This post may contain affiliate links and Corporette® may earn commissions for purchases made through links in this post. As an Amazon Associate, I earn from qualifying purchases.

I was looking around the designer dresses and clothes at Nordstrom recently and found myself thinking, man, if I ever win the lottery I am immediately going to the closest Max Mara store. (Then I started debating myself — Akris Punto? Armani? Hmmn.) So I thought this might be a fun fantasy open thread today — what would YOU do if you won the lottery? I'm assuming many of you would pay off student loans or credit card debt — maybe even family members' student loans. (I seriously know someone this happened to!) After that, where would you turn? Just for kicks let's say you've won $50 million dollars.

For some reason here's what comes to my mind (after mortgage, college for the kids, and checking with close family and friends to see about helping with debts, and doing some serious thinking about charitable donations/setting up our own foundation):

Travel

A really, really nice trip to Bali. We wanted to go for our honeymoon but couldn't quite swing the number of days needed for wedding/travel/vacation — so going to Bali is still on my bucket list. There are so many cities still on my bucket list I'm not sure what would be next; probably Tokyo or Buenos Aires. Pictured.

Luxury Home Purchases

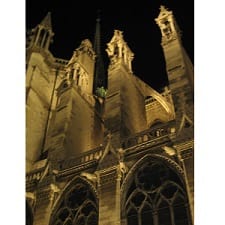

A pied à terre big enough for my family in Paris. I love Paris, have been four times over the years for vacations, and could go a million more. It feels strangely familiar and comfortable to me — maybe I lived there in a past life. (Ok, a sick apartment in New York would also be on the list!) Pictured below and at top: from my personal archives.

Personal Trainer/Chef/Assistant

Daily personal trainer, personal chef, and personal assistant. I know, I know, getting in shape and eating well can be very affordable things — but I'd still love to have someone come to the house and kick my arse on a regular schedule… serve us/clean up healthy versions of our favorite foods… and take care of all the other little details in life.

Those are the first three things that come to MY mind for total splurges — ladies, what would yours be?

Vegemite

1. Buy MIL a house in Madagascar

2. Buy a pair of tap shoes, hire a Mariachi bank and tap dance to said Mariachi band as I hand in my letter of resignation.

3. secretly pay off mortgage (if this is even possible) for an ex coworker who has a spell of bad luck

4. finally get that massage

Anonymous

#2

I like how your roll.

the gold digger

I would have bought my in-laws a house anywhere that would be impossible to visit, call, or email.

Anonymous

I think #2 just became my “keep my sanity through a bad day at work” fantasy, thank you for that glorious mental image.

KinCA

I literally snorted at #2. Thanks for my new “bad work day” fantasy.

Anon

#2 won the internet today.

Minnie Beebe

I would quit my job in a millisecond.

Invest the money (some in a trust for my son), but wouldn’t make any other major changes. But yeah, I’d be done with work, tout de suite.

KT

I’d buy my pony, darnit! (30 years of waiting!)

Yes please!

1. Quit my job

2. Build a spa in my house that includes a sauna, steam room, and ice bath

3. Go on a safari and a luxe trip to the Galapagos

4. Start career as a novelist

Yes please!

I would also invest it in some way that we could maintain a slightly higher standard of living forever without having to work at a normal job if we don’t want to. Would tinker with 2 and 3 if needed to be able to invest.

Anonymous

I feel like with $50MM I could build a really great spa and take two amazing trips, no budgeting required, and still have enough left over to live forever without having to work a normal job. Your standard of living must be something if you are worried about tweaking Nos. 2 and 3.

Yes please!

LOL. No way. Before the other posts below, I had no idea how much one would have to invest and how much you could pull out every year. After seeing that, I don’t think I’d have to adjust 2 or 3 at all and would still have more than I would know what to do with.

