This post may contain affiliate links and Corporette® may earn commissions for purchases made through links in this post. As an Amazon Associate, I earn from qualifying purchases.

Reader L wrote in to ask about white pants for work — do they make more opaque white pants for work? What are the best tricks and tips for wearing white pants to work? We've talked about how to keep white blouses white — and the best white opaque t-shirts — but we haven't talked about white pants in a long while. First, here's reader L's question:

With the beginning of spring and lighter colors I'd love to get a pair of white pants for work. The few I have tried on have been very see-though up top. Do you have any suggestions for white pants or tricks to help with too sheer pants?

First: the old rule is that you aren't supposed to wear white until Memorial Day. So technically, white pants are only for summer, not spring. But I'm seeing them EVERYWHERE this spring (particularly for weekends, with distressed/ripped white skinny jeans) — so they're clearly more popular (to say nothing of all the suffragist connotations with white pantsuits).

(According to Better Homes & Gardens the old rule was designed in the late 1800s for elitist/classist reasons — so, as they say, “wear what you want, when you want.”)

Update: Our Latest Favorite White Pants for Work

Some of our favorite white pants for work as of April 2024 include Nic + Zoe, Talbots, Spanx, Favorite Daughter, Everlane, Lafayette 148 New York, Vince, and Cinq à Sept! For budget-friendly options, try Old Navy or Tapata. If your office is OK with 5-pocket styles and/or denim, check out the highly rated Wit & Wisdom and NYDJ pants.

So let's talk about this: do you wear white pants to work, whether in spring or summer? What rules do you have around “white pants for work,” and what tips and tricks do you have to make sure they're not too sheer?

Can You Wear White Pants with Work Outfits?

As always, know your office. I think white pants can work at work, so long as they're office-appropriate. Things to look for: tropical wools, textured cottons, jacquards, lined crepes — heck, lined anything — would be great. Not too tight, not too loose.

As many white/linen options as there are out there, I would avoid white linen pants for the office in springtime because a) the linen is going to wrinkle and make you look a total mess, and b) most of us don't need the cooling effects that linen provides until the dead of summer, and even then it's when the office A/C will be on full blast.

I would probably gravitate towards more trouser-y versions — a high-waisted, flared pant is a very on-trend look, and a fluid, white trouser pant would be a sophisticated way to wear it at work — but there are also, obviously, a ton of white ankle pant options.

And here are some in reasonable price ranges — note that some of these have a “double cotton weave,” are lined, or have particularly good reviews. The first one pictured is a ponte, which I could see going either way, but it's a much-loved pant in general and the reviews are very positive, so I'd give it a try if ponte pants sound appealing.

Are White Pants Business Casual?

White pants can absolutely be the basis for a great business casual look — provided that they're not sheer, and your office allows whatever fabric you choose. For example, white denim is a great casual look — but not every office allows denim at the office.

How to Make White Pants Less Sheer

Remember, Spanx was invented to deal with this very problem — founder Sara Blakley wanted to wear white pants with sandals but wanted to wear pantyhose under them for shaping and opacity; when the cut-off pantyhose kept rolling up she invented Spanx. This one is their best-seller; this one is a higher-waisted version, both around $28; the Target version is only $16. (As some commenters are noting, these are all links to the capri-style, longer-length Spanx — if you prefer a shaping short please make extra sure there is no “line” where the shapewear ends (or, if you're me, uncomfortable sausage-spilling-out-of-stuffing look to things).

If you find Spanx too constricting, there are other options to make white pants less sheer:

- look for lined pants (we noted several options above)

- wear a silkier version of Jockey Slip Shorts (the wicking fabric has a slightly smoother fabric than the beloved original fabric) or similar non-shaping slipshort (I'm even seeing them as a drugstore hosiery option these days!)

- a non-shaping capri legging, either in white or a nude-for-you (this is going to be the least sleek option, as well as probably feeling a bit heavier, but I've heard it works)

- you can always go old school and wear pettipants! (hat tip to the readers for suggesting that one!)

As for which underwear to wear with white pants, I would suggest nude-for-you boyshorts or another option with modest coverage, at least for work — I always seem to be stuck walking behind the woman with white pants and a clearly visible thong and it's never registers as a good look. (See our latest favorites down a few paragraphs!)

(Another perspective, not mine: I will always remember the What Not to Wear book (BBC version) where they suggested if your underwear was going to be seen, it should be extra cute, and even had a picture of Trinny crouching down to show off a sparkly butterfly-themed thong.)

So, readers — what say you? Yea or nay to white pants to work? If you wear them to work, do you wait until after Memorial Day, or do they feel like a springy thing to you? Do you prefer to wear white pants as part of a white suit? What are your best tricks for making sure your white pants aren't too sheer?

Social media picture credit: Deposit photos / © mjth.

More Of Our Favorite Picks for Spring Work Outfits for Women

Opaque White Tees

Hunting for opaque white T-shirts for work? As of 2024, we'd suggest checking the double-layer lines from Boden, Express, Old Navy, and Hobbs, as well as great sources for basic Pima cotton such as L.L.Bean, Uniqlo, Everlane, Banana Republic, and Talbots. (This $268 tee also gets great reviews for opacity, and Elizabeth swears by this tee under $30!)

As of 2024, the best spots to check for nude-for-you undergarments are Gap, Old Navy, or Nubian Skin for tons of options — Victoria's Secret also has a bunch!

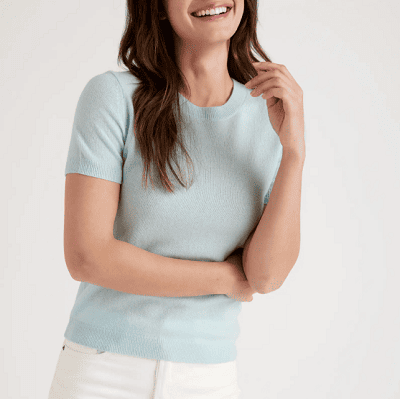

Sweater Tees

These can be amazing for spring's finicky weather — and they're often more opaque than most t-shirts!

Some of our favorite short-sleeved sweater tees for 2024 include Quince ($45!), Ann Taylor, J.Crew,* and this Amazon bestseller. (* plus sizes too!) If you're hunting for something fancier, check out Kule; Tuckernuck also has one in a cashmere/silk. As of 2024, Nordstrom and Anthropologie both have a huge selection of sweater tees. (All of the ones below come in white and black, as well as other colors!)

