This post may contain affiliate links and Corporette® may earn commissions for purchases made through links in this post. As an Amazon Associate, I earn from qualifying purchases.

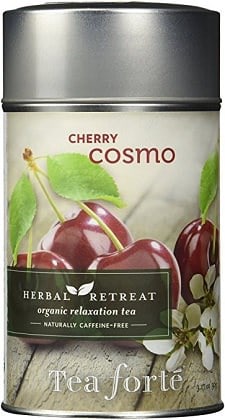

We had a pretty substantial discussion a year ago about our favorite teas, and I will say that if you're trying to cut back on or entirely cut out alcohol, drinking tea is a great way to do it. Personally, I'm a fan of anything rose hip or rooibos, but if you're looking for specific suggestions, this Cherry Cosmo is delightful. Note that this is loose leaf tea, not teabags — I bought a colorful tea infuser set off Amazon, but you can also get a traditional tea ball. If you're looking to do a Dry January this year, we'd love to hear what you're drinking instead… This Cherry Cosmo tea is $15, at Amazon. Tea Forte Herbal Retreat Cherry Cosmo Loose Leaf Organic Herbal Tea This post contains affiliate links and Corporette® may earn commissions for purchases made through links in this post. For more details see here. Thank you so much for your support!

We had a pretty substantial discussion a year ago about our favorite teas, and I will say that if you're trying to cut back on or entirely cut out alcohol, drinking tea is a great way to do it. Personally, I'm a fan of anything rose hip or rooibos, but if you're looking for specific suggestions, this Cherry Cosmo is delightful. Note that this is loose leaf tea, not teabags — I bought a colorful tea infuser set off Amazon, but you can also get a traditional tea ball. If you're looking to do a Dry January this year, we'd love to hear what you're drinking instead… This Cherry Cosmo tea is $15, at Amazon. Tea Forte Herbal Retreat Cherry Cosmo Loose Leaf Organic Herbal Tea This post contains affiliate links and Corporette® may earn commissions for purchases made through links in this post. For more details see here. Thank you so much for your support!Sales of note for 7.19.24

- Nordstrom – The Nordstrom Anniversary Sale is now open to everybody! Here are all of our picks, and here are reader favorites.

- Ann Taylor – Semi-annual sale, extra 50% off markdowns + 20% off everything!

- Banana Republic Factory – 40-60% off everything, take an extra 20% off your purchase

- Eloquii – 50% off select styles

- Everlane – Up to 70% off

- J.Crew – End of Season Sale, extra 50% off sale styles

- J.Crew Factory – 40-60% off everything

- Lo & Sons – Summer sale, up to 50% off

- Madewell – End of season sale, up to 70% off with code.

- M.M.LaFleur – Save 25% sitewide. (Please correct me if I'm wrong, but I think this is the biggest sitewide discount I've ever seen…)

- Rothy's – Lots of great finds in the “final few” section

- Talbots – Semi-annual red door sale, extra 40% off markdowns

Some of our latest posts here at Corporette…

And some of our latest threadjacks here at Corporette (reader questions and commentary) — see more here!

Some of our latest threadjacks include:

- Is there a mantra or slogan that will help me combat imposter syndrome?

- AITA for not moving to the middle seat to be closer to my husband on a recent flight?

- What are your latest favorite nonfiction books for fans of Mary Beard?

- I'm so annoyed by people who look at their smart watches instead of paying attention to our conversation…

- Let's have a secrets thread…

- I need tips on managing employees in BigLaw who have to leave for daycare pickup…

- I'm thinking of leaning out to spend more time with my family – how can I find the perfect job for that?

Anonymous

I’m not doing a dry January, but I am drinking less. Just feels natural after Celebrating all of December to skip the weeknight wine and stick to a glass or two on weekends.

Holiday tipping

Hoping to try this myself.

NOLA

I did it last year for Lent and I found that by Thursday night, I was struggling. I want to cut back as well, so trying to figure out what I want to do.

Anonymous

I did it for Lent too last year-kind of. I gave up drinking alone. Since I live alone, it was kinda a big deal. It was hard, but also good.

Anon

I’ve made that transition myself and it took a dry month to get me to break the weeknight wine habit. I did a whole 30 and after that only went back to weekend drinks. My husband and I have a long tradition of a cocktail after work on Friday night to kick of the weekend and I realized that’s the one drink I missed the most. The rest of the drinks were more mindless – a glass of cold white wine while cooking dinner, for instance, was easily replaced with a glass of fizzy water on ice – it turns out I just wanted the cold beverage and something special (Perrier feels pretty special to me.)

As a bonus I find my skin is better with drinking less water, and while I didn’t lose a whole size or anything, my tummy is a bit flatter – in case that’s motivating for you.

Senior Attorney

Dryuary here, incident to starting a Whole30 today. It was hard last year but I feel like this year it will be a lot easier. I’m ready for a change.

January blues

Ugh. This hits me every year. After the festive December comes January with nothing but frigid temps (Chicagoan here)and five-day workweeks. I just want to hibernate until April.

I’m usually energetic and motivated, but single-suit temps paired with a brutal cold that won’t go away is making it hard for me to feel optimistic. Any tips on how to shake it up and get excited about this time of year?

January blues

*single-DIGIT temps

LAnon

When I lived in Chicago, I found that my biggest issue in winter was a feeling that I would never be warm again. Like you get that cold-to-your-bones that you can only get rid of for five minutes while you’re in the shower each day. I made it a point to indulge in little luxuries of warmth – ranging from buying a huge supply of hand warmers so I could have them in my coat pockets every day to going to a Korean spa to luxuriate in various saunas. It helped a lot, especially because my family had a very Midwestern attitude that complaining about cold was some sort of weakness of character and it helped to get rid of that mindset.

