critical task on a given topic. For those students who want to become sophisticated ones, it proposes a cheap assistance from here on when to buy book review online on time.

the main point: you are in control of your finances. get educated. ask questions until you understand the topic.

no excuses people!

Good rule for life, generally.

This!

I work in finance, and you would not believe the amount of people – sadly, mostly women – who just have no idea what’s going on with their family finances. They don’t even come to reviews with their husbands, and say things on the phone like “O, I just let so-and-so handle things as long as there’s some fun money for me!!” Um…..PLEASE don’t be one of those women!

On a side note, if you have a lot of investments outside your 401k, I would advocate for having a financial advisor – ask around for recommendations. If you just have a 401k, you can likely hit up the advisor of a close family member (ie retired parent) for a no-charge review of your plan. (The advisors in my office do this quite frequently, but we are a regional firm and not so much “big business” so YMMV.)

Ramit’s book is great and I highly recommend it. The biggest takeaway for me was that its better to invest even if its not totally perfect instead of waiting to have a perfect strategy developed.

Personally, all I have is a Roth IRA and I decided to go with a target retirement plan that rebalances itself as you get older. I set up automatic weekly investments (I’m paid weekly) to max out the account over the year. Now I really don’t have to worry about it, which was the key for me to getting started. Since all I have for retirement so far is my Roth, I didn’t want to worry about really messing it up.

I really appreciate these posts. Thanks Kat!

Interesting. My company’s 401k is with Fidelity and they just made us choose to “opt-in” or “out” of a age-based JPMorgan allocation. I have my 401k’s at three different places, so I am going with the age-based allocation for that portion and am happy with my other allocations.

This is really helpful! I guess I always feel that since I’m not investing that much, it’s not really worth it to come up with a coherent strategy, so all I have are multiple savings accounts plus my RRSP, which is invested in a balanced mutual fund portfolio. But since all I have is me, I probably should take more of an active approach.

How do you ladies decide how much you’re investing, outside of your normal saving and retirement accounts?

For me, it is going to depend on the size of my emergency fund and amount of student loans. My current focus is getting my emergency fund to 8 months of basic living expenses (I’m pretty close) while paying at least a little extra to whichever student loan currently has the highest interest rate. Once I hit 8 months, then I’m going to be aggressively paying down my student loans but I am planning to split up some of my extra cash into a new investment fund. I’ve been trying to max out my Roth as well, which is my true first priority.

Once I hit 8 months, I think my plan will be to take whatever cash is left over each month after paying my bills and putting a set amount into my travel and gift savings and split it 75% to loans and 25% to invest. My pay can be irregular as a contract attorney, so the percentage of my gross or net income will vary.

I think the Mr Money Mustache website shows you what percentage of your income should be invested based on how many years you have left before retirement. That might help you pick a target.

We put max into retirement – my 401k and DH’s SEP. We don’t do IRAs any more since we hit the cap. Then we put some $$$ into our house for renovations, which has been most of what’s left. (We already have an emergency fund) Then saving for college, and the last and smallest bit is for the non-retirement account.

I max out my 401(k), direct a tiny bit in to savings, and (when I’m not saving for a house purchase very soon), send another 1.5% post-tax into investments. Not that much, I know, but having it done automatically is great. I send it into a municipal investment and then reallocate every month or two once I get a chunk. This tax year (ie spring 2014) I hope to do a backdoor IRA contribution as well… we’ll see.

I am lucky to have a finance-oriented DH, who takes care of all the allocations across our portfolios. We have a silly number of accounts (regular IRAs, Roth IRAs, my 401k, non-retirement savings, etc.) so he makes sure everything is allocated across the whole spectrum of accounts, and does a big review once every 18 months or so.

I love this wallet. I think I need to rebalance my assets away from savings and into wallets.

I really like it too and it’s tempting me.

I love/hate how all of the financial posts on thissite are accompanied by links to adorable wallets. Such a distraction!

speaking of wallets, i’ve been obsessing over this wristlet (in white) since it came out and I just bought it. It’s beautiful. The green is also more beautiful in person but I decided to go the practical route. http://www.thelimited.com/Large-Laser-Cut-Wristlet/1374442,default,pd.html?dwvar_1374442_colorCode=807&start=15&ppid=s15&q=wristlet

That is lovely! Now I’m tempted to get it myself…

with the discount cards they bombard me with via snail mail and real mail, i was able to get it for $27 including tax.

Their discounts! I’m so glad you mentioned this. I think I have an email from them with a code.