White Blouses

Some of the latest white tops we've featured as of 2024 include these great options…

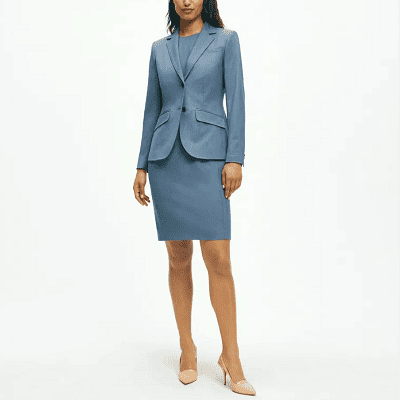

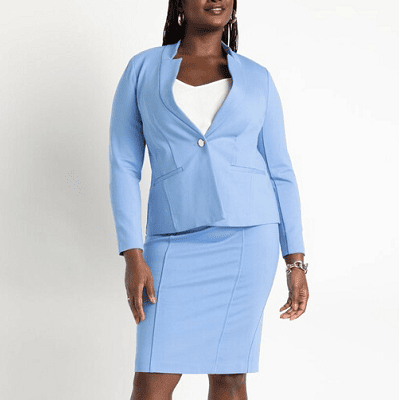

Light Blue Suits

You'd be surprised how versatile they are! We round them up every year…

If you're hunting for colorful suits, note that light blue suits for summer are some of the easiest because you can wear them as you would a light gray suit. As of July 2024, we're seeing nice ones at Reiss, Brooks Brothers, and Hugo Boss, . On the more affordable side, find blue suits at Ann Taylor (“blue echo,” ojai, and a plaid), Banana Republic Factory, from Tahari, and Eloquii.

Colorful Sheath Dresses

If you're hunting for a particular color, these dresses have all come in a ton of colors over the years…

Colorful Pants for Work

Hunting for colorful pants for work? They're very popular everywhere for 2024, but note that in general, brands like Rekucci, Krazy Larry, Banana Republic, Express, J.Crew, and Boden have a ton of options.

Great Sneakers for Work Outfits

2024 Update: Some of our latest favorite sneakers for work outfits include the following — see the full post for all the details!

This post was originally written April 18, 2017, but updated substantially as indicated.

When your partner has WAY less resources

I am dating an absolutely fabulous man. Emotionally in tune and supportive, amazing cook, enthusiastic gardener, has similar interests to mine, can happily opine on which shoes go best with that dress, AND he is so handy that he can (and has) literally built a house from the ground up.

One concern: we were talking finances and while he doesn’t have any bad debt he also has not saved much if anything for retirement. He may have a 100k net worth. My net worth is 7 figures. I’ve been grinding it out at a soulless corporate job, with about 1-2 years left until a nervous breakdown. Had given up hope of finding an SO, and was planning on early retirement around 40 – downsizing to a studio apartment, selling my car, and maybe taking a PT job for fun money. We are both near 40 now.

I am concerned that hitcing our lives together will trap me into corporate insanity for another 5-10 years or more, given that I will basically need double the resources to support both of us (will need to buy a home over 400 sf, etc.). His income potential is around 100k annually, but only if he takes on certain work that he hates. Maybe 50k annually if he sticks with work that he loves.

Am I silly to have pause at the very real consequences of joining our lives? I have worked so so hard for my nest egg and despair at the thought of staying in my current job for that much longer.

Anonymous

This may be a stupid question, but why would you be fully supporting him? Sure, maybe you don’t downsize all of the way to a studio apartment, but you can still downsize to a 2 bedroom. Maybe you sell your car and keep his (which you pay off together if it isn’t already). He can contribute to the household as he is contributing to his own now and you can contribute as well. Why can’t you make a life together where you both contribute in a meaningful way and that also works for both of your visions for your lives?

It sounds like you are locked into needs (you said you need to buy a home over 400 sf, but no one needs to buy a home of any variety). Perhaps start thinking of things in terms of wants?

Anonymous

+1. The guy is currently employed, right? He will be able to contribute to the household financially and also in other ways that may be relevant (maybe you buy a fixer-upper and he puts labor into it?). I don’t see why you would need to be a corporate slave for another 5-10 years unless he can’t support himself and wants to mooch off of you, which it doesn’t sound like is the case. You retire and cover your half with savings, he covers his half the way he does currently, by working. Or am I missing something?

Anonymous

Are you concerned about hitching yourself to his wagon because he is a bad saver in general? I think that is a legitimate concern (I mean as a general matter, I’m not suggesting he is a bad saver just because he doesn’t have retirement savings at almost 40).

If you are concerned about your ability to retire early as planned, I don’t see why you can’t assuming he keeps working. You keep the larger apartment and he pays for half, etc.

I think you need to talk to him about this. He may be equally concerned that you’re selling your soul for money and willing to live like a miser for the next 45 years.

Anonymous

He has 100K worth plus the house (with a mortgage I presume) and earns 50K a year? He’s not loaded but he’s not exactly poor either.

He continues to work, you take a PT job for the fun money and you split living expenses including maybe moving to one car. Sounds like you actually end up better off because you have someone to split living expenses with. Plus, since he’s handy, your home costs won’t be huge as he ‘ll be able to handle minor repairs.

Anonymous

Re-read your post and confused why you mention buying a home. Doesn’t he have a home? You can live there.

Anon

Exactly what I was thinking! pretty good to have saved $100k on $50k a year…that took some effort!

Torin

No you’re not silly to have pause. Have you talked to him about this?

That said, not sure why if you work you have to work a soul-crushing job. You can take something that requires significantly less hours and gives you more vacation time. You can retire and he can keep working. Or any of a number of other options I’m not thinking of off the top of my head. I don’t think your only options are soul-crushing job and stay with this guy or retire early and die alone.

Senior Attorney

I agree with this. If you get married or otherwise take on a life partner, maybe your plan changes. Maybe you don’t quit the rat race and move into a tiny apartment with no car. Maybe you downsize your career and make less and work less, and he works at what he works at, and you have a different kind of life than you had been planning.

I do agree that a prenup is a good idea.

And look carefully at whether you respect him enough to join your life with his. He sounds great but you sound pretty dismissive about his income and his net worth, which are not huge but not nothing. You don’t want to end up resentful like Anon at 2:00 p.m.

Anon

Well I am somewhat in your situation. I married a man who had saved nothing for retirement and is now making noises about retiring early. He also does not love the work that really brings in money, but he now has a job that pays just over six figures in our HCOL area after years of underemployment.

This is probably our number one source of friction and resentment right now. He thinks “we” have enough saved for him to retire or work part time, of course assuming I will keep working. Basically 90%+ of “our” savings come from me busting my butt, including doing a lot of saving before I met him

He correctly says, though, that it wouldn’t work for me to retire early because we’d lose so much more of our income than if he did.

Read the above and ask yourself whether you can do so without feeling furious at my husband. If no, I think you have your answer.

Anon

Also please document the savings you bring into the relationship as your sole and separate property. If there were ever a situation calling for a very clear prenup, this is it.

Anonymous

Can I ask…. how old his your husband? And he is talking about truly wanting to retire…. not just step down to a less stressful job?

I would also be furious, resentful, beside myself…..

Unless…. is he raising the kids? Building the house? Making my life perfect?

ELS

Co-sign. My husband is in a safety-related field and has to retire from his current position at a certain age, which is before typical retirement.

We’ve had long, LONG discussions about how, if he intends to actually retire at that early age (about 15 years before I plan to retire, since he’s older than me), he will do the majority of the housework, run errands, and basically, as Anonymous at 2:09 says, “Make my life perfect.” If he’s not down with that, he gets a part time job. I’m not going to work full time, have him sitting at home, and then also be doing half or more of the housework (we cannot afford for me to retire when he does).

