Our Top Posts of 2019

This post may contain affiliate links and Corporette® may earn commissions for purchases made through links in this post. As an Amazon Associate, I earn from qualifying purchases.

What were your favorite posts from the past year? We’ve rounded up our favorite suits for women, wear-it-to work recommendations, and office shoes and bags; today we’re closing it out with a look back at our top posts of 2019. (Stay tuned for the rest of this week, we're going to try to take a look back at the best workwear, shoes, and posts of the last DECADE, including tons of reader favorites. I'm kind of surprised how many are still available for sale, even if some favorites, like The Skirt, are long gone.)

In any event, these posts were the top read (according to Google Analytics) — and then some of Kat’s favorites! — but we’d love to hear your favorite posts and threadjacks as well!

Note that you can check out this page for our top posts of all time!

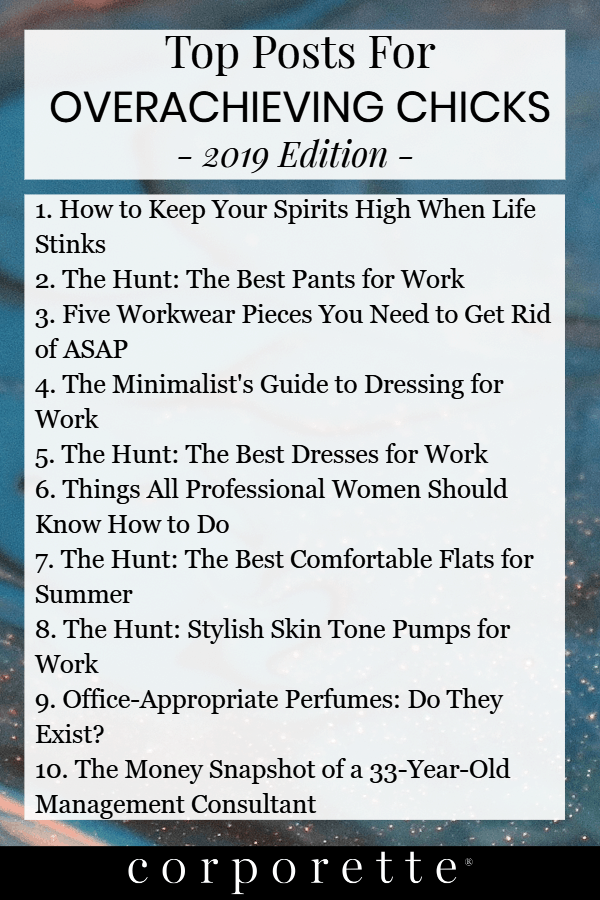

Top Posts of 2019

(according to Google Analytics)

- How to Keep Your Spirits High When Life Stinks

- The Hunt: The Best Pants for Work

- 5 Workwear Pieces You Need to Get Rid of ASAP

- The Minimalists Guide to Dressing for Work

- The Hunt: The Best Dresses for Work

- Things All Professional Women Should Know How to Do

- The Hunt: The Best Comfortable Flats for Summer

- The Hunt: Stylish Skin Tone Pumps for Work

- Office-Appropriate Perfumes: Do They Exist?

- The Money Snapshot: A 33-Year-Old Management Shares Thoughts on Three Mortgages & Her Aggressive Savings Strategy

Other Great Posts

(according to Kat)

The Top 10 Most Comfortable Heel Brands

Where to Recycle, Donate or Sell Your Work Clothes

2013, 2019, 2024: What are Realistic Five-Year Career Goals – a look at where readers said they wanted to be in 2013, and where they WANT to be in 2024

Best Interview Attire for Different Types of Jobs

Stylish Wear-to-Work Pants with Pockets

Can You Wear Leggings to Work (And the Best, Most Comfortable Substitutes)

Mid-Level Job Application Tips

Great Discussions (on topic):

- Have You Ever Felt Like You Needed to Choose Between Kids and Career?

- Where Is Your Furniture From?

- Underrated Movies (perfect if this week feels a little slow…)

- Do You Repeat Vacations or Try New Things?

- How Much Do You Spend on Fitness?

- Do Professionals Need a Nice Car?

- What Are Your Business Travel Must-Haves?

- Best Planner (great discussion that keeps growing — most comments that come in are on recent posts but this one keeps getting new comments!)

- The Best Gift You Ever Got

- Lots of great discussion about that crazy Ernst & Young seminar

I was amused, at least: The Hunt: Shrugs for Work

Updates to older discussions that I really enjoyed:

What Clothes Do You Keep At Your Office?

