This post may contain affiliate links and Corporette® may earn commissions for purchases made through links in this post. As an Amazon Associate, I earn from qualifying purchases.

Today’s topic in Tales from the Wallet: do you set financial goals for the year? I started setting explicit financial goals when I left my cushy BigLaw job a few years ago — I had been so comfortable there that I could easily move every other paycheck to an interest-bearing money market fund, and then I took a job at a nonprofit, making about a third of my former salary. Suddenly faced with the prospect of austerity, I decided to set financial goals for the year.

Every year, I’ve kept my goals short, choosing just three or four, and I’ve gone back at the end of the year to see how I did. In 2010, my goals were to “1) bank all Corporette income, 2) renovate kitchen within budget, 3) max out 401Ks, and 4) pay down at least $10K of (my husband’s) student debt.” A few years later, when my first son J. came along, the goals were to “1) save 10% of our income, 2) max out J.’s 529 on top of our savings, and 3) assess all investments and figure out fees, performance, etc.” (That last one was a doozy and I wrote about it in our post on asset reallocation.)

This post contains affiliate links and Corporette® may earn commissions for purchases made through links in this post. For more details see here. Thank you so much for your support!

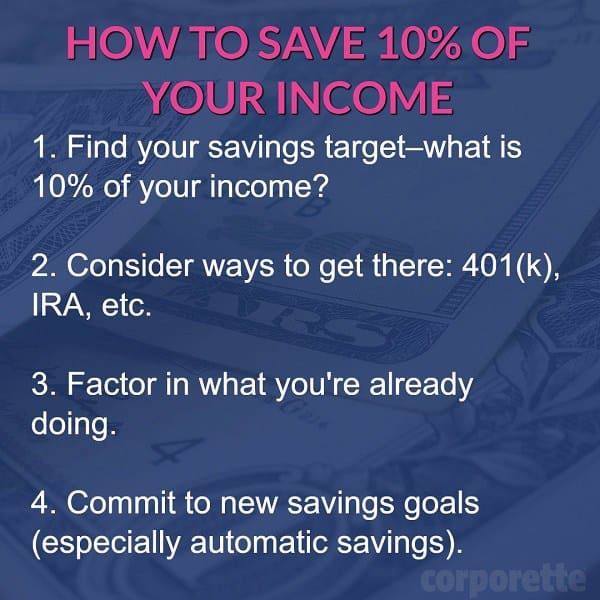

The “save X% of our income” goal is a mainstay on the goal list for me (sometimes 10, sometimes 15) and I’ve usually done a bit of planning to figure out how to get there. For example:

1. Find your savings target—what is 10% of your income? (Or 15%, or 20%, or whatever your goal is?) If you have a bonus or a commission-based income that makes this a moving target, it’s OK to use last year’s numbers for planning purposes. But it’s important to actually set a number to the goal.

2. Consider ways to get there: 401(k), IRA, 529, HSA, non-tax-deferred investments. This is a matter of definition—does your 401(k) and other tax-deferred savings count towards your savings goal? Or do you want to save 10% of your income on TOP of what you put in your 401(k) every year? I’ve done a variety of things over the years; sometimes I’ve tried to save 10% on top of our 401(k)s and 529s, sometimes I’ve included those in the savings target.

3. Factor in what you’re already doing. How much are you automatically putting in your 401K every paycheck? Assign a number to it. For example, if you put in $500 every two weeks, that’s $13,000 a year — how does that affect your savings target?

4. Consider committing to other new ways of saving. For example, consider setting up automatic savings (or automatic investing) from your accounts as well — if you can automatically move $25 a week into savings, that’s an additional $1,300 a year.

This can work for every financial goal you have. Let’s say you have several student loans with varying interest rates. It’s a great yearly goal to pick the loan with the highest interest rate and start chipping away at that one with focus to start paying down debt. Go through the steps: Quantify the amount; for example, “I have $6,225 left on the loan.” That’s $518 a month of principal, roughly. Quantify what you’re already doing to get there by looking at your minimum monthly payment — and make sure you know how much of that payment is going to principal versus how much is going to interest. Next look at what you can add — how close can you get to the magic $518 figure to pay it off? Don’t be too bummed if you can’t get there in one year; just pick what you can do.