I anticipate this means my husband will be working after his initial career is over.

Anon

I guess I should be grateful that my husband in the same position as yours, is already planning for career two after his age forced retirement. I on the other hand was getting annoyed and thinking why can’t we plan to save a ton and both retire early and live on your pension/our savings with a low expense ratio mister money mustache style? My plan probably isn’t actually feasible and I should be happy he intends to keep working.

Anon

DTMFA

Anonymous

Wow. Ok. You’re great. Marry him tmrw. You have so many more options in life. He has 100k is savings! He’s obviously responsible! He’s employed! You have plenty enough money NOW to quit this high paying job and look for something you actually like. Why are you so worried?

Anonymous

When I got married at 32 my husband had about $30K to his name; I had closer to $750k. I’ve always made 3-5x what he’s made. It’s changed the balance but I have no regrets. My priorities at the beginning were a) could he pull his own weight – I didn’t want to be supporting someone who had champagne taste and a beer budget and b) were our money styles similar. I liked that he had made an effort to prioritize savings even on a very low income, he had no debt, and he wasn’t living beyond his means in any way.

There’s a big gap between “soulless big job” and “PT job for fun money” — choose love.

Wildkitten

Holy crap I am 31 and have negative $250,000. #lawschool

Anonymous

Don’t worry, I am 37 and am just barely in the black on net worth because of student loans.

An.on

Also 37 and silently rejoiced when my net worth reached zero earlier this year b/c of $110K in student loans and a modest salary, and many years of underemployment.

Marshmallow

I’m a couple years behind you but also in the same boat for the same reason. I’m looking forward to zero net worth!

Anon

I would actually questions your values and your relationships and needs with regards to money and financial security, more than the actual numbers. Because he sounds comfortable living perhaps on a smaller scale with much less savings, and you appear to have a much greater need for large savings and security. Nothing wrong with either but may not be compatible

SC

When I read your post, my first thought was “prenup.” Of course it’s sensible to pause and think about what your life together will look like, and if you want that, but I also agree with posters above that you may be able to expand your view of that life together. Yes, you may reasonably want more than 400 sq ft of living space, but you may be able to afford a larger home if he can build or fix it.

One of the biggest expenses post-employment will be health care. If you want to work part-time for “fun money,” you may not get health insurance as a benefit. (You might, but I wouldn’t plan 25 years of early “retirement” on it.) Does your SO’s $50K/yr job have health insurance? Can you be added to that plan?

Jaydee

There is a large middle ground between a minimalist early retirement living solo off your nest egg and continuing to slave away at a corporate job forever just so you can have a partner and he will only have to do work he loves.

1) Prenup – especially when the parties have very different savings/earning levels entering the marriage, there is nothing un-romantic about a prenup. It is a very common sense thing to do and much healthier to make those decisions at a time when you are able to think them through together in a positive mindset than to be fighting it out after the relationship breaks down.

2) Figure out what you each see as your top priorities in life. For him, it sounds like enjoying the work he does is a priority. For you, it sounds like financial stability and independence is a priority. Figure out which priorities are common ground and which are areas of disagreement. Then look for compromises and areas you aren’t willing to compromise on.

3) Realize that your ideal life with a partner may look different from your ideal life on your own. For example, if he is working full-time, you may want to keep working so your schedules are similar. Instead of taking a part-time job just for fun money, maybe look for a lower-paying, less stressful full-time job that will allow you to cover expenses without relying as heavily on your savings. Maybe he agrees to take on some work he doesn’t like for a while in furtherance of a mutual goal (like buying a house or starting your own business or both being able to retire at 50 or whatever).

Anon

I just left a 4 year relationship that sounds very similar (though he had much less than your BF does). I was good for awhile and the actual dollar figures didn’t bother me because he was the most loving partner. But when it came down to it, we didn’t have the same attitude about finances or work ethic and I found I was losing respect for decisions that I felt were not thoughtful and willing to work for a future. A truly bad work situation is one thing but with every job there’s going to be some discomfort and not getting to do or say exactly what you want in the moment because you know you are working towards something. He made some financial decisions that I thought were very short-sighted and I sat with them for awhile before I realized that I wouldn’t ever fully trust that aspect of our partnership. I was fine with bearing most of the costs of our lifestyle at present but I also couldn’t see how the future in 5-6 years was going to be when I want to be retired and enjoying the fruits of my labors and diligent savings and he wouldn’t be able to retire (possibly ever). It wasn’t the dollars, it was that we didn’t have similar values in an area that I prioritize. I have been very comfortable with the decision since making it and I also realize that he deserves a partner that fully respects him and I couldn’t be that person.

Sad in SF Bay

This sounds like an obnoxious question, but it’s not: Are we too poor to buy in the San Francisco Bay Area?

Yesterday there was a long thread on a couple with a HHI of $215K looking to buy $700K-$800K house, and all the responses were that that’s too far of a stretch and they should look for something in the $500K range.

Well, my husband and I are in our early 30s, our HHI is ~$250K, and we live in the Bay Area, we work for companies in the town that Google is HQed. If I put an upper limit of $500K, I don’t even see 1 bedroom condos (other than mobile homes). We have $300K saved for retirement and we are saving $35K in retirement every year. We have $100K right now in cash for a down payment, plus saving $3K a month in cash for the down payment, as well as another $100K coming from family end of this year. We have $10K in low-interest student loans, that’s our only debt.

We want to stay in this area, it’s where the best job opportunities are for us, and we have tons of friends here. If we want to stay here, we need to buy a place. Everything that is available is at least $1M for a single family home (2 bedrooms, 1 bathroom) or it will take a 2-3 hour daily commute, which we are not willing to do.

So my honest question is, are we just too poor to live here? and if $250K HHI is too low, how do people do it? It feels obnoxious to say that we make too little money, but for what I want – buying a home and saving for retirement, it feels like it.

Oh, forgot to add, we are ambivalent about children and may be happily childfree, which will help our plan to stay in this area.

Anonymous

Few thoughts:

1) $250K isn’t “poor” even in the Bay Area, but I know many people at that income level who feel that single family home ownership is out of reach, so you’re definitely not alone.

2) There is a sense among my Bay Area friends that the housing bubble is about to burst. I’d definitely wait a year before making the decision to move away because you feel priced out.

3) Why do you “need” to buy? There is an American idea that it is an unskippable life milestone but for many people renting makes more sense financially.

4) Even if you do want to buy, you certainly don’t need to be a single family home if you’re unsure about kids. A couple could be extremely happy in a one- or certainly two-bedroom townhouse or condo.

5) I don’t think buying a $750K place on a $250K income is always crazy. The concern with that poster was the lack of retirement savings, which is not an issue for you. Based on what you’ve described about your income and savings, looking in the $700-800K range sounds reasonable. You should definitely be able to find a nice townhouse in that range in reasonable commuting distance from Mtn. View. Friends just bought a luxury two-bedroom townhouse in Santa Clara for $750.