My other solution: move to Los Angeles.

Anonymous

Currently in Chicago…currently feeling like I’ll never be warm again… good tips.

Anon

What is the deal with this midwestern attitude? My parents are EXACTLY this way and it drives me crazy. What’s wrong with not loving 0 degree weather?

Mpls

You don’t have to love it, but not complaining about it shows you are tough enough to deal with it. And being tough enough to deal with it is a big part of the Midwestern identity.

LAnon

Dad? Is that you?

Anonymous

God, Minnesotans are insufferable.

Anonymous

re: feeling like I’ll never be warm again – a good hot yoga class warms me to my core and (at least for a little while) makes me wish for the cold.

anonago

Yes! Winter time is my time to do the weird things Chicago has to offer. The Skee League is fantastic and fun and held at bars (they’re even at Begyle Brewing now which is the best!). The Back Room Shakespeare Project may be doing something on January 15? Unclear, I just signed up for the newsletter to find out. Go to Dice Dojo or another game store with friends and play the games in their game library (bonus: this is free). Also, always a fan of weekly bar trivia and probably a bar down the street from either your office or your home offers this.

Anon

The trick to enjoying winter is having winter hobbies. I recommend trying cross-country skiing; even in cold temperatures, you’ll warm up quickly. Scandinavians say that there’s no such thing as bad weather, only bad clothing, and I find that’s true in 95% of cases. Get everything you need to enjoy being outside and winter will feel a lot less glum.

cbackson

I wish I lived some place with snow. I enjoyed winter so much more when x-country skiing and snowshoeing were options. I have plenty of cold weather running/riding gear, but it makes being outside tolerable – not fun.

Anonymous

Indoor hobbies. I love to cook complicated all day type things, or craft, or do a jigsaw puzzle, or get into a new tv or book series.

C2

I double down on Vitamin D. My gym has a sauna and steam room, which I ignore 8/12 months but truly enjoy in the winter. I will go even if it’s just to walk laps for an hour and listen to an audiobook/podcast, then spend a little time in the warm.

Anon

I get through January by making it my month to organize my house – which is or isn’t fun, or some combination, depending on whether you like that kind of thing – and by taking a long weekend for MLK and going somewhere cozy. (Not beach resort, but someplace that is not home to have nice lunches out, dinners in, and cuddle with a book the rest of the time)

Anon

We recently bought an elliptical machine and set it up in our attic, along with a tv so I can watch Netflix. It’s been a game changer for me.

Anonymous

I play paddle tennis during the fall/winter – and it makes the winter go faster.

While counter-intuitive, being outside, hitting the ball and getting fresh air makes winter easier for me.

Anonymous

I make indoor laps around my house and see how many steps I can get on my fitbit. I only do this when the “feels like” temperature is 15 and under. I have gotten quite a few extra steps in this week.

AnonZ

I need some fun ideas from the hive!

My New Year’s Resolution this year is to use up a bunch of stuff that I’ve been saving, specifically in the areas of craft supplies and makeup/personal care. (I have a habit of holding onto things because they’re “special” and then never using them.)

I have some really cute fabric that I bought a few yards of because I thought it was adorable and relevant to a hobby that my husband and I share. I’d like to actually do something with it but the only thing I can think of is making it into throw pillows, which is an option but seems sort of boring.

What are other fun ideas for cute (slightly kitschy) fabric?

Never too many shoes...

I am picturing a short, poufy skirt!

Anonymous

Christmas tree skirt?

C

I don’t know what kind of fabric it is (cotton, knit, etc.) but a cute tote bag could be a fun project! I’ve also made potholders with smaller pieces of leftover fabric.

Pompom

Apron?

Anon

How about small zip pouches that either of you could use for travel toiletries, potholders, small fabric baskets, or a teddy bear.

Rainbow Hair

Zip pouches are so useful! Also — at least for me — the right amount of hard/rewarding. Or you could do a tote bag/reusable grocery bag type thing?

...

Tie it around string and use as holiday tree garland or table edge decor all year. Cover a corkboard, frame it, voila a theme specific pin board. If you have lots, you could remove the backing of a bookcase (or put it over the backing if yours is a nice one) and have a bit of that peak through between books and knick nacks. Pet toys/pillows? Buy a picture frame meant to hold numerous photos, put some photos of you both doing the hobby in some openings and this fabric in the others. If the fabric piece is big, frame it and have it as an art piece. Use it for beginning quilting lessons.

Hope this helps

tesyaa

Table runner or cloth napkins

Carrots

Could you buy some dish towels in the same color palatte and add it to the end portions as trim or decoration?

Anonymous

I use it as drawer liner or bookshelf backing to change I up. I cut cardboard or poster board to size and wrap the fabric around it, then tape or staple.

Student loan Q

Hi! I’m a new associate trying to navigate loan repayment. I’ve read the previous discussions on this site, but I have a few questions I couldn’t find answers to. I’m currently on an IBR program for $190k with monthly payments of $1350. I’ve been paying $2,500 a month but it’s going to be well over a year before I finally get to chip away at principal. I’m debating whether to refinance with SoFi. I’ve read all the praise on here, but I’m interested in getting thoughts on: (1) when is optimal to refinance with SoFi, and (2) whether SoFi is preferred over IBR if your plan with IBR is to make bigger monthly payments. Does anyone have insight? and a tremendous TIA!

