This post may contain affiliate links and Corporette® may earn commissions for purchases made through links in this post. As an Amazon Associate, I earn from qualifying purchases.

I asked the Corporette FB group a while ago what financial resources people were loving, and a reader suggested we do a post on the FIRE movement — financial independence/retire early — so I asked Rebecca Berfanger to round up some great resources on the movement for beginners! Readers, have you considered retiring early as a serious goal? (Has anyone considered and rejected it as a goal?) What steps are you taking to make it happen — and what will you do once you quit? – Kat

Have you ever looked at your financial situation — income, investments, debt, and other factors — and wondered if you could retire comfortably in your 50s, or your 40s, or sooner?

We took a look at the Financial Independence/Retire Early movement (FIRE), which emphasizes ways to achieve just what it says: true financial independence that comes from savings and investments that allow you to retire completely. Have you thought about retiring early? Do you have any ambitious retirement plans such as FIRE or other strategies?

Psst: We've also talked about cash savings vs. retirement savings and retirement savings in general (as well as having a great discussion about how much women should save for retirement in general).

A Guide to Financial Independence/Retire Early for Beginners

While FIRE will work differently for everyone, depending on how much your employer matches your retirement plan, how much you can afford to live on, and how much you can contribute to your 401k and other investments without a tax penalty, here's a guide to Financial Independence/Retire Early for beginners:

{related: when do YOU plan to retire?}

What kind of FIRE plan is right for you if you don't want to cut back your expenses? What if you live in a high cost of living area?

An important part of FIRE is an emphasis on cutting expenses in order to increase your investments, but even within FIRE, there are different mindsets.

One is “LeanFIRE,” which is just what it sounds like. You figure out the minimum that you'll need for retirement — with a focus on living frugally — whether you'll be in a modest home in a low or moderate cost of living area, or even traveling around in a trailer or RV. (Even then, you could possibly monetize that living situation into a blog or YouTube channel — but then you wouldn’t necessarily be a FIRE purist because you’d still technically be working.)

If that isn't a good fit for you, there is also “FatFIRE,” where you figure out how much you would need to be financially independent and live a comfortable lifestyle, even if you live in a high cost of living area with high property taxes and other expenses you can't avoid. For either LeanFIRE or FatFIRE, the general consensus is to save at least 25 times your annual expenses (not income) before you retire.

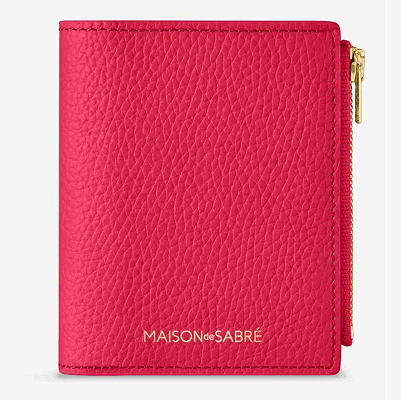

Psst: In honor of this series' original title, Tales from the Wallet — here's a wallet we love!

What are the benefits to FIRE, other than being able to leave your job?

By getting into FIRE and making a budget of your current expenses, you might figure out how you can cut back here and there without totally changing your lifestyle — something you've maybe been thinking about doing anyway. If you start investing those savings sooner rather than later, you’ll already be earning instead of letting your money sit in a low-interest checking or savings account.

You might also find it’s easier to directly deposit that extra money into your retirement fund or other investments before you even have a chance to spend it.

What are the risks of FIRE?

- The obvious risk is that no one can predict what the actual cost of living will be in the next 30, 40, possibly 50 years, assuming you are still alive and no longer working or, by then, no longer able to work.

- One of the most unpredictable expenses is the future cost of health care, which has continued to increase every year. Chances are, you or one of the family members you care for may have an unexpected medical expense that wasn't included in the regular annual expenses you planned.

- There are also unknown risks with any financial investment. (See below for where FIRE advocates invest.)

One way to counter these risks is to plan for a FatFIRE. Even if you underestimate your expenses, you’ll still fare better than someone planning for the bare minimum in expenses, something those on LeanFIRE path might do.

How much do you have to earn to make FIRE work?

The goal is to be able to cover your future expenses even if you can't match your current income. If you don't make enough in your full-time job to achieve this, the FIRE community encourages starting a side hustle or two. However, this isn't possible for everyone due to time constraints, and some people already work a second or third job just to keep up with bills. In fact, FIRE is often criticized for only being an option for those who are privileged enough to make more than what they need.

However, if you don't already have a side hustle and you do have the time, it might be worth considering for reasons other than a goal of early retirement. This Forbes article suggests the benefits of having a side hustle, while Harvard Business Review also provides ideas on how to get started.

Where do members of the FIRE community invest their money?