ELS

+1. I was against the previous poster buying more house because of the constraints on her family budget, and wanting to add another kid to an already frugal household while also buying more house.

I don’t think $700K-$750K is a bad place to be, if you’re able to still meet your savings goals and swing it with some room for fun things now and then. I would still caution that if you are interested in buying, it’s important to think about long-term income. Are your jobs stable? Would you be able to float the monthly payment if one of you was temporarily out of work? Buying a house is a calculated risk, always, but your situation is a little different than the previous poster’s.

SC

+1. Having kids makes a huge difference. The poster yesterday talked about daycare expenses ($1500/mo?) — that’s a lot of house if you are clear to put it into a mortgage instead of daycare! Plus, children come with other costs on top of that — health insurance and medical bills, activities, food, clothing, diapers, saving for college, wanting to buy in a certain school district or pay for private school, wanting a larger house or larger car.

I don’t know whether you can afford to live in the Bay Area, whether you “need” to buy a house, or whether you can afford the house you want. But I think you have a different set of considerations.

JuniorMinion

You’re not “too poor” to live there – it just might not be the right decision for you to buy something right now / you might want to wait a bit. Also worth noting I used to live in NYC where a lot of people rent forever… there is nothing wrong with that / nothing that says you “have” to buy something. When I ran the numbers for the apartment I lived in in NYC my rent would have had to go up by 50% to match what the costs would be to own my place. I’d take a look at the NYTimes calculator on whether you should rent or own (don’t have a link right with me) but its helpful.

In answer to your honest question, my husband grew up in NorCal and of his friends who stayed there they fall into two groups: 1) Parents gave them house / money for house 2) They are leveraged to within an inch of their life and are not funding retirement / savings in the way that I would personally want to. He also has a lot of friends who rent and will likely be renting for the duration as long as they stay in that area.

Anonymous

You forgot a third category – won the start-up lottery and/or were very early employees of major tech companies and have a net worth in the multi-millions by age 30. I know a shocking number of people in that category. But your first two categories are very common too.

JuniorMinion

Yeah my husband just doesn’t roll with that crowd I guess. I know a few people in that bucket as well although in my case they are people who got out of the energy investing game / made some good PE investments and got out pre 2014

also too "poor"

So, my DH and I are very conservative with our finances, and honestly, we feel like we can’t afford a house here. We probably live in the same city as you in the Bay Area. Our HHI is ~$300k, no debt, childfree, max out retirement accounts, have ~$100k in cash (or near cash, we could sell some stocks and deal with the capital gains taxes with no issues to get there). In theory, we could afford to pay $5k – $6k / mo in mortgage, but we both agree that it would be absurd to do so. We also decided that there’s a lot of steps between “studio apartment” and “$1M house”. Thus, we just upgraded to a 2/1 apartment with a garage in the neighborhood we love. We went from a steal of an apartment for $1925 to another steal of an apartment for $2450, but our quality of life is HUGELY improved. It sucks to pay so much in rent, but honestly, the market is still way too high right now to buy a place. Wait until the bubble bursts (as it will, since it’s done that every 10-15 years over the last century), then consider if it’s worth it as the bottom of the market. When fixer uppers go for $800k – $1M, it’s not worth the cost. I think the way most people do it is that they have a much higher tolerance for risk and an expensive lifestyle. We want to be able to bail out if we choose to, so sinking our entire net worth into a tiny, old, dilapidated dwelling does not further that goal.

also too "poor"

Also, look at the NYT rent vs. buy calculator… it has a ton of different variables to consider, and helped put our expenses into perspective. We ran it when we were in the $1925/mo apartment, and with some realistic expectations on inflation, interest rates, etc., our equivalent mortgage was $525k. You can find a few 1br condos in a slightly-sketchy neighborhood in San Jose for that amount, but even East Palo Alto probates that need cosmetic work go for more than $525k. And that’s the mortgage payment, so we’d still need $150 – $200k in cash for the down payment to get it down to a $525k mortgage. And for that, we’d get maybe 200 sq. ft. more than the apartment we just moved into. Since we’re paying more in rent, the calculation would be slightly different, but the point is that for us, we can rent much more than we can buy at this point.

Anonymous

You can stay in your area, you just may not be able to own a detached single family home. That’s how people make it work in NYC or London or other major world cities. If you live in a big city, generally a detached single family home with a short commute will not be affordable. You have to pick a smaller apartment or attached home and make the smaller space work or move to the suburbs and deal with the commute.

Anonymous

The difference is that the Bay Area doesn’t have affordable suburbs within commuting distance. The public transit there is a mess compared to cities like NYC and London.

Anonymous

But that doesn’t change the options. It just makes the commuting option less appealing. There’s also renting. Lots of people in big cities never buy.

JuniorMinion

To be fair calling the NYC suburbs “affordable” isn’t totally correct either – you usually have to get to an hour + each way to get to “affordable” as the close in parts of LI, Westchester, CT and North Jersey are all very expensive. You could live in less desirable parts of Queens / Brooklyn or places like Washington heights though – Do equivalents of those exist in the Bay Area?

Anonymous

“You could live in less desirable parts of Queens / Brooklyn or places like Washington heights though – Do equivalents of those exist in the Bay Area?”

To some degree, although they are probably less safe and also less affordable.

also too "poor"

This. I love the life we’ve built in the Bay Area, but we could live for less literally anywhere else in the world, including London and NYC. And we live really “cheap” compared to a lot of people in the Bay Area, especially those in SF proper. I think that people who want to stay here and have reasonable expenses and didn’t make millions in an IPO will have to reconcile their feelings about renting. I grew up in the South, where buying makes much more sense than renting. My 25 year old sister stayed in the South and lives in a lovely house that she and her husband bought for less than $200k. I felt really inadequate when I stayed in one of her TWO guest bedrooms, while I hosted her on an air mattress in the living room of our 1br apartment recently (the amount of pride I have in offering guests a room with a door now that we’ve moved is a little ridiculous). But in the end, I love our life, and I wouldn’t move to a LCOL area just for the house, when our jobs, hobbies, friends, outdoor lifestyle that we really love is here in the Bay Area.

JuniorMinion

So I live in a part of the Southwest that would rather be its own country and I used to live in NYC…. I think the “everybody should buy a house” rhetoric I hear here is related to the fact that a lot of people who grew up here have always existed in this world where buying makes more sense. When I walk friends of mine through my NYC math where it would have been so much more expensive to own my apartment they are flabbergasted.

The perspective of someone who left...

We had a household income of $300K when we lived in the Bay Area and had the down payment for a $1M home, but I didn’t feel like my Big Job was sustainable for the 20+ years it would have taken to pay off the mortgage. Taking on $800,000 of debt was terrifying to me, even with our high incomes, and I especially didn’t want to take on that much debt for something that wasn’t my dream home and wasn’t in a super desirable location. To get a dream home in a good location would have been $2M+ which was never in the cards for us. We wanted a family and I really didn’t want to be working crazy hours once I had a child.