Killer Kitten Heels

This one is fun to ponder! I mean, I’d do all the obvious stuff (pay off all the debts! college fund for future kiddo(s) and nieces/nephews!), but beyond that I’m not sure. I’d probably invest the money leftover after paying everything off in a way that would allow us to just live comfortably off the interest, so we could quit our jobs and never have to work again, and I’m sure we’d travel a lot more, but I don’t see myself wanting to run out and buy a bunch of luxury properties or fancy cars or anything like that. At most, I might trade my current house in for a small horse farm, and I’d get myself daily riding lessons. H would probably want an in-home movie theater and top-of-the-line cameras and computer equipment, so I’m sure we’d go for that. I’d probably also make giant anonymous donations to some local animal rescues, and set up a scholarship fund for alumni of a program for high school students that I currently volunteer with. I definitely see H and I as being more of the “millionaire next door” type, where our neighbors would have some vague idea that we lived off of “investments” but would have no idea we had $50mill in the bank.

(Also, side note, is it terrible that part of me would want to keep the whole thing a secret to prevent entitled family members from demanding “their share,” which would be totally out of proportion to what is reasonable? Because I’m definitely feeling a bit of that as I contemplate this question.)

Killer Kitten Heels

…..aaaaaaaand now this line of thought has me depressed that we’re going to be in debt for at least the next decade, and there’s no chance I will ever have any of the things I just listed. Sadface.

the gold digger

keep the whole thing a secret to prevent entitled family members from demanding “their share,”

Nope. Not at all. I wouldn’t tell anyone, either. My husband’s half brother is already trying to drain his own (mentally disabled) son’s trust to fund the brother’s IRA, pay for his home remodeling, and pay for a family vacation to Europe. The brother is super ticked at my husband, the trustee, for not handing over the cash.

I would, however, help out my own siblings and my husband’s stepdaughters, because they are not demanding, greedy jerks.

Baconpancakes

Nope, not terrible. There’s one side of my family that has “borrowed” $15k in small amounts from my mother over the course of three years, and lied about what they spent it on because they feel entitled to milking the cash cow she represents to them. I probably wouldn’t tell anyone in my family except my mother and my aunt, since we are the Big Hair Secret Holders in the family.

Anonymous

+1

Anonymous

Not terrible at all. I think everyone’s got a relative or three like that – mine is an uncle who can’t understand the concept of living within his means and would rather bankrupt the entire extended family than cut back his lifestyle.

CPA Lady

I like my job, my house, and my life…. and i dont want my vast wealth to go to my head. That said, I would

1. redo my kitchen and bathrooms

2. buy a new volvo with every single bell and whistle available

3. pay for one friend to go to rehab and another to go to seminary

4. Go on several really nice vacations a year

5. Buy a party boat and have parties on it with all my buddies

6. Big charitable gift to food bank

7. Invest/set up trusts, etc

2 Cents

Love Volvos!

TheElms

Travel, oh so much travel

Hire someone to help me figure out what I want to do with my life

Hire a chef/personal trainer because I don’t have the willpower on my own

Anons

I’d go crazy on charity. I’d buy up a bunch of debt from debt collectors, then just forgive it all (medical bills and student loans–I would try to target poorer populations). I’d also hire an army of lobbyists tand make political contributions to advocate for policies that would benefit the poor and middle class. I would probably go through the $50 million pretty fast, but I would try to make a pretty big dent in making America a better place. (And yes, I realize I am ignoring global problems, but when I think about what could be done to make life better for more people, my mind wanders to personal economic security for more people. That gets at the root cause of many problems and helps those people go on to help others.)

Anon in Brooklyn

“I’d buy up a bunch of debt from debt collectors, then just forgive it all (medical bills and student loans–I would try to target poorer populations). ”

Come to the consumer debt part in Brooklyn Civil Court – it is the saddest place on Earth, and so in need of this kind of intervention. (I practice there on behalf of a creditor, and I’m pretty sure the work I’m doing in that courtroom is responsible for at least half of my monthly therapy bill, and explains just about all of my bad karma.)

life

I hope that after you have built up your nest egg, you will use your expertise pro bono to start working for the other side.

It will really feel good.

Suburban

+1 not my practice area but I’ve lierally been there- Livingston street- heatbreaking. Try not to beat yourself up anon in bk.

Godzilla

YES TO CHARITY. I would also become a social justice champion under my real name because I’d have real F8CK YOU ALL $money$. Hobnob with the rich and build free colleges everywhere.