Another tip when trying to make extra payments to principal: Make the total an even number, even if it’s just rounding up, because it makes the math easy when trying to figure out your budget. If your current payment is $151, can you add an extra $49 to the payment? How about an extra $149?) If you do manage to pay off a loan entirely, celebrate accordingly, but then take the entire payment you were putting toward Loan A (say $300 a month) and add that extra $300 to Loan B, the next loan with the highest interest. (Always pay your minimums on every loan, obviously.)

Other goals you might consider:

- No new credit debt

- Pay $2,600 towards my highest loan ($50 a week)

- Save 10% of my income

- Add $2,600 in my emergency fund

- Max out my 401K

- Finally figure out _[insert scary financial thing here ]_ (Roth IRAs, 529s, automatic investing, Vanguard, learn about personal finance, Mint, YNAB, whatever)

- Save $500 a month (set it up with automatic savings!)

- Earn an extra $500 a month (such as by freelancing, getting a side gig like babysitting, etc.)

Ladies, what are your financial goals this year? What have they been in the past, and what worked and what didn’t? How do you choose and set financial goals for the year?

These are some of our latest favorite financial books for beginners:

Updated images via Stencil.

Kelsey

Years ago, I went to Carlsbad Caverns in TX and it was really amazing – it was like an underworld that you only read about in novels. It felt like being on another planet. I loved it so much, but it was like a 5 hour drive from El Paso, where a relative lived at the time. Are there any other caves like that in the U.S., preferably a closer drive to a major city? I’d love for my kids to experience that but El Paso is so depressing and that drive was a little painful for me.

AZCPA

From Tucson, there are two very doable options (less than 2 hours drive) – Colossal Cave, and Kartchner Caverns. The former is no longer “alive” and so you can actually touch the walls and take flash photography. They even have “wild” cave tours where you go into less used parts of the cave like you are spelunking. I’ve been to both and really enjoyed it.

NYNY

Carlsbad Caverns is in New Mexico, not Texas. El Paso is the closest major airport, but as a New Mexican born and raised, I need to point that out.

If you were planning a family trip, you could fly to Albuquerque and make it a road trip with other stops. White Sands is amazing, and Ruidoso is really pretty.

Duchess

You could do Luray Caverns in Virginia. It’s a little over 2 hours from DC and is right next to Shenandoah National Park.

gov anon

Mammoth Cave in Kentucky is great, but you have to book tours way in advance and it’s not really close to much else. Merramac Caverns is about an hour from St. Louis and is great for kids/families. I think St. Louis in general can be a nice trip for kids. But I’m from the Midwest so maybe a bit biased.

Anon

I was spending a ridiculous amount at the cafeteria at work and going out to eat for lunch, basically $75/wk. I did a reverse incentive – I kept track of how much I spent each week, subtracted that from $75, and whatever was leftover went into a “vacation savings”. I ended up with $2500 at the end of the year and celebrated with a trip to Europe.

The next year I was motivated to save even more, so I signed up for Digit, where it takes a little bit out of your checking account without you really noticing, and puts it into a separate savings account. It monitors the balance and takes different amounts based on how much it thinks you won’t notice. I resolved that half would be vacation, half would go to my “real” savings account. It was awesome and I found all kinds of places where I was spending on little things. I’d literally think “wait do I want this extra lip balm from the samples counter, or do I want a better vacation?” It was so encouraging to check the Digit balance and see that number go up and up.

This year, I’m keeping digit and now aiming to put 75% into savings. Hopefully I can up my saving, so the 25% fun money stays the same amount, but we’ll see. Either way, I’m saving way more than I was 3 years ago.

Sydney Bristow

I love what you did with the lunch money. What a great idea to incentivize yourself with something concrete at the other end.

Anonymous

I just started to use Digit too! It is a painless way to save, you don’t even notice that the small amounts are being deducted from your bank account. Suddenly, within a month or two of starting, I have over $1000 saved! I plan to use the money for travel or for my daughter’s expensive summer camp – fun stuff, not the necessities of life.