We left and moved to a small Midwestern city. We bought a really nice home for $400K in one of the best school districts in the state. A few years later, it’s all paid off, and we’ve also put significant money into upgrading it. It’s truly our dream home and I’m glad we’re not house poor and have money for other stuff we enjoy.

The thing I miss most about the Bay Area is the people. I had a few girlfriends there who were like sisters, and I miss seeing them weekly. I have people I’m friendly with here, but it’s been a few years and I still don’t have anyone who is approaching a sister level of closeness locally. I think it’s a combo of 1) Midwesterners being naturally more withdrawn, 2) many people here being from here and having friends they’ve known since kindergarten so they’re not looking for new besties and 3) it just generally being harder to make friends in your 30s.

I do miss the Bay Area’s scenery, weather and food scene, but truthfully, that’s a pretty easy problem to throw money at. With all the cash we saved by leaving, we take beach vacations at Christmas and spring break and we’re close enough to Chicago to go there regularly for the weekend. And we travel way more internationally than we did when we lived in California. So on balance, I haven’t really experienced a downgrade in lifestyle since leaving, except for missing my friends. I definitely DO NOT miss the Bay Area traffic, which was driving me to the brink of insanity our last year there. The first time I went to the grocery store here and got to the store, did my shopping and got back home all in under half an hour I actually started crying because I was so happy/couldn’t believe that grocery shopping could be so easy. True story.

Anon

My husband and I bought our home (4 bdroom, 2 bath, living and family room/ ~2000 sqft) in the Bay Area (East Bay) for about $700K 3 years ago before it got crazy. The value of our house has gone up by 30% in the 3 yrs (I’ve heard it’s close to 60% in SF proper). Total household income is 270K/yr. We had save enough for 20% down. One of our main criteria for buying was that we should be able to pay for all our expenses (no kids) with one income. I would suggest this for everyone because my husband has gotten laid off twice since we purchased the house.

Also, we need the extra space for frequent family visitors. We wanted our money to go further so we stayed away from area where our money wouldn’t go very far.

Anonymous BigLaw Associate

At my urging, we also left and moved to LA. While not as cheap as the MidWest, we can actually afford to buy something in the $750-900k range in about a year or so. Our rent is cheap, life is convenient and a lot more relaxed. We have four kids, so we want to buy at least a 3 bedroom, want it to be modern, want at least 2 parking spaces, and want it to be in west LA. The same sort of place would have run us 1.5M-2M in desirable areas of SF. We would have been renting forever.

I am admittedly not as familiar with Mountain View as the city, but are you sure $750k will get you anything like what you are looking for? That seems really, really low.

anon

I don’t think $750k will get you much in Mountain View, but you could look at neighboring cities like Sunnyvale, Santa Clara and San Jose. It seems like they are building condos all over the place. Honestly, most people that I know either go all into their house (very highly leverage), got help, or got some cash from a startup exit that was enough to boost them on the downpayment. We bought our place for $850k (9 years ago) when we made about $260k, and it was a *huge* stretch. But if we hadn’t bought then, I’m not sure when we would have been able to make the commitment since prices just keep going up.

Anonymous

I’m in San Jose, where housing costs are more “reasonable” if you call <$1M reasonable for a safe neighborhood with a decent elementary and middle school but a poor high school. I bought a house in South San Jose for 2x annual income in 2010, poured $50k into fixing it up, sold it in 2015 for a decent profit, and downsized to a condo in downtown for 3x annual income.

My take is that, yes, to stay in the Bay Area long term, I needed to buy. Rent just keeps increasing. In 2002, when I moved out here, $1500/month for a 2 bedroom was super pricey. Well, now those places are $3k/month if you are lucky but more like $3.5k if you are reasonable. Rent will keep increasing because that is what it does. In 2009, before I bought, and house prices were in the pits, my rent still went up $500/month!

It is expensive to buy. It is expensive to buy a place that needs work and to hire people to do that work. But, in the long-term, it's what it takes to stay in this area. Even with all I have spent on housing, I have, on net, spent less buying than if I had rented for the last 7 years. That six-figure wire transfer before closing really hurts but it's what I had to do.

WestCoast Lawyer

It obviously depends on a lot of factors, but the Bay Area market is hard for people who haven’t lived here to grasp. FWIW, when I look at your post I don’t think you are too poor to buy. But there are several things you may want to consider.

(1) What are you currently paying in rent and how comfortable are you with that payment? Figuring out what payment you will be comfortable with (without feeling too stretched to deal with unexpected repairs, etc) should be your first step, rather than focusing on the total purchase price.

(2) After seeing what happened in 2009, I’d plan to have an emergency fund that would allow you to pay the mortgage, food and other non-negotiable bills for 12 months if both you and your spouse are out of work at the same time. You will sleep better at night.

(3) Beyond your emergency fund, do you have family that would help you out if you were really in a pinch and your emergency fund ran out?

(4) The market is really hot right now, so waiting a year might not be the worst idea.

(5) But, while prices might cool off, I wouldn’t worry too much about being underwater if there is a market correction. Even in 2009, real estate on the Peninsula didn’t go down that much. We bought a few years earlier, and if we were ever underwater (below purchase price) it was not by much. Especially in the $1M and below price range, real estate here sells quickly. If you have the 12-month emergency fund, and the economy tanks again and you both find yourselves unemployed, you will have some time to assess and will still probably be able to sell if you really need to.

TO Lawyer

FWIW, I was shocked at the low house prices on the thread yesterday. I live in Toronto and most houses in the city proper are selling for over $1million, and those are not beautiful mansions. Currently, you can barely buy a 1bedroom condo for under $500K (yes the housing market is a bit insane right now).

There are some areas that are just insanely expensive – honestly I don’t know how most people afford to buy houses here, because even with two high incomes, $1million is a crazy amount of money…

Jaydee

Generally, when you talk about being able to afford a house, you aren’t strictly looking at the actual sale price of the home. You are looking at the ongoing monthly and annual costs of homeownership as a percent of your income. And you’re looking at the financing costs in terms of how much interest you will pay over the lifetime of your mortgage.

You and your husband have very little debt, so you aren’t spending a huge amount of money on debt payments each month. You have a sizeable retirement savings and are actively contributing to it, which gives you a cushion if you had a sudden change in circumstances (you could redirect some of that money into shorter-term savings or to help cover a period of unemployment or illness or whatnot). You also have a large down payment available to you, which means that a $750,000 house would only mean a $550,000 or $600,000 mortgage.

What you should do is look at your current income, figure out how much of that you want going to retirement savings, how much you want going to short-term savings, how much goes to relatively fixed expenses, and what is a reasonable amount to spend per month on housing (be sure to factor in not only the mortgage payment but property taxes, insurance, utilities, maintenance and repairs, etc.). Then start looking at where that amount lines up with housing costs in your area. Research mortgages to see what the monthly payments and total interest costs are for various types or mortgage (30-year fixed versus 15-year fixed versus an ARM). That will help you figure out how much house you can afford and whether home ownership in your area is something you want to pursue.