Anonymous

Why are you on IBR instead of a standard 10 year repayment plan? SoFi might lower your interest, but you also lose options. I’d do standard now, keep IBR as an option if you ever need it, and only refinance later on when you’re more settled in your career.

Student loan Q

The financial aid office at my law school said IBR was better than standard because you could keep the required payments low but throw more money down based on your comfort. There may be other reasons why that I didn’t catch, but our financial aid office strongly recommended IBR over standard repayment plans.

Anonymous

I think it makes it too easy to let yourself off the hook for actually paying it down. If you’re making 100k plus, you can afford to pay it off. Set an auto debit and forget it.

AIMS

This is also a good point. Depending on your lender, it is often a giant PIA to make extra payments so despite best intentions it frequently doesn’t happen. It sounds like OP has been doing it, but I would still keep this in mind, esp. as your loans can easily get sold off to different lenders.

AIMS

I think that may be true for the 25 year plan but IBR is not the same.

The 25 year plan lowers your DTI ratio so that if you, e.g., want to buy a house your required monthly payment is less on paper which can help with a mortgage. I’m not so sure that this works out the same with IBR since it’s variable based on your income. I would revisit this advice.

Also, as far as refinancing, I think it depends on your current rates vs. what you can get from SoFi, together with your job security/safety net. The biggest con with SoFi, etc., is you lose your forbearance options, but I think that is less of a concern for some than others, or at certain times vs. others. Obviously, you never know what will happen, but I am much less concerned about this now that I’ve been working for a while and have an emergency fund saved up than when I was first out of law school.

Anon

I agree with this. I set my loans to the 25-year plan and set up auto-payments in the amount of the 10-year plan payments. I then made extra payments and paid them off in 3 1/2 years. I liked having the option of the lower payment if something bad happened.

Anonymous

If you’re a new associate, it sounds like you’re in private practice. if this is your long-term plan (instead of public service, or some other loan forgiveness plan), definitely check with SoFi or other re-finance options to lower your interest rate to the lowest possible. Then, any extra you put in *does* chip away at principal. I’m so confused as to why the extra you pay isn’t already going towards principal (is it the IBR?).

The answer to your questions can’t be answered without knowing more about your plans.

Anonymous

The extra on my payments isn’t going to principal yet because I have interest that accrued since graduation (22k) so I have to chip away at that first. Of the $1350 of my IBR payments, about 970 of that goes to interest accrued that month. So I’m only paying about 1500/month to accrued interest.

My plan is to stay in biglaw for as long as I can and then go in-house. I work in a biglaw firm that pays market but does not do bonuses, so I don’t have the cushion of big bonuses to throw at loans.

The average interest rate for my current loans is 6.2, and SoFi is offering 4.6 fixed over a 10 year term with monthly payments just over $2,000.

Anonymous

You work in big law? You don’t need income based repayment.

AIMS

If you can do 10 years at just over $2000, this seems like a no brainer. You’ve already accrued $22K since graduation! Don’t keep this up – even if you switch to a regular 10 year plan, you will be better off. And if you want to buy a house and need to switch your payments to lower your DTI for mortgage purposes, you can always switch to a 25 year plan then.

Anon

You should definitely refinance with SoFi. Live like you’re poor for a couple years and throw as much at the loans as you can. That will get the principal down to a more manageable level and you can take a bit of a breather.

Anonymous

Ah, with the added info–yes, definitely refinance. it’ll feel like you’ve got nothing to show for your degree/hard work when your $180k turns out to be less than $5000 per paycheck and then you take half of that to pay student loans and rent and oh, you moved and don’t have a couch, etc etc….

But, max out your 401k and build up an emergency fund, and then put as much as possible extra money into the student loans and a year or two later, you’ll be quickly chipping away at the principal.

I sometimes prioritized my emergency cushion over my loans and then when i got impatient would throw some of the emergency money at the loans just to lower the amount that went towards interest each month.

good luck! refinancing is a couple hours of work but so so worth it!

biglawanon

A big reason my husband refianced with SoFi was to get a lower interest rate. He was able to reduce his interest rate by nearly 5%, save tens of thousands of dollars, and pay back his loans years faster. But I think you have to decide for yourself whether or not it is worth it to you to lose the benefits of having federal loans like unemployment deferment.

Simsi

My student loan repayment story (ongoing!) may be slightly useful. I graduated with around $200k in debt and for the first 1-2 years was on IBR even though I could technically afford to pay more than the IBR amount. This allowed me to build up an emergency fund I felt comfortable with. I threw extra money at the loan every once in a while, but not regularly. I then refinanced to get a substantially lower interest rate (like from 6% to 4%). I refinanced again a couple years later to a 5-year loan at under 4% through SoFi. Paying the IBR amount, even though it slightly delayed repayment, was absolutely worth it. I was not at risk of slacking off in paying my loans, but that is something you have to consider for yourself. That said: I would suggest that you direct all extra monthly payments to the principal of the loan. I could be wrong, but I’m pretty sure extra loan payments do not HAVE to go to interest (rather, the only interest you are required to pay is w/ your regular monthly payment). Directing the extra money to principal can be a PITA because it isn’t the automatic way the payment is distributed, but you can typically call (or something) to get the extra $$ applied only to principal. Good luck!

Anonymous

If you work in biglaw (i.e., have the salary) and have a high credit score, you might be eligible for a third option – refinancing with First Republic. Google it – I went from 7.8-8.5% stafford/plus loans, refinanced with sofi to a ~5%, and then refinanced again with First Republic when I discovered it was an option – i am now at 1.95% on a 5 year plan. there are longer/higher rate plans available but it is still significantly lower than even Sofi. They have a few additional requirements (open a bank account with them for automatic transfer, and a not insignificant minimum balance in the checking account) but to me it was worth it.