Two preferred types of investments are low-cost index funds, specifically Vanguard Total Stock Market Index Fund Admiral Shares (VTSAX), and rental real estate. FIRE enthusiasts don’t have a lot of faith in cryptocurrency, such as Bitcoin, or even in individual stocks. Some FIRE proponents also attempt to achieve FIRE with entrepreneurship, but that's the riskiest path.

Can you do FIRE if you have or want to have kids?

Like other aspects of FIRE, you must consider all expenses, earnings, and investments. Think about how you can save on childcare expenses and are there things you can plan for your child’s future where you will still have enough financial independence to also afford things for your child — college tuition, extracurricular activities, private education, etc. A 529 Plan might also help in determining expenses as they relate to your children (or future children), and might even have its own tax benefits for families.

How can you get started — what are the best resources for beginners?

- Mr. Money Mustache is a good place to start (including his post, “The Shockingly Simple Math Behind Early Retirement), but he emphasizes frugality that goes beyond what most people would be comfortable doing.

- Early Retirement Extreme, a blog and book by Jacob Lund Fisker, incorporates FIRE and other means of retiring within five years in ways that are, as the name suggests, extreme.

- Your Money Or Your Life, by Vicki Robin, et al., was written in the early ’90s but has been updated to reflect today's economy.

- The Simple Path to Wealth, by J.L. Collins, suggests how to get to the point where you have enough money saved.

- The ChooseFI podcast and Facebook community are relatively new on the FIRE scene. There are also local groups, which could help you figure out what local people are doing to plan for anticipated expenses, but also any options you might have at your local level for tax-optimization.

- Websites with useful calculators as well as suggestions for high-earning professionals with large student debt and high-earner tax issues, include:

- The Wealthy Accountant

- White Coat Investor (start here)

- Physician on FIRE (for tips on student loans, click here)

- The Mad FIentist (click here for tax updates)

Finally, while you should talk to a financial planner or accountant when making major financial decisions, especially when it comes to taxes, don't be surprised if they encourage more traditional retirement planning or specific investment tools that don't fall in line with the FIRE philosophy.

Also, even if you don't want to retire early, consider the benefits of following the suggestions of FIRE to help you save for an emergency fund, or to have just enough to be able to quit your job or make a career change in the future.

Let us know: Have you considered FIRE for yourself? When did you start saving for retirement? When you cut back on expenses, do you put the money toward debts such as student loans or a mortgage, or toward a down payment on a house, as opposed to investing for retirement?

Do you have any barriers to retiring early? What resources would you suggest for Financial Independence/Retire Early for beginners?

January

Thanks for doing a detailed post on this! I probably won’t pursue FIRE for myself (although I am certainly tempted), but I’m still interested in the topic.

anan

I also appreciate the post. I grew up with parents who were frugal and financially savvy, but FIRE was only a concept I learned about as a middle aged adult. How I wish I had thought about it sooner!

Ellen

I don’t know a thing about this, yet, but I expect to be able to retire early, and mabye before I am 40 if I can find a guy to marry me and make me preganant before then! If only the HIVE can recommend a guy, I will do my best to retire to Chapaqua where I can lead a life of leisure with my sister, having onley to please my husband, like she does ED, when he comes home from Merril Lynch. And when she found out he was engaged in extracuricular activites at a Manhattan gentelman’s club, she really put the screws to him. She literaly had him by the short-hairs as she called it, and he was jumping whenever she said boo! But things are better now, and he is keeping his pants on when he is in NYC, so that he has onley Rosa to please now. That is what I want. A rich man that ONLEY has eyes (and the rest of him) for ME! I can do that! Sign me up for it now! YAY!!!!!

Anon

I considered it and then decided against it, for a variety of reasons. 1) I like working, and so does my husband. 2) We want to enjoy life now, because who knows what the future holds. 3) We wanted kids (and now have 2) and that introduces too much unpredictability to ever feel independent.

So we try to live on one income (although daycare /after care/ school come out of the second income, because we’re not “rich” although we still make more than most) and use the other to pump up a healthy emergency fund. Now our E-fund is pretty good, so we use the “extra” money after schooling to pay for fun family trips, classes and sports, and babysitters so we can participate in community and school leadership.

To us, this is the perfect balance of getting the most out of our current lives while still removing some of the stress of “having” to work. We still worry about large medical bills, health insurance increases at the same time as social security is declining, and the ridiculous cost of college, so we don’t consider ourselves even close to financially independent. But we sure are enjoying life and don’t worry about small hiccups along the way.