Anon

J

Anon

Not to be pedantic (steps onto soapbox of pedantry)

but its Easter when you can start wearing white, not Memorial day.

bellatrix

I’ve always heard Memorial Day – can you say more about the Easter rule? (Because the date of Easter changes year to year, that seems like an odd rule, but it wouldn’t be the first …)

Anon

Actually I think it’s regional. The Memorial-Labor Day thing is in the north and the Easter-Labor Day thing is in the south. Which makes since, considering how hot it is here already.

Anonymous

I grew up in the Midwest, went to college in New England now live in California. I’ve always heard Memorial Day and have never heard Easter until this post.

Lulu

I am from Atlanta and have never heard anything except for Easter until today- so maybe it is regional!

marketingchic

Traditionally it was no white before Memorial Day. Growing up, I was super jealous of the other girls with their new white (scandalous!) Easter shoes at church – Mom required I wore black patent because it was too early for white.

Mrs. Jones

The traditional rule is Easter till Labor Day. I’m in the south. But I don’t follow the rule, and I think a lot of others don’t either.

That being said, why are there not more affordable white pants that are lined?!? And why is it so hard to find flattering white jeans? I had a 3-year search before buying Madewell cropped jeans and J Brand flared jeans last year.

Anonymous

the traditional rule is actually memorial day – southerners moved it up. it originates with the old old money country club set.

bellatrix

I’ve been in the south for nearly 20 years (grew up in the Midwest) and never heard Easter — but then I’m not in the old money country club set. Not even the new money country club set!

Not Legal Counsel

I think you can wear white pants all year. I live in the South, and anytime I hear a limit on when you can and cannot wear a certain color, I think the rule is antiquated.

Torin

No I don’t wear white pants to work, but it’s because I’m pretty much guaranteed to spill something on them. I accidentally dropped balsamic vinaigrette covered spinach onto my lap eating lunch today, but my slacks are black so it’s not a disaster.

White slacks and I do not play well together. They look great on other people though.

Not that Anne, the other Anne

+1 White clothing of any kind is asking for me to spill something on it and I will answer that call!

Anon

You can wear white pants but should you? I think a creamy white is ok in certain circumstances but true bright white screams weekend wear to me.

And the Spanx Sarah Blakey invented for white pants were the footless pantyhose that stop just above the hem of the pants. I know this because, as an Old, I was early on that bandwagon for work pants (though I never wore white ones). It really is a good solution to VPL and giving dressy pants some “slip” on the legs.

white out

IMO, it’s all about fabric choice and cut. If the fabrication is dressy, they don’t read ‘weekend.’ Personally, I love the sharpness/crispness of white in the summertime. I have two pairs of white pants — one for weekend and one for work — and nobody would confuse which one is for each occasion.

Anon

I’m wearing white pants today.

Anon

I have an (HRC-inspired) dream of getting married in a white suit, although I’d probably want one younger/sexier than would be appropriate to wear to work.

Anonymous

I love this idea! Something like this would be a gorg wedding look: http://fashiontasty.com/wp-content/uploads/2016/05/Suit-Outfit.jpg

Anon

Oooh that would be perfect!

Wildkitten

White suits are very popular in same-sex weddings and I bet if you did a little google or pinterest with those key words you could find a perfect suit for whatever you are looking for. As a cis-gendered straight woman, I love the all-gender-weddings magazine Catalyst because it’s so much more do-what-you-want instead of you-must-be-a-princess.

Wildkitten

White suits are very popular in same-s*x weddings and I bet if you did a little google or pinterest with those key words you could find a perfect suit for whatever you are looking for. As a cis-gendered straight woman, I love the all-gender-weddings magazine Catalyst because it’s so much more do-what-you-want instead of you-must-be-a-princess.

Wildkitten

I’m in m*d*r*t*on so check back later!

CountC

That moment that you discover none of the emails you have sent since 8 a.m. actually sent despite Outlook saying all folders are up-to-date and that it is connected to the server. UGH.

My outbox folder is way at the bottom of my folders, so I didn’t see that there were emails hovering there!

Oh well, I don’t save lives!

SoloFirstHouse

Since we are talking about houses lately…

I have a purchase contract on my first house, and my inspection is tomorrow. I want your house buying horror stories of what you wish you would have checked before you bought. Lay them on me, I would rather go in eyes wide open (I’m not a panic er).

1500sqft single family two story built in the 40s if that helps.

Anonymous

lead paint, electrical (wiring up to date?), oil tank (buried in backyard? if yes, remove?), asbestos, plumbing come to mind for me when thinking about a 1940s house.

Torin

I’ll add termites to this.

My house was built in 1950, and my inspector was really thorough. After reading his report I had no further surprises with the house itself.

Keep in mind though they only look at the house, not the rest of the property. I was however shocked by how terrible the drainage in my backyard was. Every time it rained the backyard turned into a total lake for days. Installing a drain was rather expensive and a completely unexpected expense.

Anonymous

I doubt I could have gotten the seller to dig up the basement floor to check, but the state of the 100 year old sewer line pipes under my basement floor (which collapsed and flooded my basement with sewage approximately 6 months after buying). My house was built in 1906 in a city, so this will hopefully not apply to you!

SC

I commented below, but PSA, you can have your plumbing expected by snaking a camera. You can also place an offer contingent on both inspection and plumbing inspection. Our real estate agent suggested doing this because our house was old. (As described in my comment below, we did the plumbing inspection, bought the house despite problems, and spent almost $10K replacing the main drain within months of buying the house.)

Torin

Yes this is really worth it. For me the previous owner had only owned the house for about 4 years and had had this done when they purchased it and gotten back a clear report, which they gave me a copy of. I was comfortable relying on it because it was so recent. Otherwise, would’ve wanted to have it done, especially buying such an old house.

Anonymous

Hindsight is 20/20, right?!

SC

Ugh. *Inspected. I can’t even blame autocorrect.

Mrs. Jones

Check the age of the roof and whether the windows are up to current code.

Senior Attorney

Water pressure. I’ve had to replace the galvanized steel pipes in two houses in order to get decent water pressure.

Also windows. Old drafty windows will have you heating and cooling the whole neighborhood and they’re expensive to replace.

Anonymous

If you can go with the inspector, s/he will offer you lots of useful tips about how to maintain your home.

SC

It wasn’t a surprise, exactly, but we had to spend about $8000 replacing the main drain line about 3 months after we bought the house (plus $1000 on sod, which DH and BIL laid in the middle of the summer). The pipes were from the 1930s, made from terracotta, and had collapsed due to grass roots growing in them. We knew that this was a “deferred maintenance” issue when we bought the house–we had the plumbing inspected via camera separately–but it’s also a repair that can be put off by pouring a weedkiller through the plumbing system. Unfortunately, we had to replace the drain line sooner than we would have liked, but hopefully it’ll last another 80 years.