Always Hungry diet?

Anyone have experience with the Always Hungry diet by Dr. Ludwig? I read his book and I’m thinking of giving it a try. I have about 25 pounds to lose, and I have accumulated a lot of that weight in my stomach. Looking for advice. Thanks!

Anon

Never heard of it, but the name alone makes me want to run away.

Rainbow Hair

Ha me too.

Sick leave

How often is too often to use sick leave? I accrue the equivalent of one day a month, and since I started this job 6 months ago I’ve used some sick leave about every month, but not always for a full day. I’ve been sick more than usual this year, and have also come in late/left early sometimes if I needed to make a doctor’s appointment. I have a 6 month review coming up and I’m worried this will be a problem. I’ve never run out of leave or had to use vacation in lieu of sick, and my supervisor has approved my absences. Am I being overly paranoid? Or should I start buckling down on my liberal use of leave?

Kate

Do you take vacation in there too?

Sick Leave

I took one day of vacation to attend a conference that I had scheduled prior to accepting the job offer, and another day the week of Thanksgiving.

Torin

If you’re sick and you have the leave use it. No one wants your germs.

Anonattorney

I think this is so job dependent. But, generally, I think it only looks like someone is abusing sick leave when there are pretty significant patterns. Like, the person is only ever sick on Mondays. And never looks sick in the office. And always has some weird, convoluted story about how they got sick. In other words, unless you are a super shady person, I don’t think anyone will comment on your sick leave. It’s also a risky thing for a boss to do, because it could violate employment laws if you are properly using your company’s policy. So I wouldn’t worry about it.

Anonymous

+1 to this.

Anonymous

Ha, this fall I called in sick the Tuesday after Labor Day weekend, the Tuesday after Columbus Day weekend, the Monday/Tuesday after Thanksgiving break and the first day back at work after the Christmas holiday (which was the 27th for us). I honestly came down with a bad cold each of those weekends (and was still sneezing/coughing when I did return to work) but I felt SO terrible about it, because it’s absolutely the pattern of someone trying to abuse their sick leave to take extended vacations without using vacation time. (I think my body just tends to get sick when it knows I have a break? I always got sick immediately following final exams in college.) Anyway my boss was really nice about it but I felt so guilty, especially since I haven’t been at my job that long. But I agree – OP, unless it fits a “playing hooky” pattern like this I think you’re overthinking it!

Anon

You never get over that feeling. I’m 30 years into my career and took the last two days of the year last week as sick days. Because I was sick. But I was worried the whole time it would look like I was taking the rest of my sick days rather than losing them.

Rainbow Hair

I used to always get migraines the second day of a break… because it was like stress-stress-stress-stress-stress-stress-STOP! and apparently my brain couldn’t handle that and I had to sit in a dark room alone instead of enjoying my time off. So yeah, I hear ya.

Ellen

It sounds to me like you are dogging it. Don’t think that managment is not aware of this, either. When I was an associate, I worked practicalley 24/7 and the manageing partner knew it. He also saw Mason takeing sick days, like you, after holiday weekends, and he commented about it to me. So when it came time to figureing out what to do with him, we quickley concluded that we did NOT need him to attend to Lynn’s s-xueal needs, and that we could easily let him go, even tho it meant I had to carry my own pump’s to court. So the news to the HIVE is to know that your boss knows when you are being lazy, and are really NOT sick at all. I got to be a PARTNER b/c of my hard work, inititiave, and ability to bill cleint’s. You do NOT get their by takeing sick days. FOOEY on us who give us a bad name by takeing sick days when we are not sick. DOUBEL FOOEY!

Anonymous

Just for data points, no one on my team has taken sick leave for 2 years and we have a liberal leave policy and people do take vacation. If you’re new, taking some time every month would stand out to me because of this. If you’re an excellent performer, I would probably be OK, but if you’re not, it would be noted.

Anonymous

I don’t understand this. Does no one on your team ever get sick? Or do they just come to work sick? The latter is so unbelievably disrespectful to coworkers, especially those who might be pregnant or immunocompromised. (To be clear, I’m talking about salaried workers who have paid sick leave – not hourly workers who face losing their paycheck if they stay home sick. But you said y’all have a liberal leave policy.) And does no one ever have doctor’s or dentist appointments? Even if you’re all freakishly healthy, most people have 3-4 medical appointments per year (doctor x1, dentist x2, maybe eye doctor).

Anonymous

They don’t seem to get sick.

Jo March

Isn’t there a difference between sick leave and a sick day? A sick day at my office would be 1-2 days because you woke up with a cold or food poisoning. Sick leave would be scheduled in advance, such as for a surgery + recovery period.

However, as I type that out, both seem like valid reasons to be out, even for a new employee…

Anonymous

At my office (and I think in the US in general) you use “sick leave” whenever you’re out for medical reasons, whether you wake up puking or you’re having an elective surgery that was scheduled three months in advance. If you use more than 5 days of sick leave consecutively, then you usually have to go through HR and file FMLA paperwork (done in advance for planned leaves), but that doesn’t apply to the average cold/flu/food poisoning. People also use the sick leave for medical appointments, including mental health (therapy). It’s not appropriate to use it for vacation or for running other personal errands and we have other categories of paid time off for those things.

anon

I’d also ask myself…. why am I sick so often?