Two Cents

Someone posted a few days ago a financial success of saving 50% of income. Tips on how to do that?

June

I was not the poster a few days ago but also saved over 50% of my (gross) income last year.

It sounds so basic, but “pay yourself first” works for me. I set up automatic payments to max out my retirement accounts and also set up automatic deductions from my checking account into each my savings account and my brokerage account. Money that I squirrel away without ever seeing doesn’t really tempt me, and it is encouraging to see those accounts grow when I check them periodically.

For me, the trickiest part has been avoiding lifestyle creep. Friends seem to be taking extravagant vacations and buying designer clothes, and I have really avoided much of that- not because it is “bad” but because I have come to realize that those are relatively low priorities for me. Excessive grocery spending, though, that’s a real temptation to blow my savings rate.

HSAL

This is going to sound flip, but don’t have kids. Household income is around 85K – if we didn’t have a child we’d be able to save about 30% post tax, but with daycare and other costs it’s more like 5%.

Less flip, I think it’s just about living like a college student. Smaller homes, smaller cars, spending mainly on “needs” instead of “wants.” This obviously gets easier the higher your income is. This year I’m taking our raises and decreases in health insurance and sending those directly to savings, so I’ll never have a chance to miss it.

afd afd

I recently graduated and I’m saving almost 50% of my income . .. by living almost exactly as I lived in college.

Actually among my classmates and older friends that is the general advice that everyone gives and does – to continue living like you did in college, especially since most people work in the same city where we went to school, so its not actually a huge difference

Veronica Mars

And don’t get a furbaby either. Pets are expensive!

Two Cents

I hear you, but too late. :) Two toddlers…. and $5K a month in daycare…

TheElms

To save 50% of your income you have to prioritize and then typically have to reduce your biggest expenses to achieve the priorities. For most people that is things like mortgage/rent, car payments, and student loans. For example if you are currently renting a 2 bedroom but could manage in a 1 bedroom you would break your lease and rent a 1 bedroom or get a roommate. You’d save the difference. You can also get there if you have high big ticket items but are extremely careful with your discretionary spending. Also, it helps if you salary is relatively large to start with because then mandatory items account for a smaller percentage of your salary.

In my first year working as an attorney I saved at least 50% of my salary because I knew at the end of the year I needed to buy a car and I wanted to knock out some student loans. I made $160k and rented a room in a group apartment for $1100 including utilities, cable, internet etc. I didn’t own a car, so no car payment and I took public transit to work, which was subsidized by work. I lived in a walkable neighborhood so I could walk anywhere I wanted to go on the weekend or take public transit. After the subsidy I it was $100 a month to get to work. Over the course of that year I could probably count on one hand the number of times I took a cab that work didn’t pay (work paid if I worked late). I had a reasonable work and fun wardrobe to begin with so I think I probably spent less than $500 on clothes over the year. I rarely ate out and had some meals covered by work because of working late. I probably spent about $200 a month on food. I was working long hours so I didn’t have a great deal of time to do fun stuff, so I probably only spent about $100 on entertainment a month. I think my cell phone bill was about $50 a month. I was paying about $2k a month in student loan repayments (just to cover the required minimums) so that was a big chunk of my budget. And I know I took a vacation that cost about $5k. So if you add all that up its about $3550 a month in fixed expenses or about $42,600 annually plus the clothes and vacation and it came to about $48,100 and because I’m sure there were other things I can’t remember now I’ll say the total was $50,000. I paid the tax on my $160k salary and saved the difference. It wasn’t the most fun year of my life, but I got to take a nice vacation which was a priority and I had the money to pay off a big chunk of my student loans and buy a car which I needed.

TheElms

And I’ll say that 50% all the time may simply not be realistic. Life got complicated, I got married, added furbabies, bought a house. This year’s goals include:

– pay off second mortgage on house

– continue funding emergency fund (we want a year of living expenses)

– continue funding various targeted savings accounts (new car, vacation, pet)

– set up and contribute to Roth IRA’s (this has been a big failure in the past)

– save as much as possible for retirement (still trying to work out what percent this will be)

Last year I paid off my student loans, paid for some house renovations in cash, continued to fund various targeted savings accounts, maxed out 401Ks.