Sarabeth

Chimney, even the one that is no longer connected to anything. We bought a house that had originally had a chimney for a coal-fired boiler in the basement. Had later converted to gas heat, so chimney was not in use and we didn’t get a separate inspection for out. Turned out to be full of cracks that flooded the basement when it rained, so we had to get someone to come dismantle it and extend the roof over the hole.

Sunflower

Having owned two old houses, I’d focus on electrical issues. Specifically, I’d make sure the house is up to current codes and there is sufficient capacity for your needs. People use way, way more electrical appliances nowadays than they did when your house was built and adding capacity can get expensive. I’d also try to identify the ages of major items in the house. When we bought a house last year, the inspector was careful to note that the water heaters, pool heater, air conditioner, furnace, dish washer, washer, and dryer all worked fine at that time but were probably at or near the end of their life expectancies.

Anonymous

In the course of buying and selling my home recently, I learned that you can become a home inspector with a few courses, as opposed to having a background in construction or any other building trade. Make sure that yours does have a contruction background, so things can be properly identified and prioritized.

Examples: the water shut off valve was a gate valve the inspector hadn’t seen before, and so he put in the report that is wasn’t operational (in reality, he didn’t know how to work it). He also listed as a significant safety concern that a gas line (with a working shut off valve) wasn’t capped, even though the gas company said capping it wasn’t necessary. Buyer freaked out – the “fix” was a $3 cap from the hardware store.

Anonymous

Agree with this about quality of inspectors. You may get a good one or you may not. Big things have been listed–electricity, gas, and plumbing. They can be hugely expensive and problematic if you need to fix/replace them. Roof, windows, and insulation would be my next priority. Appliances, furnace, etc., just keep in mind whether they’re at the end of their life cycle. If they are, you might want to get a warranty (can’t remember the name but it’s basically insurance on things breaking for a year after the sale).

Baconpancakes

Does anyone use Stylebook? I’ve been using Polyvore to create my own version of Stylebook, but it seems like the ease and features of the app would be worth the $4.

Shoes

I do! Its a great creative outlet for me and helps put together outfits and track when you wear them. Its a bit labor-intensive to set it up initially (either photograph all of your clothes or find pictures online) but once you get going its easy to keep it up to date with new purchases.

Anonagain

Yes! I’m lousy at fashion and have used it mostly to keep track of what I wore when, to avoid wearing the same thing too frequently or to the same event two times in a row. I was pleasantly surprised by how much it reduced the mental stress of trying to get dressed in the morning, since I could see all the outfit combinations I’d come up with in the past and didn’t have to re-create them in my head each day. It was totally worth the $4 to me, and I never buy apps in general – this was maybe the second one I’ve ever purchased. Entering in all your clothes is a bit of a pain, but the process is also a good reality check about what you actually wear (or not), and what you’ve worn to death and need to replace, etc.

Cait

What would you qualify as a job worth moving for? I’m finishing grad school in May and looking primarily at positions in Atlanta (where I’m currently located), but I’m single and could move basically anywhere if I needed to. I know that I don’t want to relocate for a part-time position, but almost all the jobs I’m looking at are entry level. How can I tell if its worth it to move all the way to, Indiana or Arizona, for example, for just an entry level job opportunity?

Anonymous

If the job is a full-time job and is paying you enough to afford to live in that particular location. In fact if you are that flexible broaden your search geographically, you may find that you get multiple offers–this is presuming that you also are marketing yourself pretty well through networking and any resumes you send out. I’m assuming that you are specialized in something if you are in grad school which means that you might have a set of skills that is not that common and hopefully sets you apart a bit from others. The only time you should consider not moving is if it’s a very short term contract say six months, since you would get there and potentially have to do it again after six months.

Wildkitten

Do you want to live in those places? If so – now is a great chance!

I should be happy for him...

My husband just learned that he’s been promoted to full professor. I should be happy for him, but I’m devastated. His promotion means we won’t be leaving this area until he retires in 20+ years. Jobs in his field are not rare, but being hired elsewhere at his new rank would be *very* unusual, and he has made it plain that he won’t accept a demotion unless it offers some phenomenal combination of other benefits. I hate the area we’re living in. My parents are aging on the other side of the country, the schools are mediocre, the cultural opportunities are pretty much nonexistent, and I’m massively underemployed (I have a PhD in a field closely related to his, but not closely enough that we could job-share). And even with his promotion raise, his salary still doesn’t quite reach $70K.

Yes, he lived in this town and worked at this university when we got married. But he always said, “oh, this is my starter job, we can move in a few years.” The trouble is, he’s inherently cautious and conservative and, frankly, less than motivated. I should have seen the writing on the wall. I was young and stupid, I guess.

GirlFriday

I’m sorry and I get where you’re coming from. I also really hate where we live right now. DH came here for work, and I actively chose to follow instead of throw a temper tantrum (that happened later, ha!) so I don’t blame him. This place sucks and it seems like we will never leave. The two things that have helped me are: 1) friends – I would not give up my small group of friends here for anything. Do you have people like that in your life? It took us two years to make friends, so be patient. 2) When I am getting really frustrated with my situation, I make a list of things I’m grateful for. I know it sounds cheesy, but it helps. Hang in there. Have you had conversations with your husband about how you want to leave?

Anonymous

“I have a PhD in a field closely related to his, but not closely enough that we could job-share). And even with his promotion raise, his salary still doesn’t quite reach $70K.”

This sentence above is what jumped out at me. You dislike the area but you are also underemployed– at least that’s how I’m reading it. I also have a PhD so I understand where you are coming from. You have to bring this up and discuss it with him. The fact that his salary has not risen that high means that it is possible to move. I am just saying this because I imagine if he was say a Distinguished Professor with a very high salary getting a similar position would be near impossible. It is possible for your husband to move but it also requires sacrifice he would have to take a step down and work his way back up to Professor again but would he do it if it means that you are happier? Also I don’t know what field your husband is in but would he consider leaving academia, there are people who do and work in other fields. I feel sorry for you because this should be a joyous occasion but unfortunately it is not. Take heart.

OP

Anonymous, part of the problem is that academia IS his second career, and I think he’s just done with chasing promotions. Thanks for your thoughts and kind words.

OP

GirlFriday, thank you. We used to have those conversations. He applied for some other jobs in the first couple of years after our marriage, but didn’t get an offer and…stopped trying?

Wildkitten

I’m really sorry. That sucks. I think it’s important to be happy for DH right now. Can you talk to a friend or therapist about your feelings so it doesn’t come across as you dumping on his parade? Obviously you should talk about all of these concerns and feelings and how you are going to deal with them and what you want to do and what you want him to do and what you want to do together, but I think you should find someone else to talk to about all of your feelings so you can be happy for him right now, and then talk about it later when he’s a little bit chilled and you have sorted your feelings into thoughts and ideas. YMMV.

Wildkitten

And by “be happy for him” I mean “fake it for like a week” so you have time to sort through all of the emotions – I completely understand that you do NOT feel happy for him right now.

OP

thanks, Wildkitten, you’re right that dumping on him now won’t be productive.

Anon

I’d suggest reposting in tomorrow morning’s thread to get some responses on this.