Catlady

1. Quit job, but finish out all my projects and whatnot

2. Eradicate all of my debt and the debt of all my family members

3. Purchase ridiculous Lower East Side/Soho apartment and home in Montauk

4. Flip and sell our current home

5. Get my hands tattooed

6. Start donating like there’s no tomorrow

As for purchases:

-Audi R8

-BMW X5

-Indian Chief Dark Horse

-Every available Alexander McQueen piece

Anonymous

This is fun to think about!

1. Pay the taxes on it (I would assume around $25 million)

2. Pay off car loan

3. Break lease and buy $500,000 house (Texas, that is more than enough for one person)

4. Pay off brother and parent’s houses. Why not?

5. Talk to a financial advisor about the best way to invest $20 million of it.

$. $1 million into checking account to plan world adventure,

7. Put the rest (3-4 million?) in a philanthropic foundation

8. Quit job, spend rest of life traveling and volunteering.

Anonymous

Quit my job in a hot second. Give a huge chunk of it to my parents. Spend the rest of my life traveling and shopping. Never cook or clean my own house ever again.

Pep

1. Quit job

2. Pay off student loan, mortgage, other debt

3. Travel

4. Home improvements

5. Go back to school part time and study things I’m interested in (medieval history, etc)

6. Eye job

7. Generous donation to alma mater, but I want my name on something

hells no

I would not buy Akris Punto. First, now you have an Akris budget. Second, WHY?

I would be Candy Spelling: maybe with a properly-attired butler, but in sweats (or, probably, Athleta). No more work clothes for me!

Catlady

YES, burn (or donate) all my work clothes in the yard

Anonymous

With a band, while tap-dancing.

[I salute y’all who will pay off debt. I’d do that if I won 5-figures. This is EIGHT FIGURES. And EIGHT FIGURES AFTER TAXES. I’d pay off debt with a wheelbarrow full of Benjamins, tap dancing, and the band.]

The only reason I wouldn’t be ostentatious where I live is all of the nut-job beggars and sudden distant cousing who would inevitably show up asking for $. Blowing my $ on travel and nonsense at least gives $ to the hardworking travel and nonsense industries.

Killer Kitten Heels

I just died at “the hardworking travel and nonsense industries.” Thank you for the laugh.

Diplomat

1. Quit

2. Buy a house (nothing ostentatious) and fund college for kids and nephews.

3. Send my mom to finally finish her degree.

4. Buy a vacation property where my family can meet one-two times a year.

5. Sock away several million.

6. Give the rest away–maybe a grant program for low-income parents who need child care expenses?

Garden & Gun

I flipped through it yesterday at the dentist. Some ladies didn’t have proper hunting clothes for trips to their hunting plantation (which had a barn-sort of building that is nicer and more pinterest-perfect than my house), so they had hunting pants made for them. [Problems I didn’t know I had!]

Y’all: I am just going to buy everything in that magazine (bespoke hunting pants, hunting plantation, sweet dogs, cold c*cktails).

CountC

Hahaha YES. I would pick up several back issues of the best of the south G&Gd amd buy ALL THE THINGS.

CountC

Hahaha YES. I would pick up several back issues of the best of the south G&Gd amd buy ALL THE THINGS.

Legal canuck

I would pay off all debt. Put money away for retirement and for my girls school.

Then we would take some and travel.

Then we would do some renos to our house.

Then I would quit my job and find something I am passionate about.

life

Hire someone to clean my apartment regularly.

Start getting regular haircuts, dye jobs with beautiful complex highlights.

Get electrolysis or laser to get rid of all unnecessary body hair that has plagued my dark haired body all my life.

Buy a Tesla.

Invest the rest, and volunteer during the day/donate much of my gains towards healthcare delivery and childhood education/hunger/poverty programs. When I pass, leave it all to my favorite foundation to continue these programs.

Hazel

1. Set up $100k in college fund for each niece and nephew (9 so far–so round to $1 million)

2. Fully fund my parents’ retirement

3. Build my dream house (on acreage, with woodland and lake)

4. Hire in-home help for a chronically ill friend

5. Pay off student loans for 2 more close friends

6. World travel for a year or two, with various friends/family members joining me for their favorite countries!

7. Generous donations to preferred charities.

8. Invest the rest, and live a quiet life as a lady of leisure, with plenty of travel, gardening, and pets.

Cat

So after taxes, that $50M is more like, $30M.