Anonymous

I save close to 60% of my net income (after taxes but including my 401(k) contribution). My net income is approximately $158k, and I live on about $65k.

I own a condo and my housing costs are about $2k a month, I paid off my student loans a couple years ago, and I don’t have a car. I also don’t have kids. I spend about $10k annually on charitable contributions, and I travel frequently but stay with friends or use Airbnb instead of hotels. The rest of my spending is smaller discretionary spending, which makes it easy to ramp up or cut back depending on the month.

Bottom line, 60% savings would be much harder on a smaller income.

Anonymous

Agreed. This just doesn’t work if you are making $75k. Net, after taxes, 401k deductions and health insurance, $75k amounts to close to $40k. Very tough to save 60% of your income when your net is only $40k, even if you don’t have kids and cook all of your meals and don’t take vacations and live in a one bedroom and never get coffee or buy new clothes.

Anonymous @ 3:36

Exactly. There are some things I do that I recommend to others trying to save money (being able to live without a car can be huge), but I also tell people that the easiest way to save money is to focus on making more of it.

Ellen

You MUST have a rich UNCLE to save 50%, or a dad that pay’s all your bill’s. Personaly, I have my dad manage all of my finances, and he would NOT tell me what percentage of my income he is saveing for me. I know he has a 401(k) and the Partnership fund for me, but he also has stocks and bonds with Merill that Ed manage’s for me. I hope it is goieng to be enough b/c I do NOT have a husband to earn money to pay all of my expenses, YET, but I am workeing on it! YAY!!!!!!

Anony4this

You know your anxiety is at an all time low and your cynicism at an all time high when you don’t care that there is a crazy man on the street outside your office threatening that he has a bomb and the police are swarming. Our building is somewhat off the main road and I just cannot be bothered to give an F.

afd afd

What? Where are you? Stay safe!

Anony4this

Thanks! I am not in a major metro area. Apparently, the guy lives down the street in a mobile home park and is upset that his gas was turned off for nonpayment, so naturally, bomb threat?

Police have cleared the area and all is well it seems. Good times!

D.C. Travel Advice

I am headed to D.C. with a friend for a long weekend in early March. I would love recommendations where to dine and what to do while there.

CMT

NMAAHC!

D.C. Travel Advice

All of the passes are already gone for the days we are traveling, but I have my fingers crossed that I can snag two tickets with the same-day online option or the walk ups option.

DC Anon

Restaurants on 14th St:

Estadio (amazing tapas and housemade G&Ts plus sherry cocktails)

Ghibellina (delicious Italian food, great amaro selection, buzzy bar)

I have eaten at the bar at both of these places and would highly recommend it if you’re with just one other person.

Restaurants in Shaw:

Table (hipstery, consistently outstanding food)

Kinship (luxe, low lighting, get the lobster french toast)

The Dabney (gorgeous ambiance, entrance is located in an alley, food and drinks are farm to table delicious)

Try to get reservations for after-dinner cocktails at Columbia Room

If you can’t get into Columbia Room, go to Chaplin’s (Japanese silent film themed cocktail and dumpling bar)

If the weather is nice, do a segway tour of the monuments. Sounds cheesy, but it’s the best way to see everything in a couple hours. Walking around Georgetown is fun (although don’t plan on eating there; most of the restaurants are tourist traps). I’d also recommend walking around Dupont. DGS Delicatessen is a great lunch or brunch option (the reubens are killer).

Anon

For things to do, my favorites museums are the Newseum, the American History Museum, the National Gallery (highlights are the East Wing, the people mover to get between the two buildings and the da Vinci), and the Phillips collection (particularly the Rothko room). If you have good weather, you could rent bike shares and ride around the mall and depending on your comfort level you could use bikes to see some less touristy neighborhoods like Shaw, H Street NE, or Columbia Heights.