Anonymous

Wow. That sounds horrendously unfair to you. Not that he got promoted, which is of course an accomplishment, but that he won’t consider moving when you hate the area, your family is far away, the schools are bad and you’re massively underemployed. Of those, the last one is the most troubling to me. Does he not care about your career at all? What does he say when you say “I want to move somewhere else where I might have a better career”? As I’m sure you know, spousal hiring is frequently an option in universities so if he applied elsewhere there’s a very good chance a position for you would be part of a package deal. I wouldn’t even pretend to be happy for him. He made a promise to you (“this is a starter job, we can move in a few years”) and he’s backing out of it. I have no real advice except maybe marital counseling but I’d be livid and couldn’t even pretend to be happy for him.

-Fellow academic wife (which is a tough enough life as it is even when your spouse cares deeply about your happiness and career!)

Wildkitten

I agree but I don’t know that they’ve actually discussed these things? It seems like they were surprised by the promotion?

4:59

He almost certainly couldn’t have been surprised. Maybe she was, but he likely would have had to assemble a sort of “brag book” of references and accomplishments that the university relied upon in making the decision, so he must have known it was at least a reasonably likely possibility. Also, even if the promotion was a complete surprise, it sounds like he’s known she’s unhappy and underemployed for a long time and has been dragging his feet about job-searching. The time to job search would have been before he was being considered for promotion to full professor, and he let that time pass by without doing anything about it.

Anon

Yeah, no way this was a surprise. You have to apply for promotion to full professor and the process usually takes at least 6 months. My sympathies to you, OP, this is the worst part of academia. You probably know this, but it’s not completely impossible to move at this point, though it is much harder. This would most easily happen through a move into administration, either as department chair or some kind of dean, though that may not be his thing (your brief description of him sort of makes me think it isn’t). If moving is really important to you, though, congratulate him on the promotion and in a few weeks try to have an open talk about this.

OP

4:59, you’re right. He submitted his dossier last August. I knew it was happening. It was his first year of eligibility, though, so I had crossed my fingers that maybe he would be turned down the first time. YES, he has been dragging his feet with full knowledge of my unhappiness.

Thanks also to Anon at 6:58. He has mentioned administration as a possibility in the past, but you’re right that, well, it wouldn’t be the best fit. LOL.

OP

Wildkitten, we’ve discussed. Unfortunately, actions, in this case, speak louder than words.

Anonymous BigLaw Associate

I agree with this, as harsh as it seems.

OP-Why did you agree to go here in the first place? And could a better job for you be part of the “some phenomenal combination of other benefits” you mention?

OP

Because he said it was his “starter job.” Because I had no offers of my own to counter/negotiate with. Because I…gave up on myself? Threw myself under the bus?

OP

Anonymous fellow academic wife, thank you x1000 for the validation.

“Does he not care about your career at all?”

He said he did. I will even go so far as to give him the benefit of the doubt that, at the beginning of our marriage, he in fact DID care. But 8 years and 2 kids later, it seems that his need for stability (and a housewife?) has taken precedence. Sure, he’d like to see me happy, but he wants my happiness not to come at the cost of any rocking of his boat. He truly seems to think that I should be content with the 1-2 adjunct courses PER YEAR that I can pick up at his university, and if I really need more than that, then he would be cool with me picking up another course or two at the small college on the other side of town.

TBH, marital counseling is necessary and perhaps would be too little, too late at this point.

Thanks so much for your support.

Anonymous

Ugh. I am glad you are considering marital counseling and (it seems) that he may not change even with counseling. This sounds like a miserable situation for you and one that your husband is not really interested in improving for your benefit. I don’t have any words of wisdom for you other than to send good thoughts your way. Be kind to yourself.

OP

Thank you. It is SO nice to hear words of support.

OP

Also, lest I sound like a total b*t*h, I am glad that he has chosen to strive for promotion and the extra income it brings our family, and proud that he has achieved his professional goal. I just…feel unheard, unvalued, unloved.

Assistant Professor

I’m really late to this thread, but wanted to chime in in case you are still reading, OP. I’m in academia too, so I know how difficult it can be to get a job at any rank, and you’re right that there aren’t many opportunities for your husband to make a lateral move as a full professor to somewhere else. So, as an alternative, could you consider applying for assistant professor jobs elsewhere (and have him follow you if you get a job as a spousal hire of some sort)? I see you say you have been adjuncting for many years now and not in a TT position, which isn’t ideal for being on the job market, but if you have really good teaching evals from the classes you have been teaching, some liberal arts/regional colleges would surely take a look at your app (especially if you mention in your cover letter than you have been adjucting because you have been tied to your current location until now).

I’m an advanced assistant professor and already make more than your husband does salary wise (and no, I’m not in a HCOL city, I’m in a rural college town), so there’s a chance of you making a higher salary if you got an assistant prof job than your family is making now. So, bottom line, if he won’t apply to other jobs, you should. Even if nothing pans out, at least you’ll feel like you are being proactive about attempting to change your situation.

Anonymous

+1 Agree with this 100%. Try and get a job elsewhere.

Anonymous

Thanks for adding your thoughts. I don’t know if there’s a realistic chance that I could get hired. I am in one of those narrow humanities fields where applicants far outnumber openings, recent grads seem to be strongly preferred, and my research doesn’t push any of the current cultural buttons. But I take your excellent point that, if I want an opportunity, I should pursue it myself so I have something to put on the table for discussion. Thanks again.

Assistant Professor

Oh absolutely, landing a TT job is certainly no guarantee (I should have expressed that I fully realize this more in my original response) and I hear you on the humanities field with more applicants than openings. It’s really rough. But, you can also look for positions that aren’t TT but at a college/university that might be relevant to your PhD skills, like a position in an Office of Corporate and Foundation Relations (where your job is to help faculty apply for grants- the people in that office at my college are awesome).

Most of all, I’m sorry that your husband has changed/wasn’t upfront about/has grown too comfortable in his priority of staying at your current college and isn’t giving your career and your overall happiness nearly the same consideration. That really sucks and is big time upsetting. A two-body problem is always difficult to solve in academia, and the only way to really solve it is if both partners are flexible and willing to take less than ideal options and to trade-off who sacrifices at different points in time. I’m sorry that your husband is not/maybe never was truly committed to solving the two-body problem/location preferences for you both- I would be really upset too.

Good luck looking into opportunities for yourself. It will be a slog, but I think you owe it to yourself to try. As you said, having an opportunity “to put on the table for discussion” is the only way you’ll have an leverage here, I think. Hugs to you.

Velma

Don’t give up on yourself! Your PhD has value in higher ed staff positions, as well as outside higher ed. I’m a PhD in English. Due to the two-body problem, I moved into book publishing, freelanced during the baby years, and then slid into a FT communication role at one of the local universities. I’m now in a leadership position and make quite a bit more than your husband–and certainly more than I would have as an English professor. There are opportunities for you out there.

Perhaps consider some consulting or a staff/temp role in higher ed. Adjunct teaching is soul-killing.