TJ – I’d love suggestions for beachfront accommodations in Florida or Bermuda for a May extended long weekend. Ideally a great beach for swimming/snorkeling and quiet accommodation (husband hates large hotels). Preferably adults only and $200-$300/night (can be flexible on price). I was looking at the Florida Keys but seems like the swimming there isn’t as great and then I was looking at Bermuda but wondering if it will be too cold in May. Any suggestions much appreciated – so tired of trolling TripAdvisor.

In my experience, May is borderline too-cold for Bermuda— not too cold for having a lovely time, just for swimming/snorkeling.

This is not directly on point, but I have to admit that I just had a revelation about my finances. I was just looking at some information from the Pew Research Institute. It shows net worth for the top and bottom of the US population. I have been acting like a rich person, spending pretty freely, because I have a high income. But I actually have a (very) negative net worth, which means I fall way at the bottom. I am very aware that I don’t have the same issues as a person with little or no income, and I really don’t live extravagantly (very modest car and home, no jewelry, etc.), but holy cow did it change my perspective on how I should be behaving from a financial perspective.

Sounds interesting. Do you have a link to this?

http://www.pewsocialtrends.org/files/2013/04/wealth_recovery_final.pdf

This is a great topic. One of my goals for this year is to simplify my financial life (WHY do I still have a checking account in a state where I haven’t lived in 7 years?!) and to pay more attention to my retirement and investment accounts. I did a review of the different accounts a couple of weeks ago, and found that I was way off on my target allocations, so I switched where future contributions go and sold some shares where I was over-invested and reinvested in some categories where I wasn’t anywhere near my target. I plan to review every 6 months or so to see what further adjustments need to be made.

This is the worst thread jack for a “Tales from the Wallet” post, but I just have to let it out!

Today was a terrible day. My long-time boyfriend left today for a new job out of state and we will be living apart for the foreseeable future. When I got to work, waiting for me in my inbox were feedback forms from a presentation I did a couple of weeks ago. Most of the comments were great and very positive, however, one participant took it upon themselves to track how many times I said “um” in the day-long seminar (477…yes, they seriously kept a tally) and another person said that if I had been presenting on my own, she would have asked for a refund (I am new and was obviously only assisting a more experience attorney during the presentation). Did I mention this presentation was actually a non-billable matter? Also, it hasn’t been sunny in about 6 months where I live and on my morning drive in to work, it was snowing.

So, I took a little lunch break today…at Louis Vuitton. I bought the Neverfull bag that I have had my eye on for a while, but felt I couldn’t afford. Ladies, I feel happy and completely rejuvenated! It may only be a temporary fix to my problems, but I think we all deserve a little treat once in awhile!

Sorry you’re having a rough day, glad the shopping helped brighten it! It sounds like you encountered a Toastmaster, I think they’re trained to track ums.

OK – so despite being a smart well informed person – I’m kinda awful when it comes to investment. I have 401ks and a decent amount in saving, but it is earning next to nothing in one of those online bank accounts.

I remember there was a post awhile ago about which investment firm people liked the most (schwab, vanguard, etc.) but I can’t seem to find it.

Any suggestions about where a dummy should invest – expecially if I have low risk tolerance and will need access to some of the funds in a few months to by a home?

I have some investment background, but my financial situation is similar. Honestly, most of my assets are in cash. I get a better rate in my savings account than I can find in a 1-year CD. I can’t even bring myself to be fully invested in my 401k because I think the markets are still overvalued. Unfortunately I’m in an area where there’s a real estate bubble as well — if you’re not living in the Bay Area, it’s probably your best bet long-term.

Vanguard is known for having very low expense ratios for its mutual funds. You’ll probably get more handholding at Schwab, and that might be worth it for you.

Thanks for the advice. I will look into Vanguard and Schwab. Unfortunately, I’m in NYC, and there is bubble-inducing behavior going on here are well.

I believe the consensus among financial gurus is that if you are planning to use the money within five years, you just park it right in a savings account. Low risk = low return, and when you need it within a year, you want No Risk.

Sigh. That was supposed to be for FINANCEDUNCE, above. (Not yelling at you, just trying to get your attention.)

Love the featured wallet. PSA: It’s only $98 on the kate spade website.

I recently started using LikeAssets.com. It functions a lot like Mint.com, but it pulls your info from your brokerages, shows you the breakdown of your entire portfolio, and tells you how your portfolio is doing agains the market by comparing similar assets. It’s extremely helpful for figuring how you’re invested and if you need to rebalance. The only caveat is that it doesn’t work with all brokerages (yet).