This post may contain affiliate links and Corporette® may earn commissions for purchases made through links in this post. As an Amazon Associate, I earn from qualifying purchases.

How do you prevent “frugal fatigue,” also sometimes called “savings burnout”? It’s that feeling that you’ve been scrimping and saving and you have no money and the debts are still there and you’re not getting anywhere and dammit you just want to not think about it and buy what you want for a little while?

I know readers have talked about this, and when I was writing the post about my budget spreadsheet, I realized that I have another spreadsheet I use also that, for me, prevents this kind of frugal fatigue: my “snapshot spreadsheet.”

This is how I personally prevent frugal fatigue, but I’m curious to hear from you guys — ladies, how do you prevent savings burnout? Do you rely on Mint or YNAB to give you an accurate picture of your net worth? How do you track net worth changes? Do you have similar ways of recognizing and patting yourself on the back for major monetary accomplishments, like debt payment or saving? (These particularly are helpful in guarding against savings burnout!)

Let me backtrack: when we bought our apartment, we had to keep a list of all of our accounts in an Excel spreadsheet. I’d been using Microsoft Money since college and had set up Mint when we got married, but I was intrigued by a) how this listing of all our accounts felt like a much more detailed, yet simple picture of our money situation, and b) how often I had to update the numbers, even in the short time frame around closing.

Investments changed as the stock market fluctuated, debts that we owed changed as we paid them off or accrued new ones (like our credit cards), and so forth. Mint tracked it all, but it was on a micro-basis — I was always startled by how the numbers changed when I came in to do my Excel spreadsheet.

So, even after we closed, I decided it was a useful exercise — so every 6 months or so, I take a “money snapshot.”

Our “Financial Snapshot” Spreadsheet Tracks…

Liquid Assets Available – This section of the chart lists every bank account on its own line. For us right now this includes Chase checking and saving (personal), Chase checking and saving (business — I suppose it’s debatable whether I should include business accounts on this spreadsheet, but I’m a small enough operation that I do), Ally, cash we keep in Schwab and Vanguard (not yet invested in the market). I total it at the bottom: Total Cash.

Investments – This section lists every investment account we have (but not individual positions, which I only keep track of when I intend to take action, like asset reallocation or selling losing stocks to get capital losses). This is where the “snapshot” comes in — it’s just a snapshot of how much money we hold in each account, with full knowledge that it’s changing by the second. This includes joint accounts in Schwab and Vanguard, individual pre-marriage accounts in Schwab and Vanguard, and our 401Ks, IRAs, and 529s. That section has a little total at the bottom: Total Investments.

Debts – This section lists the total debt remaining on our mortgage and student loans, and our current credit card balance (which I always do my best to pay off every month).

Assets – This is closely modeled on the section on Mint that has the assets, and I’ve watched it with varying degrees of intensity over the years. Right after we bought the apartment, Mint indicated that the value plummeted, and the bottom dropped out of my stomach. We were still happy with our purchase and felt like we got a good deal, but it bummed me out to see this lower valuation on paper. So I changed it in Mint and stopped tracking the “value” according to Mint, and instead just entered what we had paid for the apartment as a straight valuation — that was what it was worth to me. After a few years, I changed it back to tracking the real estate market, but tried to keep any wide swings in the real estate market (up or down) in perspective. I also “count” the things we list on our personal articles policy here, items like my pearls, engagement ring, and Cartier watch, but I know I’m not accurately tracking resale value either — it’s just another number, and kind of aligns it with my Mint account.

SO! Then I total all our assets — then all our liabilities. Then, after a few years of doing this, I decided to start tracking change — and that is a really long-winded way, perhaps, of addressing how I prevent savings burnout or frugal fatigue.

- Asset increase over last time: (a dollar amount)

- Debt decrease over last time: ($)

- Asset increase over last time: (a percentage)

- Asset increase over one year ago: (%)

- Debt decrease over last time: (%)

- Debt decrease since one year ago: (%)

- Change in estimated house value: ($)

- Asset increase/decrease not counting house: ($)