Little Purchases That Made Your Life Better

4 Ways to Make the Most of Your Evenings

happy second to last day of the decade!

i’m thinking about moving states and jobs in the new year. I am currently considering searching for in-house work in California, likely LA area. i will be leaving NYC biglaw after six years.

A question: do in-house positions in CA typically require the CA bar? I know that CA does not honor reciprocity, and I know that it is possible for in-house lawyers to practice without passing the CA bar in a limited capacity under multi-jurisdictional practice. I believe I will meet the requirements for MJP. However, in practice do companies require or strongly prefer that I take the CA bar? Would obviously like to not take it, if possible!

I think most employers have a strong preference for it. Aside from any ethical issues, it shows you’re serious about moving here.

Anecdata: A good friend just moved from NYC biglaw mergers & acquisitions to an in-house job with a manufacturing company in Silicon Valley and he is not required to take the California bar. He does have to register with the State Bar and “meet certain qualifications.” I think that’s character checks and such.

I was in the same boat as you: six years of Big Law in NY, followed by a move to in-house in CA. I was able to find multiple places that didn’t care that I wasn’t CA-barred, as long as I was able to waive in as Registered In-House Counsel. The main disadvantages are: (1) I can’t do pro bono work involving court representation; and, (2) It precludes working at super small start-ups.

Anhoka—thank you for the input. May I ask if it was something that companies inquired about during the interview process?

Also, would love any general advice you have on going from NYC biglaw to CA in house.

Of course! So a number of the positions stated in the job posting whether it was CA Bar required or not. But when I went in for interviews, people asked about my status, and I said I was willing to take the bar exam, or register in-house: whichever the company preferred.

In terms of advice, it’s mostly just to apply for everything and leverage any connections you may have, however tenuous. It is much, much easier to get an interview if: (a) you can demonstrate a reason for why you want to be in CA; and, (b) someone passes on your CV from inside the company, even if it’s not within Legal.

You can be registered in-house counsel with CA and skip the bar, but that’s less of an issue than understanding the nuances of CA law. Depending on your practice area that may make a difference.

that’s helpful! I am corporate so I’m not sure it would make too much of a difference (I never appear in court etc).

That’s probably easier, CA specific practices are employment law, some aspects of litigation, trade secrets, probably more, but transactional work usually is easier to transfer to CA

Ugh — I’ve gone up in size to where I need to do a wardrobe refresh. Is the J. Crew Cameron pant really pear-friendly (and do they stock it in stores?)? I’m a dress person in winter and found some cute new issuances that aren’t on sale yet.

Is it worth the card in case of sale notices / etc.? Would love to get the dresses on sale but may need to purchase now as I have a work trip coming up and need items that I can wear comfortably.

I’m a pear with heavy thighs (no behind unless I’ve really gained) and the Cameron pant truly does work for me. It comes in a couple different fabrics – be sure to get the bistretch I think it is. Yes, it’s in stores, but your size might not be. (I rarely find 14s in store but they’re readily available online.)

The card is stupid awesome – I got it a couple months ago for, yes, a weight gain wardrobe overhaul, and they’ve sent me so many coupons I literally can’t use them all. (Nice problem to have.)

I find the Cameron to be pear-friendly but it runs a size small. If you have a few days and something you want at JCrew isn’t on sale, just wait for their next cycle to start. Cardholders sometimes get a slightly better deal than other shoppers, but not for every promotion. Do join the Rewards program (free) to get free standard shipping on all orders.

This would be the perfect time to be incredibly productive, as phones and emails are slow and I should be able to concentrate on big projects. Why can’t I? Why do I just want to click on all the holiday sales ads that keep popping up?

God, same.

I’m convinced that all offices could just close for the last two weeks of the year, with very little if any lose in productivity. Everyone I know who is working isn’t getting much of anything done, but we don’t have the benefit of two full weeks away to rest so won’t come back to the office all refreshed in the New Year.

I’m in the office, getting minimum work done because nothing has to be done for a few weeks yet, just so that I don’t have to burn a vacation day.

The reason is because most of us are more productive when we’re busy. If we know we’re in meetings all day and only have a one-hour slot to write a brief, we’re going to get it done in that hour. If we have three days of blank calendars stretching ahead of us and no one breathing down our necks asking to see the final product, we’re going to expand it to take all three days. It took me a long time to figure this out – I always figured “but I need a huge stretch of uninterrupted time to get anything done!” and the fact is that I get MUCH more done when I’m forced to shrink my timeline.

I have read this phenomenon described as “Parkinson’s law”, i.e. Work expands to fill the time for completion. In my practice area it’s standard to ask for and receive multiple continuances and so you can drag out time for ages to complete something that shouldn’t really take that long. In recent years I’ve been trying to fight that impulse and just buckle down and get it done by the original deadline but I’m swimming against the current on this with co counsel and opposing counsel alike!