I’d stick the $30M in some conservative investments to enable me to live off the interest (the old rule of thumb was 4% per year but I don’t know if that holds up with the current market, so let’s assume 3% per year or $900,000/year, less taxes of course).

That’s definitely enough for me (and husband) to quit our jobs, but not so much that I’d be flying around buying multiple apartments — I’d probably move somewhere on the water, and look forward to traveling and having a maid, chef, and personal trainer, but I’m not sure how I’d fill my days exactly. I’d struggle without having some sort of schedule and accountability but I’m sure I’d figure it out!

Two Cents

1. I LOVE my job (appellate attorney) so I wouldn’t quit, but maybe see if I could work part-time

2. Buy a beautiful 5 bedroom home that is all on one floor, not that large (2500 sq ft max), smack in the middle of my city, with a large backyard, and where we can walk to everything

3. Hire a full time daily housekeeper/home organizer and chef

4. Adopt 2 kids

5. Hire full time nanny to help me with my now 4 kids

6. Buy a beach vacation home where the family could come together for a family reunion

7. Take my mom on a once in a lifetime vacation somewhere fabulous

8. Buy my mom a beautiful home in the Bay Area, maybe in Berkeley or Rockridge

9. Buy my dad a beautiful home and pay off all of his medical bills

10. Buy a MIL a beautiful home, this has been a dream of hers to own property

11. Become a philanthropist and give away lots of money to important causes

12. Fund college for my children and my nieces/nephews

13. Do some anonymous random acts of kindness (ie: leave an envelope for $1000 on a needy family’s door)

14. Buy nicer clothes but nothing too crazy (maximum clothing budget 10K a year)

15. Give most of my money away (no one needs 50 M)

16. Give a very generous donation to my law school. It’s not top tier so it’s not rolling in dough, but my education there has helped me immensely professionally and I am very grateful

This is a fun exercise. :)

Anonymous

Honestly, I don’t think my life would change all that much. Maybe my work load would switch to more pro bono work, but I can’t imagine changing anything else.

Sydney Bristow

I’d pay off our student loans, pay off the student loans of my siblings, pay off my grandparents remaining debt, and buy my dad a Tesla.

Then my husband and I would buy $5 million Australian worth of property. A place in Sydney and a beach house near the Great Barrier Reef. That would allow us to stay there as permanent residents.

Hopefully the remaining money would allow us to live comfortably and travel without needing to work. Aside from the homes and travel at about the level we’ve been doing, we’d live modestly. I’d try my hand and writing a book.

Anon

Ok this is pathetic and going to bring down the mood but this makes me depressed. I’m recently single and the idea of all this money but no one to share a life with is sad. I would probably just invest it and keep working because I don’t have anyone in my life to travel with or buy a house with. I already own my own place and can afford to upgrade it, I know I can travel on my own but have no desire to – I’m just realizing that you can’t buy your dream life.

Anonymous

If you had that much $, you’d have someone to share it with in a heartbeat.

Ellen

I agree. I would find a guy who was NOT interested in me for my money, tho. I would have the TIME to find a guy b/c I would NOT be workeing full time any more. I would NOT want to leave the manageing partner high and dry, so I would NOT quit my job. I would, however, take more time off, and onley bill mabye 2500 hours a year, which would leave me alot of free time to pursue OTHER INTEREST’s.

Once I found I guy worthy of me and my status, I would make sure he was abel to handle all of the finance’s so that I could relax at work. We would also have a nanny to handle the 2 kid’s I would have and we would also have a 401K to tap 30 year’s from now when I retire. YAY!!!!!!

Bluestocking

Pay off student loans, car loan and mortgage. Go shopping for lots of clothes and shoes. Hire a weekly cleaning service and lawn care. Re-do my bathroom.

Then I’d wait 6 months before making any major life-changing decisions, which might include quitting my job, starting a foundation, getting more involved in hobbies that I now squeeze into after-work hours, traveling more, and/or buying a new home in my current city and a vacation home or 2 in the place(s) I visit most.