For food, some of my favorites are Rasika, Toki Underground, and Thai X-ing. Toki Underground usually has super long waits, but there are tons of bars nearby where you can go while you’re waiting.

TO Lawyer

I set savings goals but they’re generally just a breakdown of what I’d like to save in each bucket that year: emergency, slush fund, TFSA and RRSP. I direct the savings into each account out of each paycheck so it takes me a couple hours at the beginning of the year to figure out what to do) and then it’s hands off. Sometimes I put a target extra amount i.e. let’s say I want to say $5ooo in addition to the biweekly contributions and I do that as I go. So if one month, there’s an extra few hundred dollars over the cushion I like to leave in my checking account, that may go towards that target.

Anon

I have a question about 529s. I live in California. In California, you can’t get a tax deduction for contributions to a 529. Does it still make sense to use a 529 as an investment vehicle for kid college expenses? Would appreciate hearing from other Californians on their practices here.

AZCPA

In most places, the deduction for contributing is fairly minor anyway – all the real benefits are long term. The money you contribute grows tax free for both federal and state income tax purposes. So there are significant benefits to using one!

AB

The blog kimberlymichelle.com did a write up on her choice to use a certain 529 in California.

Carrots

I have two goals and they’re are fairly simple:

– keep within the budgets I set up in YNAB – anything extra goes towards student loan payments focusing on highest interest first.

– the last couple of years I’ve been doing the weekly savings challenge (Week 1, $1; Week 2, $2; etc.). I’m doubling the amounts this year, especially since the account I was putting them in (not my emergency savings) was what I used to go to Europe this past fall.

Marshmallow

We have one overarching financial goal for this year: zero credit card debt by 2018. We have a LOT to pay off so it’s a big task. We will be reshuffling our balances to get as much on no-interest promos as possible, then paying down steadily throughout the year until (fingers crossed) an anticipated bonus can knock the rest out.

Marshmallow

I just did some math and apparently our credit card debt is about 23% of our household income. It’s less horrible than I had in my head. One bite at a time!

Anon

Goals this year:

– Continue contributing 6% to my 401K. This is a number I can live with in comparison to my other expenses and a BIG improvement over about 3 years ago and a .5% increase from last year.

– Pay off one credit card by April, pay off another by the end of 2017.

– refinance private student loans. I just need to take the time and do this now.

– no new credit card debt (I’ve hit this goal for two years in a row – something I’m proud of).

– Continue making regular deposits into my savings account

In the past, I’ve set too lofty, not realistic goals. These are realistic and take into account putting more into an emergency fund, whereas before I was so focused on paying down debt that I didn’t put enough in an emergency fund and low and behold, emergencies happen (can you say both toilets broke in the same week or three appliances in one day?). I’ve realized I have to put some in savings even though I’d rather pay down the debt. Instead, I put regular amounts in savings and come up with reasonable pay off goals and go one by one using the snowball method. I’m making progress each year and that is what matters.

emeralds

I had really detailed financial goals for 2016, and a progress worksheet that I stuck on the fridge where I’d see it every day. But then 2016 ended up being a money pit (some my fault, mostly unavoidable emergencies), so my revised goal just became to survive from March-August without tanking my savings, and then build my emergency fund back up by the new year. And I did it! Barely, but I did it.

Fingers crossed that 2017 should be easier. I want to start working on my down payment fund again, take a vacation this summer, and buy a new couch because ours is gross and broken (like literally, it’s being held together by a sheet of plywood and wood glue). January is looking expensive, because a ton of my mid-ticket seasonal items seem to have died at the same time (snow boots, fleece running leggings, coat is on life support with lining halfway ripped out…) but I’m trying to space them out as much as I can.

emeralds

Oh: no CC debt, no student loans, happy for now with my level of retirement savings.

Poll time

Poll for NY metro dwellers (feel free to go anonymous for this)

1) Do you own or rent?

2) Where? (which borough/neighborhood, or town if in the suburbs)

If you own:

3a) How much did you pay for your home?

3b) Condo, townhouse, single-family home, other?

3c) What are the costs of your HOA, taxes, other recurring fees?

If you rent:

4a) How much is your rent?