Anon

I should add, the biggest factor in living on one income was the house we bought. We made a conscious decision to buy a small house in the suburbs in an ok-but-not-top-notch school district, which ended up being about half the cost of what we could actually afford. But we don’t really need the 3 separate living spaces, extra playroom, and multiple guest rooms, and our kids will be fine academically even without (or maybe because of the lack of) the high pressure environments of the top schools in our state. We also drive older domestic cars for 10 years but with 5 year loans, so we only ever have one car payment at a time.

Had we not made that deliberate choice to buy a house significantly below our means, we wouldn’t be able to live on one income. We specifically had our bank lender write a pre-approval letter for a smaller amount so our real estate agent wouldn’t be tempted to show us something “better” just in case. That’s my one piece of advice for new graduates and the newly married – the house you buy will have such a large impact on your finances in life, make sure to really think hard about what you need vs what you want.

biglawanon

Yeah, we live in a 3BR condo, about 1600 sq ft, in a nice urban neighborhood, but not the fanciest possible neighborhood, with 4 kids. We could have been approved to buy something that cost 4-5 times as much. We’re very happy and not having tons of upkeep is great with busy lives. Kids go to good, but not the absolute best, public schools. They will be fine, really. We tend to have one nice car and one old car at a time. We do tend to like somewhat higher price point cars, but again do the five year loan with low interest and then keep the cars until they don’t work anymore or are not work fixing. Our oldest car is over 20 years old. We prefer to spend money on vacations/experiences rather than houses/cars/things. And then stockpile the rest for retirement.

Colleen

We did this too- except we traded age/modernity and location for size/finish. We’re in a location further than other towns near our big city, but excellent schools. We also bought a boring 70s colonial that needed a bunch of cosmetic work vs a new build or recent Reno. We can afford it on once income and have had to do exactly that. Having a cushion enabled us to take extra time between jobs to be home with the kids, as well as be really picky about our next move(s).

Anoon

Why does the c0mment count show one more than the actual c0mments?

Anon

Maybe because I have a post in moderation? Not sure what I said to land it there…

Anonymous

When I was a teenager and got my first job, my parents opened a Roth IRA for me and encouraged me to put all the money I could in it. So if I earned $700 dollars that year, I put $700 in my retirement account and they upped my allowance enough that I still ended up with $700 of spending money. It got me into the habit of always making sure my retirement was maxed out every year, even if that meant a lot of ramen the years I started a job in October or November. I don’t think I’m interested in FIRE, because I would get bored if I didn’t have a job, but I do like knowing that I won’t be desperately worried about money when the time comes!

Anon

Your parents were so, so smart. And now you are too.

Anonymous

My dad did the same, except he’d match whatever I made and put it straight in the IRA. It was such a wonderful head start.

Sam

My parents did this too and I consider it such a big gift – it gave me a huge head start. I want to do the same for my kids.

biglawanon

I had never heard of the FIRE acronym, but my husband and I have been planning to retire early for years. We hope to have 30-40 years of retirement. Our strategy is to stick with our high-paying, albeit stressful and long-hours jobs, and stockpile money, mostly in index funds and other mutual funds. We own our condo in a HCOL area, and plan to sell that on retirement and move into a smaller condo in our desired retirement destination (happens to be less expensive). We plan to keep working, get to 2.5M is savings (not including home value), and drop the mic.

Anon for this

I’ve thought a lot about retiring early. Long story short, we are very fortunate to be in a position where neither my husband nor I needs to work for money. He decided a few years ago to devote himself to writing, and he ended up with a 2-book deal with a major publisher. I stayed within my same field but moved to a part-time position that has more social justice elements to it. We have two children below the age of 4.

The big question: are there valuable things that work provides besides money? For both of us, there’s a sense of identity that comes from work that is really important. We want to model for our kids that work can be an important source of meaning, that you can do good in the world through your work. I also want to know that I can provide for myself and my family is there was some sort of global financial collapse. And earning money feels good, at least for me.

Anon

I’m mid-30s and starting to think about whether I could be financially independent by 45-50 or so. I earn a lot of money and have low fixed expenses for my HCOL city, but I struggle a lot with discretionary spending (eating out, clothing, etc.).

Is there anyone else who’s reached financial independence who could talk about the process of saving this kind of money from a psychological rather than logistical perspective? I could definitely make this happen logistically but I am struggling with spending less money.

Anon 4 this

I am also mid-30s, married, both in BigLaw, and live in a HCOL. For us the saving started as a need because we needed to pay off our combined 400K in student loans and I thought we needed to save to buy a house (debatable whether this was a need). So those goals ate our discretionary income from BigLaw for years 1-6. I expected it to be harder than it was.

