Tales from the Wallet: Why You Might Need A Sinking Fund

This post may contain affiliate links and Corporette® may earn commissions for purchases made through links in this post. As an Amazon Associate, I earn from qualifying purchases.

I've always been a fan of amortizing for certain expenses by saving money each month in a special spot, aka a sinking fund. It's been a while since we discussed this — readers, do you have sinking funds? What are your big sinking fund categories?

In the past we've shared our money roadmap (what to do first/next in your personal finance journey), how to automate your savings and how to set up automatic investing, as well as discussed how to save for multiple financial goals. We've also talked about where to keep your emergency fund, and where to stash your cash when you're unsure what you're saving for (e.g., retirement, wedding, house, etc).

(Some of our more specific discussions that I often think about including surviving divorce, financially, as well as how to pay off big student loans and other big debts. We've also shared financial tips for new lawyers and others in their first high-paying jobs!)

What is a Sinking Fund?

A sinking fund is a way of saving money to spend it in the short term. It's designed to address large but irregular expenses. It differs from a regular savings account or emergency fund because the money is already earmarked to be spent.

Should You Invest Your Sinking Fund?

Generally expenses for your sinking fund should be on the near horizon, so it probably doesn't make sense to invest the money into stocks or index funds. If you're not quite sure what you're saving for (wedding? house? grad school?) then I think it makes more sense to invest that money (automatically if you can!).

I would really hesitate to use retirement savings for any of those purposes, though, so I probably would not save them there unless you have a Roth and your timeline is more than 5 years away because you can always take the principal out of a Roth after it's been in it for five years.

Why Would You Need a Sinking Fund?

Less Stress for Large Bills / A Gift to Your Future Self

I've always been a huge fan of sinking funds because let's face it, sometimes you get a large bill and it feels kind of painful, even if it is somewhat expected! For my husband and me, the one that started me on my journey towards sinking funds was our term insurance. We got it all set up when our youngest son was born, and then I kind of forgot about it… a year later we got the relatively large bills for both of us — and at the same time because we'd set up our term insurance policies at the same time.

That first bill was pretty painful — in part because we were overinsured, which was easily adjusted down. (Now we're both basically covered enough to pay the mortgage if one of us dies.) But I still decided it was time to set up an account to save for this once-a-year set of bills.

At first, I just totaled the premium amounts on the term insurance, then divided by 12 — muuuch more doable. Then, as I started thinking about it, I decided to total all of our various insurance premiums, and divided that new total by 12. I set up an automatic transfer to a high yield savings account, and voila, my first sinking fund was created.

Good Interest While You Wait

This is another benefit of sinking funds – you can set them up in a high yield savings account or even a short term CD to get a better interest rate than you might if you kept the money in your savings account.

This is in contrast to the high interest rates you might pay if you put some of the expenses on credit cards, too.

Clear Delineations from Other Accounts

I suppose I could have just taken the money from our emergency fund, and then replaced the money with those automatic transfers I'd set up… but I'm one of those people who really hates touching the emergency fund.

On the flip side, when the insurance bills come, I have no qualms about using our sinking fund for insurance to pay the money. Almost every single time I do this, instead of feeling guilty or like we're living beyond our means, I feel relieved that I thought to do this all those moons ago. It's kind of like a gift to my future self.

My Sinking Fund Categories

Once you figure out the logistics, it's really easy to set up sinking funds, particularly with high yield savings accounts where it's easy to set up different “buckets” or even entirely different accounts. I've used Ally for years, but there are others out there (and this post is not sponsored).

Other sinking fund categories that I've used over the years:

- insurance (general)

- health — I've always tried to put however much we think we might need for our deductible into a savings account to make large healthcare bills a bit more palatable, and I recently started a monthly transfer for our new health savings account

- condo/house projects — we've had big amounts set aside and little amounts set aside. I sometimes, like now, like to set a really small amount aside every month ($20) even though we don't know what we might spend it on… then when we suddenly decide to replace tile or wallpaper the powder room or something like that, the money set aside already makes me feel better about moving forward on the project.

- Roth IRA — each month we set aside money for my husband's Roth IRA contribution (our accountant advised against my having one)

- Vacation funds — as a family of 4 vacations can be pretty expensive, so I've tried to assess how much various types of vacations might cost for us, and how often we'd want to go on them, and then set up automatic transfers for each of those… as the money grows it reminds me it's time to plan a vacation. This is one of those situations where the delineation from other accounts really helps me justify spending the money.

- Expensive kid stuff — We don't currently have any sinking funds set up for the kids, but in years past I've had them for two situations. First, if the kids had very expensive classes ($700+) on a semi-regular basis… or second, a large tuition expense that I preferred to spread out over 12 months instead of 9.

- (for the business, I have sinking funds set up for 1) taxes and my retirement — taxes I pay 3-5 times a year for estimated taxes and sometimes extra at tax time if the estimated taxes didn't capture everything; for my retirement it's one big contribution per year and 2) continuing education / contractors / legal / accounting)

It's not quite a sinking fund, but I do have a “Griffin Fun Money” fund that is separate from the emergency fund

How to Set Up a Sinking Fund

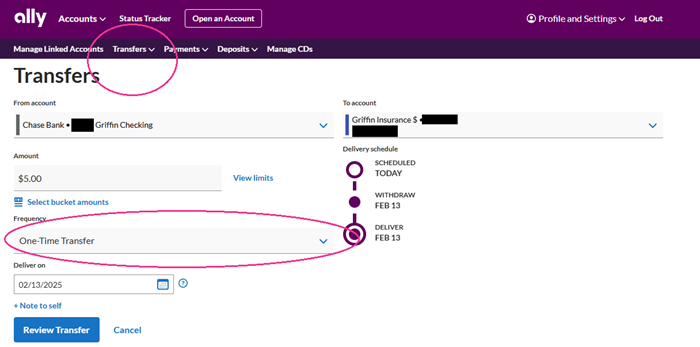

Each bank is a bit different, but you're going to look for a “Transfers” section — and there's almost always a way to set it up so it is a repeating transfer.

Here's how it looks in Ally (for me, at least) when I want to transfer money from Chase (where we do our daily banking) to an Ally account. When I click the Frequency dropdown menu, I have the option to set the transfer up on a regular basis like biweekly, to choose a specific day of the month, or to choose a repeating day like first/last business day of each month. You can also set up an end date to stop the transfers.

If you have a lot of repeating transfers and automated savings/investments, make sure you keep a list of what amount is transferring and when!

Stock photo via Pexels / maitree rimthong.

So a sinking fund is just a fancy name for saving up?

That was my thought.

I estimated all of my random annual expenses: AAA, memberships, bar licensure, car repairs, Christmas presents, etc., divided by 12, and put that into my monthly budget.

Glad this works for you, but having 15 different savings accounts would drive me batty. We just do an annual budget (incl. one-off anticipated expenses) and keep enough in the checking account to cover a month or two of everything at a time. If it starts feeling like that’s running low, we check against our projection.

YNAB. YNAB is the answer for this, not a million separate bank accounts.

I know readers here love it but I could not stand it when I tried it! It was many years ago though.

I DIY’d an envelope budgeting system with Excel. Much easier, more customizable, and more user-friendly.

Like these suggestions. We have a historic high dividends stock brokerage account with southern hemisphere investments that is serving as an additional sinking fund/rainy day fund. We also maintain a checking and savings that’s only for these foreseeable but sometimes surprise purposes. My mom calls it the “envelope” system.