If you have an underlying medical condition that explains it than no problem. But if you don’t, ask yourself…. am I washing my hands enough/putting them in my mouth too much etc.. This is huge. Keep a hand sanitizer at your desk. Keep one by your front door at home. Use it every time you enter your home, after you take out the trash, and wash your hands with water before you eat. Keep your hands away from your face. Stay away from sick people whenever possible, and if you are near them, be meticulous with your hygeine (and ask them to be!!!). Every person should wash their hands after the cough/sneeze into their hands or blow their nose. People almost never do this. Carry hand sanitizer with you.

Are you getting enough sleep?

More stress than usual?

Not eating well?

Do you have all of the immunizations you should have?

Do you need to see your doctor or an Immunologist to investigate what is going on? Because getting sick once a month for 6 months is really abnormal.

I have not taken a sick day…. ever. 25 years. I work in Medicine and if I call in sick it is a HUGE HUGE HUGE hassle for dozens of patients. And shockingly the vast majority of doctors I work with never get sick despite working crazy schedules, poor sleep, eating crap…. Yet somehow the support staff get sick often. Many reasons…

Wash your hands well.

Anonymous

She said she took up to a day of sick leave every month, but some of it was for doctor’s appointments. It doesn’t sound like she was sick every month for six months.

San Diego bound

I’ll be in San Diego later this month for a conference. I’ll have one night on my own and one I’m meeting up with a college room-mate. I’ll be staying at the Westin San Diego. First, is this a safe area to run in the early mornings by myself or should I stick with the hotel gym?

And, are there options for my lone self to do the night of my arrival? It’s been ten years since I’ve had an evening without the kids. Any restaurant recommendations? I’d like to find one near the hotel for the night it’s just me. I’m looking for Mexican or seafood or simply a great place.

Thanks for any ideas!

Rainbow Hair

For a brief second I was hopeful that you’re the other woman attending this meeting I’ll be at in SD this month… but it’s at the Hilton :-(

Nylon Girl

My favorite SD restaurant is Brooklyn Girl in the Mission District. It’s a Lyft ride away.

SMC-San Diego

Sorry to be responding so late – I just saw this. Assuming you are not running in the middle of the night, you will be safe. My suggestion is head down Broadway to the bay, turn left and run along the waterfront. You will have plenty of company. Don’t run down C Street.

Near the Westin San Diego, your best bets for food will be in Little Italy. if you search Yelp – Little Italy – San Diego, you will see lots of options and can pick whatever appeals to you. Alternatively, the Fish Market is close and right on the bay front. it is not the best seafood in the world, but it is decent and the view is great. Brooklyn Girl is fantastic but nowhere near your hotel (and it is is Mission Hills, not the Mission District – San Diego vs. San Francisco!)

Finally in terms of what to do a lot depends on your interest and how much time you have. Unfortunately it gets dark early these days so a lot of the best “San Diego” stuff is out. (For example, the Zoo and USS Midway close at 5:00 p.m. in winter). If you get in before dark, you could take the ferry to Coronado (its departure point is really close to the Westin), eat dinner at Candelas and then take the ferry back. Just be sure to catch the last ferry back! It is a pretty ride.

I hope you have fun!

Anonattorney

Retirement savings question: How do you all determine how much you want to have saved for retirement? Not how much to currently save; how big the nest egg needs to be when you retire. All of the calculators I look at use a high percentage of your pre-retirement income, but I don’t really think that’s going to be accurate for me. Aside from the unknown healthcare costs (which, to be fair, could be enormous), I’d like to think that I could have a pretty happy retirement on a pretty small percentage of my current income.

Anyway, any guidance or thoughts?

TheElms

Could you figure out what you think your costs in retirement would be / what you would be comfortable living on to allow sufficient fun money, consider that you after tax take home need. Then guesstimate what your tax rate will be and find out your pre-tax “salary” need and use that in the calculators?

Anonymous

I don’t. I don’t see how I could? Idk if I’ll be married, single, kids, healthy? Where I’ll live? I just save as much as I can.

Anonymous

I don’t understand the “percentage of your current income” mentality. The question is: how much money do you need to enjoy your life?

So, how did you spend in 2017 on living expenses? Including everything: housing, food, entertainment, etc. Did you feel like you were living relatively comfortably? Figure out how much money you need to generate that amount of money in returns at 5 to 7% annual return, then double it. That’s your minimum.

Example:If you spent approximately $50,000 last year, $1,000,000 kicks of $50,000 in income at 5%. $2,000,000 would be your retirement goal under my retirement math. This gives you a significant cushion for spending in excess of $50,o00 that you can either dip into as needed or reinvest and allow to grow.

I’m sure lots of people on this site think $50,000 is a paltry sum, but that’s just an easy number for the math. Use whatever numbers make sense to you.

Kate

Right. We make way more than $50k now but are saving for kids’ college, retirement, paying off our mortgage, etc.

At retirement, I’m assuming no mortgage, and to a certain degree that our current home (worth $800k today) will fund Long term care. Obviously I can’t live in the home and expect to draw cash for DH if he’s in a nursing home, but this is a huge family home. We’ll downsize after the kids are gone and we’ll end up probably with another $500k on top of our savings when we cash out. That plus our savings should cover enough of LTC. If we both need 25 years of LTC, we’re talkig about a totally different scenario.

biglawanon

I don’t think those estimates really apply to higher income people. We determined we could very very easily live on about 15% of our current income. We took that amount, factored in inflation and how long we’d likely live (we were optimistic on that part!) to come up with the optimal amount we need to save and when we can retire…

Anonymous

I’m not trying to hit a target, I just save as much as I possibly can. I saw my grandmother burn through millions on years of round-the-clock nursing care, but like you I think that as long as I’m living independently my costs will be very low (my house is paid off, I drive cars into the ground, I like to travel but not extravagantly, etc. so barring medical/nursing costs I think I could be very comfortable on an income of maybe $40k?). I guess at some point I will have to make the decision about whether I have “enough” to retire, but that point is a long way off so now in my 30s I’m just saving as much as I can.

anon

I somewhat arbitrarily set our household minimum annual savings as maxing my 401K (so $18.5K plus match). Then, any leftover money at the end of each pay period gets swept into a general savings account. Around the end of the year, I look at how much money is in that savings account and figure out how much should be kept in “accessible” savings (upping the emergency fund, savings for a project like a down payment for a house, pre-funding predictable expenses like kids’ summer camp, etc). Whatever is left over gets put into some kind of retirement account. Some years, that’s nothing. Other years, it’s a few thousand dollars.