4b) I’m particularly interested in people that have made a conscious decision to rent rather than own, and specific numbers/factors that went into your decision

5) Are you happy that you decided to buy/continue renting and why?

Sydney Bristow

Rent

Queens

~$1950/month for a 1-bedroom (rent stabilized)

My student loans are the value of a small house elsewhere in the country. There was no way that we could afford to buy a place without borrowing significant money from my husband’s parents (who were willing) for a large portion of our down payment. We weren’t comfortable with taking on that kind of family debt in addition to a large mortgage in addition to my student loans. Apartments in our neighborhood according to Zillow are going for at least $600k. There are sometimes places cheaper than that ($350k is probably the cheapest I’ve seen) but they are in such rough shape that it almost isn’t livable.

Anonymous

1) Do you own or rent?

2) Where? (which borough/neighborhood, or town if in the suburbs)

If you own:

3a) How much did you pay for your home?

3b) Condo, townhouse, single-family home, other?

3c) What are the costs of your HOA, taxes, other recurring fees?

If you rent:

4a) How much is your rent? $2750 (HHI around $290k last year)

4b) I’m particularly interested in people that have made a conscious decision to rent rather than own, and specific numbers/factors that went into your decision.

I decided to rent for several reasons. (1) Flexibility. I am in Biglaw now, and don’t know if I intend to stay in it forever. To buy an apartment comparable to the apartment I rent, I wouldn’t have the option of downgrading my income very substantially because I would have to keep paying a hefty mortgage/maintenance on a monthly basis. (2) In New York City, the value proposition for me simply wasn’t there. All of the places I looked at that I could afford had $1000+ monthly maintenance on top of the mortgage, so my housing costs were going to go up, and I didn’t feel the tax deduction would outweigh it. (3) I may leave New York City within 5 years, and the transactional costs of buying and selling within that time frame would cut into any money I would leave with and my mortgage would likely be so large that I would accrue almost no equity. (4) This is the biggest one. I didn’t want to tie up a significant part of my cash liquidity in an illiquid asset. For what it is worth, I don’t know a single person in NYC in my age range who bought whose parents didn’t either provide the down payment, “lend” the down payment at 0% interest, or buy the apartment for them outright. For me, it was all me, and I simply wasn’t comfortable tying up so much of my savings into one asset.

5) Are you happy that you decided to buy/continue renting and why?

Anon for this

Rent by myself, UWS (Lincoln Center), $3,000 for 1 BR, Income ~$250k last year

I decided to rent because I don’t expect to be living in a 1 BR for the 8 to 9 years for the amount of the fees to make sense to buy. Also, I think right now the monthly amount I’d pay to own a similar place that I rent is pricing in a much higher growth than I personally think is there for this market (~5 to 6% based on my assumptions, and historical growth rates are closer to 1 to 2% over the long term). I’ll consider buying if there’s another market crash and the prices make sense relative to renting.

Anonymous

1) Do you own or rent? Own

2) Where? (which borough/neighborhood, or town if in the suburbs) Kensington Brooklyn

If you own:

3a) How much did you pay for your home? $640K

3b) Condo, townhouse, single-family home, other? Coop

3c) What are the costs of your HOA, taxes, other recurring fees? Approx $900

If you rent:

4a) How much is your rent?

4b) I’m particularly interested in people that have made a conscious decision to rent rather than own, and specific numbers/factors that went into your decision

5) Are you happy that you decided to buy/continue renting and why? We bought very recently and are very happy with the decision. We were able to buy a large 2+ bedroom coop that was similar in size to our old rent-stabilized apartment, in the same neighborhood, and zoned for the same decent school. Our monthly costs are going to be almost the same after taxes (coop maintenance is partly deductible as it goes to the building’s mortgage), and we now know we can stay in this neighborhood, which is quickly going up in price. Because we were lucky enough to have a rent stabilized apartment before we had that peace of mind we could continue to afford it, but we knew that our apartment would never get any nicer than it was – the landlord had no incentive to fix it up, and whenever they fixed anything it was of the worst quality you could imagine. We renovated our new place (well, still in progress, sigh) and it was amazing actually being able to pick out finishes, arrange the kitchen how we want it, etc. And we now have insane luxuries like an ice maker (only in NY does this seem exotic) and a built-in dishwasher. We feel pretty confident our investment will appreciate in value and plan to live here for the foreseeable future. (We’re in our 40s and have 1 child).