Anonymous

After all the practical stuff like paying off the mortgage, saving for future kids’ college, helping family and investing a large chunk, I would do a lot of luxury travel (Antarctica being #1) and donate to environmental and conservation causes. I actually doubt I would buy a second home. It’s certainly tempting to buy a home in Hawaii or Paris or someplace like that but I love traveling to new places and would still want to spend most of the year in our current hometown, so not sure how much use the vacation homes would get. And it seems like maintaining them, even being able to hire all the help in the world, would be a time sink I don’t need. My husband also wouldn’t want to quit his job and I wouldn’t want to be away from him for too long, so most likely I’d escape for a month or so every winter to a rental or luxury hotel in the Caribbean, Hawaii or South Pacific, but would probably visit a different place each time. I might buy a condo right near the closest major airport to us, since it’s ~2 hours away and that would make all the travel a lot more convenient. (Clearly I’ve given this waaaay too much thought).

Anonymous

Yes — why buy a second home? Go to all of the places and you still won’t be repeating! And someone else has to clean them, pay for insurance, board them up for hurricanes, etc. The world awaits — why limit yourself to just a couple of properties when you can visit the whole d*mn world?!

Killer Kitten Heels

Agree 100%.

Especially with how many awesome AirBnB options there are in pretty much every place I’d ever want to visit, I can’t see the point in buying a vacation home when I could use probably a quarter of the amount of money to finance month-long trips to all different places and still have the “home-away-from-home” experience.

Baconpancakes

Depends on how many people use it – my SO’s grandparents built a beach house that is now used by their three children and all their grandchildren – it’s full basically all summer.

Which reminds me, 11. Renovate the beach house to add freaking air conditioning and get rid of that avocado green carpet.

Sydney Bristow

My best friend’s family (grandparents, multiple kids, now grandkids who are old enough to stay alone) also owns a beach house. I think it is full most of the year. It is a much loved place.

The reason I would buy property is because we really want to live in Australia and it is the most straightforward way to accomplish that goal.

Anonymous

In that case: family beach compound, Kennedy-style.

SC

I’d definitely quit my job and never work again, and I’m sure my husband would do the same. I’d spend $10 million buying a fancy house, funding my kids’ education, paying for nice things for family members, and donating to my undergrad. An online interest calculator says that with $40 million, I can withdraw $114,00 per month with just a 3% interest rate and never deplete the initial investment. Conservatively (accounting for taxes etc), I think I could live very well and travel and donate to my favorite causes on $1 million per year for the rest of my life :-) Also, I would drink nice wine every night, and sometimes at lunch.

Wine

At that level of income, I would let my cook use it for braising meat (in my new Aga stove that I would never see b/c the kitchen is for the staff now) and spaghetti sauce.

Baconpancakes

1. Debt

2. Add a 2nd story bedroom and bath to the house, and dig out and finish the basement

3. Create a trust fund for my parents, and my cousin

4. Set up college trust funds for my 3 closest friends’ kids

5. Donate so much to the botanical garden that they name an entire section after me

6. Donate to my alma mater to get that godawful building I hate torn down and a new one built in place with better views and a reading garden

7. Buy a 4-bed in Ballard.

8. Get an entirely new work wardrobe from the designers you ladies are mentioning whom I’m never even heard of before.

9. Get season tickets to the opera

10. Pick a destination every year to travel to for 3 weeks.

Legally Brunette

8. Get an entirely new work wardrobe from the designers you ladies are mentioning whom I’m never even heard of before.

Ha! I love this.

Anonymous

Again, this is a work clothes blog. Pls buy c*cktail attire and smoking jackets and beaded lougewear. I do not want you buying suits with your millions!

Baconpancakes

I mean, beaded dresses and silk smoking jackets and Louboutins and Jimmy Choos sure, yeah, but even if I won the lottery I’d keep working, and there’s no reason not to look FABULOUS at my desk.