I think the reason it wasn’t so hard was that I really wanted to be debt free and I really wanted a house. As a result, I didn’t mind not having extra clothes or whatever else I considered spending money on. And its not like I never got to have new clothes or a treat (we saved for an went on some fabulous vacations), it just meant I thought carefully about what I was spending my money on. Now those goals are behind us, we are looking at saving enough to have a solid retirement savings account and being able to take lower stress jobs that would come with lower pay. Again its worth it to spend carefully because we aren’t happy in our current jobs. THat said we still spend on stuff that is important to us. For example, we have a shared hobby that costs about $500 a month and we happily do that. We love to eat out both because of convenience and because yummy food, but we try to limit that to once every other week. We don’t always meet our goal because sometimes convenience prevails but when I’m slightly annoyed that I have to cook when I’m exhausted I know its because it funds shared hobby and allows us to save for the bigger goal. Our net worth crossed $1 million this year and that was an amazing feeling.

TL;DR: Pick the three things that are most important to you for now and the future. Spend your money on those things. You can’t have it all. For us, its (1) being able to comfortably take lower stress/lower paying jobs, (2) shared hobby, and (3) travel. As a result we don’t have the nicest clothes, eat at the fanciest restaurants as often as we would like, or drive a fancy car.

Anon @ 3:37 pm

Thanks for this perspective. It’s really helpful to hear your thought process and encouraging to see how much you’ve been able to grow your net worth.

Anonymous

Timely topic. I read this today on the ChooseFI Facebook page.

https://medium.com/@taraganguly/i-finally-crushed-my-six-figure-student-loan-debt-and-along-with-it-my-lifelong-financial-shame-2ddf406b2e2b

waterproof phone case

Any suggestions for a waterproof phone case? Going on a trip next week that will involve several water activities and would love to be able capture some moments. Amazon preferred due to time constraint. TIA!

Colleen

I don’t know how “early” you have to retire to be considered FIRE, but we have 3 kids, and the youngest will be (in theory) out of college when I turn 55. We’d like to be able to retire/do the F whatever we want at that point. So for me, it would be scale back on consulting but stay working, because I like to work, but having no financial pressure and having my own schedule so we can visit the kids, travel, whatever. For DH, it means checking out entirely and building stuff in his barn/doing any number of his million hobbies.

We have our retirement savings accelerated so that we are on track (as of now; we’re 34/35) to be fully funded for retiring at 55. We have the kids college saved for such that we will have to work through having them in college, but not both full time and only if we are paying full freight for all 3 at private schools, *and* assuming MIL/FIL are still living (they plan to contribute to college for the kids it works out- we aren’t counting on that at all, however, and are saving so we have in-state for each in cash, then will top off with income as needed).

Our loans were paid off aggressively. We have lived below our means, but still comfortably, since we got together. For example, we could have bought a $1M+ house on our salaries (we live in a high COLA so this isn’t a fancy mansion), but we went with a $700k that needed work and didn’t have as many bells and whistles.

We wanted 3 kids, but had them close together and early-ish (last one at 33) so we could put that behind us early on, as opposed to constantly living in young kid crazy.

FIREd-ish

I “retired” as a lawyer at 36 with enough money to pursue the Lean FIRE path. I was planning to Fat FIRE in about 5 years but I got sick and Lean FIRE was a great fall-back option.

I got better and decided to go back to school to change fields entirely to nursing. I am in an accelerated program and loving it.

I am so glad I found FIRE and decided to go for it. I don’t know what I would have done had I not had the money to quit law when my body gave out.

I will be below Lean FIRE at the end of my program but I can get back to Lean FIRE in 2-3 of full-time work as a nurse after graduation. I will be to Fat FIRE within 7-10 years if I do part-time work after reaching Lean FIRE.

Greenbacks Magnet

Great post. Really liked that you went into details about this as this is a great topic for anyone who wants to be financially independent. FIRE can be done. I suggest at least 3 income streams to do it.

Thanks,

Miriam

http://Www.greenbacksmagnet.com

Anonymous

We’re on track to have our mortgage fully paid off when I’m 50. We’ve been maxing retirement accounts starting in our early 30s, and will continue to do so until then… but then we’re switching to semi-retirement (picking up consulting/contracting work, and not contributing further to our retirement accounts, but not drawing on them, either). The combination of dropping mortgage payments and not needing the additional income for adding to savings means that our overall income can go down pretty substantially while otherwise maintaining our existing lifestyle. Not sure if there’s a specific name for this approach, but I’m excited about it!

lawyer

I’m 35 and sort-of at FIRE, but I like my job more now that it feels like a choice instead of a necessity, so I’m going to keep at it until it ceases to be enjoyable. I’ve recently reduced my savings rate and am more focused on my hobbies and family than trying to bill any more hours than the base. We are also trying for a second child, and while I love the idea of being a full time mom to older children (over age 3), I find the infant stage to be pretty challenging for me mentally and emotionally, so I want to keep working to afford a nanny and to super fund my second child’s 529 plan (like I did for my first child).