Anonymous

Poll for NY metro dwellers (feel free to go anonymous for this)

1) Do you own or rent?

2) Where? (which borough/neighborhood, or town if in the suburbs)

If you own:

3a) How much did you pay for your home?

3b) Condo, townhouse, single-family home, other?

3c) What are the costs of your HOA, taxes, other recurring fees?

If you rent:

4a) How much is your rent?

4b) I’m particularly interested in people that have made a conscious decision to rent rather than own, and specific numbers/factors that went into your decision

5) Are you happy that you decided to buy/continue renting and why?

I currently live in a coop owned by my family in Williamsburg, paying $800 a month for maintenance, but I just entered into a contract to purchase a coop in Jackson Heights, Queens. It’s a one bedroom for $470k with maintenance of $750. We put in the offer back in October. I’m somewhat nervous about the interest rate hikes and the economy/possible end of the world. Other than that, I feel good about the purchase.

Anonymous

The last couple of years weren’t great for us. I finished up a degree and had no income for 2015-2016. We moved at the end of the year and I (stupidly) procrastinated hard-core job searching by spending a ton of time and money on furnishing/decorating our new place. In 2015-2016, we had an average $2,000 monthly loss. We had robust savings before– now that’s been depleted with only our emergency fund left. I am so lucky DH is both extremely understanding and has a good income, because it could have been a disaster.

This year, even before I find a job, we’ll be at a $1,500 gain monthly. We are on a serious budget kick. We’re committed to making meal plans every Sunday and only cooking meals that fit within our weekly $75 grocery budget. Our restaurant budget is $100 per month, compared to an average of around $500 per month last year. We’re strictly adhering to all other areas of our budget too– I’ve been using YNAB for years but have always found it too easy to convince myself it’s OK to go over budget. It’s not OK in 2017.

June

Congratulations on moving in the right direction! Your self awareness and conscientiousness will serve you well going forward.

Sydney Bristow

I totally hear you on convincing yourself to go over budget each month. I’ve been doing the same for the past couple of years. I’ve given myself a $100 cushion to go over each month this year in an attempt to try and curb this impulse.

Sydney Bristow

After someone asked about the amount spent on clothing in 2016, I went through and calculated the amount and percentage I spent for all of my budget categories. It was a painful realization even though I’m able to pay cash for all of those things. I haven’t added to my debt and only have student loans, but I really need to pay down my student loans and haven’t been working hard enough on that.

In 2016, I spent 23.4% of my take home pay on my minimum student loan payments and 8.2% on extra payments. My IBR minimum payments will be going up for 2017 so my first goal is to increase both of these percentages.

In 2016, I contributed 6% of my income to my 401K and saved an additional 7.3% of my take home pay to my emergency fund. I’m comfortable with my emergency fund as it is, so I’d like to keep the 401K number the same in 2017 and move that 7.3% to my student loans.

In 2016, 7.3% of my take home pay went to “miscellaneous” expenses. I’ve adjusted my YNAB categories to be more specific and break this down. I now have categories for toiletries, entertainment, and books, which should catch a lot of that miscellaneous amount. Overall, I want to decrease my spending in these categories and wind up at a smaller percentage for these categories combined in 2017.

Before this year began, I sat down and listed out all the trips that we have planned and the ones we’ve talked about doing but haven’t completely decided on yet. I put numbers down for expected flight, hotel, rental car, etc costs and divided by 12. My goal is to move that number to my trip savings account each month.

Food is the other category that I spent more than I realized (11% of take home pay) and didn’t really pinpoint where the main issue was. Really it is everything, but I broke down my food category in YNAB to groceries, Seamless/eating out, and lunches out at work. I want the total percentage for these categories to be lower this year and hopefully breaking it out will make it easier to know where cutting back will make the most difference.