Baconpancakes

Oh, and 12. Have a ridiculously, absurdly luxe and super fun wedding. Hold it in the poshest winery around, the one with the huge timbered barn in case it rains (even millions can’t control the weather!), get a hand-carved chuppah like the one from Gilmore Girls, hire a decorator to make all the DIY table moss terrariums pinteresty things and swags of white fabric, get an amazing live band, pay for the dresses and spa day and hair/makeup of the entire bridal party, have a croquembouche made in addition to multiple single-tier delicious cakes of all different flavors, get catering from my favorite local restaurant, hire a couple of the genius bartenders from that same restaurant to make top-shelf drinks, have giant yard games, an awesome photo booth, and a treasure hunt, then after the grownup party is over, have a barista serving espresso drinks, a donut food truck, and a BBQ food truck. Also I would invite everyone I know. You guys are all invited to my wedding if I get the $50M prize.

NOLA

1. Buy a house here. Have a whole room for all of my shoes

2. Have a condo in NYC

3. Endow everything for my job that is currently underfunded then quit. Endow the music program at the church

4. Travel and pay for my friends to travel with me

5. Personal chef and trainer. Then surgery to remove all of the extra skin I’d have after losing so much weight.

In-House Europe

NOLA, you wouldn’t need surgery – you barely need to lose weight!

Anonymous

I would buy a mews house in London, a flat in Paris, and a country estate in Scotland. Then I would go there and live.

Aunt Jamesina

1. All the boring adult things (pay off loans, retirement, etc.)

2. Take courses in every conceivable thing I’m interested in

3. Buy a small vacation property in the south of France

4. Buy a condo in my city.

5. Run a dog rescue from my country property (a glorious restored 1970s ranch, maybe 2000 square feet max).

6. Start a trust so my family gets all their basic needs (especially education) met.

jwalk

1) Pay taxes.

2) Pay off student loans and mortgage for me and my partner.

3) Fund my siblings’ college education.

4) Put $1 million aside to invest specifically for retirement purposes.

5) Give my alma mater funding to reinstate language housing (preferably with my name on it).

6) Donate to charities.

7) Invest 90% of the remaining amount.

8) Take the last 10% and renovate my house, go on really nice vacations every few months, and take my father to Germany (always wanted to go, but he’s never been outside of North America).

I likely wouldn’t move (though a small apartment in Paris might be a nice addition…) or quit my job just yet, and I don’t think I would tell anyone outside of immediate family. That’s partly because of the potential for family members to ask for more than they deserve (as others mentioned), but mostly because I wouldn’t want my friends to think any differently of me. I might start giving them really nice gifts for their birthdays, or anonymously intervene if an emergency situation presented itself in their lives, but otherwise I’d just let them think I got a ridiculous raise or something.

As my investments grew and maybe I became bored with my job, I might look into funding a woman-owned start-up of some kind, one where I could be involved almost on a consulting basis but not have to be at work every day. I think that would be fun but still let me mostly live a life of leisure. :)

Married to a hoarder

I would build his & hers mansions connected by a tunnel and/or skybridge so that he can blow his # on gadgets and electronics and cars while never unloading random crap (and crap it is).

I would finally have a nice house.

Husband has always wanted some sort of tunnel / fallout shelter / folly sort of a house. Now we can all be happy!

Anon

Hahahaha and I feel your pain.

Sydney Bristow

Haha my husband jokes that we need separate wings because of our different decorating styles and my minimalist tendencies versus his historical archive tendencies. At least it all is impeccably organized and he knows that I draw the line at getting a storage unit.

New Tampanian

I love my job so I’d keep it.

1) all my debt

2) all my sister, step father and mother’s debt

3) trust for my mother to live off of (mental illness factor here)

4) fund step father’s retirement

5) trust funds for my closest friends kiddos for college

6) go on a ridiculous vacation

wait some time…

7) buy a house – preferably on the water, brand new construction

8) Have regular beauty maintenance (hair, nails, skin, etc.)

9) Personal stylist/shopper

10) Personal trainer

11) LOTS of charitable work

Rebecca

1. Pay off our mortgage

2. Replace husband’s truck

3. Do a few big fixes to the house

4. Buy a vacation house (But where? We’ve talked about CO or NM but I would also like a beach option.)

5. Go crazy with charity, we’d probably end up with a wing at the humane society named after us

I’d say college money for our nieces and nephews but I’m thinking they are already taken care of by the grandparents. I’m not sure I’d quit my job right away. I like it and like my coworkers. I always say I’d want to be a stay-at-home lady of leisure but honestly I think I’d get bored with that really fast. I might end up doing something with a non-profit where I felt more fulfilled and didn’t have to worry about working for peanuts (or free).