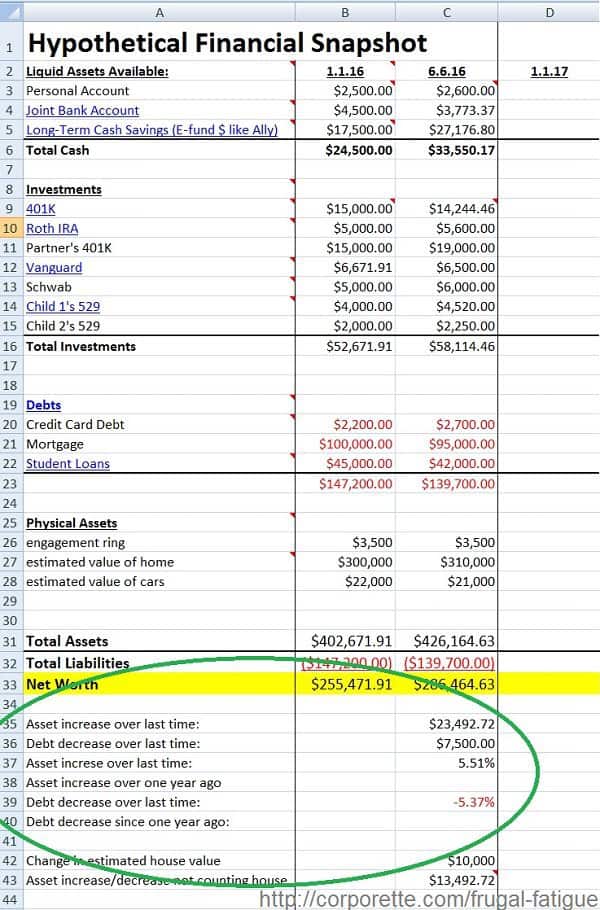

I like seeing the difference and how things change, and it encourages me — even if it feels like we’re butting up against our monthly limits because we’ve prioritized savings, or even if it feels like I’m always watching the bottom line, it reminds me of the greater goals in the picture. (The image coming to mind right now is one of chipping away at like four different icebergs at the same time…) In case it’s helpful to you guys I’ve mocked up a hypothetical snapshot to show you how it might look for a woman married with 2 kids and a house worth $300K:

So, in this hypothetical, you can see that without any huge change to individual accounts (no windfalls, no inheritances, nothing) they increased their assets by $23K and decreased their debt by $7500K — which is awesome! Sure, $10K of that was from the “estimated house value,” but it was still an asset increase of almost $13,500 in only six months. Go team!

You can download a copy of the hypothetical snapshot above to customize for yourself here if you’d like.

Ladies, this is my method for preventing savings burnout — what do you guys do? I’d love to hear your thoughts and methods. (Do you have a similar tracking system for your net worth — or do you prefer to rely on Mint or another system?)

Further reading:

- Do You Get Saver’s Fatigue? [Financially Blonde]

- 10 Ways to Make Frugality Fun [Bankrate]

- 12 Ways to Fight Off Frugal Fatigue [Mint Life]

Ellen

Kat/Kate, this is the STORY of my LIFE! I am constantley batteling FRUEGEL Fatigue, in that I have so many obligation’s that it gets me crazy–thank God I have Dad to handel the financieal obligations, such as balanceing my checkbook, paying my bills, investeing my 401K money, and putting a hold on my credit card’s when he see’s I am spendeing to much!

Frankly, Dad is tired of being my keeper, and that is why he is pushing almost every man that comes around toward me in the hope they will MARRY me and take him off the hook. The number of sheer looser’s he has tried to foist off on me since Sheketovits is ASTOUNDEING! Virtually every schmoe that has exhibited even the slightest interest in me (even for sex) all of a sudden is “a catch” for me. No thank you, Dad, I do NOT want to catch a fish I already know is smelley!

I need a REAL man to take care of all of my finance’s, and in exchange, I will become a mother to OUR children, and teach them to be good kid’s so that they will grow up to be sucesful! I also will be abel, if I MARRY the right guy, to RETIRE from my 8,000 hour annual comitment into something FAR more manageable! YAY!!!!!

Freda

Wow Ellen you need to grow up and handle your own money. Put on your big girl panties now. I would be ashamed and embarassed to depend on someone else to handle my own money. It’s called being an adult and you sound like you’re in extended adolescence. It’s all right to want to get married and have children but no man wants to marry a toddler. It sou d’s like you have no co tell over your own life and that is despicable.

FunMoneyMoneyMoneyMoneyMoney!

Coincidentally on the subject of money this afternoon…. : )

I am curious if anyone has had success setting a “weekend” budget–i.e. “I have $X to spend on (whatever) each weekend. If so, how much and what does that generally include? Significant Other and I are in the process of merging finances and this has come up–our present thinking is that the defined amount would be for purely discretionary things we do on weekends–i.e. meals out, spa/massage appointments, movies/plays/concerts, beer festivals, etc. etc. etc. and NOT include items in our other budget categories such as groceries, travel (long weekends would be budgeted for elsewhere, so this would just be “typical” Friday night through return to work on Monday in our moderate/upper moderate cost of living city. Thanks!

Sarabeth

We have a monthly budget line for dining out, and another for “other discretionary.” For us, “other discretionary” is mostly movie/performance tickets, museum entries, and social dance classes. I find it much more useful to think about a monthly basis than on a weekly basis, mostly because the overall amount is small enough that one set of ballet tickets would be more than 1/4 of the monthly budget. I want to be able to smooth things over a slightly longer timeframe (also, we use YNAB, which is organized monthly).

Anonymous

I agree that monthly might work better than weekly. We do something similar looking out across the entire year. Every month I have a set amount automatically transferred into a savings account. I use it as kind of a variable expense savings account. So we know about what we spend per year on renewing our theater subscription, concert tickets, the satellite radio, special events we go to once a year, etc. Then I also add in enough to cover gifts throughout the year (both expected and random sudden engagement presents), vet bills, car repairs, and bar dues. All the things that are going to come up about once a year but you don’t necessarily know when or how much. But also enough to be like “omg my favorite band is playing on Friday?? I must go at any price!”