Yup, this.

I’ve learned this too, but I can’t ever seem to artificially shrink my timeline. Any tips/suggestions on that? I’ve tried creating my own timeline “draft X by 2:00, finish reviewing Y by 2:30,” but it doesn’t seem to create the needed pressure.

Totally. I’m closing files and listening to podcasts because I lack the attention span to do anything more complicated, and because I still have all week to do it.

+1, there’s an old saying “if you want something done, ask a busy person.” True for a reason!

Why can’t you? Because you’re human, and you probably don’t want to be at work right now, and there’s probably no real pressure to get anything done. And that’s a very hard situation in which to force oneself to do something.

I’m with ya, so I am doing online CLEs.

I have an on-line CLE I am listening to from the bar association that the manageing partner gave (and I wrote), so this way, I can get 3X the number of credits (2) x 3 if I listen to it with the blessing of the manageing partner. I am still embarased that I could not get the name of the law firm off the slides I found b/f they posted it on the bar’s website. FOOEY! Margie thinks the manageing partner looks cute, and she provided a link to her freinds bragging about the manageing partner! YAY!!

After taxes, my bonus this year will be 50k. My 401k and backdoor roth are maxed out. I already have six months in emergency savings. My student loans are at a 1.9% interest rate. I see my options as: (1) pay down the student loans, (2) invest in a vanguard index fund for long term savings (I have few investments outside of retirement accounts; I’m early 30s) or (3) use the bonus as a downpayment (I currently rent in a HCOL city and a mortgage would 50% less than my rental payments). I’m leaning toward 2 because real estate is so expensive I couldn’t get very much with a 50k downpayment and the neighborhood would be in a very up and coming area. The loans I would rather pay off over 5 years because the interest rate is lower than what I would hypothetically get in the market. Any pros and cons I’m not thinking about?

I would add it to a down payment fund. Assuming you save throughout the year and your bonus for the next couple of years, you’d be able to get a good sized downpayment, right?

If you’ve determined you won’t buy in your HCOL city at all, then I’d just throw into index funds and let it grow. I think index funds is far more prudent than paying off 2% student loans, unless you just want the mental weight of them gone. Have a lower debt to income ratio will help with your mortgage approvals and interest rate.

+1 this is great advice

When (if ever) do you want to leave your HCOL city? How secure is your job?

Real estate can be an expensive way to tie up a lot of money (and over spend on real estate — I’d rent a studio / 1BR but never buy less than a 2BR in any real-estate scarce city, which tends to be HCOL and VHCOL cities). Or a good way to lock in long-term housing expenses at 2020 levels. I don’t know your planned life trajectory. That matters a lot.

Do you actually want to buy a house? Why not save the bonus for a down payment? Or is that what you mean by option 2?

If I were in your position, I would lay down the student loans even though it’s a low interest rate, because of the emotional effect that student loan debt had on me. However, if you’re okay with holding the debt, I think investing in lower risk vanguard funds (bonds) could be a good strategy while you figure out if you want to use the money for a down payment or not.

I would save it for a downpayment for the home that you want. Sounds like it would be a good investment for you and that you would have the rest of the money saved up in a year or so.

Thanks so much for the comments and things to think about! Not sure I’d want to buy in my HCOL city but good suggestion to hold on to the cash while I figure it out in the next year or so and keep saving in the meantime. Do like the idea of locking in my housing expense at 2020 level.

I agree with other responses – if you dont plan to be in your HCOL city long, i’d put it in index funds. If you plan on being their longer term, i’d start saving for a piece of property.

where did you get a 1.9% student loan rate though?? I really need to refinance and can’t find anything that loan.

+2, this is totally true for me. I am most efficient when I have a bunch of tasks to get done.

Has anyone ever ordered from Daily Harvest? I’m thinking about doing it for the smoothies (1 shipment a month) as a quick breakfast or meal replacement when I’m on the go. I’d love any feedback about taste, customer service, shipping, etc.

I did Daily Harvest for awhile last year. The smoothies and the oatmeal were good, I wasn’t a super fan of any of the other offerings (and tried through most of them). They worked well for giving my something fast and easy, I eventually realized I could batch do the same thing and started traveling more so I stopped. I had no problems with shipping/service/etc and thought most of them were pretty tasty. If they still sell the mint cacao one that is like drinking a healthy shamrock shake lol. Not my favorite breakfast option, but awesome for weekends as I tend to skip either lunch or dinner on those days and it makes for a yummy replacement.