Anonymous

You have to figure out what assumptions work for you.

We worked through a plan with a financial advisor, and his advice was that we need $21M to fund a 41 year retirement, and not run out of money in more than 15% of scenarios. This exercise included a number of scenarios (ie the market crashes in the year before retire). Expenses are basically modeled against what we are spending now, with the mortgage payment going away at some point.

His assumptions were excessively pessimistic though!! 5% investment return against 3.5% inflation

Anonymous

Is that a typo?! $21 million?? How does anyone who is not top 1-2% have that? My husband and I have a household income of less than $100,000 — we’re not even going to EARN anywhere near $21 million in our lives, let alone be able to save it.

Anonymous

And fwiw, we feel pretty wealthy on our $100k income – obviously we’re not buying up vacation properties and flying private when we travel, but we have plenty of money for all our needs and most of our wants and our children get to do a lot of fun things that are above and beyond what’s necessary for their education and socialization.

Anonymous

$21M is Not a typo — but rather an absurd combination of assumptions that escalate the number in a way that is unrealistic.

Partly due to the calculation being based on retiring at 55 and living until 95. $21M represents the total cost of funding the retirement, including the returns of anything earned off investment returns during retirement years. I think his calculation was that we needed $9M networth at retirement date. If we can have $5-7M as a nest egg when we retire, we’ll be in good stead.

However, I think this approach of considering various scenarios was one that is interesting and worth considering. Especially that market returns may average a certain percentage, but in any given year are much higher or much lower. I don’t mind knowing what the conservative outlook is if the market repeats 2008-2009 in the last 3 years before retirement.

Anonymous

But again, even $5M is an impossible goal for most people. My husband and I won’t even earn $4M in our lives (assuming we work for 40 years, starting at 25 and retiring at 65). And with an almost-six figure HHI income, we’re far from poor – most Americans earn less than us, many a lot less. And it seems incredibly unrealistic to assume it’s possible to save more than half your pre-tax earnings for retirement (since most people buy a home, help children with college, etc.) so that means we’re capped out at $2M even assuming we do everything right, live super frugally and throw every dollar we can at savings.

anon

Obviously, this modeling is psychotic, and the poster is asking for a retirement lifestyle and security that 99.99999% of the world will never have.

It’s actually useless for her to even post it.

anon

Obviously, this modeling is psychotic, and the poster is asking for a retirement income/lifestyle and security that 99.99999% of the world will never have.

It’s actually useless for her to even post it.

Anonymous

The original poster made absolutely no indication that they are in that category of sub-6-figure income. As a site for “overachieving women”, I’d assume that most on here have household incomes over 6 figures, particularly if they are 2 income households.

The other major factor you are overlooking is the compounding effect of earnings on your investments. By starting investing early, compounding greatly assists.

You won’t need to save $4M out of your incomes to have this kind of nest egg at retirement.

At a 6% rate of return over 40 years, you’ll have $4M going into retirement by saving $2k/month. — this means saving $1M, and earning $3M in investments.

It becomes harder to catch up as you start investing when you are older.

Anonymous

That’s insane. 21 million is completely totally insane. You surely must get that. Just don’t bother sharing.

Anonymous

This is my quick back of the envelope:

1. What is your current amount annual after-tax spending? If stable, then it won’t change significantly in retirement – just the categories. (Note your annual spend will vary based on life changes, so adjust as needed.) So for example, let’s pick a number of $75,000 per year.

2. Gross up annual spend to pre-tax dollars (sigh). So for example let’s assume 28% Fed & 5% State = 33%. So $75,000 after tax spend, translates to $112,000 (75/ (1-.33) pre-tax dollars

3. Estimate how long you will need the portfolio to last. So for example if you stop working at 65 and pass away at 100 that is 35 years the portfolio needs to support you.

4. Multiply your after tax annual need (112,000) * years need to fund (35) = $3.9 million. And this is in today’s dollars, not future dollars. Your biggest enemy is inflation.

Frozen Pipes!

I live in a rental unit in the midwest. On 12/31 early morning, a water main pipe burst. Due to the holiday, the city couldn’t focus on it (it was not the city’s problem probably anyway) and the complex office said they couldn’t get someone out until 1/2 but it may not be fixed til 1/3 or 1/4. This has meant no water at all for dozens of apts, during a holiday, and with temps far below freezing.

Does this count as all they can do or do tenants deserve to demand some rent abatement or something? Never had this experience, don’t want to be demanding unjustly or get taken advantage of by the complex company (they have several properties throughout the US)

Torin

Your lease may have something to say about this. Rental law varies wildly by state but generally landlords are required to provide hot water. I would demand pro-rated rent for the time without hot water, personally.

Anonymous

I’d ask for everyone to be put up in a hotel until it’s rectified. You have no bathrooms, right?