So every month a fixed amount goes in and we keep a pad of a couple thousand for the bad surprise car/vet stuff just in case. It’s like a hybrid minor emergency/fun emergency fund. That has been working well for us for about two years. Prior to that, every yearly or randomly occurring expense would blow my budget. Now I just tally up what all can be reimbursed out of that account when I get my credit card bill and transfer a chunk back to checking.

DCR

I keep track of my total assets in a similar way as Kat. In addition, when there is one goal I’m focused on (previously saving for a house down payment, now paying off the last of my student loans) I track my progress on a monthly basis. Seeing the progress each month really motivates me to keep on track, especially when I can calculate when I will meet my goal. For example, right now I know if I pay $X per month, I will pay off my student loans by the end of the year. This really motivates me to make sure that I have $X per month to spend, and I’m planning my summer vacation around still saving that much each month.

However, I freely acknowledge that my budget process works because I make a BigLaw salary. Even when in a budget mindset, I still have a lot of money. So, for example, when I wanted to buy some new clothing last month, I could balance my monthly spending budget by bringing my lunches and not eating out on the weekends. Most people do not have the kind of salary that allows for this.

Solo

It’s really hard. I am on track to pay off my student loans by the end of 2017, but that is with a lot of sacrifices and no BigLaw salary, although I should make close to 90K this year. No vacations or fun purchases. I’m 35 and single and want a kid and a house at some point, and I don’t want to start that life with student loans hanging around. Sometimes friends and family tell me I’m being too strict about it, but we do what works for us, right? The satisfaction I will have on the day of that final payment will make it all worth it.

Sydney Bristow

I use YNAB so it’s easy to see my net worth. I don’t include my investments in there because they are all in my retirement amount.

I track paying off my loans using an app called DebtPayoffA. It’s not perfect but let’s me see the change in payoff dates and amount paid based on extra payments I make. It also lets you decide whether to use the debt snowball.

None of this helps me avoid frugal fatigue. I just give up too often and wind up spending on things that technically fit in my budget but then feel a little guilty about not putting it towards my loans.

Gail the Goldfish

I keep a spreadsheet similar to this, but when I’m really feeling frugal fatigue, I deal with it the same way I deal with work burnout–I take a vacation. I’ve got a lot of student loans. They’re on track to get paid back by 2020 (I make a decent amount, but nowhere close to BigLaw salaries+bonuses). I could probably pay them back a few months earlier if I just didn’t take a week-long vacation every year (we’re not talking crazy expensive trips, here, but even a week of hotel accomodations can be the equivalent of one month’s loan payments), but I’m not going to scrimp to the point of not enjoying life for the next 4 years. This works because I’m still making enough that I can make extra payments on the loans, save for retirement, etc. Vacation feels like I’m spending the money on something good as opposed to just more stuff I probably don’t need.

Anon

I always take a couple of months break from saving when I reach a financial milestone. That makes me feel like I am having fun in my life and not always scrimping.

purplesneakers

Two ways:

– I have a set amount of money I assign as ‘fun money’ every month. It’s not much, but it gives me wiggle room in my budget for small indulgences – coffee with friends, a chocolate bar, a stamp to send a letter. This makes me feel like I’m not totally depriving myself.

– I have a list in my planner of things I want to see and do, most of which are either free or low-cost (books and movies from the library, a walk down the rec trail, window shopping.) Having concrete things to do helps keep down random spending.

I think what’s helped me the most is a change in mindset. Five moves in six years means that I’ve learned to just not but things; my litmus test is, ‘would I schlep this across the Atlantic?’ Most times, the answer is no. The other thing (and this might be cultural; I wasn’t raised in the US) is that I’ve found that as I grow older, I would rather have fewer nice things than a whole lot of junk. I’m okay with dining out once a month, or saving up to buy a nice dress, or whatever, because I find I get more pleasure out of it then.

Anonymous

+1 to the designated fun money. I actually have a separate checking account for my fun-money, and a certain small percentage of each check gets direct-deposited to that account. If I want coffee, movie tickets, a random trip to Sephora – it comes out of that account. I still get my frivolous purchases and it’s already budgeted into my monthly numbers.

babyweight

+2 I get an “allowance” of x amount out of every paycheck that goes into a separate checking account. It’s mine to burn on lunch, shoes, etc.

Runner 5

Sometimes when I’m bored of being frugal I let myself spend what I want for a few days – with the caveat that I still have to record it into my budgeting app and therefore it gets absorbed into my budget.

Caroline

I’m definitely stealing the idea of making a regular payment into a separate mad money account. My budget always falls down on meals out with friends or birthday presents. (I’m not frugal, I’d class myself as ‘careful with money’ or at least I’m trying to be.)

Caroline

Tracking the changes in debts and assets is a great idea. I’m definitely setting this up in the new year.