I wouldn’t want to tell anyone either. I mean, I’m sure we’d have to tell our families and close friends (they’d wonder how we got new cars and houses), but I can just see all the sob stories coming out of the woodwork.

nutella

My guy and I have had serious, long conversations about this topic. We wouldn’t live too differently than we do now, except have a nicer home and travel more, but really the thing we talked the most about was the fun of quitting our jobs. It’s not that we don’t already have a F* you fund, so we really could quit our jobs tomorrow, but we’d still have to work and the thought of quitting in a way that you don’t have to be honest and polite and worry about not burning bridges because you still want a career elsewhere is just soooooo nice.

I like the mariachi band idea. If we win, I will be sure to report back that I/we both did that, muahaha :)

Hey macaroni

Cry hysterically. But a house and cars. Pay debts. Save a lot. Start over.

Baconpancakes

I appreciate the honesty of your first response.

Anonymous

Ahh, what a beautiful thought…

So after taxes that’s what, $25-30mill? Let’s see here –

1. Pay off All The Debt. Student loans begone!

2. See no.1, but for long-term SO, parents and brother. Mortgage, cars, the whole nine yards. No more monthly payments for my family.

3. Buy: car (oooh, Tesla!), house (large enough for me, SO and future kids), a couple nonsense purchases (MacBook! Guitar! Home gym! Fancy-pants skincare stuff!)

4. Set up trusts for niece, future nieces/nephews, future kids. Max out 401(k).

5. Buy out ownership of an apartment complex in a good part of town. Even after all the overhead, that’ll be guaranteed money every month, no matter what the stock market does.

6. Whatever’s left gets split – 75% into investments tuned such that I can live comfortably off the interest, 15% into liquid savings, 10% designated fun-money.

7. With that 10%, GO TO ALL THE PLACES. France, Ireland, Japan and South Korea would be my first priorities. Australia? Italy? Morocco? ANYWHERE I WANT.

Anonymous

Oh, and hell yes I’d have the brass band and the rollerskates and the freaking neon lights and fireworks when I went to hand in my resignation. I’m just picturing (and probably dating myself with this) Q with the mariachi band and the trumpet in Star Trek Next Generation – that’d be me. Off-key trumpet and all.

Baconpancakes

Hahaha I know exactly what scene you mean and I’m only 31.

BG

Take it one step further – hire John Laroquette (I think that was the guy who played Q…) to come hand the resignation in with me.

KS IT Chick

Pay off the debt, including the house.

Set up college funds for the nieces & nephew, at about $100K each.

Set up an endowment for the local animal rescue organization

Replace the artificial turf in the football stadium at our alma mater with real grass, and set up an endowment for maintenance. (Artificial turf is terrible for knee injuries.)

Set up technology replacement funds at my husband’s employer (small university) and my employer (small hospital) to allow for long term funding so that the people who take our jobs don’t have to deal with the money issues we have fought.

Tell my cousin the leech that she & her band of grifters can go get stuffed.

VACatLady

Oh fun! After paying off debt, I’d:

– buy our dream house

-quit my job

– prepay my son’s college

– get more involved with charitable giving

– travel!

Anon

I love all of these thoughtful, generous, mature ideas. I would do those, and then I would (in my fantasy, at least) also do less mature things . . . .

I would do trust funds for niece and nephew and zero to brother and sister-in-law. And when the kids turn 18, I will gladly take them around the world. Without their parents.

I would donate to one alma mater, and send the press clippings to the other alma mater with a note to the dean letting him know that if he had only not been a horse’s hind end — would probably include a photo to help him imagine it — to me as a student, the money would’ve gone to that school.

I would give money to my high school so everyone arriving for my next reunion would see my name on a building (because they still wouldn’t see me!).

I would walk into my favorite legal services organization and hand out $10,000 checks to every employee.

I would buy out store that sells puppies in my town so I could put them out of business and encourage adoption instead. (I’d negotiate a non-compete with the seller.)

I would travel like crazy, but every now and then, I would also send “how do you like me now?” postcards to old boyfriends, the nasty sister-in-law, etc.