Any category that I can save money in will be funneled to my student loans. My only other resolution was that I would stay within $100 of my monthly budget (which I’ve laid out entirely ahead of time) and that any difference between my income and expenses will be sent to my loans. I’m buckling down in 2017.

Celia

I had a successful savings event years ago. I’ve never made very much money (teaching high school was actuallly the second highest gross income for me –yikes!). So:

You know how the grocery stores put “you saved $X.XX today!” on your receipts? I would take that amount in cash and stick it in an envelope. I was able to save up for new tires in just three months. Considering they cost 2/3 my rent, and I didn’t have a credit card at the time, I think that was pretty good.

My parents used cash envelopes for everything when they started out. Nowadays, we can do mini-accounts with online banking. It’s not really “saving” unless you actually put the money aside, right?

Anon

Pay off my student loans (~38K left, should be gone by August 2017)

Merge finances (fully? partially?) with now-Husband

Save, save, save for robust emergency fund/down payment fund/baby fund

Anon

This year’s goals:

1. Continue contributing 10% to 401k (6% from me, 4% match).

2. Continue maxing out HSA – the balance will simultaneously be drawn down as I do egg banking, but at least I’ll be using pre-tax dollars for nearly all the out of pocket expenses.

3. Save $10-12k from post-tax income toward an eventual downpayment. While accumulating capital will continue, I’m not planning on buying anything until we have a correction in the real estate market.

4. Looking to switch firms for the next logical career step, which should also come with a ~30-40% salary bump.

Anon

My husband and I decided after getting married to tackle student loans. We instituted our own form of austerity – held off on all unnecessary expenses, delayed all big-ticket purchases, shopped sales – and paid them off within a year. We also learned a lot about contentment during that time. It’s amazing how satisfied you can be with your own belongings when you just don’t look at the catalogs or ads. Since then we’ve stayed debt-free and now save about 30% of our income.

We’ve also decided to set charitable giving goals. We plan out our own financial expenses–so why not plan and make sure we’re in a position to be able to give and be generous as well? We are Christians (and grew up with the concept of tithing) so we decided that giving away 10% of our income (pre-tax, pre-everything) is a non-negotiable commitment for us. As we hit other financial targets, we increase our giving to various organizations (and sometimes individuals) by another percentage point. This has been an effective way of forcing us to include others in our financial goals.

newlawyer

I am saving up for a down payment on a house, estimated goal date summer 2018. I have about $45k in savings (outside of my emergency fund and 401k) to use on the house, and it is just sitting in a bank account earning close to nothing. Has anyone used safe investment strategies for money that you are not trying to invest long term but know that you will need in a relatively short period (i.e. ~1.5 yrs)? Not looking for a huge return obviously, just anything more than 1%. New to investing and any advice would be very useful. TIA.

Anonymous

I’m a fan of Betterment. It’s a robo investment advisor that allocates your money into different index funds. You can do the same thing yourself on Vanguard but for the time it saves and the user friendly interface, the fee is worth it to me. I started an IRA roth account on Betterment back in 2014 (before I started a job with a 401k and my income still qualified for a Roth) with a mix of 90%/10% stocks/bonds mix and it’s earned 15% so far (obviously, it will fluctuate). The value of the amount has dropped as much as 5% in one day after events like the Brexit but it recovers – and overall, I am satisfied with the earnings. By comparison, I started another portfolio on Betterment in early 2016 with a 85%/15% mix for a down payment, I started with 10k and have contributed 40k total for the year, and so far, it’s earned 2.3% of the overall amount so far – which is pretty good since I didn’t contribute 40k from the start.

I also have some money in individual stocks which I trade via Robinhood, which I really love. if you’re new to trading stocks, it’s a good platform to start with since it’s commission free trading. You can start with like 10 shares of a stock just to see how it works. But keep in mind that stocks you hold for less than a year is taxed at the same rate as your income tax, which really adds up.

My goal is to max out my 401k (18k), pay off my student loans in Q2 (9k), and save 40% of my net income (excluding the 401k). My income is ~210k.