Pompom

I think my corporate-owned/managed apartment complex did a rent abatement when we had a city water main break last Spring/late Winter. Thankfully, I’m in the SEUS and so it wasn’t AWFUL, but it was not great, either. The main broke within our apartment complex property, and managed to kill water for the entire county for like 2-3 days.

Dulcinea

In MA your landlord would have to put you up in a hotel until water restored. Lack of running water is a major health code violation.

Anon

No water is generally considered a rental emergency, so it should be fixed immediately. Not sure of the laws in your state, but I would look into this more for sure.

wildkitten

if you are in chicago hit up wildki t t e n r 3 t t 3 at google mail and I can ask my favorite all-claims lawyer!

IL housing attorney in a previous life

I practice law in IL and no hot water is an emergency situation that should have been fixed right away.

You need documentation of your request and the LL’s failure to rectify the situation. Most likely scenario is some rent abatement, better to ask the LL directly. You could possibly go to court for it but it may not be worth the cost in the end

biglawanon

I don’t think those estimates really apply to higher income people. We determined we could very very easily live on about 15% of our current income. We took that amount, factored in inflation and how long we’d likely live (we were optimistic on that part!) to come up with the optimal amount we need to save and when we can retire.

biglawanon

Oops, meant for above. Will post there.

Faux wrap top

Anyone have the MM LaFleur Deneuve top or similar (https://mmlafleur.com/shop/deneuve-3-0-rain-cloud)? I’m really crazy about faux wrap front tops, but I’ve got a size 8-ish hourglass shape and can only find photos of this style on either rectangular straight sizes or curvy plus sizes. FWIW I’ve also got a rather long torso with a low waist, and usually tuck in shirts. Do those who own this style top think it would work for me or should I pass?

Anon

I love this top. The wrap is high-cut and backed up by fabric behind it. I’ve had no peek a boo moment with it. I am tall and it is not really a tuckable length on me but I think tucking it would ruin the drape anyway. It’s meant to be blouson and lands around the top of the hip.

I have it in three colors and would have it in five if they had my size in the other two.

Faux wrap top

This is great to hear, thanks!

Anonymous

I have it and would recommend it as long as you are okay with wearing high waisted pants/skirt with it. Maybe it’s just me/or maybe I just ordered a size too small, but mine is a bit short on me. I have to pair it with specific pants or else I may have a whale tail showing…

Pompom

Can I ask a potentially stupid question about MMLF?

How do you say it out loud? Is it “Em-Em LaFleur” (as in, the letters) or “Madame LaFleur”?

Anonymous

The abbreviation for Madame is Mme, so it must be MM as in the letters.

Pompom

Ok, yes, that’s what I thought.

I have a friend who is very emphatic about calling it Madam LaFleur (as in, it is always Madam LaFleur, and always said with a bit of a serious tone, and I love this friend but she is always right—just ask her!)…I’m always a bit puzzled and bemused and knew this would be the place to ask!

Anonymous

It’s styled MM.LaFleur not M.M.LaFleur so I don’t think MM are supposed to be initials, but it’s correct that it’s not the right abbreviation for Madame. “MM.” in French is the abbreviation for Messieurs, the plural of Monsieur, and I actually think that’s what the founders intended (like “House of LaFleur”). But everyone I know says “Em Em LaFleur” like the Ms are initials.

Senior Attorney

I have this in black and be warned: It bleeds all over the rest of the laundry every. single. time. I wash it. Even in cold water. I ruined a whole load of undies that way. So unhappy!

Anonymous

Ugh, yep. Ruined a new set of white sheets when I crawled into bed fully dressed at the end of an exhausting day and took an hour nap.

Everytime I pack it, I have to make sure it is next to like colors.

M

Ive tried it on before and found it too short for my long waist. For me, it would only work with a high waisted bottom. I have their short sleeved faux wrap top (blanking on name) and that fits me far better

Anon

Thanks to the commenter this morning who mentioned the wooden escalators at Macy’s in NYC.

It brought back a memory of going school shopping with my mom before I started kindergarten at age 4. It wasn’t Macy’s and it wasn’t NYC, but it was one of the last old downtown stand-alone department stores in our small west coast city. We rode the wooden escalator to the children’s department and bought three new dresses and a pair of Mary Janes. I remember holding Mom’s hand on the escalator and being somwhat frightened of it.

It’s a nice memory. Mom died a couple of months ago and our lives were so chaotic when I was little, and she was so sick when I was older, that I’m so grateful to have this memory of happier times and newness and, apparently, a moment when my parents had a bit of money (which wasn’t true, usually)

Call your Mom and tell her you love her.

AIMS

This is so great. Thank you for posting. I’m sorry that your mom passed, but it’s nice to have those memories, especially when they find you by surprise.

Anon in NYC

What a sweet memory. Thank you for sharing. I’m so sorry that your mom passed.

Ellos

Has anyone had experience with this brand? I don’t know them at all, but just saw an ad for a coat I’m dying over.

DTMFA?

Could really use a gut-check here: BF of 10 months completely blew me off for NYE. We hadn’t made official plans, but I didn’t think it was a huge assumption that we would spend it together. That morning, I texted to ask what his plans were, and he responded that he was probably spending it with his family. I wrote back and invited him over, thinking that he might have assumed I had other plans (not sure why, but whatev). He didn’t respond. At all. Until this morning (Jan. 2!), when he texted to say “happy new year”. No call or text at midnight on NYE, nothing until this morning. And no explanation or apology for 48 hours of silence.

This makes me think that he must have been out with someone else for NYE, even though we are ostensibly exclusive. I’ve suspected cheating in the past, and I can’t fathom another circumstance when he wouldn’t have taken two seconds to text or call me at midnight. Is there any other logical explanation that I’m missing?

DTMFA?

Anon

10 months is long enough to assume you have a date for NYE or that if you don’t, you’ll have a good amount of heads-up time.

My sister in this exact situation with a boyfriend being cagey about NYE found out he did indeed spend it with another woman. (At a hotel, with a room for the two of them)

Even if no cheating, do you really want a LTR with someone who is to terrible at communicating and caring about you that you suspect cheating?

Anonymous

It’s incredibly strange to me that you just assumed you’d spend NYE together, yet at no point did you talk about what you were going to do. Incredibly strange.

Break up. You don’t care enough to talk to him.

Senior Attorney

I disagree with the first paragraph (definitely 10 months of dating and being ostensibly exclusive entitles you to assume you will spend NYE together) but agree heartily with the first sentence of the second paragraph!

Anonymous

Yeah assume together but not like not without discussing? Like how do you know what you’re doing?

Anonymous

I don’t think it’s strange after 10 months to expect that you’ll spend New Year’s Eve together, but I do think it’s a little odd to not say anything at all about it to your partner until the morning of Dec. 31. I mean, if nothing else, what sort of plans can be made that late? At least in most cities, it’s too late to get dinner reservations or tickets to an event. But of course he also could have said something about it. There’s a clear breakdown in communication here, but it’s not all on her.

Monday

I’d be suspicious too. “Spending it with family” + zero communication with you for that long is an unlikely combination.

anon

Why wouldn’t he invite you along if he were spending it with family? No matter what, it seems strange he didn’t try to include you. Or call you or text you after midnight. Definite red flag.

Torin

I don’t know that I would conclude from him ignoring your text inviting him to spend NYE with you that he was cheating. But I do think it sounds like y’all don’t communicate very well. You assumed y’all had NYE plans together, when I would think after 10 months that would be something y’all would actually discuss instead of assuming. When he told you he was spending it with his family, you responded by inviting him to not do that for some reason. Then he ignored you. Bad communication all around, on your part and on his. Plus you don’t apparently trust him. Break up or make a real attempt to communicate better.

Anonymous

Yup. Why, if you assumed you were spending NYE together, would you not have said “hey so what do you want to do NYE?” Before the actual day of? It’s so strange.

Anon

ostensibly exclusive? So you two haven’t discussed it? You need to start having some conversations. Also, if he was with family, he may have just gone to bed early.

Monday

I assume she said “ostensibly” meaning they’ve agreed to be exclusive but she thinks he’s cheating. Also, going to bed early sure, but then no word to his girlfriend of almost a year until this morning? It didn’t occur to him to at least respond to her over all of yesterday?

Never too many shoes...

Gone to bed early and slept until January 2nd?

Nope, this relationship is over.

Anon

Or he could be alone in his room, high. Ask me how I know.

But yes, the communication in this relationship is problematic from both partners.

Anonymous

So I’m not a big New Year’s Eve person and neither is my husband and I could totally see him doing something like this, especially early on in our relationship. I’d probably be more bothered about him not responding to the text for two days than making plans to do something without you on NYE. But between the lack of communication and the fact that you already suspect cheating, it sounds like there are plenty of reasons to end the relationship.

Anonymous

It is weird that you didn’t discuss any plans with him until the morning of. Also weird that he went MIA. DTMFA.

Anonymous

There could be logical explanations that are not cheating:

– usually spends nye with family and when you hadn’t planned any thing with him, he defaulted to that… circuits were busy and your text came late.

– was hurt that you hadn’t planned anything in advance with him, and he acted distant because of it.

…or, he could be cheating.

If you’ve suspected him off cheating before, then this could be a sign. If you send to be suspicious of your partners in general, it might be worth benefit of the doubt.

Whatever the case, have an honest with him about this. It sounds like you aren’t on the same page as him in multiple areas, and it is a chance to re-set/re-evaluate.

Anonymous

Probably too late, but any (easy) suggestions for using up leftover chocolate ganache? I made way too much for a cheesecake I made over New Year’s. I’m not interested in doing something super complicated like macarons and it’s too thin to use as a frosting for a cake or cupcakes.

Anonymous

Eat it straight out of the bowl? :)

Anonymous

I have been doing this, which is why I want to find a recipe to use it up in a more intentional fashion haha :)

Anonymous

put it on a cracker!

Rainbow Hair

I wonder if you could swirl it into pancakes or waffles…

Anon in NYC

https://www.thekitchn.com/got-ganache-7-things-to-do-wit-116516

My suggestions would be truffles (if it’s firm enough after sitting in the fridge), or using it like chocolate fondue. I bet you would warm up a small quantity each night and drizzle it over fruit / ice cream.

Anon in NYC

*could, not would.

Anon

Use it as a between-layers filling on a layer cake.

Use it as a sauce for ice cream.

Make sandwich cookies and use it as the cement between the cookies.

Or send it to me. I already have a spoon.

C

If you made it with heavy cream, you can throw it in a stand mixer and let it run on high until it whips into a fluffy, indulgent frosting. Then you could put it on cakes, cupcakes, cookies…anything you’d typically put normal frosting on!

Lap Swimmer

Please shop for me: I am normally size 2-4 in clothing or 6 in swim suits. I am considered petite (5’2″) but have had a really hard time with one-piece swimsuits running short since my pregnancy because I now have a larger behind. I have tried Lands End and not happy with their fabric. I really like the thick sports fabrics from Tyr and Speedo but again, those are short now. What can you recommend?